Investors of capital, whether financial or human, utilize numerous methods to decide to participate with an early-stage / seed-stage technology company. The risks are, by definition, much higher than later stage companies pursuing investment in their Series B/C or beyond rounds. It is helpful to establish consistent “health appraisal” metrics and risk-factors for use in your decision-making process – whether you are investing at pre-seed or seed stage, as an individual or you are part of an investment group.

In 1952, Dr. Virginia Apgar created a scoring system for doctors and nurses to assess newborns at birth. Medical professionals worldwide use the Apgar system to this day, to quickly help understand the baby’s condition immediately after birth. Low Apgar scores may indicate the baby needs special care, such as requiring special help with their breathing.

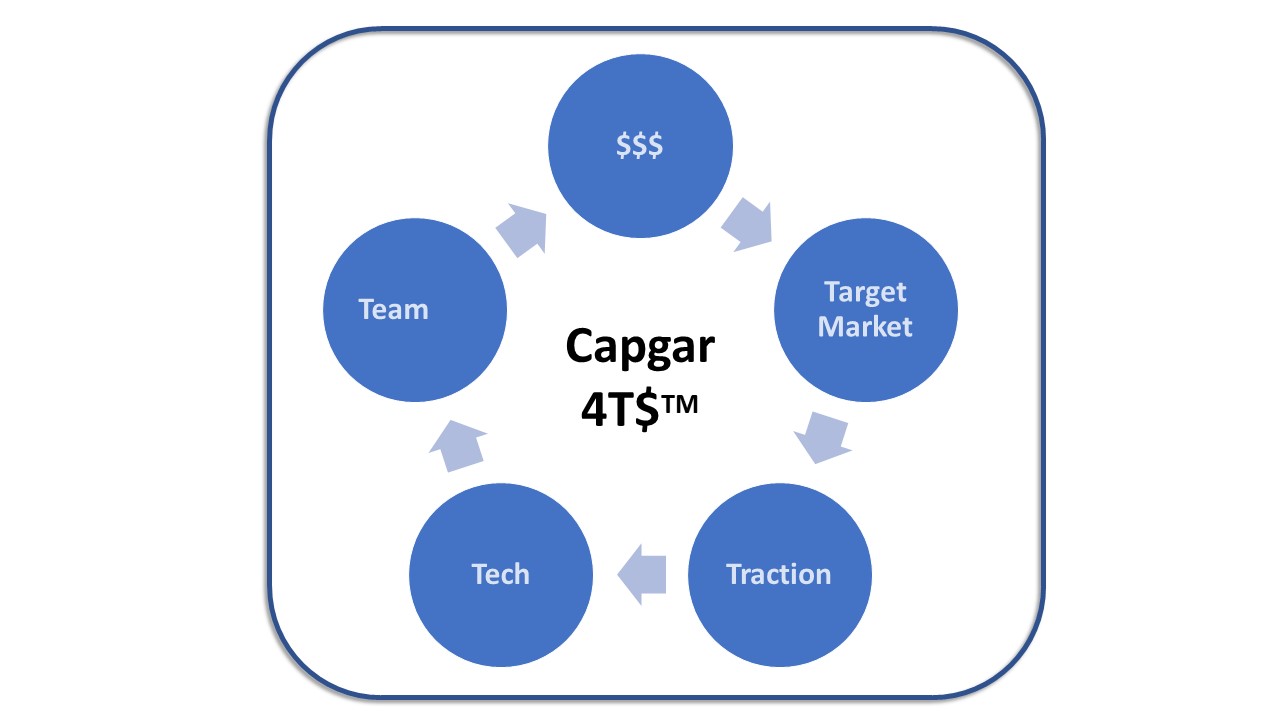

This article introduces an equivalent scoring system to determine the health of an early-stage startup, with a different perspective, by examining key company mortality factors. The company Apgar scoring system is called Capgar-4T$ ™, establishing a standard for diagnostic measurement of the key vital signs of the company, projecting the potential survivability of the startup at the time of evaluation. The mortality factor analysis and Capgar-4T$ scoring can be carried out by 3rd parties / potential investors, or internally by the management team and key stakeholders.

