You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

We attended the Needham Growth Conference which is one of the first conferences of the year and in the quiet period before most companies reported so even though there was no “official” comment from most companies on the quarter, the surrounding commentary spoke volumes:

- The down cycle (and everyone admits its a cycle

…

Read More

It should come as no big surprise that Samsung will miss its Q4 numbers. The company pre announced that profits will be 10.8T KWON (about $9.7B ) versus the 13.2T KWON analysts had predicted, close to a 20% miss. This number is also down about 39% sequentially. Revenue at 59T KWON instead of expected 62.8T KWON and down about 10%. The… Read More

On the first day of trading in the new year Apple just announced, after the close, that revenues will be lower than previously expected coming in at $84B versus the expected range of $89B to $93B and analyst estimates of the current quarter at $91.5B. Ugly….. The blame was laid squarely on China as slowing sales and trade tensions… Read More

For those who have been paying any attention to the semiconductor industry its no surprise that memory demand and therefore pricing is down from its peak earlier in the year. Its not getting better any time fast.

After several strong years of demand and pricing, which was followed by enormous CAPEX spending we are seeing the standard… Read More

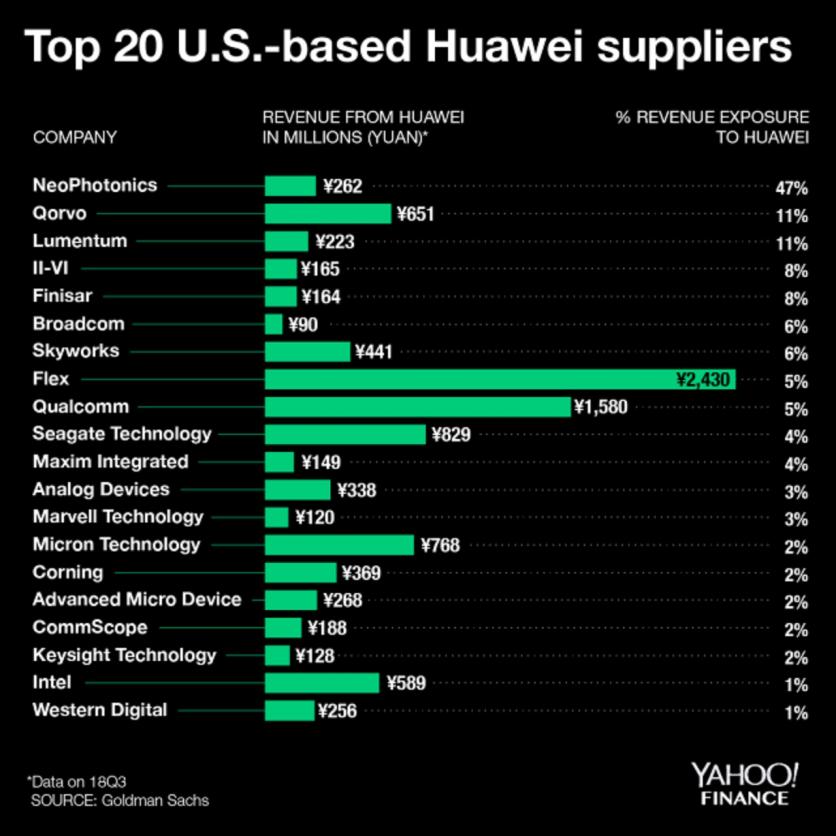

In our recent note sent several days ago we suggested that the China conflict would come back to haunt the US chip industry. From a stock perspective we suggested taking short term gains from a recent bounce back off the table. Both ideas turned out true, but way faster than we had thought! Not only have investors figured out that the… Read More

At the recent trade talks in South America, the US and China both kicked the can down the road as neither one were obviously willing to do a deal nor had done any background work to get a deal done. Instead we have a bunch of empty promises and vague and conflicting descriptions of what was not really even agreed to.

Essentially worthless… Read More

Applied Materials reported a just “in line” quarter but guidance was well below street expectation. AMAT reported EPS of $0.97 and revenues of $4.01B versus street of $0.97 and $4B. Guidance missed the mark by a wide margin with revs of $3.56 to $3.86 and EPS of $0.75 to $0.83 versus already reduced street expectations… Read More

The DOJ last week released a previously sealed indictment against UMC, Jinhua and three individuals for stealing Micron trade secrets. The indictment is very damning of UMC with very specific semiconductor technology files that were stolen by UMC related people then passed on to Jinhua through its joint development with UMC.… Read More

Semiconductor stocks have had another significant down leg as the bad news continues to pile on. Bad news in this case doesn’t come in threes , it comes in droves. TI is perhaps very scary news as it is a rather broad based supplier of semiconductors that has fared better than more pure play chip suppliers. TI gave weak guidance… Read More

ASML reported EUR2.78B in revenues with EUR2.08B in systems. 58% was for memory. EUV was EUR513M with 5 systems. Importantly orders were for EUR2.20B in systems at 64% memory and 5 EUV tools. This was likely better than expectations given the overall industry weakness. EPS of EUR1.60 was more or less in line with expectations. Guidance… Read More

CEO Interview with Jerome Paye of TAU Systems