The state of the Semiconductor Industry before the earnings season. This post will give the industry’s status before the results are revealed. We are sharing the information available.

The first Q2 swallows

A few companies with quarters not aligned to calendar quarters have reported. Nvidia was slightly ahead of expectations, and the stock price made the company the most valuable in periods of June. All of it is driven by the data centre and H100 AI sales.

![]()

Broadcom reported disappointing semiconductor revenue, only saved by AI Network and Accelerator sales to Meta and Google. Marvell painted a similar picture with everything down except the data centre business. This is not a good sign for the broader earnings season coming up. (Broadcom result)

Lastly, Micron showed 17% growth, mainly due to memory price increases, and only the storage business was growing in bits sold. Even the computer was flat in bits sold, indicating that Micron is not getting much action from Nvidia. (Micron result)

The closure of Q1

The total revenue of Semiconductor companies was flat in Q1-24 compared to the prior quarter, but the overall growth compared to Q1-23 was quite strong. 29% growth signals the industry is well into the cyclical recovery period (Long-term growth is currently at 8%).

If Nvidia’s strong growth is excluded, the growth falls to under 10% or close to the long-term level.

![]()

The exclusion of Nvidia revenue makes Foundry revenue growth very similar to the growth of Semiconductor companies, highlighting that Nvidia revenue is mostly profit, and only 15% makes a mark on Foundry revenue.

The four growth curves represent the semiconductor time machine; while imperfect, they allow a peek into the future of the Semiconductor Companies.

With zero inventory movements, the time machine works like this:

![]()

The revenue of Tools, Materials, & Foundries is a chain of events predicting the revenue of semiconductor companies. While it can be used to predict individual results of some of the largest Semiconductor companies, is works better as an overall indicator of the industry.

The negative growth of materials and the drop in foundry revenue does not suggest a strong recovery in the Q2 results and the tools revenue is not a solid longer term indication of revenue expansion.

Mean revenue results

With Nvidia’s strong performance clouding general industry insights, it is worth looking at a Box and Whiskers plot based on mean values.

![]()

This is a way of investigating industry growth with the outsized impact of the outliers. Here, it becomes obvious that not only is Nvidia driving the overall growth but also the Korean memory companies led by SK Hynix, which are currently winning HBM at Nvidia.

The mean growth for semiconductor companies compared to Q1-23 is 0.2%, indicating that the AI pocket of growth is the only action in the Semiconductor Industry in Q1.

Median growth for tool companies is positively impacted by the good performance of Chinese tool companies.

