During my frequent trips to Taiwan as a foundry relationship professional I remember meeting Frankwell Lin, CEO of Andes, in Taiwan 15+ years ago. As I walked to TSMC HQ from the Hotel Royal (my second home for many years) Andes was about mid point and Frankwell’s door was always open. Sometimes just tea, sometimes technology,… Read More

Perforce and Siemens Collaborate on 3DIC Design at the Chiplet SummitThe recent Chiplet Summit at the Santa Clara…Read More

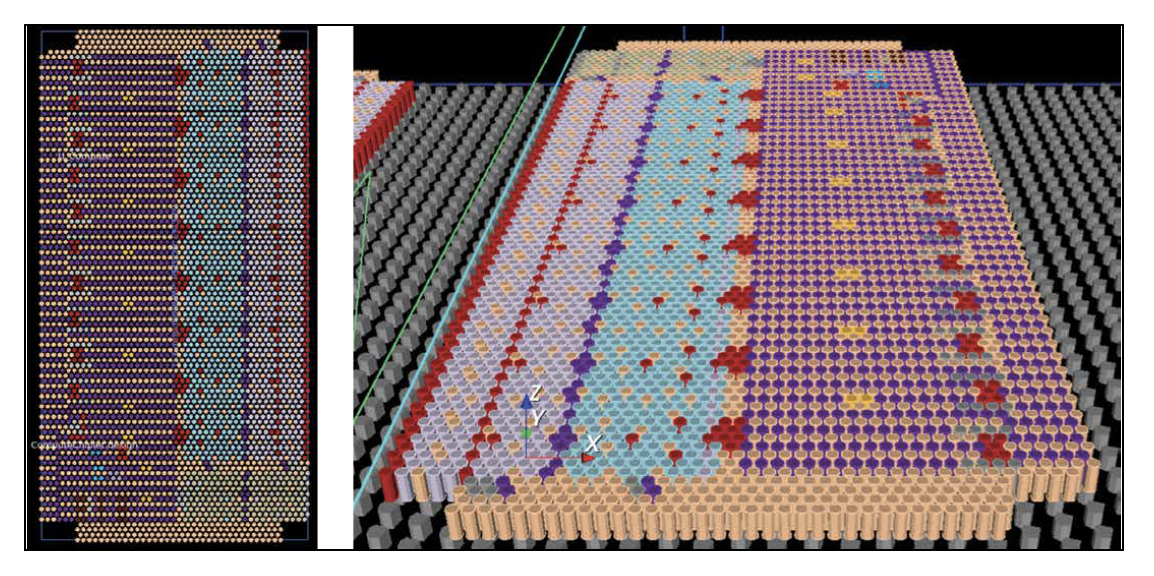

Perforce and Siemens Collaborate on 3DIC Design at the Chiplet SummitThe recent Chiplet Summit at the Santa Clara…Read More Building the Interconnect Foundation: Bump and TSV Planning for Multi-Die SystemsThe first article in this series examined how…Read More

Building the Interconnect Foundation: Bump and TSV Planning for Multi-Die SystemsThe first article in this series examined how…Read More CHERI: Hardware-Enforced Capability Architecture for Systematic Memory SafetyThe rapid escalation of cyberattacks over the past…Read More

