Intro

For 22 years now Tanner EDAhas been in the business pf offering tools for AMS and MEMS designers. I learned what’s new at DAC on Tuesday morning.

Notes

Nicholas Williams – Director of Product Management

Tanner EDA front end: S-Edit integrates with Berkeley Fast Analog Simulator

W-Edit – is the waveform viewer

Who is Tanner – full suite for custom IC design

– 22 years in industry

– AMS focus

– First on Windows (also Linux)

– 20K licenses, 67 Countries

S-Edit – Schematics (Import Mentor and Cadence legacy data)

– Cross probe between schematics and layout

– Checking

– Launch simulation, make measurements

Berkeley Analog Fast Spice (AFS)

– About 5 to 10X faster than SPICE

– 10M element capacity

W-Edit – setup measurements

– Scripting for sophisticated measurements

– Built in measurement functions

Layout editor – L-Edit

SDL – schematic driven layout

HiPer DevGen – layout generators

HiPer Verify – Netlist extraction tool (Takes Calibre or Assura decks as inputs)

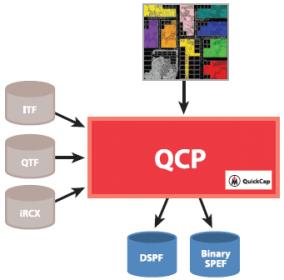

HiPer PX – parasitic extraction

Why choose Tanner?

– Economic price

– Installed base

– PDKs

Why not your own Fast SPICE?

Easier to partner with a leader already.

John Zuk

Last year – Hiper DevGen (Dublin based, IC Mask)

– This year added: Resistor arrays for matching, adding mosfet array generators, adding current mirrors

– Focus is on analog blocks

SDL – read in netlist analyze it, find current mirrors, use Hiper Devgen automatically

Interactive DRC – close enough to final rules, then HiPer Verfiy in batch to complete the layout verification

Open Access – in integration now, L-edit is first, S-edit is next. PC –based we donated technology that they didn’t even have.

– Took more effort than anticipated.

– Working with Si2 to define what OA should be

– iDRC and iLVS are in the future, after L-edit and S-edit, waiting to be embraced

– IPL Constraints – looking at that as well, designer notes, will be part of S-edit

– V16 is due in October and will be the first to support OA

iPDK – Looks more practical than Open PDK

– In V17 this would be supported in 2012, beta by June 2012

Resell BDA tool – 1st line of support,

OEM – parasitic extraction tool (Tuo Delft in Netherlands, HiPer PX extraction)

– Hiper devgen

Tanner version – scaled down version limited by processors and total elements, lighter version, token based

– Worldwide sales agreement

– First copy to be sold very soon

Fiscal Year – 140 new customers in 2011

Greg

3D field solver as an upgrade

V16 – multi user now available

OA – realtime collaboration on the same database

ClioSoft – what is the cost of this?