Thanks to the Semiconductor Ecosystem Survey from GSA-Wharton and the key indicators of semiconductor companies’ technology strategies related to IP:

- IP Reuse: On average, a fabless semiconductor company reuses about 63% of design IP in the revision of an existing product design and about 44% in a new product design.

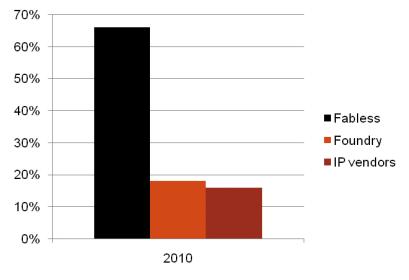

- Source of IP: Silicon foundries are becoming an important source of design IP for fabless companies in addition to third-party IP firms. On average, 18% of design IP blocks are from the foundry’s portfolio/library, followed by 16% for third-party licensing firms.

The other key indicators are about differentiation and time-to-market.Let’s make some comments. First of all, as I am focusing on IP… I am happy, as the report clearly links IP as one of the major source of innovation. But, when I think to my blogger colleagues who’s focus is on EDA (namely, Dan Nenni, Daniel Payne and Paul McLellan), I think they have good reasons to be disappointed, as within the 26 pages you will never found the mention of EDA. The report is dealing about “Innovation”, “partners” and “ecosystem”, referring to the fables companies, so –intentionally or not- deciding to omit EDA companies in the ecosystem looks strange to me… Let’s come back to IP. The number of design IP blocks coming from foundries (18%) is higher than these coming from the IP vendors (16%). Is it a surprise? No, as when looking at the list of IP offered by the major foundries, you realize that this list is pretty long, even if we can qualify these IP as commodities in most of the cases. Yes if you consider the large number of IP vendors (more than 460 listed on D&R). They have to offer differentiated products to compete with their foundry partners! The other figure, 66% of design IP blocks are being internally sourced by the fabless, certainly opens a growth opportunity for the IP “providers” (foundry or IP vendor). We all know that the trend is, and will be, to outsource more design IP blocks, with a limit defined by the fabless themselves: you don’t want to outsource the part of the design on which you build your differentiation. We can guess that these differentiating functions represent a lot less than 66% of the design blocks. The real number is probably in the 20 to 30% range, say 25%, arbitrary. Now, the question is to know how long it will take for the fables to move from 66% down to 25% of internally reused IP blocks: 5 years? 10 years?  Let’s look at these two scenarios and forecast the effect on the IP market size growth rate. In one case, the IP market would move from 16% (of design blocks) to 37% in 2015 (assuming the outsourcing is equally shared by the IP vendors and the foundries, which is certainly not right, but the “less wrong” assumption we can make here).

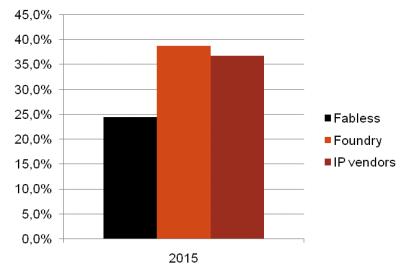

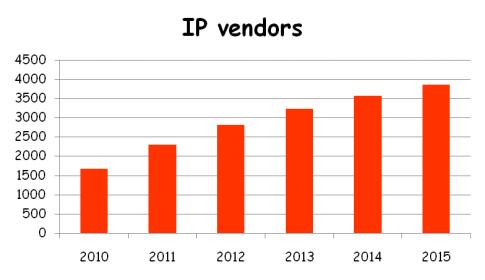

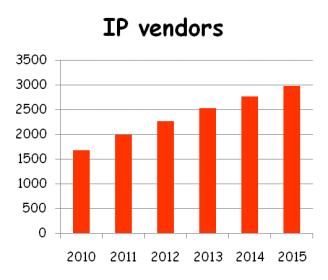

Let’s look at these two scenarios and forecast the effect on the IP market size growth rate. In one case, the IP market would move from 16% (of design blocks) to 37% in 2015 (assuming the outsourcing is equally shared by the IP vendors and the foundries, which is certainly not right, but the “less wrong” assumption we can make here). If we take into account this outsourcing effect only, this would lead to an IP market CAGR of 18%, and a market size passing from $1 677M in 2010 to $3 850M in 2015.