Background

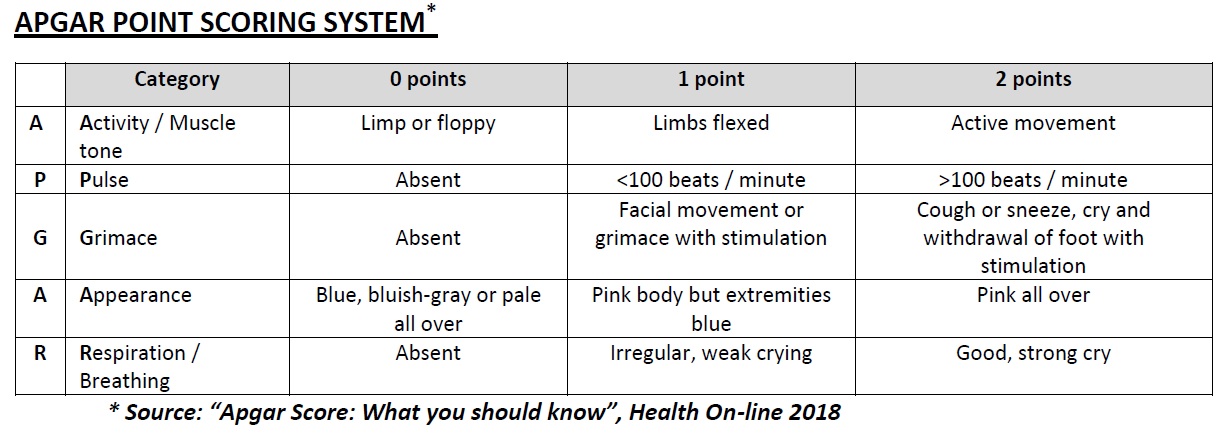

Dr. Apgar used her name as a mnemonic for each of the five health categories that a baby will score at birth, based on a scale of 0 to 2, as detailed in the table below. The Apgar is measured at the 1-minute and 5-minute mark from the birth. A score of 7 to 10 is considered normal for both the one-minute and five-minute Apgar tests. The Apgar score is not used to predict the newborn’s long-term health, behavior, or intelligence. It is solely a standard used by the obstetrical profession to quantify the health of the baby, at a specific point in time, to quickly summarize the health of the newborn against infant mortality.

Capgar-4T$ System Overview

The health and viability of a startup is dependent on a wide variety of factors. Similar to the newborn Apgar scoring, the company-Apgar has been established to provide a standard measurement technique for diagnosing the health of the enterprise, or equivalently, their potential mortality rate.