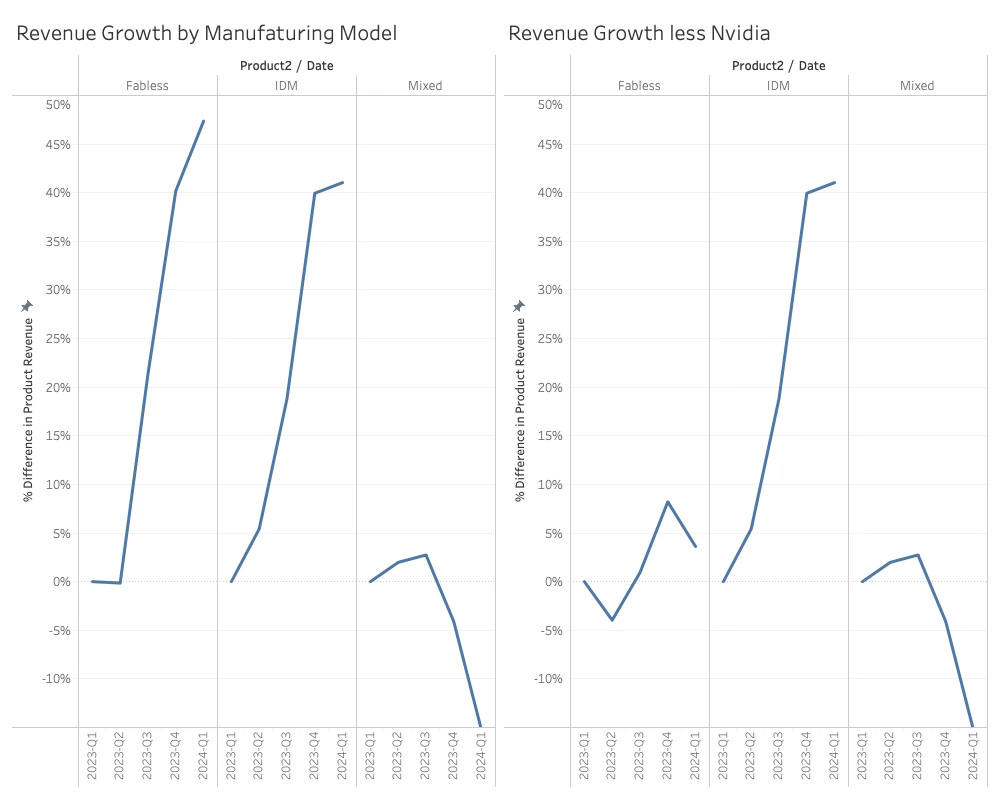

Revenue growth by Manufacturing Model

We divide Semiconductor companies into three different categories:

1) Integrated Device Manufacturers: Traditional model with fabs.

2) Fabless Semiconductor Companies: Companies exclusively using foundries

3) Mixed Manufacturing Model: Analog and power fabs with high-end digital outsourced to foundries.

The relative growth for Fabless is strong, but the impact of Nvidia accounts for most of the development. Without Nvidia, the result is 4%. The IDMs are lifted by the increase in memory pricing rather than bit growth. The mixed model companies have seen significant declines over the last two quarters.

The Inventory Situation

The inventory position for different areas of the supply chain can reveal how much of a surprise the current revenue level represents. If revenue is unfolding in line with the quarterly manufacturing plan, you would expect to see a decrease in inventory as companies try to optimise their inventory. The exception is if companies are running on low inventory, which is not the case in the current market environment (with notable exceptions for Nvidia and the company’s supply chain.

![]()

The chart shows the inventory days according to the supply chain position. As foundries and semiconductor companies have been depleting inventory compared to Q1-23, the materials companies were still struggling with the last pile-up collision.

The Q1-24 increase in inventory is driven by lower-than-expected demand from the end markets, which slams through the supply chain. This will likely continue into Q2-24 as neither foundries nor semiconductor companies invest in materials to support a potential Q2-24 revenue increase.

