Japan’s Foundry Morgana: A Journey from Mirage to Reality?Three years ago, I wrote an article about Japan’s semiconductor industry under the title “Japan’s Foundry Morgana.” Back in September 2020, I analyzed the decline of Japan’s once world-leading semiconductor sector and the ambitious plans for inviting TSMC to build an advanced process fab. Who could have imagined that by 2023, fueled by the experiences from the semiconductor crisis, the plans to revive the Japanese foundry footprint would have advanced at such quick pace and determination. It’s worth looking again at what happened so far and if Japan could be a blue print for other regions on the quest to semiconductor supply resilience.

Japan’s Foundry Morgana: A Journey from Mirage to Reality?Three years ago, I wrote an article about Japan’s semiconductor industry under the title “Japan’s Foundry Morgana.” Back in September 2020, I analyzed the decline of Japan’s once world-leading semiconductor sector and the ambitious plans for inviting TSMC to build an advanced process fab. Who could have imagined that by 2023, fueled by the experiences from the semiconductor crisis, the plans to revive the Japanese foundry footprint would have advanced at such quick pace and determination. It’s worth looking again at what happened so far and if Japan could be a blue print for other regions on the quest to semiconductor supply resilience.

A Look Back: The State of the Japanese Semiconductor Industry

In the late 1980s, Japan emerged as a global leader in semiconductors, holding strong alongside the US. Home to over 30 large-scale industry players like Renesas, Hitachi, Denso, Fujitsu, and Mitsubishi Electronics, Japan boasted a robust semiconductor ecosystem. By 1990 Japanese IDM’s NEC, Toshiba and Hitachi had taken the top three positions in the world-wide semiconductor sales ranking, just ahead of Intel and Motorola.

However, since the year 2000, Japan’s share of international IC exports declined sharply, dropping from 14% to less than 5% by 2020. Despite losing ground, some Japanese IDMs continued to excel in specialized segments like power electronics and optical CMOS sensors.

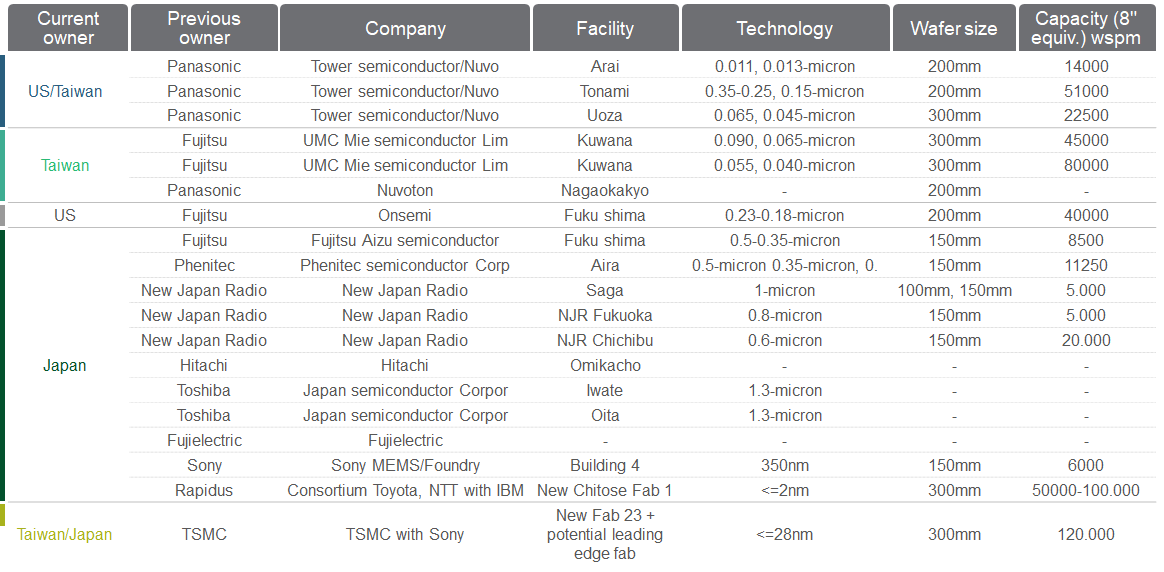

Japanese silicon foundries primarily arose as carve-outs from leading IDMs, but they struggled to keep up with rivals in Taiwan, China, and the US. Japan held only 2% of global foundry capacity as of 2020. Factors such as late market entry into the foundry business, a lack of cost-containment strategies, and a narrow market segment focus led to the decline of Japan’s foundry ecosystem.