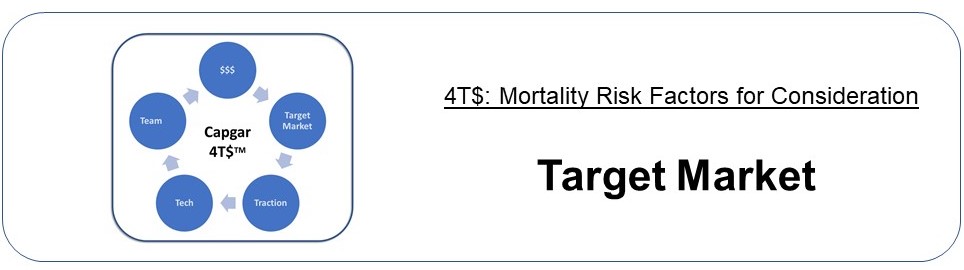

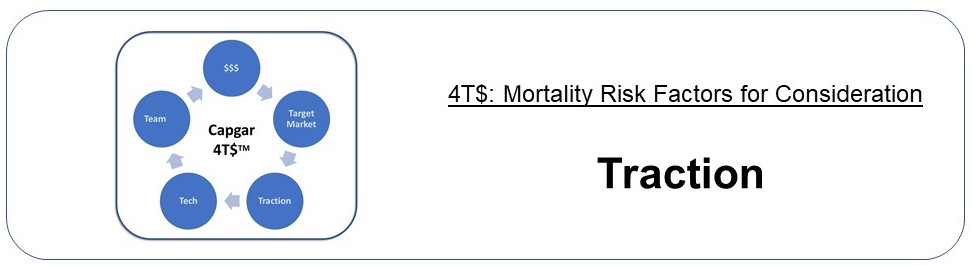

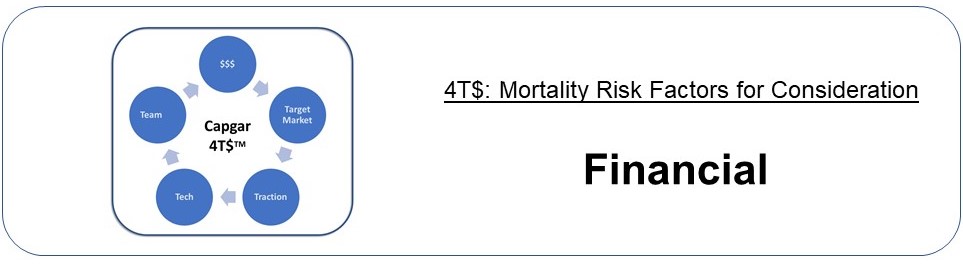

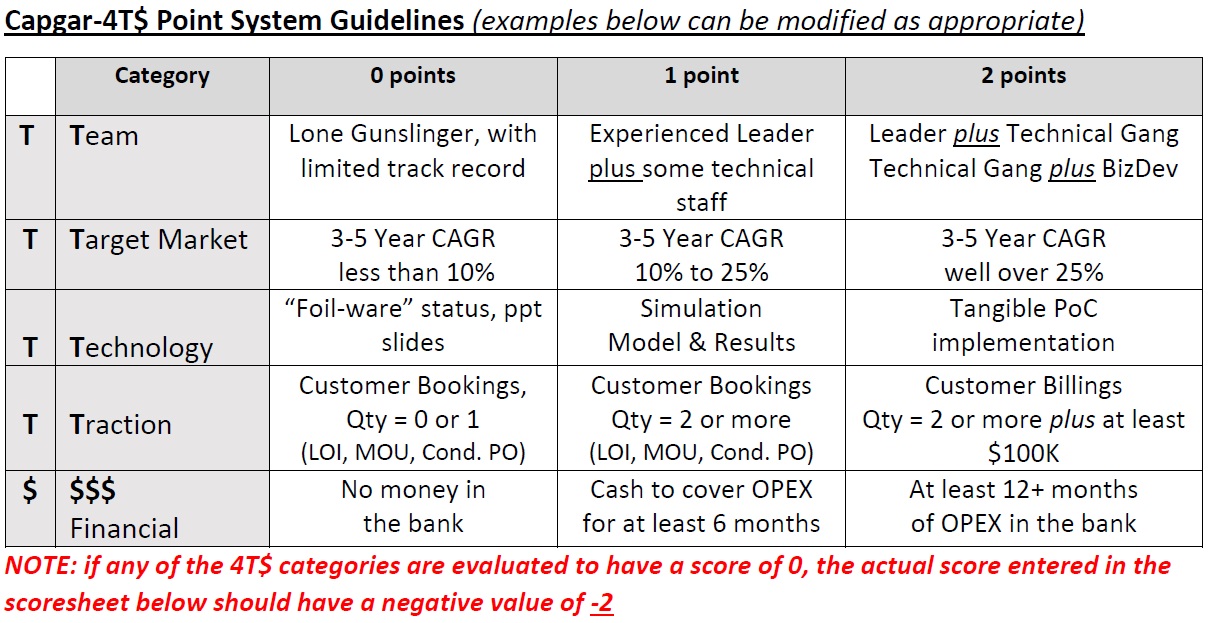

Capgar incorporates a new mnemonic, “4T$”, based on the 5 critical categories used in determining the company’s overall health. The mnemonic represents the key vital signs at a point in time, with the 4 T’s representing:

