Wally Rhines’s keynote at the ARM TechCon was about differentiation and how to use it to create measurable value. We all know what differentiation means in some intuitive sense, but how do you make it measurable? Wally’s answer was that differentiation is a measure of the difficulty of switching suppliers and is best measured by the gross profit margin (GPM). It doesn’t really work for pure software products because of the accounting rules we are forced to use, but it is fine if the software is embedded in something (think a smartphone).

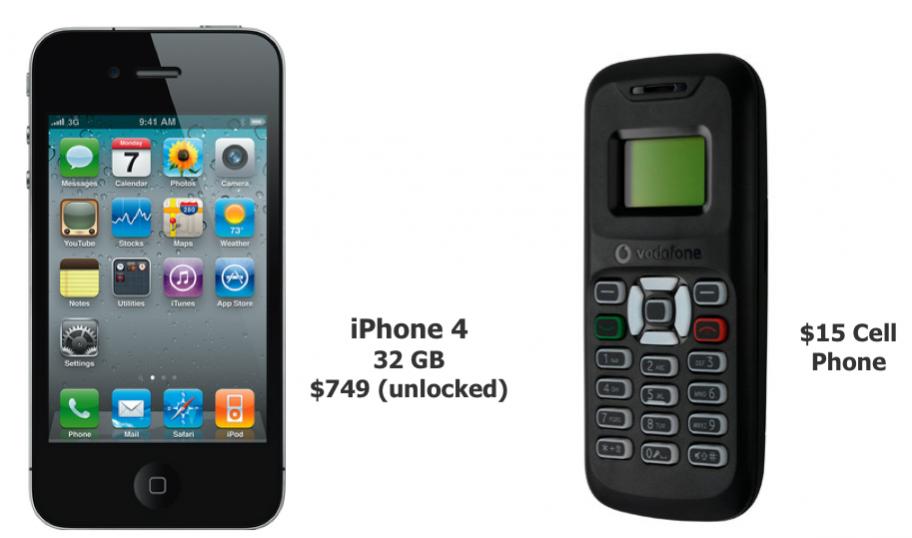

Wally Rhines’s keynote at the ARM TechCon was about differentiation and how to use it to create measurable value. We all know what differentiation means in some intuitive sense, but how do you make it measurable? Wally’s answer was that differentiation is a measure of the difficulty of switching suppliers and is best measured by the gross profit margin (GPM). It doesn’t really work for pure software products because of the accounting rules we are forced to use, but it is fine if the software is embedded in something (think a smartphone).

The alternative to differentiation is commoditization, where the products are interchangeable and compete only on price. Sometimes this is quite deliberate (think DRAM) and sometimes it happens despite the companies involved trying to unsuccessfully to differentiate (think PCs).