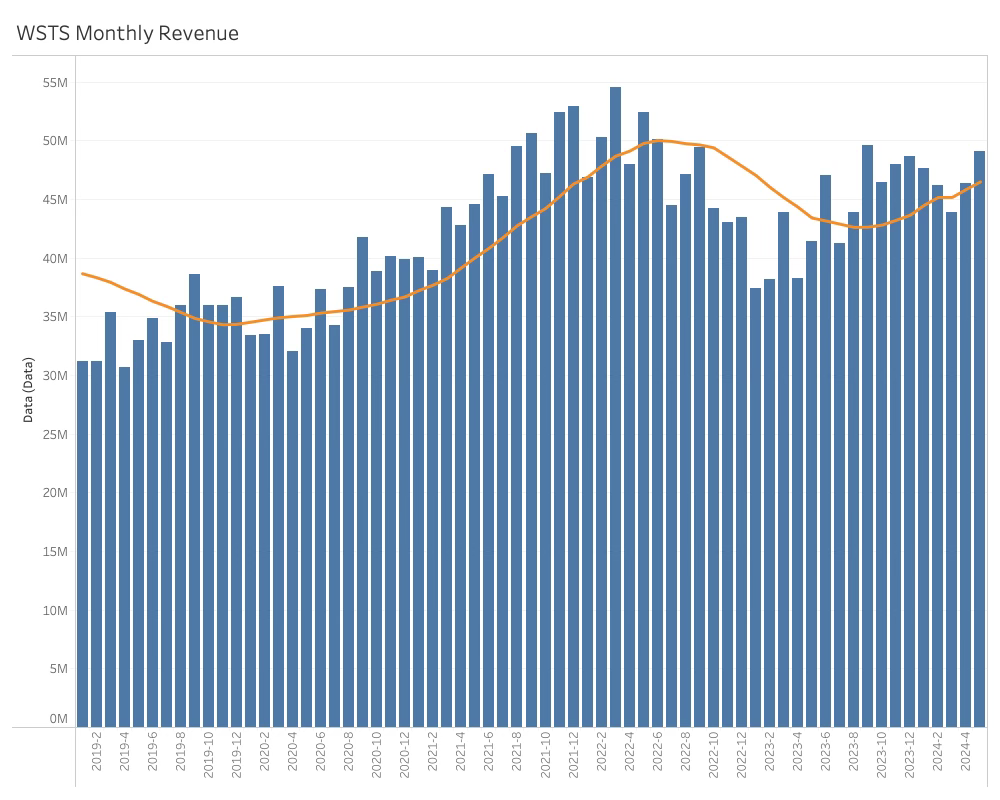

World Semiconductor Trade Statistics (WSTS)

WSTS just released their Semiconductor trade statistics for May, which showed another monthly increase. While this should be a good signal, there are issues with how WSTS accounts for semiconductor revenue.

WSTS only gets monthly reports from its members. The reporting is screened by a third-party accountant who shields the identity of the reporting company, so WSTS does not know who reports what, only what products were sold. As many important companies are not members, WSTS has to guess about their revenue numbers by month. This problem is growing with the revenue of Nvidia, which is not a member of WSTS and now accounts for more than 8.6B/month or more than 17% of total WSTS revenue. A year ago, it was 2.4B$/month. In addition, neither Intel, AMD, nor Broadcom are members of WSTS.

This makes WSTS numbers very unpredictable and not very useful for making predictions anymore.

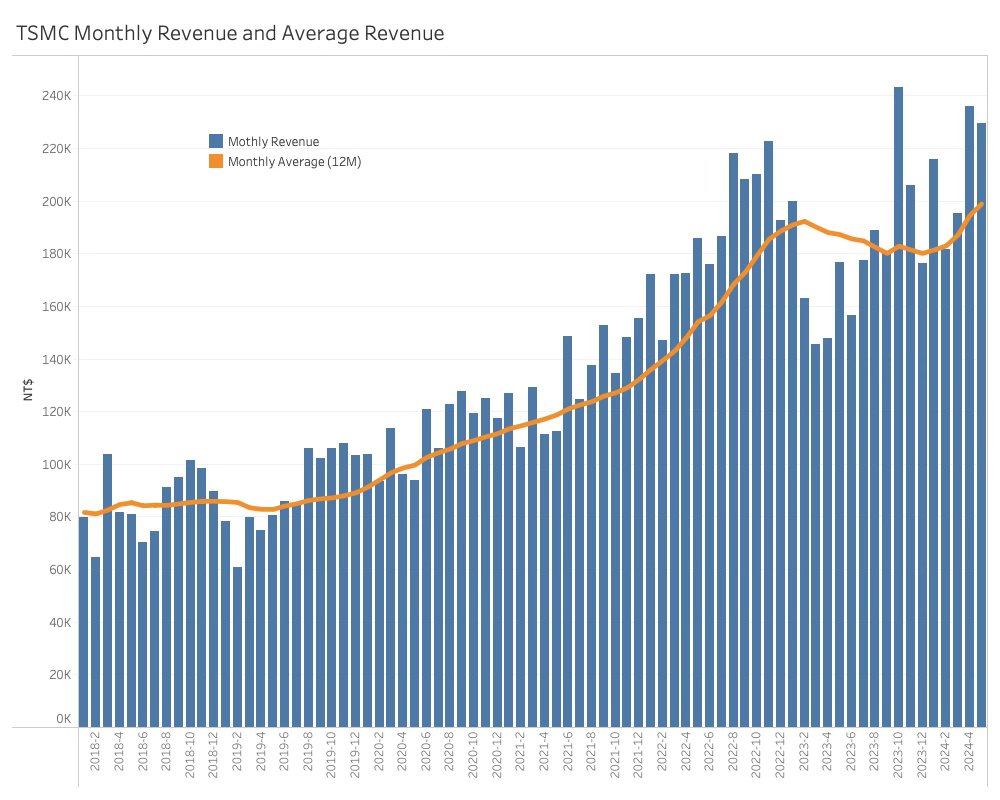

TSMC update

As TSMC reports monthly revenue, it is possible to see Q2 revenue already. While it is a TSMC Record, the quarter is slightly above Q4-22 and Q4-23.

