Safety engineers, hardware designers and reliability specialists in safety-critical industries like automotive, aerospace, medical device and industrial automation use FMEDA (Failure Modes, Effects and Diagnostic Analysis). ISO 26262 compliance for ADAS, braking systems and ECUs require FMEDA in the automotive sector.… Read More

Perforce and Siemens Collaborate on 3DIC Design at the Chiplet SummitThe recent Chiplet Summit at the Santa Clara…Read More

Perforce and Siemens Collaborate on 3DIC Design at the Chiplet SummitThe recent Chiplet Summit at the Santa Clara…Read More Building the Interconnect Foundation: Bump and TSV Planning for Multi-Die SystemsThe first article in this series examined how…Read More

Building the Interconnect Foundation: Bump and TSV Planning for Multi-Die SystemsThe first article in this series examined how…Read More CHERI: Hardware-Enforced Capability Architecture for Systematic Memory SafetyThe rapid escalation of cyberattacks over the past…Read More

CHERI: Hardware-Enforced Capability Architecture for Systematic Memory SafetyThe rapid escalation of cyberattacks over the past…Read More WEBINAR: Two-Part Series on RF Power Amplifier DesignAt lower frequencies with simpler modulation, RF power…Read More

WEBINAR: Two-Part Series on RF Power Amplifier DesignAt lower frequencies with simpler modulation, RF power…Read More Securing RISC-V Third-Party IP: Enabling Comprehensive CWE-Based Assurance Across the Design Supply Chainby Jagadish Nayak RISC-V adoption continues to accelerate…Read More

Securing RISC-V Third-Party IP: Enabling Comprehensive CWE-Based Assurance Across the Design Supply Chainby Jagadish Nayak RISC-V adoption continues to accelerate…Read MoreRVA23 Ends Speculation’s Monopoly in RISC-V CPUs

RVA23 marks a turning point in how mainstream CPUs are expected to scale performance. By making the RISC-V Vector Extension (RVV) mandatory, it elevates structured, explicit parallelism to the same architectural status as scalar execution. Vectors are no longer optional accelerators bolted onto speculation-heavy cores.… Read More

Perforce and Siemens Collaborate on 3DIC Design at the Chiplet Summit

The recent Chiplet Summit at the Santa Clara Convention Center was buzzing with many enabling technologies for chiplet-based design. Collaboration was also on display during many parts of the show. A presentation in the Siemens booth was a perfect example of both of those trends. In the Siemens booth, Perforce presented an excellent… Read More

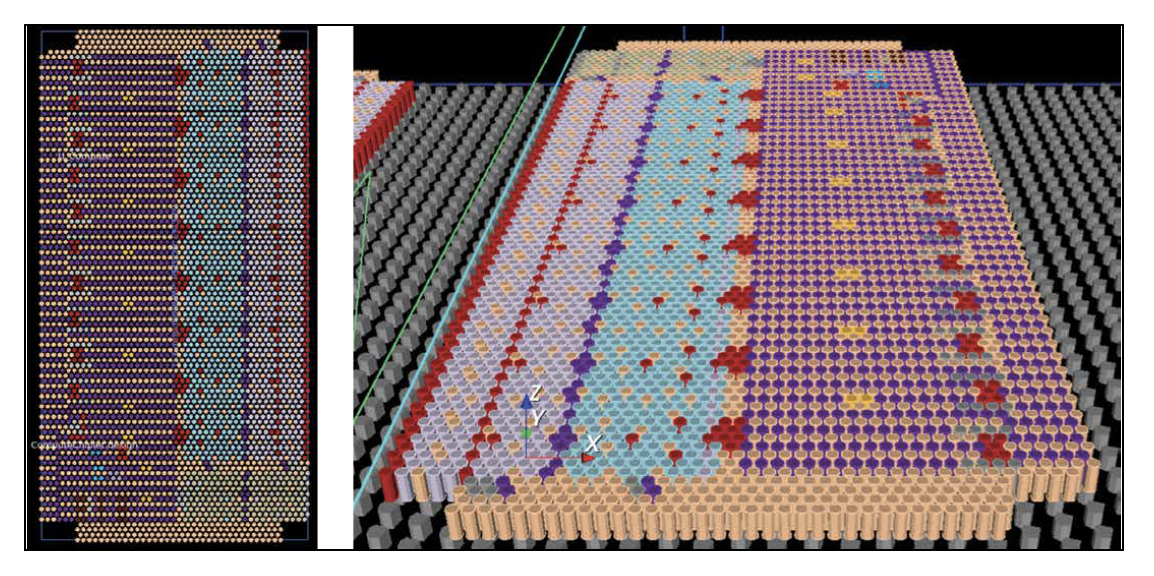

Building the Interconnect Foundation: Bump and TSV Planning for Multi-Die Systems

The first article in this series examined how feasibility exploration enables architects to evaluate multi-die system configurations while minimizing early design risk. Once architectural decisions are validated, designers must translate conceptual connectivity requirements into physical interconnect infrastructure.… Read More

