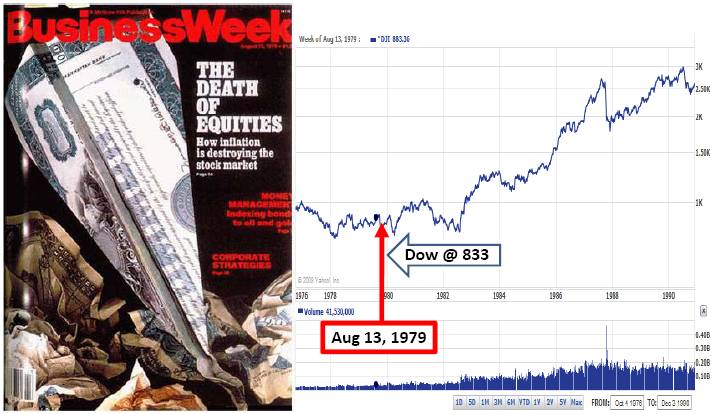

Bill Gross, founder and co-chief investment officer of PIMCO, the world’s largest Bond Fund, recently declared, “We’re Witnessing the Death of Equities.” Contrarians should take note as Gross made a similar calling 10 days before the previous major stock market bottom on March 9[SUP]th[/SUP] 2009. For Entrepreneurs and Venture Folks who are essentially “equity innovators”, I would like to suggest that these declarations of end times probably mark the start of a new up cycle similar to what occurred in the 1980s and 1990s. Prior to that there was a generational stock market bottoming that coincided with the Business Week magazine cover of August 13, 1979 Titled: “The Death of Equities.”

Critics of the High Tech Euphoria of 1999-2000 like to point out how valuations were so out of line that anyone rational could see that the bubble was going to burst. Even established, profitable firms like Intel, Cisco, Sun Microsystems, Qualcomm and others were selling for P/Es greater than 60 or even 100. In other words they were offering a return of <1.7% (1/60). Several weeks ago the “ultra safe” 10 year US Treasury dropped in yield to under 1.4% (the equivalent of a P/E greater than 70). If you see the herd, can you say bubble?

Fear of a second financial crises (ala Lehman September 2008) has taken hold in Europe and what starts over there impacts the rest of the world. Investors have fled stocks for German and US Government Bonds. During the past 6 months I noticed on many days that Apple tracks the German Bond Market. Apple, now the largest cap stock with a modest P/E of under 15 is acting like its own currency, but not valued like the Government Bonds because there is fear that when the world ends Apple will not be there to pay investors like the US and German governments will be. Does anyone see the disconnect between the innovator creating enormous value and Jabba the Hut Consuming everything in sight?

The disparity we see today is well covered in an article (highly recommend to readers) by David Goldman, which in great detail describes how investors have moved money around based not on absolute returns but on risk adjusted terms. In this environment stocks such as utilities and consumer staples (Coca Cola, Walmart, tobacco companies, etc) are rightfully seen as low risk businesses that offer investors a steady stream of dividends and thus outperforming high growth technology firms. Unlikely as it seems these companies sell at P/Es that are much higher than Apple, Intel and Microsoft.

On September 29, 2008, the worst day of the financial crises, the stock market plunged 9% with 499 of the S&P500 stocks falling. The lone winner was Campbell Soup. When they turn out the last lights of the economy it is good to know that Campbell’s Soup will still be around. Better stock up today.

As the European crises spread from Greece to Italy and Spain, the flight to riskless assets (bonds) has caused interest rates to hit multi-generation lows (since the Great Depression). In David Goldman’s model the utility and consumer stocks have demonstrated a very high correlation to interest rates, increasing in value as rates dropped. Technology stocks have gone the other direction and experienced massive P/E compression undershooting what is expected in a normal economy given their revenue growth.

A turn appears to be in the offing as the German led drill down on reforming the PIIGs (Portugal, Italy, Ireland, Greece) during the past 12 months has only slowed the world economy further, thrown people out of work and tanked interest rates. Politicians know they are sitting on a pile of liabilities stretching out to forever that can’t be paid off in a no growth “Campbell Soup” economy. Time to put Silicon Valley to work and to crank the printing presses. History shows that Semiconductor stocks performed well in the late 1970s when Carter oversaw the highest inflation of the past 100 years. Why? Because Moore’s Law immediately gets to work driving out inflationary inefficiencies and driving productivity booms. Against all I was taught in MBA school, I welcome the Money Printers because I know through proven experience that the empowerment of our Equity Entrepreneurs overcomes inflation.

Death to Bonds!

Full Disclosure: I am Long AAPL, INTC, ALTR, QCOM and am not recommending investment allocations of any stock or bond to readers.

Share this post via:

TSMC vs Intel Foundry vs Samsung Foundry 2026