TSMC’s strong quarter suggests an uptick in market activity. It is hard to judge if this is broad-based or still AI-centric. Apart from Nvidia, TSMC will manufacture AI GPUs for Intel and AMD this quarter. This could signal that AMD and Intel are expecting meaningful AI orders. Whether this materialises is another matter entirely. Also, TSMC is winning orders from Samsung’s foundry business, which is struggling to get good yields on leading-edge nodes.

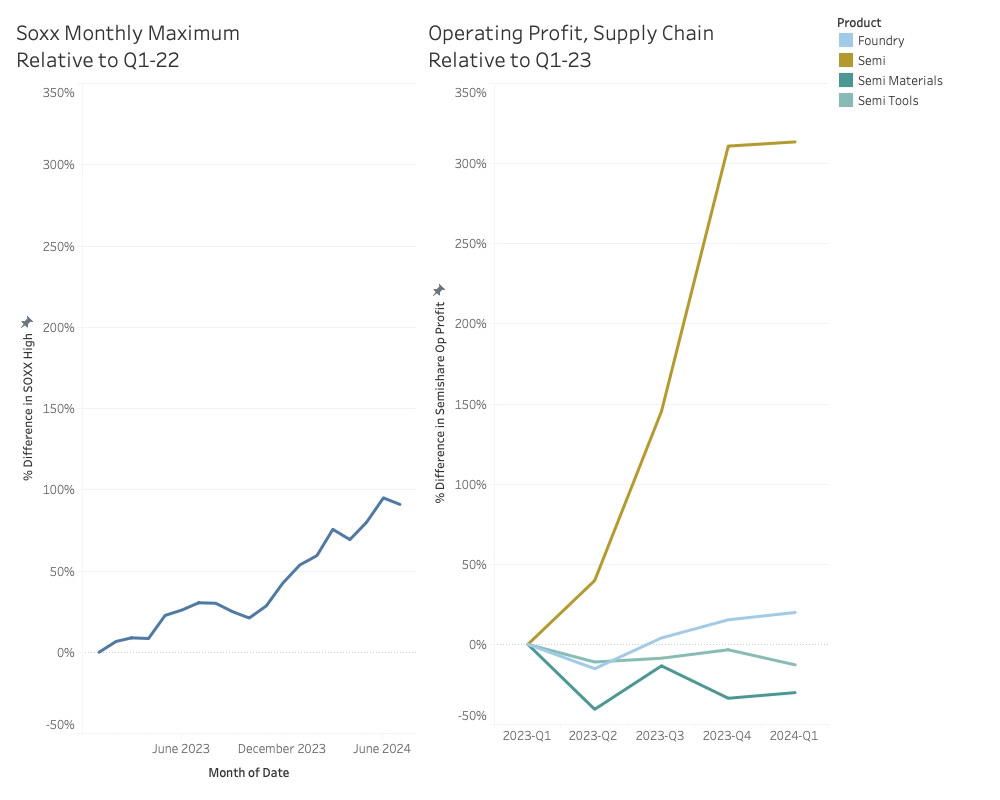

Semiconductor Operating Profits

The operating profits for Semiconductor companies compared to Q1-23 looks incredibly good with over 300% growth, while the rest of the supply chain have meager results.

![]()