If we take into account this outsourcing effect only, this would lead to an IP market CAGR of 18%, and a market size passing from $1 677M in 2010 to $3 850M in 2015. But we know that many other effects can generate the growth: the emergence of new protocols is pushing the fabless or IDM to outsource the function, because it is too complex to design, or require competencies not available within the company. The need to integrate into a SoC the Analog Mixed Signal (AMS) blocks which were previously supported via ASSP. Or new functions issued from innovation, which simply did not exist before, and have to be licensed to the inventors (HDMI is a good example). This to say that the size of the market will be larger than that we have found by only using the growth of outsourcing rate! This 18% CAGR is impressive, especially when you consider the other growth factors for the IP market: · The emergence of new protocols, pushing the fabless or IDM to outsource the function, because it is too complex or too long to design, or require competencies not available within the company.· The need to integrate into a SoC the Analog Mixed Signal (AMS) blocks which were previously supported via ASSP.· Or to integrate new functions issued from innovation, which simply did not exist before, when the shortest path is to licensed it, to the inventors or IP vendors (HDMI is a good example).This to say that the market size should be larger than that we have found by only using the growth of outsourcing rate, so the assumption based on a 5 years period is probably overoptimistic. Let’s rework this evaluation, using a 10 years period instead of 5 for the outsourcing rate to pass from 34% to 75%, the off loading being equally shared by IP vendors and foundries, a questionable assumption (!). The results for 2015 would be:

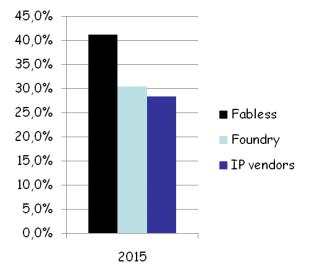

But we know that many other effects can generate the growth: the emergence of new protocols is pushing the fabless or IDM to outsource the function, because it is too complex to design, or require competencies not available within the company. The need to integrate into a SoC the Analog Mixed Signal (AMS) blocks which were previously supported via ASSP. Or new functions issued from innovation, which simply did not exist before, and have to be licensed to the inventors (HDMI is a good example). This to say that the size of the market will be larger than that we have found by only using the growth of outsourcing rate! This 18% CAGR is impressive, especially when you consider the other growth factors for the IP market: · The emergence of new protocols, pushing the fabless or IDM to outsource the function, because it is too complex or too long to design, or require competencies not available within the company.· The need to integrate into a SoC the Analog Mixed Signal (AMS) blocks which were previously supported via ASSP.· Or to integrate new functions issued from innovation, which simply did not exist before, when the shortest path is to licensed it, to the inventors or IP vendors (HDMI is a good example).This to say that the market size should be larger than that we have found by only using the growth of outsourcing rate, so the assumption based on a 5 years period is probably overoptimistic. Let’s rework this evaluation, using a 10 years period instead of 5 for the outsourcing rate to pass from 34% to 75%, the off loading being equally shared by IP vendors and foundries, a questionable assumption (!). The results for 2015 would be:

If we take into account this outsourcing effect only, this would lead to an IP market CAGR of 12%, and a market size passing from $1 677M in 2010 to almost $3 000M in 2015. Amazingly, this CAGR is similar with the result found by Semico (Semico projects this market to continue to grow, exhibiting a CAGR of 12.6% from 2010 – 2015).

This is that we could call a “quick and dirty” analysis, which does not take into account all the effects fueling the growth rate of outsourcing IP, and extend to the overall market (IDM and Fabless) the results validated for the Fabless chip makers. The benefit is to show that, opposite to EDA (except if they can change their business model to increase their product value), the IP market will grow and the CAGR (linked to outsourcing only) can be from 12% to 18% depending at what speed the Fabless and IDM will offload the non strategic part of their design.

Another very interesting point is the fact the foundries are the other beneficiary from outsourcing design IP blocks. This point would request another blog to better understand how the foundries will position this service. Will they act like the FPGA vendors, who have realized for long time now that offering IP is strategic to catch new businesses, and even more to keep their customers captives, but do not necessarily value IP at the right (higher) price? How will the foundries position in respect with the IP vendors, officially their partners? Will they compete with them, considering that IP is a decent source for extra revenue or simply provide IP on a case by case basis? Clearly, they will have to invest even more time to define their IP strategy, and money to develop or acquire the IP function their customer will increasingly need due to outsourcing…

Eric Esteve (www.ip-nest.com)

The Name Changes but the Vision Remains the Same – ESD Alliance Through the Years