If you have been to an Ajit Manocha keynote recently, he talks a lot about Foundry 2.0. I covered his keynote at Semicon West in July here. Dan Hutcheson of VLSI Research interviewed Ajit about this new business model to identify it, see how it was different and see how GlobalFoundries were executing the model differently from the traditional model. The result is a video(21 minutes long) and a white paper.

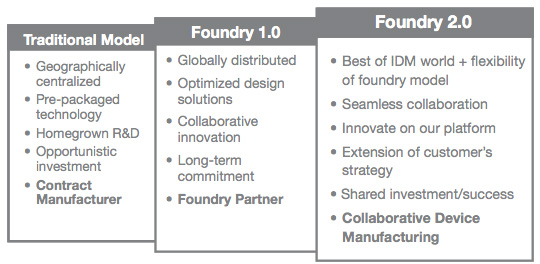

The foundry business started with the sale of excess capacity in what we now call IDMs but back then we just called semiconductor companies. This was pure contract manufacturing. Since sometimes the company buying wafers might be a competitor of the company supplying them, this wasn’t a relationship based on trust and, since the excess capacity might go away, it was typically pretty short term too.

The true foundry business, with dedicated companies such as GlobalFoundries, started with the founding of TSMC. This was Foundry 1.0 and taking the business to the next level where it was a trusted partnership between the foundry and the fabless customers. This rode on the back of the fact that differentiation was moving from manufacturing to design and so owning your own fab was no longer a requirement for success. In fact, they were becoming so expensive that they were a liability. In addition to the cost of the fab itself, the cost of technology development for each process generation was also getting prohibitive. All of these made the foundry model attractive whereby the cost of the fab and process development would be amortized by the foundry across many fabless companies that specialized in design not manufacture. Eventually many IDMs joined the party, switching to fab-lite strategies, using foundry for their leading edge capacity.

In this era, deep technical access to the fabs was limited. Generally a foundry would release design rules and spice rules, and the design companies would run with them and create designs, tape them out and the foundries would manufacture them. Then a couple of things happened. Firstly, mobile (and consumer products in general) grew explosively and couldn’t tolerate a long product cycle. Design cycles needed to shrink and absolutely had to be right first time to hit their market window. And the processes got so complicated that some preliminary design and electrical rules were no longer enough to get working designs. And many designs increasingly consisted of 3rd party IP meaning that there were a lot of moving parts getting the first designs into a new fab/process: IP suppliers, EDA companies, fabless companies and, of course, the foundry itself.

The business model started to break down too, because the foundries wanted to sell fixed-price wafers (essentially making the designer responsible for yield) but the designers didn’t have the tools or the data to do that (and in their world would ideally just pay for good die, making the foundry responsible for the yield). The trust had broken down and the customer-foundry relationship started to be adversarial. Fabless companies saw what IDMs (especially Intel) could do and they wanted one of that too. They wanted a similar relationship to their foundries as a company like Intel’s design groups had with their manufacturing divisions.

This is Foundry 2.0. GlobalFoundries was well positioned having deep roots in an IDM (it was basically a spinout from AMD) and deep roots in foundry (once they acquired Charterered). Ajit himself had been a senior manager in an IDM, taken it through the transition to fab-lite and then fabless. The core of Foundry 2.0 is Collaborative Device Manufacturing, keeping the intimacy of the IDM internal relationships joined with the flexibility of the foundry-fabless model.

Foundry 2.0 has already seen significant success at GlobalFoundries. It is more like working with two internal departments as opposed to Foundry 1.0’s two companies focused too much on their own bottom lines.

VLSI Research white paper on Foundry 2.0, the Next Generation of Foundry-Fabless Relationships, Why It’s Different and Why You Should Care.

Video of interview by Dan Hutcheson with Ajit Manocha is here.

Flynn Was Right: How a 2003 Warning Foretold Today’s Architectural Pivot