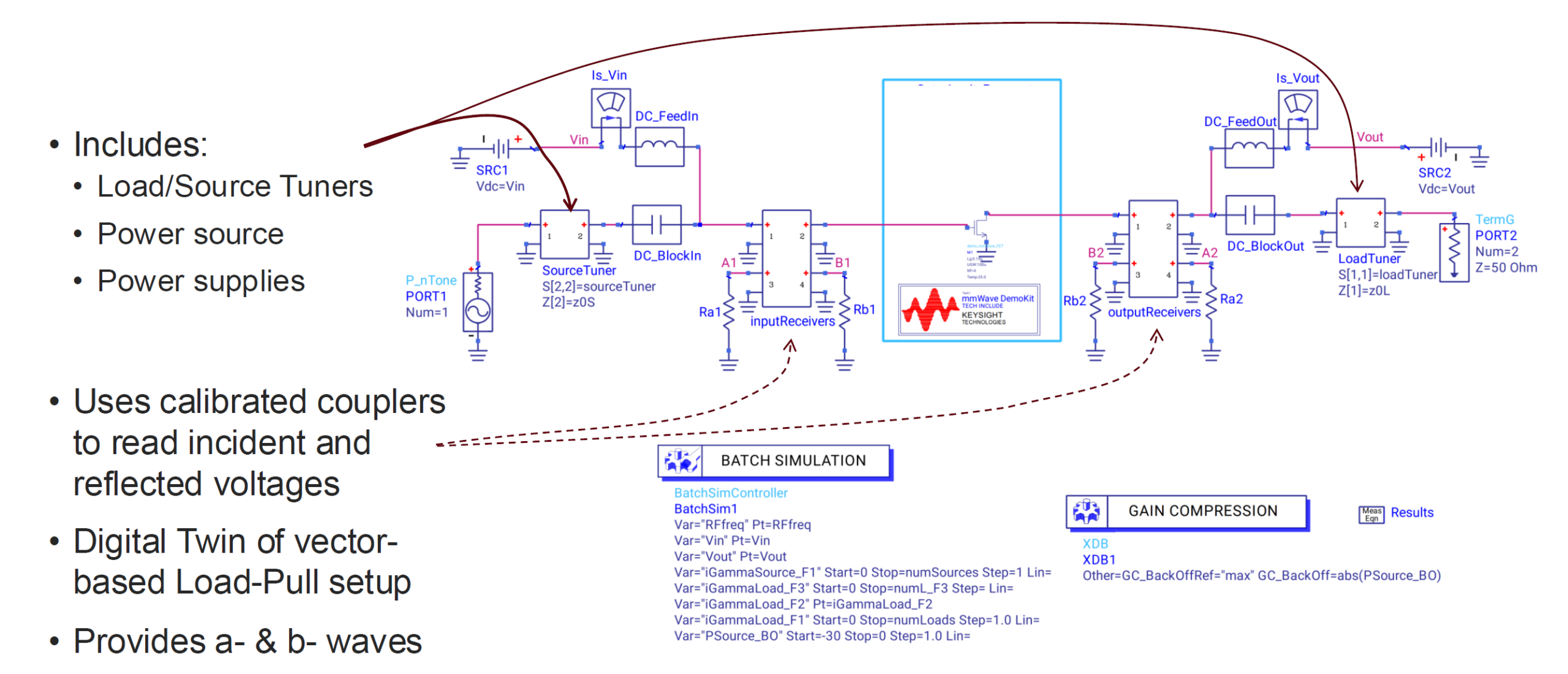

CHERI: Hardware-Enforced Capability Architecture for Systematic Memory SafetyThe rapid escalation of cyberattacks over the past…Read More WEBINAR: Two-Part Series on RF Power Amplifier DesignAt lower frequencies with simpler modulation, RF power…Read More