CHERI: Hardware-Enforced Capability Architecture for Systematic Memory Safety

The rapid escalation of cyberattacks over the past two decades has exposed a fundamental weakness at the core of modern computing systems: the lack of memory safety. Industry data consistently shows that the majority of critical software vulnerabilities stem from memory corruption issues such as buffer overflows, use-after-free… Read More

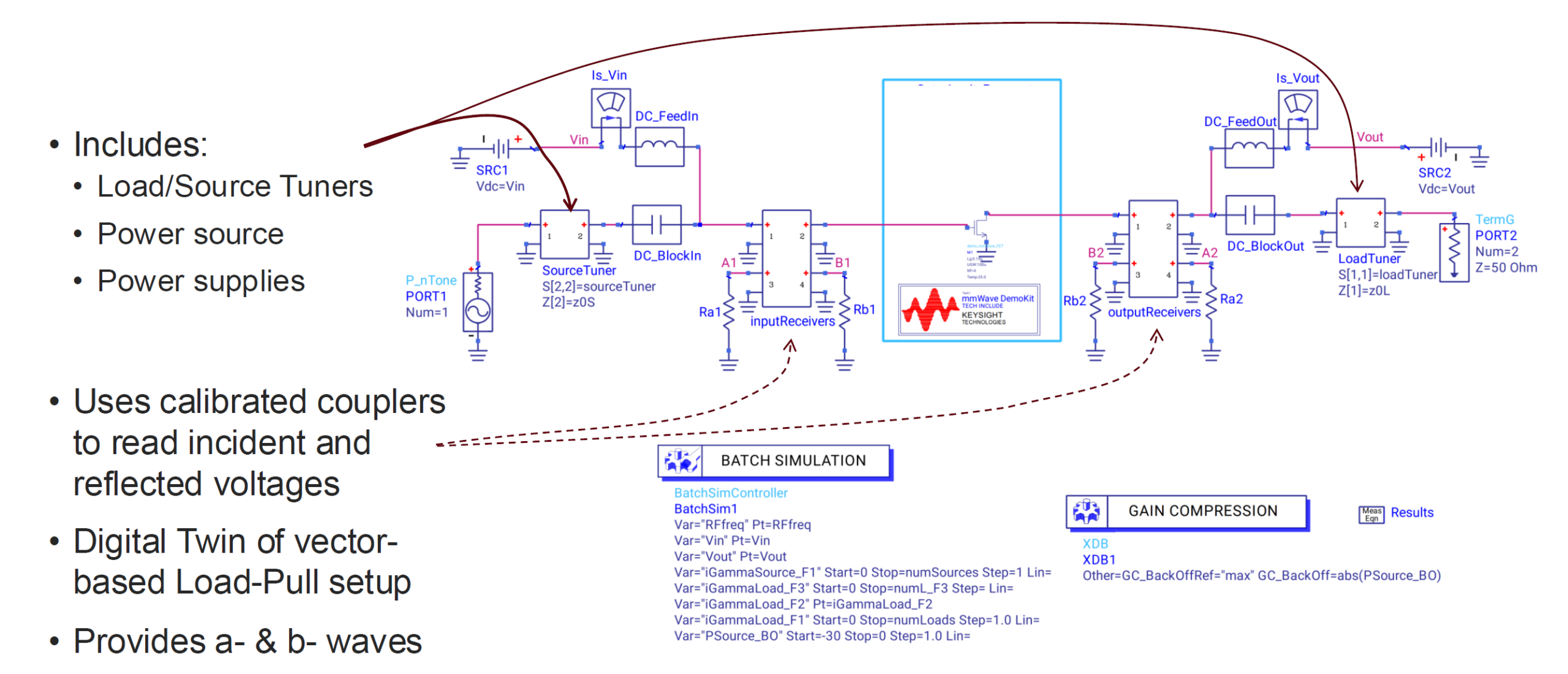

WEBINAR: Two-Part Series on RF Power Amplifier Design

At lower frequencies with simpler modulation, RF power amplifier (PA) designers could safely concentrate on a few primary metrics – like gain and bandwidth – and rely on relaxed margins to ensure proper operation in a range of conditions. Today’s advanced RF PA design is a different story. mmWave and sub-THz frequencies introduce… Read More

