It is interesting watching as changes in technology bring giants to their knees. Far and away the best book on the subject is Clayton Christensen’s The Innovator’s Dilemma. If you haven’t read it then rush out and buy it immediately. In tech, you are not educated if you haven’t.

Two things made me think about this recently. One is Kodak filing for bankruptcy. Some commentary is basically critical that Kodak were blindsided by the digital revolution. But in fact they not only pioneered early digital cameras, but also predicted almost exactly the speed of adoption by government (think spy satellite), then business, and then the consumer. The problem was that nobody knew how to make money on digital cameras which are a one-off low-margin sale. It was classic Innovator’s Dilemma stuff: everyone saw it coming and even so, nobody knew what to do about it. Curiously, FujiFilm, Kodak’s big competitor has fared better and managed to diversify into other markets. But that is always a risk strategy. Most forest product companies that try to get into electronics do not become Nokia, one of the most amazing business transformations ever. Now in turn the standalone digital camera industry is itself under threat, at least the the low end. When your cell phone has an 8 megapixel camera and is always in your pocket, why do you want another camera that is only marginally better.

Two things made me think about this recently. One is Kodak filing for bankruptcy. Some commentary is basically critical that Kodak were blindsided by the digital revolution. But in fact they not only pioneered early digital cameras, but also predicted almost exactly the speed of adoption by government (think spy satellite), then business, and then the consumer. The problem was that nobody knew how to make money on digital cameras which are a one-off low-margin sale. It was classic Innovator’s Dilemma stuff: everyone saw it coming and even so, nobody knew what to do about it. Curiously, FujiFilm, Kodak’s big competitor has fared better and managed to diversify into other markets. But that is always a risk strategy. Most forest product companies that try to get into electronics do not become Nokia, one of the most amazing business transformations ever. Now in turn the standalone digital camera industry is itself under threat, at least the the low end. When your cell phone has an 8 megapixel camera and is always in your pocket, why do you want another camera that is only marginally better.

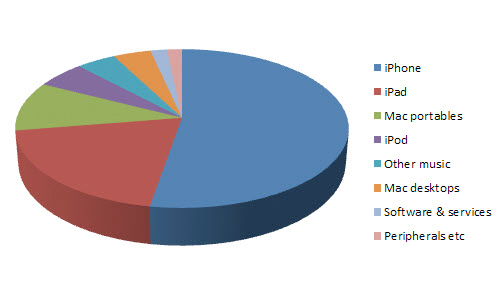

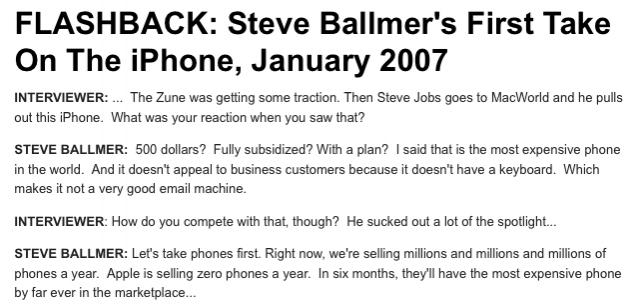

Talking of cell phones, here are a couple of anecdotesabout changes in technology leadership. Apple’s iPhone business is now larger than Microsoft (in revenue). Not just Office or Xbox, but all of Microsoft, a company that recently was regarded as so powerful that it should be broken up since it would otherwise be a perpetual monopoly. But here’s an even more amazing fact. Apple is now criticized as being too dependent on iPhone, a one-product company. But if you take away Apple’s iPhone business completely, then the rest of Apple is still bigger than Microsoft and pretty well diversified.

Talking of cell phones, here are a couple of anecdotesabout changes in technology leadership. Apple’s iPhone business is now larger than Microsoft (in revenue). Not just Office or Xbox, but all of Microsoft, a company that recently was regarded as so powerful that it should be broken up since it would otherwise be a perpetual monopoly. But here’s an even more amazing fact. Apple is now criticized as being too dependent on iPhone, a one-product company. But if you take away Apple’s iPhone business completely, then the rest of Apple is still bigger than Microsoft and pretty well diversified.

Of course for EDA, companies that ship huge volume are not a dream but more of a nightmare. Apple designs one or two chips per year and so have comparatively modest demands for EDA tools. Of course they also buy lots of silicon from Qualcomm, Broadcom and memory suppliers in particular. But since EDA doesn’t share in volume, it shares in design starts, it benefits from less concentrated market power. Lots of competitors all designing their own chips is the EDA dream (and EDA doesn’t really care if chips go into production). As a handful of companies become more and more dominant in the end markets, shipping enormous quantities of relatively few designs, I think it will be a challenge for EDA to maintain its business models unchanged. And, as has been pointed out on this site many times, it will also have a major impact on where the chips are manufactured and from where the capital for the fabs comes.

Facing the Quantum Nature of EUV Lithography