Team

Target Market

Technology

Traction

and

$ representing the financial aspects of the company

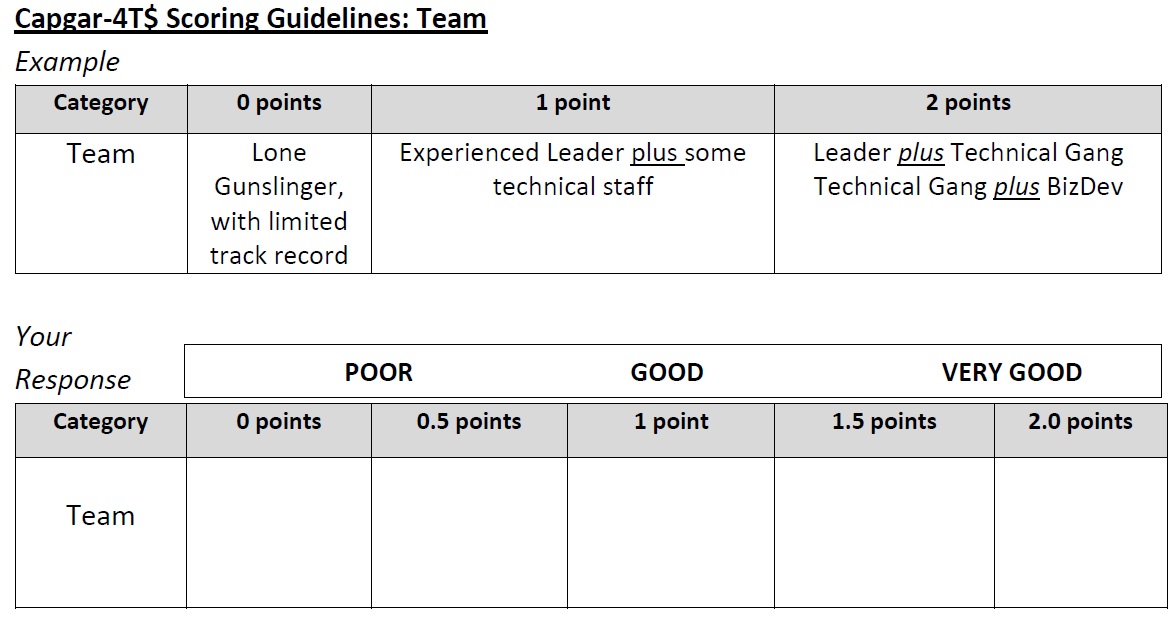

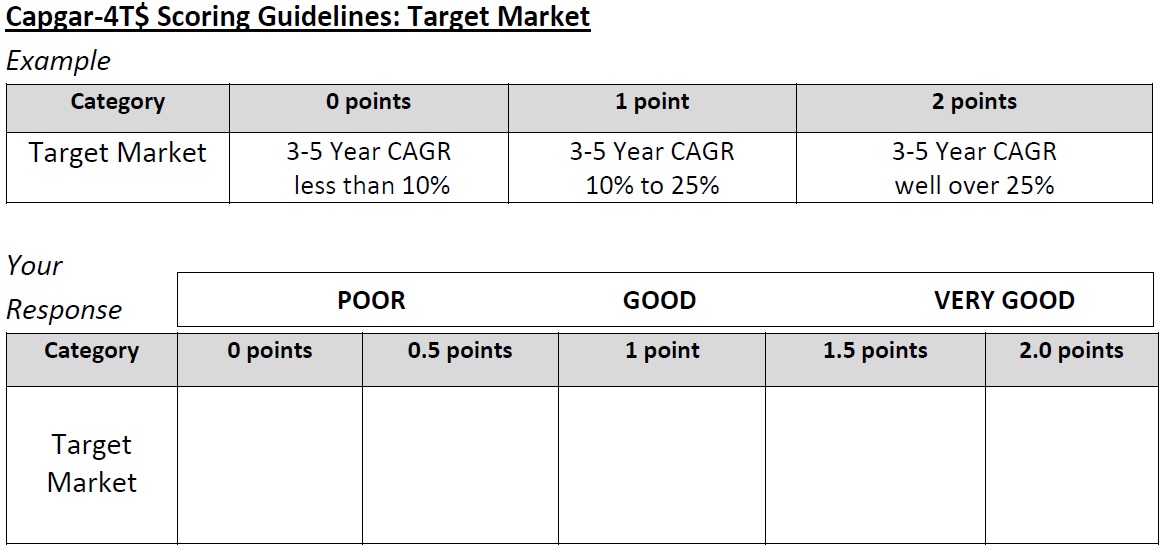

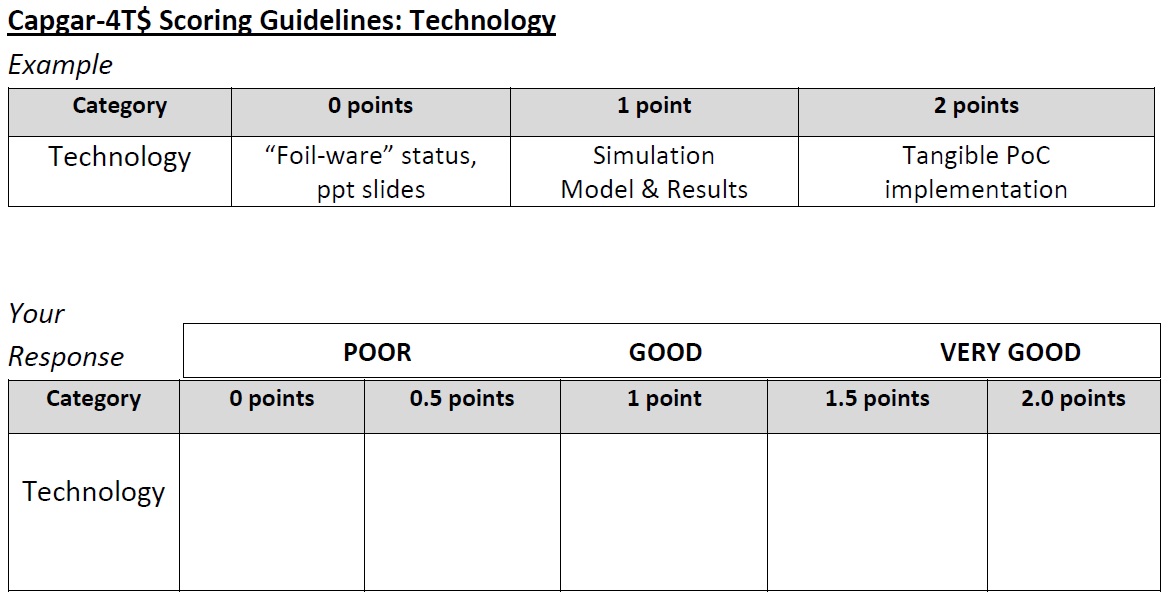

Distinct from the use of Apgar scoring just for the newborn’s earliest moments, the Capgar-4T$ system can assist in periodic identification of operational deficiencies, useful for the potential investor, as well as for management team and the board of directors. Scoring for the 4T$ measurement is similarly structured to use the same Apgar 0, 1 or 2 rating scale. For the “gray” areas in the categories, it adds 0.5 and 1.5 scores for each of the five categories.