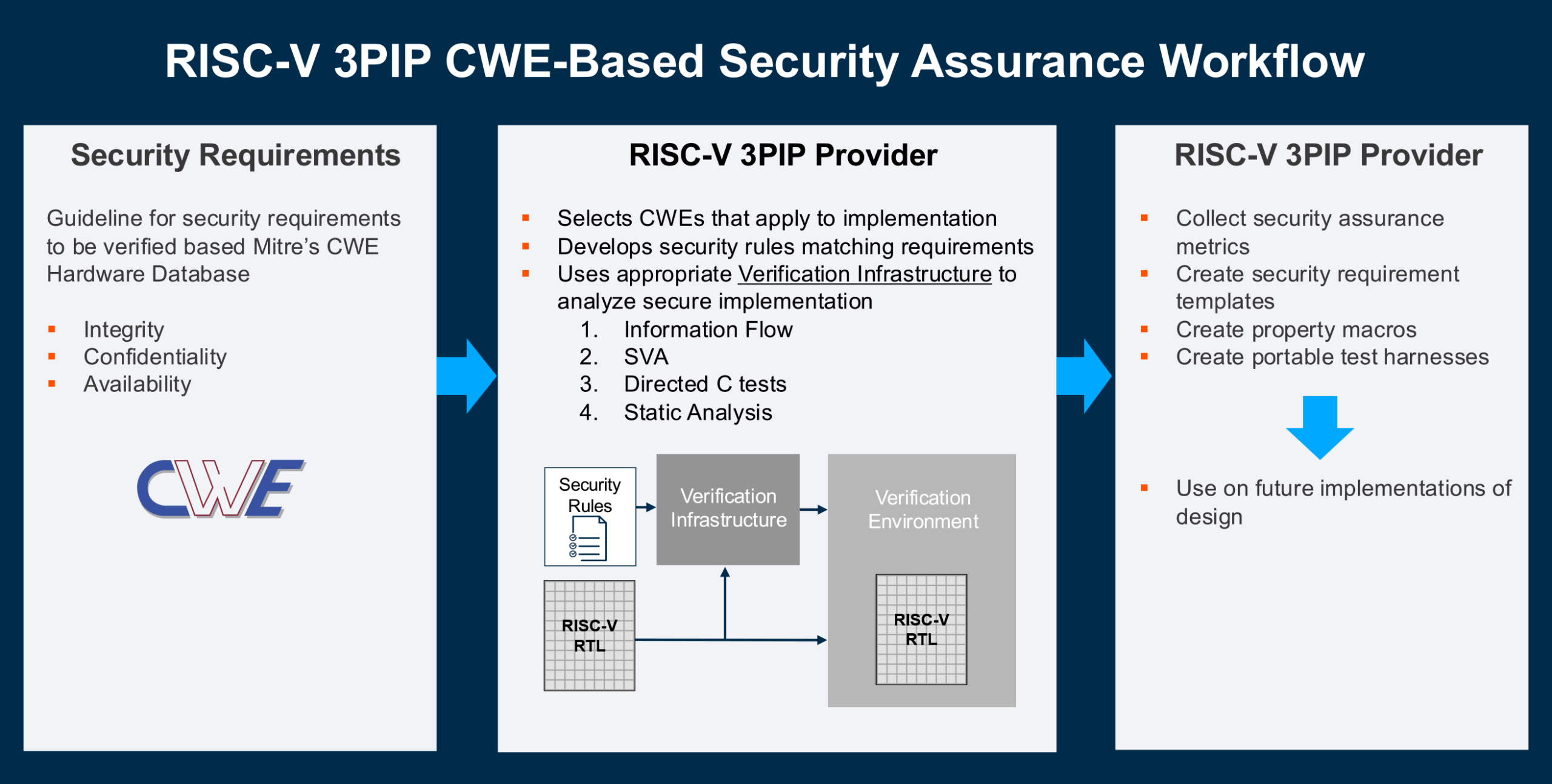

Securing RISC-V Third-Party IP: Enabling Comprehensive CWE-Based Assurance Across the Design Supply Chain

by Jagadish Nayak

RISC-V adoption continues to accelerate across commercial and government microelectronics programs. Whether open-source or commercially licensed, most RISC-V processor cores are integrated as third-party IP (3PIP), potentially introducing supply chain security challenges that demand structured,… Read More

Apple’s iPhone 17 Series 5G mmWave Antenna Module Revealed to be Powered by Soitec FD-SOI Substrates

Recent independent teardown and technical analyses have confirmed that the 5G mmWave antenna module powering Apple’s latest iPhone 17 lineup relies on advanced SOITEC based Fully Depleted Silicon-On-Insulator (FD-SOI) substrate technology. The discovery highlights a significant architectural shift in high-frequency… Read More

Another Quantum Topic: Quantum Communication

In my recent series on quantum computing (QC), I intentionally overlooked a couple of adjacent topics: quantum communication and quantum sensing. These face some of the same challenges as QC, however I noticed a recent report on a test quantum network implemented by Cisco and Qunnect which led me to find more from Cisco on their … Read More

Advancing Automotive Memory: Development of an 8nm 128Mb Embedded STT-MRAM with Sub-ppm Reliability

The rapid evolution of automotive technology has intensified the demand for highly reliable, high-performance semiconductor memory solutions. Modern vehicles increasingly rely ADAS driving features, and complex infotainment platforms, all of which require memory that can operate flawlessly under extreme environmental… Read More

CEO Interview with Jerome Paye of TAU Systems