Semiconductor startups used to rule the roost in Silicon Valley. The very name, Silicon Valley, comes from the birth of the semiconductor industry in the San Francisco bay area 60+ years ago. Large percentage of venture financing used to go to semiconductor startups, even as recently as 15 years ago. As a chip designer doing startups in the late ‘90s and early 2000s in the San Francisco bay area, I felt as if there was a semi startup on every street corner.

Not so much in the last 10 years. Maturing industry, high capital requirements, and dwindling exits have caused a huge decline in funding for semiconductor startups. The narrative of Silicon Valley moved to consumer internet and software-led businesses. Remember, software is eating the world. But in the last few years, we have seen a slow but steady resurgence of semiconductor startups and witnessed blockbuster financing and acquisitions. So, are semiconductor startups on the comeback trail? Or is it a mirage?

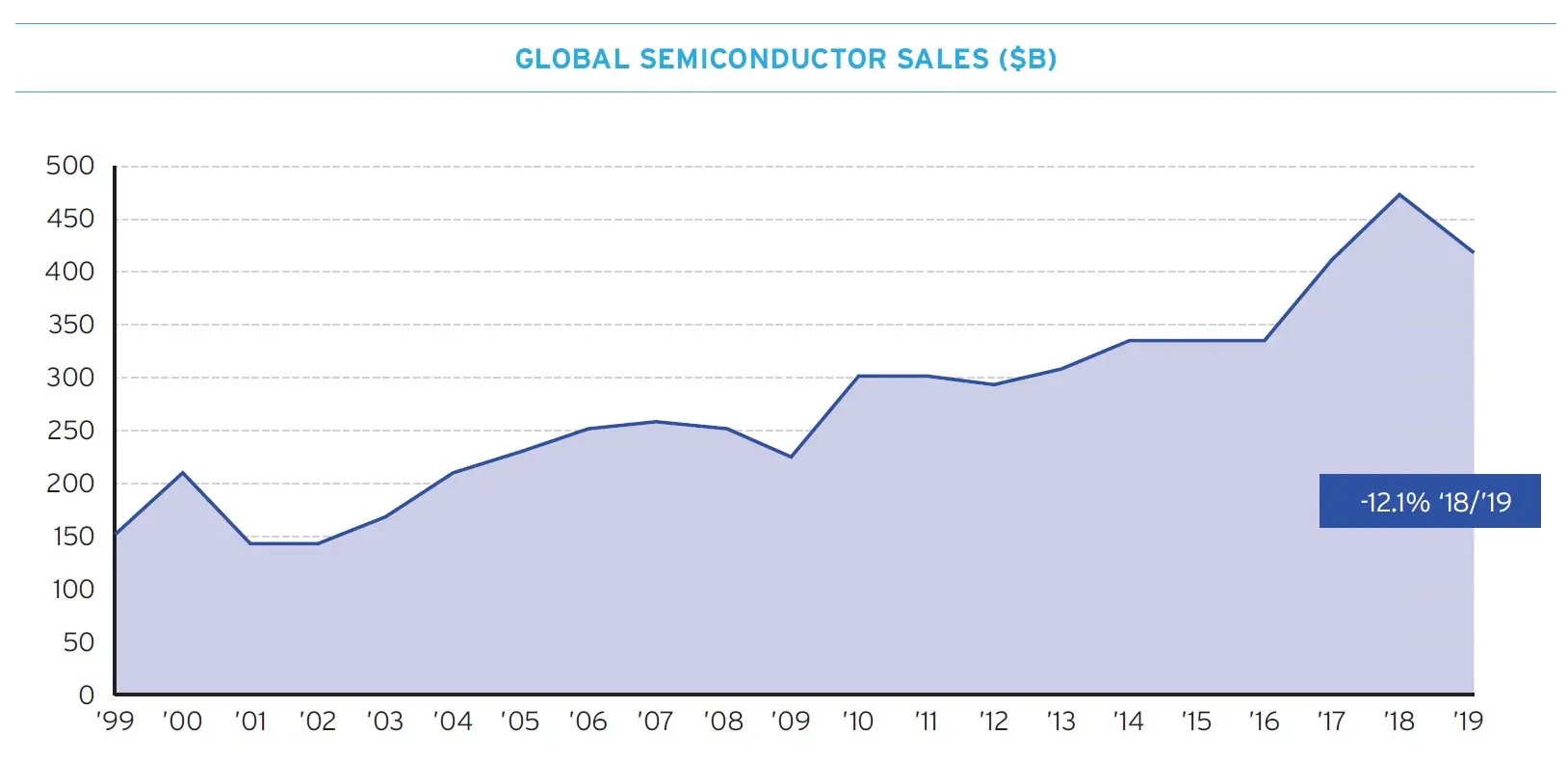

First, it is important to separate semiconductor startups from the overall semiconductor industry. Globally, the market for semiconductor products has been growing for several decades and in recent years led by growth in computers, smartphones, consumer electronics, and automotive and industrial electronics. Computers have gotten powerful, phones have faster internet speeds, consumer gadgets have gotten smaller – all because of the technological advances in semiconductors.