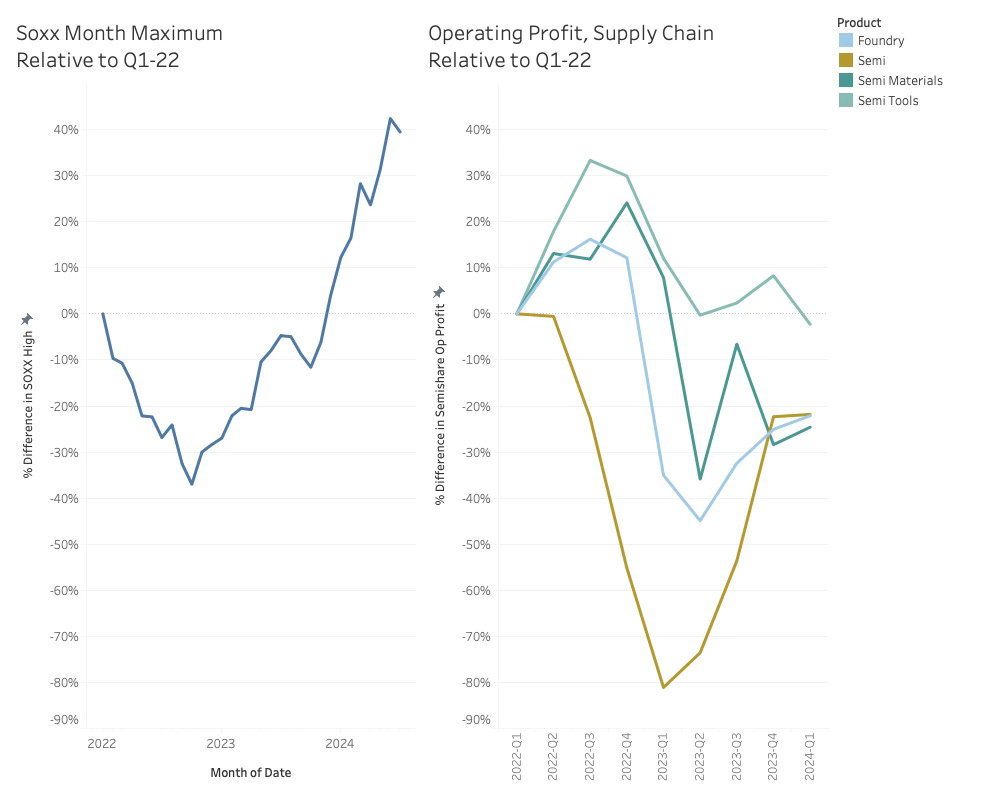

As the Q1-23 view is taken from the Semiconductor cycle minimum it involves memory companies starting in negative and ending in postive which does not tell the full story. Turning the dial back to Q1-22 gives a significantly different view, where all of the supply chain operating profit growth is under water.

It is also worth noting that Nvidia is now dominating the total operation profit of the Semiconductor companies, skewing the graphs dramatically.

![]()

While we still wait for most Semiconductor companies to publish the Q2-24 result, the division between Nvidia and the rest of the industry is clear. In Q1, Nvidia accounted for more than half the semiconductor operating profit. This is likely to be the case in Q2 also.

The Stock market perspective

While we do not try and predict share prices, we do not mind comparing business development with increases in share prices.

We understand that revenue is not the only important element in a company valuation, but it is incredibly important for semiconductor companies to have revenue growth. Without revenue growth, it is difficult to make meaningfull gains in free cashflow which is more important in valuations.

We use the Philadelphia Semiconductor Index (SOXX) as a good proxy for the collective share price of semiconductors. As can be seen, in the graph below, the current share gains are not justified by a similar gain in revenue growth.

![]()

From an operating profit perspective, the increase in share price looks more justified, while is should be noted that Nvidia is driving both.

Adding a comparison from Q1-22 gives a different view, where none of the supply chain sectors have retuned to an operating profit at the level of Q1-22

Conclusion

While there is a lot of semiconductor optimism before the current earnings season, there is not a lot of evidence that there is significant revenue growth or inventory depletion that indicate a general upturn. The optimism surrounding the WSTS numbers does not point to a general upturn as they are dominated by Nvidia’s hyper growth and the increasing revenue of the memory companies due to price increases. The memory volume is not increasing.

TSMC will be reporting healthy numbers but not anything that goes through the roof. The good result will be dominated by supplies of AI products for Nvidia, Intel, AMD and Broadcom. It will be interesing to see if the Semiconductor companies can turn these products into revenue. We will have a special focus on Intel as the company will need to show results soon.

If you are an investor or another stakeholder in the Semiconductor Industry, you can gain insights from our updates as the Semiconductor companies reports Q2 results.

Also Read:

Automotive Semiconductor Market Slowing

2024 Starts Slow, But Primed for Growth

Share this post via:

CEO Interview with Jerome Paye of TAU Systems