There is a temptation to blame U.S. President Donald J. Trump for everything that is right or for everything that is wrong in the world today. Either that or blame Brexit. It’s just possible that Uber, instead, ought to be considered the target of shame for everything from traffic fatalities to global warming.

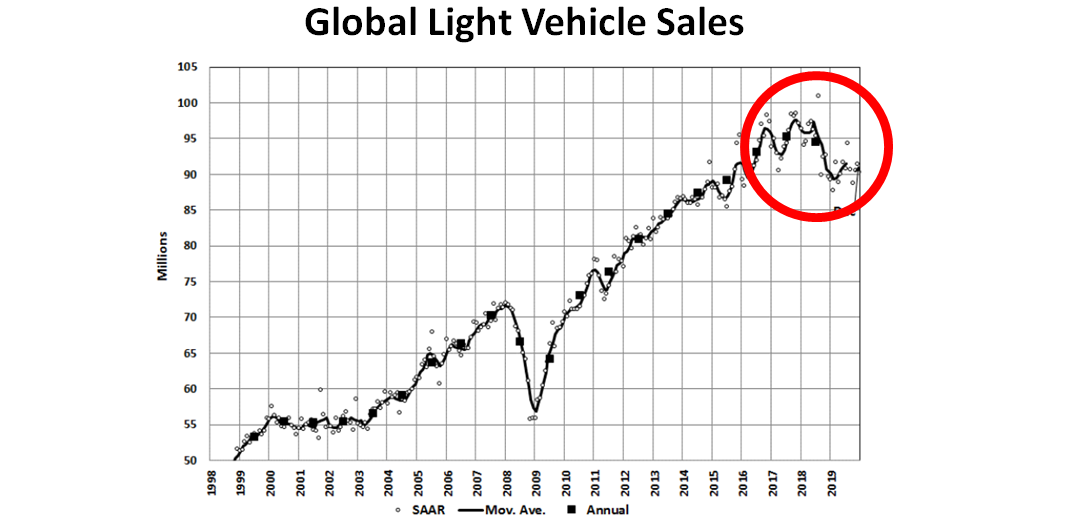

The automotive industry is in the midst of an extended sales swoon not attributable to any single obvious global economic downturn. There is a tendency to blame Trump trade tensions for the slide. A more obvious culprit is the emergence of ride hailing which has introduced billions of dollars in cheap, subsidized transportation across the developed and developing world.

Regionally, the auto industry is being hit hardest by the auto sales downturn in Asia, a region which previously delivered the lion’s share of industry growth. It should come as no surprise, then, that Asia has rapidly become the epicenter of the ride hailing phenomenon.

Uber and Lyft and Yandex and Gett may be popular in their respective geographies, but the tsunami of subsidized ride hailing availability in countries such as China and regions such as Southeast Asia (Grab and Gojek) is orders of magnitude beyond the growth rates in more developed markets. China alone dominates the landscape of ride hailing availability and usage.

SOURCE: Strategy Analytics

Strategy Analytics estimates the number of ride hailing drivers – working for operators such as DiDi Chuxing – in China at more than 19M by the end of 2019. The number of users in China, alone, is in the hundreds of millions.

Taxis were already cheap in China. But ride hailing operators can be cheaper still and introduce a new level of convenience for payment and pickup.

Factor in the high cost, complexity, and inconvenience of acquiring a license plate – let alone an actual car – in China, and a clear picture emerges of vastly simplified consumer decision making as regards owning a vehicle or using ride hailing. Perhaps more than in any other market, driving for DiDi may be the shortest path to obtaining a vehicle in China – other than purchasing.

This phenomenon is operative elsewhere in the world. Uber has been blamed for undermining the profitability of prominent car makers such as Ford and General Motors in Brazil, where cars are increasingly being leased by ride hail drivers from rental car operators that purchase vehicle at bulk discounts.

“How Uber Drains Car Maker Profits in South America’s Biggest Market”

According to a Reuters report, Uber and DiDi encourage the rental car operators to buy cars to be leased to drivers thereby increasing their purchasing leverage with the auto makers. Of course, this has driven up the number of ride hail vehicles on the road – comparable to the run up in China – more drivers, more passengers. (Reuters quoted Anfavea consumer car buying research in Brazil showing the availability of Uber and DiDi as the second most reported reason for avoiding a vehicle purchase – after financial limitations.)

Of course, Brazil (Uber’s second largest market) and other South American countries, may face a reckoning as a surplus of drivers may cause Uber and DiDi to reduce driver incentives. Such actions in China, reported by Bernstein & Associates, produced a fourth quarter 2019 downturn in the number of drivers and passengers.

“China’s Ride Hailing Decline Hurting Car Sales”

It is worth noting this ride hailing dialectic, given Uber’s early claims that the service would devastate or eliminate car ownership altogether. At the outset of ride hailing, consumers shift away from owning cars in favor of using Uber et. al. Uber et. al. commence aggressive advertising and recruiting of drivers – including those that do not own cars thereby creating a market for rented/leased cars.

Uber et. al. cut deals with car rental companies to expand their fleets – this “artificially” inflates vehicle demand. Fleets of vehicles sponsored by Uber et. al. add to traffic and congestion. Uber et. al. supply begins to exceed demand, and Uber et. al. begin to reduce incentives thereby puncturing the demand bubble of their own creation.

DiDi’s reported pullback on incentives in China likely reflected a diminishing supply of investment capital, according to analysts. In fact, multiple reports indicate Softbank is pulling in the reins on its investment targets including organizations ranging from WeWork to peer-to-peer car share operator Getaround and car subscription provider Fair.

Where regulators have been shy to step in, capital markets may end up limiting what has ‘til now been unbridled growth in the ride hailing sector. Uber, DiDi, Yandex, Gett, and others have increasingly been blamed for increased congestion, vehicle emissions, and even highway fatalities. Every discounted and subsidized Uber ride is arguably an avoidable contribution to global warming, right?

As cheap capital dries up, however, cheap rides too may become a thing of the past. The decline in cheap rides will, in turn, contribute to the expected recovery in vehicle sales and ownership. One thing seems clear, Trump, alone, cannot be blamed for the current downturn in vehicle sales, and increasing highway congestion, emissions, and fatalities. As for global warming, we can say Trump shares blame with Uber and DiDi and the rest. In reality, we are all to blame as the demand for automobile ownership remains high – reflected in forecasted increases in vehicle sales in the years ahead.

Share this post via:

CEO Interview with Jerome Paye of TAU Systems