The amount of negative news and information about the semiconductor industry seems to be increasing at a faster rate. Micron put up a better quarter than expected but more importantly guided less than expected. We are surprised that the street is surprised as the decline in memory pricing is well known and Micron has been clear about… Read More

Tag: lrcx

Is the Q4 Bounce Back now a 2009 Recovery?

Last week saw a unique confluence of events that continue the negative news flow in semicap following the story about GloFo. At a financial conference, Micron’s CFO said NAND prices were declining, this was on top of an analyst note in the morning about the same issue. Even though this should be no surprise as memory has had … Read More

KLAC gets an EUV Kicker

KLAC put up a great quarter coming in at revenues of $1.07B and EPS of $2.22. Guidance is for $1.03B to $1.1B with EPS of $2 to $2.32. Both reported and guided were at the high end of the range and above consensus. We had suggested in our preview notes that KLAC would be the least impacted of the big three (AMAT, LRCX & KLAC) semi equipment… Read More

Samsung Memory is easy come easy go but for how low?

Lam Research (LRCX) reported a great June quarter coming in at $3.126B in revenues and $5.31 in EPS easily beating the street’s $3.06B and EPS of $4.94. However no one will care as guidance for the September quarter is for $2.3B in revs and EPS of $3.20, way, well below the already downward revised estimates of $2.77B and $3.88.… Read More

Chip Equipment where to from here?

We may know the top, do we know the bottom? What is the downside in NAND, DRAM, Foundry. Can China help or is risk worse than upside?

It would appear that our concerns in our preview piece prior to the AMAT call came true as the stock now has a “4” handle, NAND is in question and display is down.

However its not like business … Read More

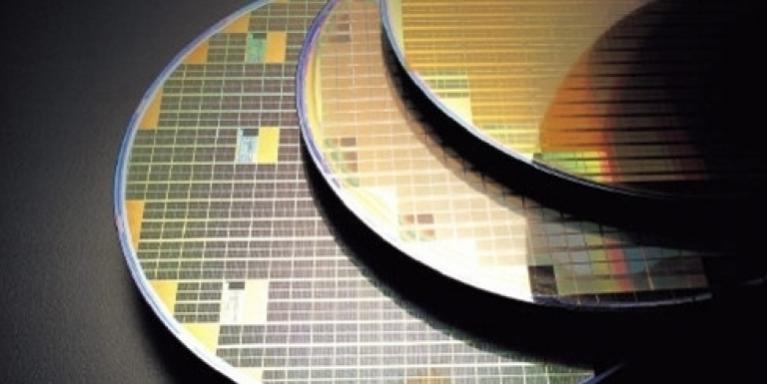

Choosing the lesser of 2 evils EUV vs Multi Patterning!

For Halloween this week we thought it would be appropriate to talk about things that strike fear into the hearts of semiconductor makers and process engineers toiling away in fabs. Do I want to do multi-patterning with the huge increase in complexity, number of steps, masks and tools or do I want to do EUV with unproven tools, unproven… Read More

The post election Semicap bubble just burst in one day

Back to a more normal reality… Market gets”De-Fanged”… Where to from here? The “Icarus” Effect… Much of the market, and especially Tech & “FANG” (Facebook, Amazon, Netflix & Google) stocks gave back most all of their post election day gains in one session.… Read More

What’s the Intel Capex Outlook?

Intel has terrific QTR & slightly light guide Intel is recovering & transforming at the same time. Whats the Capex outlook? Impact on ASML KLAC LRCX?

Intel reported revenues of $15.78B and earnings of $0.80 for the quarter beating expectations and previous upward guidance. CCG (PCs) were up 21% Q/Q and 5% Y/Y. Data center… Read More

DOJ takes victory Lap in KLAC / LRCX deal post mortem (3 of 3)

The KLA deal died due to fox guarding the hen house.

Fox can’t guard Hen House…

In an industry where there are relatively few widget makers and only one, very dominant, widget inspector, the thought of one of the widget makers buying the most crucial widget inspector obviously would be anti-competitive. Not only would… Read More

KLAC & LRCX – Fall Out from the deal Falling Apart (1 of 3)

The odds of deal completion has fallen to low levels. Whats the fallout on the companies and stocks? Is there life after a failed merger?

“A quagmire wrapped up inside an enigma” – LRCX & KLAC’s merger is the talk of the town, both in the semiconductor equipment industry as well as DOJ watchers in Washington… Read More