The completion of Nuvoton’s acquisition of Panasonic’s semiconductor unit in September 2020 marked a symbolic end to the Japan-owned foundry landscape, leaving a limited number of small-scale foundries.

The New Landscape: Attracting TSMC and Rebuilding the Foundry Sector

Fast forward to today, and Japan’s semiconductor industry is writing a new chapter. The once ambitious plan to invite TSMC has materialized, resulting in TSMC’s agreement to build two fabs in Japan. Backed by extensive government funding, these fabs symbolize a fresh start and an alignment with the global semiconductor landscape.

The Japanese government’s engagement in this venture is unprecedented, pledging to shoulder a significant portion of the construction costs. Leaders of the ruling party’s lawmaker coalition on chips recognize this as a national strategy, part of Japan’s efforts to revive its domestic chipmaking industry, a sector that is viewed as crucial for growth and economic security.

The joint effort between Hitachi, Renesas, Toshiba, and the Japanese Ministry of Economy signifies a strategic shift. It’s not just about reviving the Japanese-owned foundry sector; it’s about embracing international collaboration, recognizing the importance of supply security, and focusing on processes that align with Japan’s core strengths.

The Rise of Rapidus: A Bold Leap Forward

Alongside the collaboration with TSMC, Japan’s ambitious project Rapidus is a critical piece of the puzzle. Aiming for 2nm production in 2027, Rapidus represents a daring and costly venture. Supported by a consortium that includes IBM and backed by the Japanese government and large conglomerates, Rapidus seeks to reshape Japan’s semiconductor landscape by leapfrogging several generations of nodes.

The endeavor is both extremely challenging and tremendously expensive. Modern fabrication technologies are expensive to develop in general. Rapidus itself projects that it will need approximately $35 billion to initiate pilot 2nm chip production in 2025, and then bring that to high-volume manufacturing in 2027.

Despite the high stakes, the vision is clear and backed by strong commitment. Rapidus aims to serve a limited but significant client base, including tech giants like Apple and Google, focusing on quality and innovation. The focus on limited customers is a strategic move to secure enough demand and revenue to recover massive investment while avoiding emulation of TSMC’s extensive client base.

Rapidus’ success holds much significance for Japan’s advanced semiconductor supply chain, symbolizing more than just a money-making venture but a catalyst for revitalizing the Japanese industry. The Japanese government views it as a critical step towards creating more opportunities for local chip designers, even if immediate success may not be guaranteed.

Conclusion: From Mirage to Reality, A Blueprint for Others?

The reference to “Foundry Morgana” or fata morgana in my initial article resonated with the elusive, almost mythical nature of Japan’s semiconductor revitalization efforts. However, today’s landscape shows a transformation from illusion to reality.

With TSMC’s strategic presence and the pursuit of Rapidus, Japan demonstrates a new level of commitment. It is embracing both its past strength and future potential, rebuilding its foundry landscape with international collaboration, and aligning with global advancements.

Japan’s Foundry Morgana is no longer just a distant reflection. It’s a (potential) reality ;-), emerging on the horizon as a renewal of semiconductors Made in Japan.

The dynamics between Rapidus and TSMC and the larger global context add more intrigue to Japan’s semiconductor industry’s resurrection. The potential impact of geopolitics, market cap, governmental subsidization, and known knowns regarding yields and timetables further adds to the complexity of this journey.

Furthermore, Japan’s approach to revitalizing its semiconductor industry may serve as a blueprint for other regions seeking to enhance their own technological prowess. Europe, for example, with its ambitions to grow its semiconductor manufacturing and reduce dependence, could look to Japan’s strategy for inspiration.

Sources:

https://www.anandtech.com/show/18979/rapidus-wants-to-supply-2nm-chips-to-tech-giants-challenge-tsmc

https://www.taipeitimes.com/News/biz/archives/2023/08/04/2003804192

https://www.electronicsweekly.com/news/business/japan-asks-tsmc-build-fab-2020-07/

https://www.taiwannews.com.tw/en/news/3999523

https://www.semiconductors.org/wp-content/uploads/2018/06/SIA-Beyond-Borders-Report-FINAL-June-7.pdf

https://sst.semiconductor-digest.com/2016/07/whats-happening-to-japans-semiconductor-industry/

https://blog.semi.org/semi-news/japan-a-thriving-highly-versatile-chip-manufacturing-region

Also Read:

How Taiwan Saved the Semiconductor Industry

Intel Enables the Multi-Die Revolution with Packaging Innovation

TSMC Redefines Foundry to Enable Next-Generation Products

Share this post via:

Facing the Quantum Nature of EUV Lithography