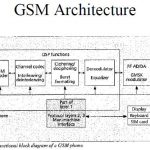

If we look back in the early 90’s, when the Global System for Mobile Communication (GSM) standard was just an emerging technology, the main innovation was the move from Analog to the Digital Processing of the Signal (DSP), allowing to make unlimited manipulation to an Analog signal, once digitized by the means of a converter (ADC). To run the Digital baseband Processing (see picture), the system designer had to implement the Vocoder, Channel codec, Interleaving, Ciphering, Burst formatting, Demodulator and (Viterbi) Equalizer. Digital Signal Processing science was already heavily used for military application like Radar, but was emerging in telecommunication. The very first GSM mobile handset built based on standard part (ASSP) were using no less than three TI 320C25 DSP, each of them costing several dozen of dollar!

Very quickly, it appears that the chip makers developing IC for mobile handset baseband processing should rely on ASIC technology rather than using ASSP, for two major reasons: cost and power consumption. As one company was dominating the DSP market, Texas Instruments, the mobile handset manufacturers, Ericsson, Nokia and Alcatel had to push TI to propose a DSP core, which could be integrated into an ASIC, developed by the above mentioned OEM. During the years 1995 to early 2000’s, thanks to their dominant position in DSP market, TI was the undisputed leader in manufacturing the baseband processor, through ASIC technology, for the GSM handset OEM, who also developed the IC, at that time.

But a small company named DSP Group, had appeared in the late 90’s, proposing a DSP IP core, not linked to any existing DSP vendor (TI, Motorola or Analog Devices), and even more important, to any ASIC technology vendor. The merge of the IP licensing division of DSP Group and Parthus has been named CEVA and CEVA’ DSP was specially tailored for the wireless handset application. TI competition (VSLI Technology, STMicroelectronics and more) was certainly happy as they could propose an alternative solution to the Nokia et al., but it took some time before these OEM decide to move the S/W installed base from TI DSP to CEVA DSP IP core, that they had to do if they decide to move from TI to another supplier. It was a long route, but CEVA is enjoying today most of the Application Processors chip maker leaders in their customer list, namely:

This help to understand why CEVA has enjoyed 70% market share for DSP IP products in 2011, according with the Linley Group. A 70% market share simply means that CEVA’ DSP IP have been integrated into 1 billion IC shipped in production in 2011! If the Teak DSP IP core was the company flagship in early 2000, the ever increasing need for digital signal processing power associated with 3G and Long Term Evolution (LTE or 4G) has led to propose various new products, the latest being CEVA XC4000 DSP IP core:

And, by the way, the XC4000 target various applications, on top of the wireless handset:

- Wireless Infrastructure

A scalable solution for Femtocells up to Macrocells

- Wireless connectivity

A single platform for: Wi-Fi 802.11a/b/g/n/ac, GNSS, Bluetooth and more

- Universal DTV Demodulator

A programmable solution targeting digital TV demodulation in software

Target standards: DVB-T, DVB-T2, ISDB-T, ATSC, DTMB, etc.

- SmartGrid

A single platform for: wireless PAN (802.11, 802.15.4, etc.), PLC (Power Line Communication), and Cellular communication (LTE, WCMDA, etc.)

- Wireless Terminals

Handsets, Smartphones, Tablets, data cards, etc.

Addressing: LTE, LTE-A, WiMAX, HSPA/+, and legacy 2G/3G standards

If we look at the Wireless handset market, it appears that Smartphone and Media tablet, both being based on the same SoC, the Application Processor, will represent the natural evolution, and the analysts forecast the shipment of one billion Smartphone and 200 million Media tablets in 2015. If you look more carefully, you will discover that at least 50%, if not the majority of these devices will be shipped in ASIA, and to be more specific, in China for most of these. An IP vendor neglecting China today would certainly decline in a few years. Looking again at CEVA’s customer list, we can see that many of the Application Processor chip makers selling in these new “Eldorado” markets have selected CEVA. This is a good sign that CEVA will maintain their 70% market share of the DSP IP market in the future!

Like ARM IP core is coming in mind immediately when you consider a CPU core for Application Processor wireless handset phone or smartphone, CEVA DSP IP is the dominant solution for the same. Just a final remark: CEVA is claiming to have design-in their DSP IP in the Chinese version of the Samsung Galaxy S3, which will probably be the most selling smartphone on a world-wide basis…

Eric Esteve from IPNEST –