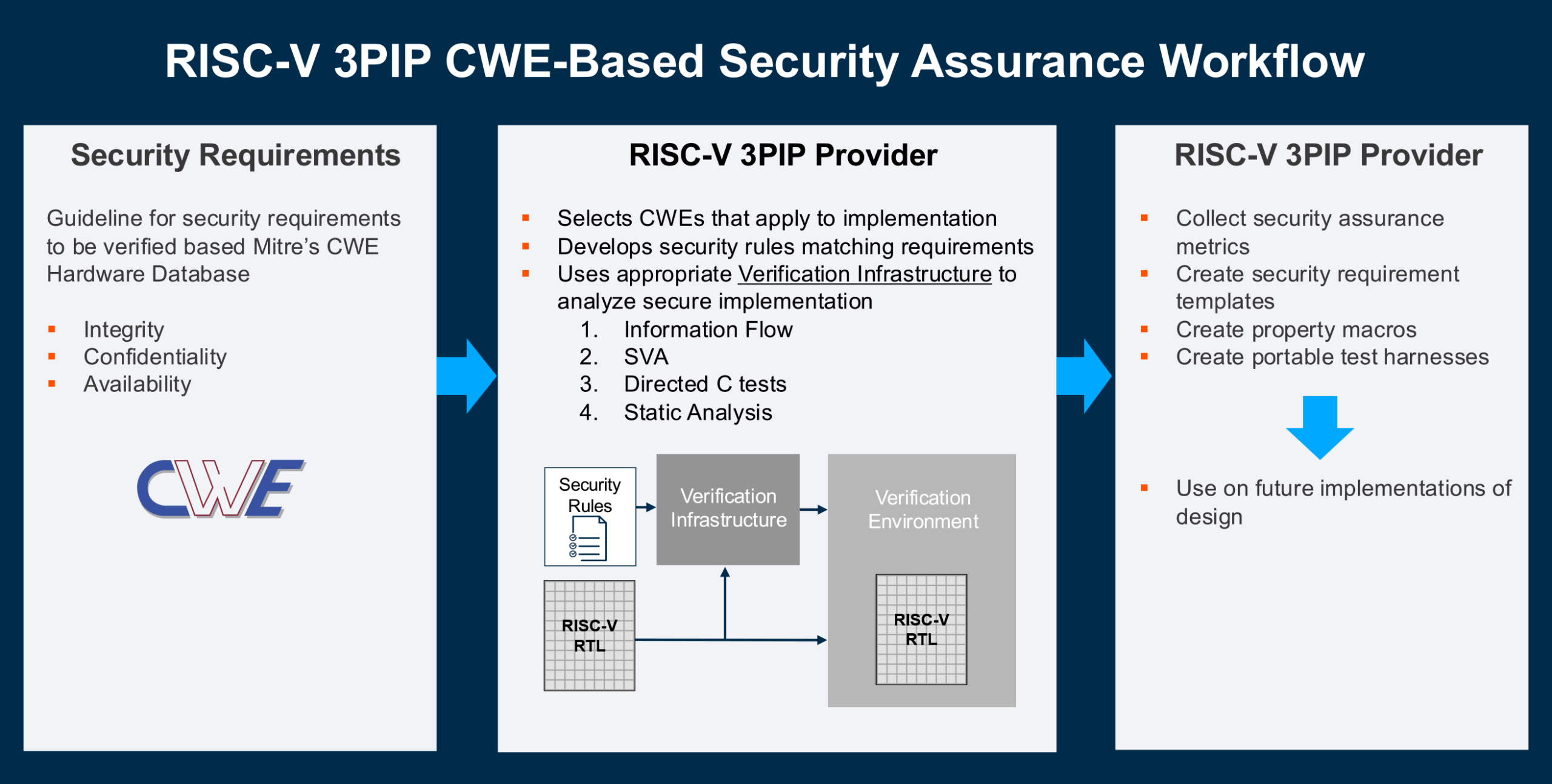

WEBINAR: Two-Part Series on RF Power Amplifier DesignAt lower frequencies with simpler modulation, RF power…Read More Securing RISC-V Third-Party IP: Enabling Comprehensive CWE-Based Assurance Across the Design Supply Chainby Jagadish Nayak RISC-V adoption continues to accelerate…Read More

Securing RISC-V Third-Party IP: Enabling Comprehensive CWE-Based Assurance Across the Design Supply Chainby Jagadish Nayak RISC-V adoption continues to accelerate…Read MoreOperationalizing Secure Semiconductor Collaboration: Safely, Globally, and at Scale

Semiconductor manufacturing is among the most complex industrial activities in existence. As device geometries shrink and systems become more interconnected, software has become as critical as process technology itself. Modern fabs depend on extensive automation, real-time analytics, and deep integration between tools,… Read More

Keynote: On-Package Chiplet Innovations with UCIe

In the rapidly evolving landscape of semiconductor technology, the Universal Chiplet Interconnect Express (UCIe) emerges as a groundbreaking open standard designed to revolutionize on-package chiplet integrations. Presented by Dr. Debendra Das Sharma, Chair of the UCIe Consortium and Intel Senior Fellow, at the Chiplet… Read More

CEO Interview with Jerome Paye of TAU Systems

Jerome Paye has served as CEO of TAU Systems since late 2025, having joined the company shortly after its founding in 2022 as Chief Operating Officer. In that time, he has helped build TAU Systems into a high-performing team now focused on delivering the ultimate light source for semiconductor lithography.

Paye brings more than… Read More

Things From Intel 10K That Make You Go …. Hmmmm

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 27, 2025.

1) Intel is constrained on manufacturing. Not by TSMC. But by IFS and mainly by Intel 7, a node from 2021. Normally constraints are good, it means you are running efficiently with lots of … Read More

Podcast EP334: The Unique Benefits of LightSolver’s Laser Processing Unit Technology with Dr. Chene Tradonsky

Daniel is joined by Dr. Chene Tradonsky, a physicist and the CTO and co-founder of LightSolver, where he leads the development of a proprietary physics-based computing system built on coupled laser dynamics to accelerate compute-heavy simulations and other computationally demanding workloads. Before moving into physics,… Read More

Global 2nm Supply Crunch: TSMC Leads as Intel 18A, Samsung, and Rapidus Race to Compete

The semiconductor industry is in the midst of a structural supply challenge that’s tightly coupled to exploding demand for advanced chips, especially those used in AI, HPC, and next-generation mobile and consumer devices. At the center of this vortex is the 2nm class of manufacturing technology, representing one of the most … Read More

Reducing Risk Early: Multi-Die Design Feasibility Exploration

The semiconductor industry is entering a new era in system design. As traditional monolithic scaling approaches its economic and physical limits, multi-die architectures are emerging as a primary pathway for delivering continued improvements in performance, power efficiency, and integration density. By distributing … Read More

From Satellites to 5G: Ceva’s PentaG-NTN™ Lowers Barriers for Terminal Innovators

Ceva, Inc., a leading provider of silicon and software IP for the Smart Edge, has unveiled PentaG-NTN™, its groundbreaking 5G Advanced modem IP subsystem tailored for satellite user terminals in Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) constellations. Announced at Mobile World Congress 2026 in Barcelona on March 3,… Read More

Siemens Reveals Agentic Questa

There’s no denying that verification now leads the field in agentic AI announcements, accelerating the trend around this significant contribution to design automation. Siemens have just announced their Questa One Agentic Toolkit, their response to this trend, building on the core Questa One platform. Questa One provides … Read More

CEO Interview with Jerome Paye of TAU Systems