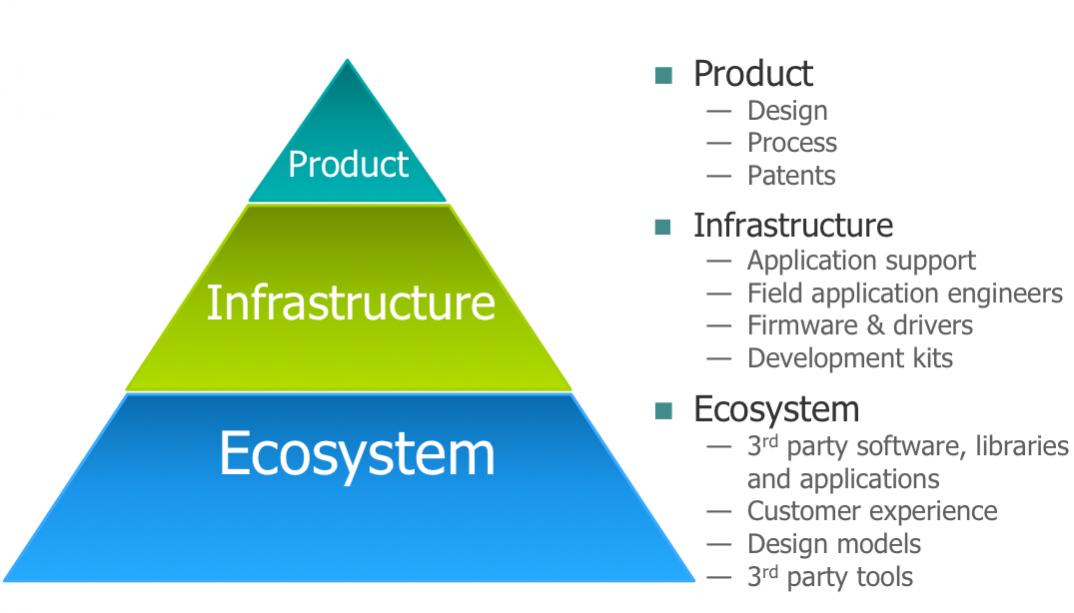

Sustainable differentiation depends on the three-legged-stool of product, infrastructure and ecosystem, each more difficult for a competitor to create. ARM is actually a good example. They don’t have a monopoly on good processor design but they have done a good job of creating the infrastructure of compilers etc that are required to make a processor usable. But where they excel is in the number of partners that they have built into an ecosystem around the ARM processor families, ranging from cell-phone manufacturers, to semiconductor partners, RTOS suppliers and many other categories.

Sustainable differentiation depends on the three-legged-stool of product, infrastructure and ecosystem, each more difficult for a competitor to create. ARM is actually a good example. They don’t have a monopoly on good processor design but they have done a good job of creating the infrastructure of compilers etc that are required to make a processor usable. But where they excel is in the number of partners that they have built into an ecosystem around the ARM processor families, ranging from cell-phone manufacturers, to semiconductor partners, RTOS suppliers and many other categories.

So once something is commoditized is it possible to escape from the pit. Wally’s example was bottled water. It sells for 30,000 times the price of a glass of tapwater, although it is basically the same product. And how big is that market. Embarrassingly, it is 13X the size of the EDA market at $65B. However, I’m not sure that this is really a good example of a product where differentiation is measured by the difficulty of changing suppliers. To switch from Evian to Calistoga doesn’t have a lot of switching cost.

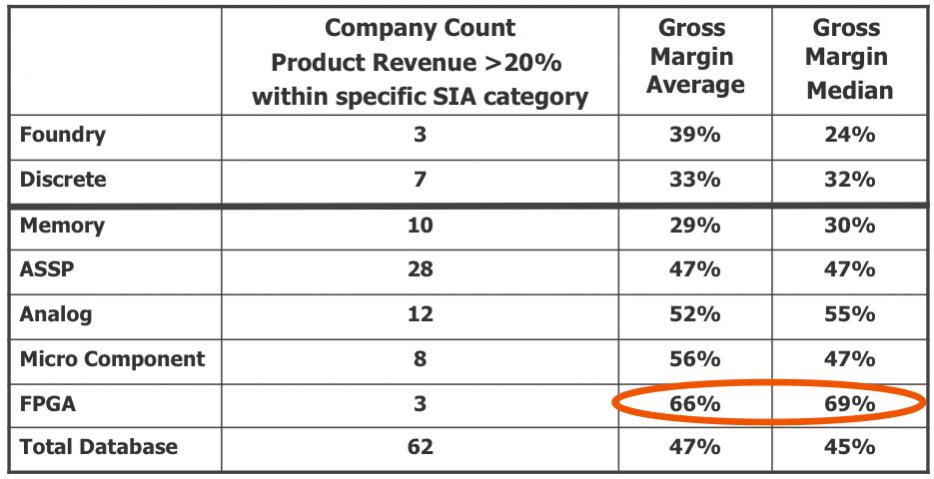

So what about semiconductors? Where is the differentiation? The most differentiated (based on GPM) is FPGA, followed by analog. Memories and discretes bring up the rear.