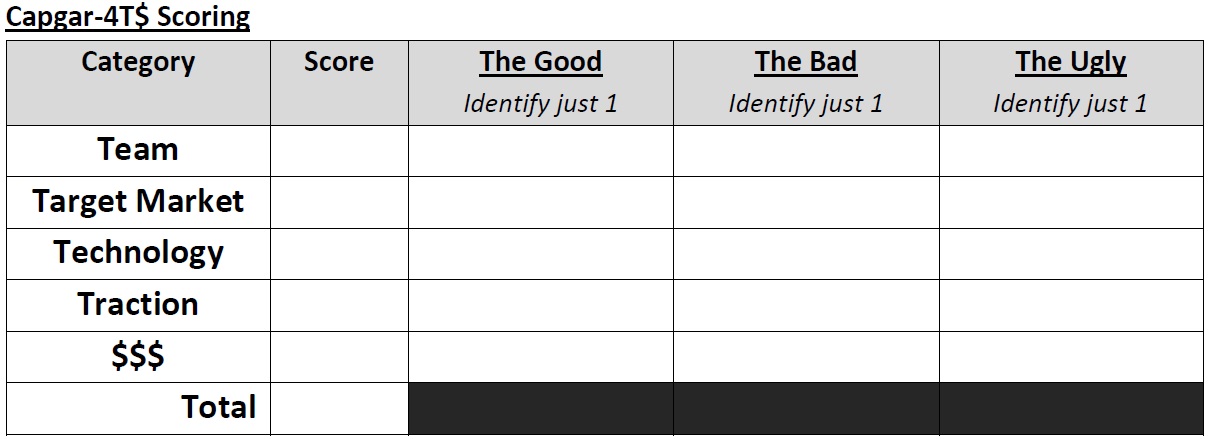

Although the Capgar-4T$ appraisal system can be completed by a single individual, it is suggested to have 2 to 3 additional “evaluators” involved in reviewing the company’s health.

After discussion and deliberation, the judicial council can decide on the consensus score for that category. The final Capgar-4T$ score will range between 0 and 10. Note: If any of the 4T$ categories results in a score of “0”, the actual category value should be entered as “-2”. To have a meaningful use of the Capgar-4T$ system, the appraisal process should be of an appropriate duration to adequately cover the 4T$ categories for all involved – interacting with the startup management team and if in place, outside members of the board and key advisors.

Summary

The measurement and analysis of complex systems, whether human or manmade, is inherently difficult. The Capgar-4T$ system can be of value in evaluating an early-stage business, as part of your decision-making process for involvement:

– To invest your capital

o whether it be financial or human (your time & efforts vs. ROI)

– To use in a strategic analysis and planning process

o For the senior management team, board and key stakeholders to use in conjunction with Corporate-level KPI reviews

A key aspect in reviewing the 4T$ scoring results is to understand the significance of a score of zero or .5 in any of the categories. In some cases, a zero could dictate urgent and immediate “life-saving” measures need to be taken, e.g. running out of cash to make payroll. Whereas a low score of 0 or 0.5 in Traction can point to either the startup not undertaking market discovery and validation, ala the “Lean Canvas” model, or the fact that the startup has a “solution looking for a problem”.

The Capgar-4T$ ™ System delivers an effective diagnostic system for the analysis of investment opportunities and offers a consistent process for use in establishing overall viability of the startup, at a specific point in time. The resulting 4T$ score can be used to identify the critical strategic issues to be addressed for future business growth and vitality, and ultimately the decision to invest and/or participate as a member of the startup.

The relationship between innovation drivers and business cycles is a well understood symbiotic concept. Investment in early-stage technology startups, aka “Frontier Tech” or “Hard Tech”, is vital to continued innovation. A key element for renewed business growth will be in the analysis and selection of startups that are the most promising investment options, utilizing an industry standard rating system for high-tech ventures, as presented with the 4T$ process.

