You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

Semiconductor equipment vendor ranking, which didn’t change much between 2016 and 2017, is undergoing a makeover, as Lam Research, ASML, and Tokyo Electron (TEL) are switching places and top-ranked Applied Materials is getting closer to losing its number one ranking.

Since the 1990s, Applied Materials has been the market leader… Read More

The DOJ last week released a previously sealed indictment against UMC, Jinhua and three individuals for stealing Micron trade secrets. The indictment is very damning of UMC with very specific semiconductor technology files that were stolen by UMC related people then passed on to Jinhua through its joint development with UMC.… Read More

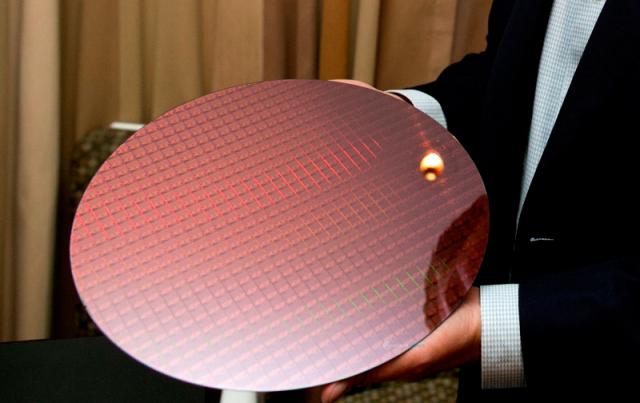

ASML reported EUR2.78B in revenues with EUR2.08B in systems. 58% was for memory. EUV was EUR513M with 5 systems. Importantly orders were for EUR2.20B in systems at 64% memory and 5 EUV tools. This was likely better than expectations given the overall industry weakness. EPS of EUR1.60 was more or less in line with expectations. Guidance… Read More

Given that the semiconductor industry is clearly in the midst of a down cycle (even though there are cycle deniers, also members of the flat earth society…), most investors and industry participants want to know the timing of the down cycle and the shape of the recovery as we want to know when its safe to buy the stocks again. … Read More

Applied Materials (AMAT) is batting clean up in a quarter that has not been pretty. Lately semi stocks seem to have been hit by not only stock specific issues but continued and increasing memory concerns coupled with more macro issues. On top of all this, China trade issues which have in the meantime taken a back burner to other issues… Read More

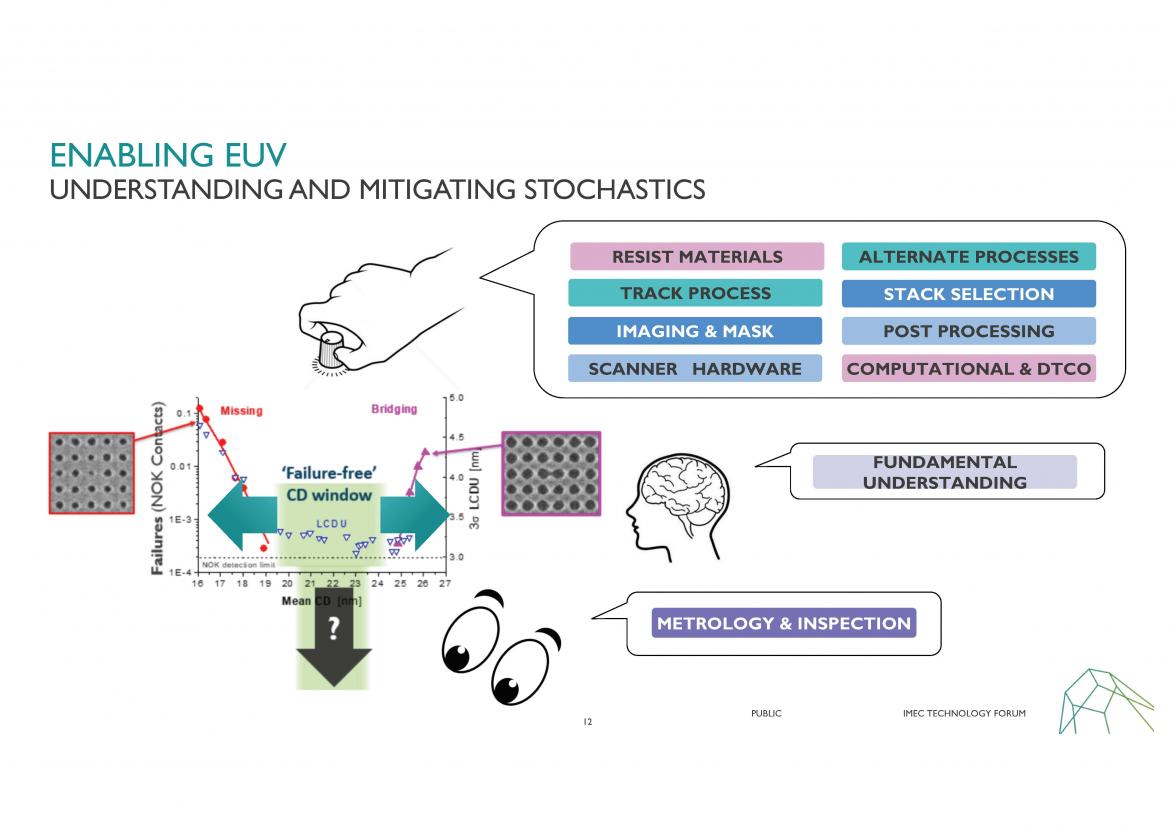

At SEMICON West I attended the imec technology forum, multiple Tech Spot presentations and conducted a number of interviews relevant to advanced lithography and EUV. In this article I will summarize what I learned plus make some comments on the outlook for EUV.… Read More

KLAC put up a great quarter coming in at revenues of $1.07B and EPS of $2.22. Guidance is for $1.03B to $1.1B with EPS of $2 to $2.32. Both reported and guided were at the high end of the range and above consensus. We had suggested in our preview notes that KLAC would be the least impacted of the big three (AMAT, LRCX & KLAC) semi equipment… Read More

We have been on a roller coaster ride of on again off again trade talk between China and the US. It is unclear where we are on a day by day basis but of late it appears that we are not seeing a lot of progress and some progress we thought we had made may not have actually happened.… Read More

We may know the top, do we know the bottom? What is the downside in NAND, DRAM, Foundry. Can China help or is risk worse than upside?

It would appear that our concerns in our preview piece prior to the AMAT call came true as the stock now has a “4” handle, NAND is in question and display is down.

However its not like business … Read More

Intel (INTC) blew away expectations based on strong performance in the data center. Revenues of $16.1B versus street of $15.05B and EPS of $0.93 versus street of $0.72. While revenue was up 9% over prior year, earnings were 50% higher. Guidance is for Q2 revenue of $16.3B and EPS of $0.85 versus street of $15.55B and EPS of $0.81. IOT,… Read More