The unsettled realities of modern automotive markets (BEV/HEV, ADAS/AD, radical views on how to make money) don’t only affect automakers. These disruptions also ripple down the supply chain prompting a game of musical chairs, each supplier aiming to maximize their chances of still having a chair (and a bigger chair) when the music stops. One area where this is very apparent is in the tier immediately below the automakers (the Tier1s) who supply complete subsystems – electronics, mechanical and software – to be integrated directly into cars. They are making a play to offer more highly integrated services, as evidenced by a recent announcement from DENSO, the second largest of the Tier1s.

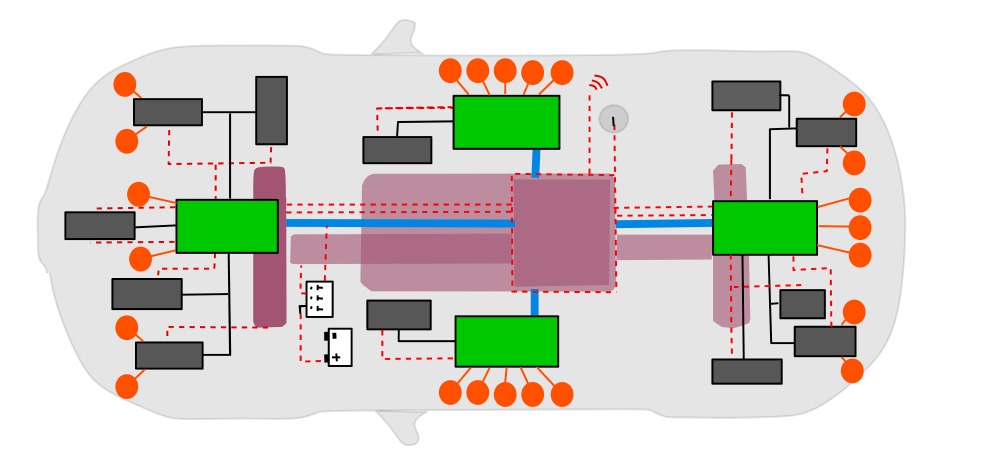

Zonal architecture (image courtesy of Jeff Miles)

More AI will drive more unified systems

There are plenty of opportunities for Tier1s around BEV/HEV power and related electronics (where DENSO also has a story), but here I want to focus on AI implications for automotive systems. AI systems are inevitably distributed around a car, but as capabilities advance, training and testing must comprehend the total system. Which in piecemeal distributed systems will become increasingly impractical and may push towards unified supplier platforms. (There is talk of higher speed communication shifting all AI to the center, but it’s not fast enough yet to meet that goal and I worry about power implications in shipping raw data from many sensors to the center.)

Take side mirrors as an example. Ten years ago the electronics for a side mirror was simple enough; just enough to control mirror orientation from a joystick in the driver arm-rest. But then we added cameras and AI to detect a motorbike or car approaching on the left or right, which at first simply flashed light on the mirror housing to warn us not to change lane. Now maybe we also want visual confirmation outlining the vehicle in the side mirror or the cabin console.

How much of that processing should be in (or near) the side mirror and how much in a zonal or even central controller? Questions like this don’t have pre-determined answers and depend very much on the total car system architecture, latency/safety requirements, communications speeds, and the software and AI models that are a part of that architecture. Is it possible to build a safe system when different suppliers are providing software, models, and hardware for the mirror, zonal controller and central controller? Yes in this limited context, but when this input is one of many on which ADAS or autonomous driving depends and the car crashes or hits a pedestrian, who is at fault?

OEMs already depend on Tier1s to deliver integrated and fully characterized subsystems, hardware and software combined. Perhaps now their scope should not be limited to modules. Distributed AI adds a new kind of complexity which ultimately must be proven in-system. Think about the millions or billions of miles which must be trained and tested in digital twins to provide high levels of confidence and safety. That’s difficult to commit when AI backbone components for sensing, edge NPUs, fusion, and safety systems are under control of multiple suppliers. This objective seems more tractable when the whole system is under the control of one supplier. At least that’s how I think the Tier1s would see it.

DENSO and Quadric

DENSO announced very recently that they will acquire an intellectual property (IP) core license for Quadric’s Chimera general purpose NPU (GPNPU) and that the two companies will co-develop IP for an in-vehicle semiconductor. This announcement is interesting for several reasons. First it was initiated by DENSO, not by Quadric. Press releases from IP companies on license agreements are a dime a dozen, but DENSO had a larger goal, to signal that they are now getting into the semiconductor design game.

Second, DENSO has been an investor in Quadric for several years, to track progress in NPU technologies along with a couple of other contenders. Now this upgrade from being simply an investor to being a licensor and co-developer is an important step forward for both companies.

The press release highlights DENSO’s expectation that in-vehicle SoCs they will build must be able to process large amounts of information at high speed. They are also attracted to Quadric’s Chimera GPNPU ability to support DENSO adding their own AI capabilities in future, requiring support for a wide variety of general-purpose operations. DENSO see this profile as essential to support in-vehicle technologies and to support updates to AI advances in the future.

Feels like an important endorsement for Quadric. You can read the press release HERE.

Also Read:

A New Class of Accelerator Debuts

The Fallacy of Operator Fallback and the Future of Machine Learning Accelerators

2024 Outlook with Steve Roddy of Quadric

Share this post via:

Comments

There are no comments yet.

You must register or log in to view/post comments.