The following sections provide a list of possible mortality-influencing topics for consideration prior to final category scoring. At the conclusion of each section there are category scorecards for each of the 4T$ rating levels. Also included is the 4T$ Summary Worksheet to summarize the analysis.

• First and foremost, is there a team or is it just a founder – moonlighting or full-time

• Commitment: Bootstrapping with founding team’s personal money or using O.P.M.

• Leader(s) – key personality traits; Winslow tested?

• Why? Is it a Lifestyle business or lusting after a Beverly hills mansion?

• Grit-level? See Duckworth for “passion and perseverance”

• Sacrifices, if any – e.g. payroll details

• Organizational structure

• Who’s the “rainmaker”?

• Relevant industry experience and reputation; references

• Who, where, how many on the team; employees, advisors and contractors

• Team esprit-de-corps / “fire-in-the-belly”

• History together / track record

• Equity split

• Clear articulation of the “burning problem and it’s economic and/or social impact”

• “Economic $$ Benefit” of using the products

• Solutions / alternatives

• Top-5 competitors: financials, market share, market cap to sales ratio

• Trends and CAGR of the segment(s); where is it on the Gartner Hype-Cycle ?

• Competitive landscape, strategy and advantage (Porter); Blue Ocean opportunity?

• Sales cycle details, purchasing / budgeting cycles

• M&A history in the target market

• Position in the target market “value” stack

• First-mover vs fast-follower

• Features and Advantages vs existing alternatives

• Evolutionary (10x to 20x faster, better, cheaper) or revolutionary (search engines, streaming video)

• Patent position

• Production status: “slide-ware” … pre-alpha … to FCS

• 3rd party components: licensed or open-source

• Supply chain – vendors, process, lead times, location, multiple sources

• Impact on the overall industry or segment(s)

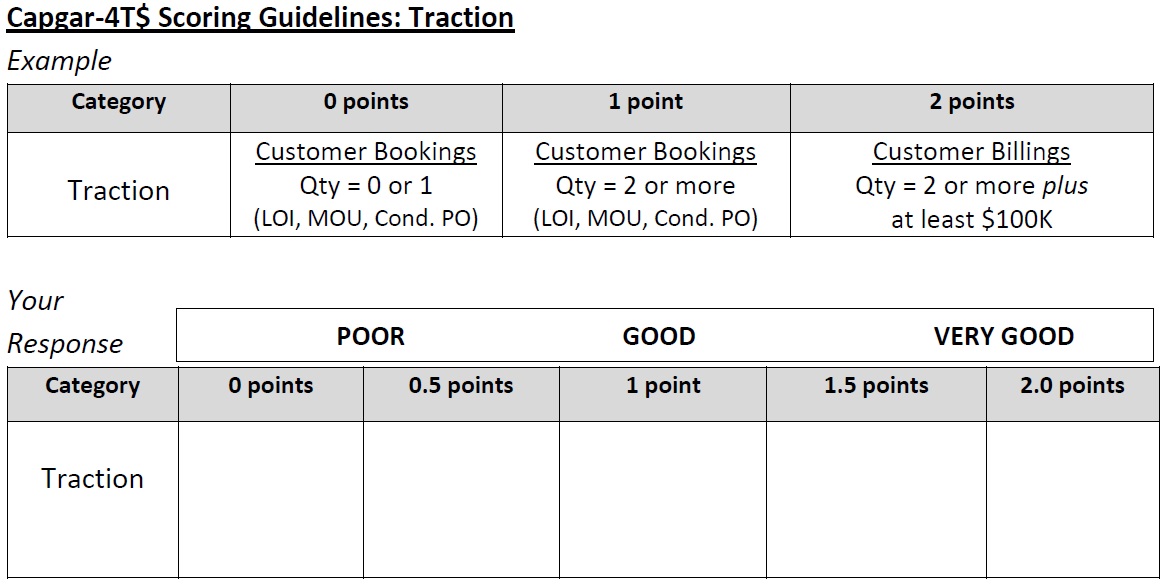

• Sales results (LOI, MOU, Conditional POs) are the best proxies to determine:

• Sales results (LOI, MOU, Conditional POs) are the best proxies to determine:

o The gestation stage of the start-up

o That the company’s messaging/branding/marketing mix is resonating in the market

o Product-Market fit

• Target account list; shotgun or rifle-shot?