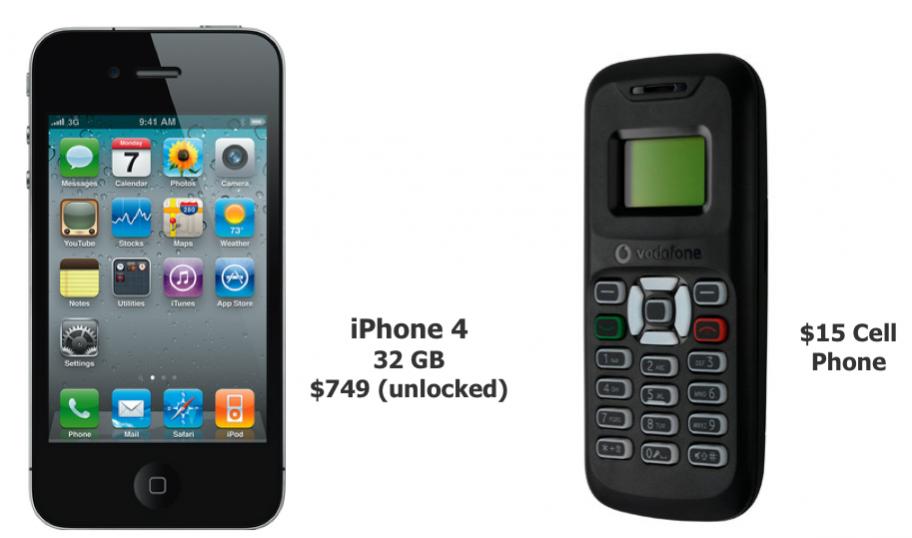

FPGAs fit the three-legged-stool model where there is product (FPGA itself), infrastructure (tools) and an ecosystem. Once you have a piece of IP working on, say, Xilinx then it is pretty certain that the next product in that family will be on Xilinx too. Why requalify it on Altera when the underlying product (the FPGA itself) isn’t that much different. And at the other end of the scale, memories are pin compatible and switching is easy. Indeed many manufacturers use multiple sources anyway (for example, the teardowns of the latest iPhone seems to have Samsung memory chips in the A5 SoC in the US, but Elpida in Europe).

Foundry looked at as a group has low GPM too. But that hides what is really happening which is that TSMC has margins in the 50% range (and increasing) whereas the other foundries struggle around 20%. Again this partially reflects the strong ecosystem that TSMC has built up around its processes with IP and reference design flows.

Wally had an interesting chart listing the semiconductor companies not by their revenue but by their gross margin. Linear Technology leads the pack with 77%, followed by Altera, PMC-Sierra, Nationa, Qualcom, Silicon Labs, Intel, ADI, Xilinx and Conexant. Analog, FPGA and microprocessors.

Going forward Wally reckons that there will be less differentiation by process, the traditional edge for a semiconductor company, and more for design. The infrastructure will be build around proprietary IP. For everyone except Intel I think I’d agree but Intel being a process generation or two ahead of everyone else gives them differentiation even where their design is not the best.

But how to build an ecosystem?

First, luck with good followup. Both ARM and Intel have done this, riding the cell-phone and the PC industries when they took off. They were in the right place at the right time but then executed very well.

Another approach is to sacrifice a key capability as Adobe did with Acrobat. Give up the revenue from Acrobat Reader. Or IBM did with the PC by their extreme openness (although they rather screwed that one up: a company with the best semiconductor technology, a great RISC processor, world-leading operating system developers gave all the money to Intel and Microsoft).

TSMC in the early days had a problem. They were second sourcing designs that were made to run in different fabs and different processes so constantly had to tweak their fab to get good yield. So they took their design rules, traditionally the biggest secret in any semiconductor company, and published them. At VLSI/Compass we created libraries and sold them so suddenly people were doing designs directly in TSMC’s process and all that design tweaking went away.

So there you have it. GPM is the best measure of differentiation, also driven by the difficult of switching. And the hardest thing to reproduce for a competitor is an ecosystem.

So there you have it. GPM is the best measure of differentiation, also driven by the difficult of switching. And the hardest thing to reproduce for a competitor is an ecosystem.

Comments

0 Replies to “Think differentiation”

You must register or log in to view/post comments.