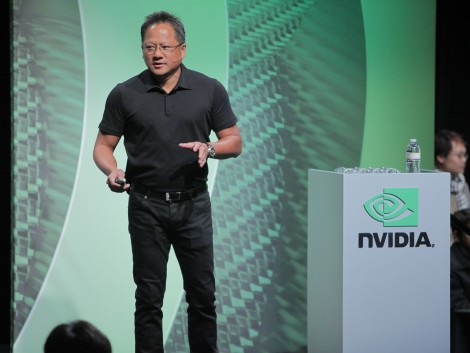

Jen Hsun Huang, the CEO of nVidia, has a phrase he often repeats to his employees: “We are 30 days from going out of business.” With product cycles as short as 6 months, the troops are on a constant march to revenue. The earnings conference call on August 11th highlighted two critical pieces of information. First, is the success that they are having in growing their PC graphics revenue despite the Sandy Bridge onslaught. Second, and more important, there is an internal and now a publicly articulated goal that they will reach a $1B revenue run rate for Tegra in 2012.

Jen Hsun Huang, the CEO of nVidia, has a phrase he often repeats to his employees: “We are 30 days from going out of business.” With product cycles as short as 6 months, the troops are on a constant march to revenue. The earnings conference call on August 11th highlighted two critical pieces of information. First, is the success that they are having in growing their PC graphics revenue despite the Sandy Bridge onslaught. Second, and more important, there is an internal and now a publicly articulated goal that they will reach a $1B revenue run rate for Tegra in 2012.

As outlined in an earlier Semiwiki blog titled “Intel’s Barbed Wire Fence Strategy”

http://www.semiwiki.com/forum/content/651-intel-s-barbed-wire-strategy.html Intel is in the business of expanding its fence lines. Their current target is nVidia’s graphics business. It represents not only additional revenue but also the ability to deny nVidia the funds to develop Tegra chips that will be used competitively in Smartphones and Tablets using Android as well as some Windows 8 mobiles.

All this may sound like Intel is the one to be most at risk to market share loss in 2012, especially with the launch of Windows 8 but, as a matter of fact, it is the other way around. First recognize that nVidia has finally returned to its peak run rate of $1B a quarter that they reached in 2007. Meanwhile, Intel is on track to do $55B in revenue this year or nearly 50% higher than 2007. Intel has the additional profits to crank out more designs targeting more segments. But there are clouds of uncertainty.

Windows 8, as understood by most people, unlocks the whole PC market to ARM based processors. Untrue! To get Win 8 to be light on its feet – meaning small memory footprint and fast boot/resume – Microsoft had to make compromises. First and foremost, Microsoft had to limit the hardware ecosystem. A closed system with support for fewer I/O devices makes life easier. No more Swiss Army Knife. How well will the Win 8 mobile run? We won’t know until it ships. The reduced hardware ecosystem should be fine for tablet – but a “clamshell” design is open to interpretation. Are they reduced netbooks?

Intel’s challenge is much different than nVidia’s but still attainable. Back in May, at their Analyst Meeting, Paul Otellini announced they were dropping their Thermal Design Point (TDP) for processors from 35W to 17W. We now know what drove them to this decision, or better yet, who drove them to this decision.

A story broke yesterday in the Wall St. Journal where it was noted that Apple informed Intel that it better drastically slash its power consumption or risk losing Apple’s business. As an Intel exec said, “It was a real wake up call to us.” For more on the story – follow the link:

http://blogs.wsj.com/digits/2011/08/10/intel-sets-300-million-fund-to-spur-ultrabooks/

As I mentioned in an earlier blog, the MAC Air is driving the mobile market. It uses Intel ULV processors that have a TDP of 17W (50% lower than regular Intel mobile Sandy Bridge CPUs) and sells for a minimum of $220. The price of the CPU is based on the yield they get per wafer. In this case <50%. Intel needs to get to 7W ideally to make Apple happy in the near term. And they need to offer an entry-level price closer to $75 – so Apple can take MAC Air to $799 thereby sucking the oxygen out of the notebook PC market. This is where I believe Intel will be one year from now with the 22nm Ivy Bridge ULV (A straight die shrink of Sandy Bridge at a similar MHz to today’s ULV). If this still seems high relative to ARM, it is, and Apple has probably informed Intel that they need a 3-5W TDP with Haswell as they go even more aggressive on a future MAC Air. Sound confusing? Consider this like two great armies rushing to the same spot at the front. Each has their own unique strengths and weaknesses. In the end – it is the market that lies just a tad above Apple’s entry level $499 iPAD. Call it $499+1. Note: You must be logged in to read/write comments

Share this post via:

Flynn Was Right: How a 2003 Warning Foretold Today’s Architectural Pivot