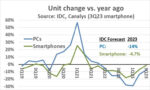

Unit shipments of both PCs and smartphones versus a year ago have turned positive. According to IDC, PC shipments in 1Q 2024 were up 1.5% from 1Q 2023, the first positive year-to-year change since 4Q 2021. Smartphone year-to-year growth turned positive in 4Q 2023 at 8.5%. The growth continued in 1Q 2024 at 7.8%. 4Q 2023 was the first… Read More

Author: Bill Jewell

Electronics Turns Positive

Semiconductor CapEx Down in 2024

U.S. President Biden announced on Wednesday an agreement to provide Intel with $8.5 billion in direct funding and $11 billion in loans under the CHIPS and Science Act. Intel will use the funding for wafer fabs in Arizona, Ohio, New Mexico, and Oregon. As reported in our December 2023 newsletter, the CHIPS Act provides a total of $52.7… Read More

Strong End to 2023 Drives Healthy 2024

The global semiconductor market grew 8.4% in 4Q 2023 from 3Q 2023, according to WSTS. The 8.4% gain was the highest quarter-to-quarter growth since 9.1% in 2Q 2021. This was also the highest 3Q to 4Q increase in 20 years, since an 11% rise in 4Q 2003. 4Q 2023 was up 11.6% from a year ago, following five quarters of negative year-to-year… Read More

CES 2024

CES 2024 is being held this week in Las Vegas, Nevada with an estimated 130,000 attendees and over 4,000 exhibitors. CES (previously Consumer Electronics Show) has been held in Las Vegas every year since 1978, except for 2021 due to COVID-19. This was my ninth CES representing Semiconductor Intelligence, with the first in 2012.… Read More

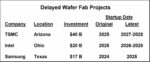

CHIPS Act and U.S. Fabs

In August 2022, U.S. President Biden signed into law the CHIPS and Science Act of 2022 to provide incentives for semiconductor manufacturing in the United States. In a case of creating the acronym first and then finding a name to fit, CHIPS stands for Creating Helpful Incentives to Produce Semiconductors. The act provides a total… Read More

Semiconductors Headed Toward Strong 2024

The global semiconductor market is now solidly in a turnaround. WSTS revised its data for 2Q 2023 growth over 1Q 2023 to 6.0% from 4.2% previously. 3Q 2023 was up 6.3% from 2Q 2023. With our Semiconductor Intelligence forecast of 3% growth in 4Q 2023, the year-to-year growth in 4Q 2023 will be a positive 6%. This will set the stage for… Read More

Electronics Production Trending Up

Production of electronic devices is finally on the uptrend following a post-pandemic slump in late 2021. According to IDC, smartphone shipments versus a year ago turned negative in 3Q 2021 at -6%. The decline hit a low of -18% in 4Q 2022. Since then, smartphones have been recovering. IDC data is not yet available, but Canalys estimated… Read More

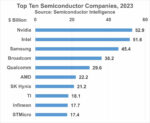

Nvidia Number One in 2023

Nvidia will likely become the largest semiconductor company for the year 2023. We at Semiconductor Intelligence (SC-IQ) estimate Nvidia’s total 2023 revenue will be about $52.9 billion, passing previous number one Intel at an estimated $51.6 billion. Nvidia’s 2023 revenue will be almost double its 2022 revenue on the strength… Read More

Turnaround in Semiconductor Market

The global semiconductor market grew 4.2% in 2Q 2023 versus 1Q 2023, according to WSTS. The 2Q 2023 growth was the first positive quarter-to-quarter change since 4Q 2021, a year and a half ago. Versus a year ago, the market declined 17.3%, an improvement from a 21.3% year-to-year decline in 1Q 2023. Semiconductor market year-to-year… Read More

Has Electronics Bottomed?

The current slump in the electronics market began in 2021. Smartphone shipments versus a year earlier turned negative in 3Q 2021. The smartphone market declines in 2020 were primarily due to COVID-19 related production cutbacks. The current smartphone decline is due to weak demand. According to IDC, smartphone shipments were… Read More

TSMC vs Intel Foundry vs Samsung Foundry 2026