You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

-Lam reports record QTR and great guide amid growing anxiety

-Weakness has not yet trickled down to Lam’s order book

-Company contacted by US government on new China restrictions

-Combination of supply issues/China/economy cut WFE view

Numbers are great

Lam reported revenues of $4.64B and EPS of $8.83 which represented… Read More

-Supply chain issues finally catch up to Lam- Ongoing issue

-Problem from one main supplier to spread to more

-Causes low December Quarter and soft guide for March

-Quarters could be lumpy due to differed & revenue push outs

Lam Stews over supply Chain Issues

It sucks when you have all the demand in the world but can’t build… Read More

Lam- good quarter but supply chain headwinds limit upside

Memory seems OK for now but watch pricing

China will also weaken which may add caution

Performance remains solid as does technology prowess

The yellow caution flag in the Semi race impacts Lam as well

As we suggested two weeks ago and saw with ASML this morning, supply chain… Read More

– If chips are “as good as it gets” so are the stock prices

– Are we at a near term ceiling that stocks have bounced off of?

– If growth slows do valuations also slow?

– Are we in a holding pattern waiting for a down cycle?

Second order derivative investing

As we have said many times in the past, investors… Read More

– Business is about as good as it gets- $75B WFE in 2021?

– China remains strong at 32% despite SMIC lack of license

– NAND remains 48% of revs versus 31% foundry

– DRAM steady @ 14% – Service was record $1.3B

Strong results in a strong market

Lam reported revenues of $3.85B and EPS of $7.49 for the March… Read More

- LCRX puts up a solid QTR and slightly soft guidance

- China Concerns weigh on future but COVID remains driver

- Memory spend could be better & help offset China

Solid September Quarter

Lam reported Non GAAP EPS of $5.67 versus $5.19 street and Revenues of $3.18B which was $70M better than street expectations. Lam obviously does … Read More

Two bits of recent news has excited people in the semiconductor manufacturing space. First TSMC (bit.ly/384joVr) announced their intention to invest $12 B dollars in a Fab in Arizona. Then came the Corona-driven bipartisan proposed $23B federal government investment in semiconductor manufacturing (nyti.ms/2YZzFqnl). … Read More

Lam reported strong beat & guide, memory returns-

China trade and Covid impact near zero-

Looking at a strong H2 with WFE in mid $50B+-

Back on Cruise Control

Lam reported a great quarter, easily beating expectations coming in at $2.79B and $4.78 in non GAAP EPS-

Guide is for $3.1B +-$200M and EPS of $5.06+-$0.40-

Margins and all… Read More

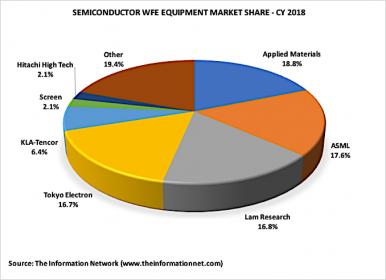

Lam Research (NASDAQ:LRCX) will announce its quarterly earnings on October 23, 2019, and Applied Materials (NASDAQ:AMAT) the following month on November 14, 2019. Both companies make equipment used to manufacture semiconductor devices. While private and institutional investors often own both individual stocks, this article… Read More

The semiconductor equipment market grew 37.3% in 2017 on the heels of capex spend by memory companies in order to increase bit capacity and move to more sophisticated products with smaller nanometer dimensions. Unfortunately these companies overspent resulting in excessive oversupply of memory chips. As memory prices started… Read More