• Sales collateral:

o presentations, datasheets, whitepapers,

o press coverage, customer case studies & testimonials

• Sales Channels – direct or in-direct, territories

• # of customers, # of evaluation sites, “out-of-the box” experience

• Impact on the industry of business success

• Prospecting meeting summaries; identification of key learnings

• Bookings and Billings History

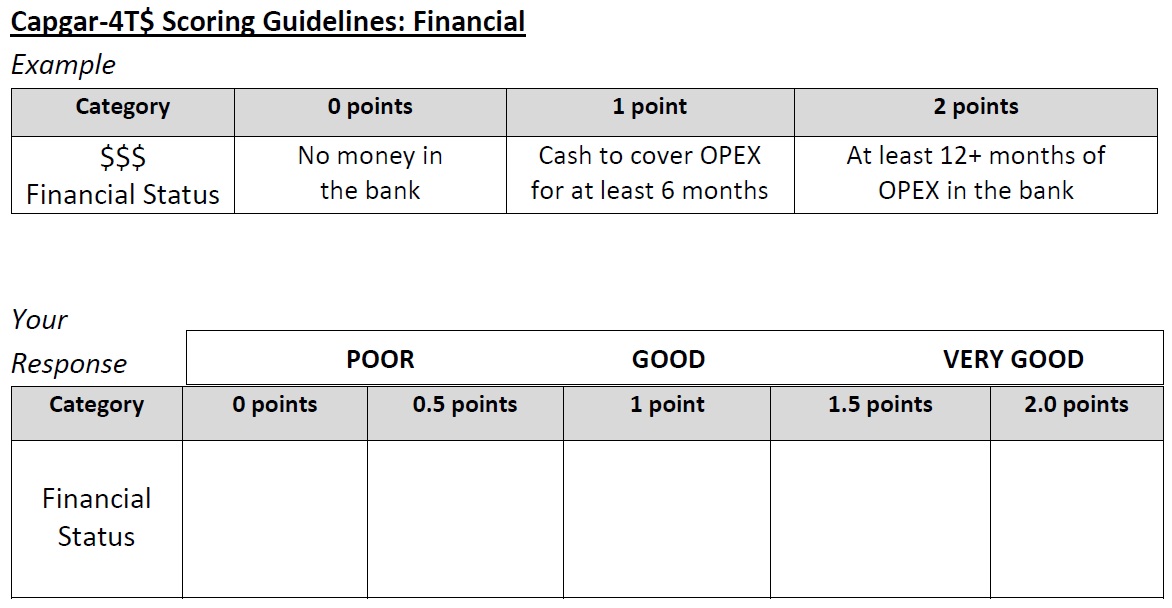

• Current cash balance vs burn-rate

• Financial savviness: e.g. do they know why it is called “top-line” growth?

• 1st level: does leader know how to read a P/L, B-S

• P/L and Cash-flow projections – believable or naive

• Understand COGS and optimization paths

• Knowledge of the supply chain, capacity constraints, risk planning

• Investor specifics – equity: SAFE, Convertible Notes, CAP table, warrants, ESOP

• Litigation historical or pending

• Engagement status with Angels, VCs and CVCs

COMPANY NAME: _______________________ DATE: ________________

PARTICIPANTS: _____________________________________________________________

References

- Steve Blank youtube video on the Principles of Lean

- Winslow personality testing

- Angel Duckworth on “Grit”

- Gartner Hype Cycle

- Porter on Competitive Strategy

- Blue Ocean Strategy

Richard Curtin

The Capgar Group

TSMC N3 Process Technology Wiki