Source: “2020 State of the US Semiconductor Industry” from SIA

In a large growing market with improving technology why is there no place for new startups? While semiconductor is maturing as an industry, it is hardly a commoditized market with no place for innovation.

Well, structurally a few things happened:

- Cleantech, one of the prominent semiconductor sectors, had flopped badly, losing lots of capital for investors.

- The technological advances made in internet infrastructure and mobile technologies led to a boom in the software application ecosystem across social, mobile, and cloud, moving entrepreneurial interest away from semiconductors.

- China emerged as a large supplier of semiconductors, thus increasing competition while driving down premiums in the market.

- Huge waves of consolidation happened in publicly traded semiconductor companies.

Most sectors go through these phenomena – they are nothing new. When this happens, newer innovations kickstart the next disruption cycle. Why didn’t it happen with semi startups?

Well, the success of a startup ecosystem rests on the number and variety of experiments that are attempted. The more experiments across a wider variety of areas, the better the chances for a breakout success. For semiconductor startups, two main issues slowed down these experiments:

- It takes roughly $30M of financing to even get to a product and another $100M or more to get to volume production.

- Buyer universe is limited because of the public market consolidation. The reduced list of buyers meant smaller acquisition premiums and smaller exits.

Huge capital costs combined with a small buyer universe and small exits don’t make for an attractive investment area. Combine this with harder macro trend, we saw a vicious cycle of diminishing interest and funding in semiconductor startups.

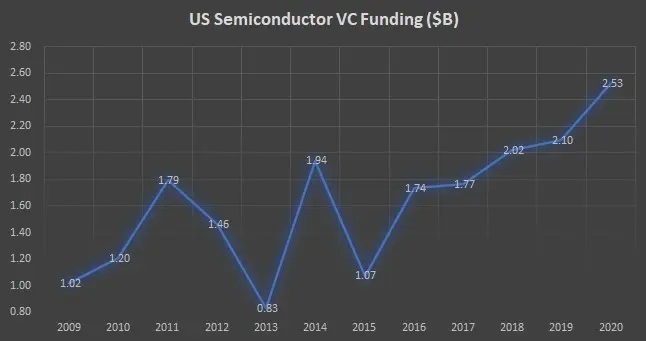

Things have started turning around over the last few years. Since 2017, investments in semiconductor startups have increased significantly. So, what happened?

One of the main reasons is the explosion of Artificial Intelligence (AI). Innovative semiconductor products were required to meet the computing demand of AI. Advances in AI and Computer Vision helped make huge strides in autonomous vehicles and autonomous platforms. That drove demand for specialized semiconductor sensors and processor architectures.

The cost of building semiconductor products has come down significantly, especially if you are not operating at the cutting edge of semiconductor manufacturing processes. Most semiconductor products do not require these advanced processes. Today, you can build a first-generation semiconductor chip with $10M or less. That is lot less than $30M.

Expanding buyer universe – Apple, Google, Microsoft, Facebook, Amazon, and other large internet and software companies have started building semiconductors for their internal use and consumer products. They have become new acquirers of semiconductor startups.

US-China trade tensions have centered around semiconductors and there has been an increased focus on self-sufficiency and nationalization. This has driven demand for US semiconductor suppliers. Chip shortages facing the automotive industry is driving home the point of self sufficiency.

All these factors have driven huge investments and exits in Semiconductors recently. Just a few examples:

- Qualcomm acquired a two-year-old semiconductor startup, Nuvia for $1.4B

- Automotive Sensor Semiconductor companies, Luminar, Aeva, Aeye, Ouster and Innoviz all going public at valuation of $1B or more.

- Investments flowing into semiconductor startups focused on AI, Quantum computing, Robotics, and others.

So, are semiconductor startups back for good? As new areas come up including Quantum computing, Space technologies, Computational biology … the need for innovation and newer semiconductor products is on the rise. I remain bullish that the resurgence we have seen in semiconductor startups is here to stay. And once again, the name, Silicon Valley, will fit its description.

Deep (tech) thoughts with Karthee!

Share this post via:

Flynn Was Right: How a 2003 Warning Foretold Today’s Architectural Pivot