GlobalFoundries Inc. (GF) is a leading pure-play semiconductor foundry that manufactures feature-rich, mature, and specialty process nodes rather than pursuing cutting-edge logic like 3nm or 2nm. GF focuses on automotive, IoT, wireless, defense, aerospace, and RF communications, positioning itself as a critical global supplier in the diversified semiconductor value chain.

Headquartered in the United States and with multiple fabs worldwide, GF is known for its reliable long-life process nodes, commitment to U.S. and European sovereignty, and strategic importance to secure semiconductor supply chains.

Fast Facts

| Item | Details |

|---|---|

| Name | GlobalFoundries Inc. (GF) |

| Founded | March 2009 |

| Headquarters | Malta, New York, USA |

| CEO | Tim Breen (since April 2025) |

| Stock | NASDAQ: GFS (IPO in October 2021) |

| Employees | ~13,000 (as of 2025) |

| 2024 Revenue | $6.75 billion |

| Ownership | Majority-owned by Mubadala Investment Company (UAE sovereign wealth fund) |

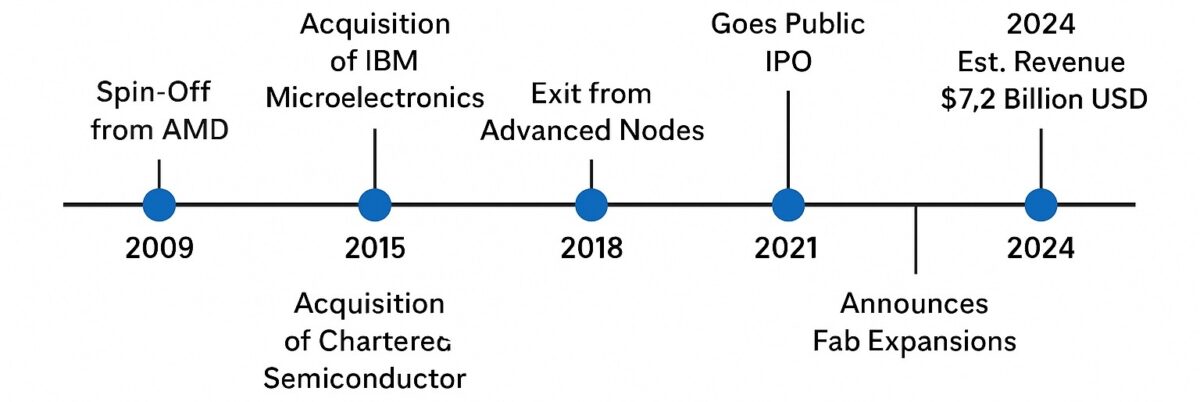

History

| Year | Event |

|---|---|

| 2009 | Founded via spin-off from AMD’s manufacturing arm |

| 2010 | Acquired Chartered Semiconductor (Singapore) |

| 2015 | Acquired IBM Microelectronics (including East Fishkill fab and SOI technologies) |

| 2018 | Exited advanced node race (7nm and below); focused on feature-rich platforms |

| 2021 | Went public on the NASDAQ (Ticker: GFS) |

| 2023–25 | Announced capacity expansions in U.S., Singapore, and Germany |

Foundry Strategy

GlobalFoundries operates a “More-than-Moore” strategy focused on application-optimized technologies rather than chasing raw transistor scaling. It emphasizes:

-

Mature nodes: 180nm, 130nm, 90nm, 55nm, 40nm

-

RF SOI & Silicon Photonics

-

FD-SOI (22FDX / 12FDX)

-

Embedded Non-Volatile Memory (eNVM)

-

Power Management (BCD, GaN)

-

Automotive-grade semiconductors

-

Secure and defense-grade semiconductors

Global Fab Footprint

🇺🇸 United States

-

Fab 8 – Malta, New York (300mm, 14/12nm FinFET, 22FDX)

-

Fab 9 – Essex Junction, Vermont (200mm, acquired from IBM)

-

Fab 10 – East Fishkill, New York (now sold to onsemi, but GF retains IP and technology rights)

🇸🇬 Singapore

-

Multiple 200mm and 300mm fabs focused on mixed-signal, RF, power, and NVM processes.

🇩🇪 Germany

-

Fab 1 – Dresden, 300mm site producing 22FDX and 40/28nm processes.

Future Expansion

-

Dresden MegaFab expansion (with EU funding)

-

Malta Fab 8.2 expansion (CHIPS Act-funded)

-

Continued investment in Singapore new 300mm fab module

Key Technologies

| Platform | Description |

|---|---|

| 22FDX/12FDX | Fully Depleted SOI – low power, low leakage for IoT and wireless |

| FinFET | 14nm/12nm node for performance-sensitive products |

| RF SOI | Industry leader in RF switch and front-end module manufacturing |

| Auto & Power | Automotive-grade process reliability; BCD for power ICs |

| eNVM | Embedded flash and MRAM options for industrial and automotive |

| Secure Foundry | Trusted foundry certifications for U.S. DoD contracts |

Business Focus

GlobalFoundries serves more than 200 customers, including:

-

Qualcomm (RF)

-

NXP (automotive & industrial)

-

Broadcom

-

General Motors

-

Lockheed Martin

-

Bosch

-

STMicroelectronics (for FD-SOI collaboration)

Applications include:

-

5G RF front ends

-

AIoT edge computing

-

Electric vehicle (EV) components

-

Secure aerospace & defense electronics

-

Industrial automation and robotics

Financial & Strategic Outlook

-

IPO (2021) raised $2.6B, giving GF a market cap of ~$30–40B as of 2025.

-

Received U.S. CHIPS Act incentives for Fab 8 expansion.

-

Key partner in U.S. and EU semiconductor sovereignty efforts.

-

Pledged carbon neutrality by 2050.

Leadership

Executive team

-

Tim Breen — Chief Executive Officer

-

Niels Anderskouv — President & Chief Operating Officer

-

John Hollister — Chief Financial Officer

-

Gregg Bartlett — Chief Technology Officer

-

Mike Hogan — Chief Business Officer

-

Saam Azar — Chief Legal Officer

-

Pradip Singh — Chief Manufacturing Officer

-

Samuel Vicari — Chief Customer Officer

-

Pradheepa Raman — Chief People Officer

-

Brad Clay — Chief Information Officer

Board leadership

-

Dr. Thomas Caulfield — Executive Chairman

-

David Kerko — Lead Independent Director

-

Directors: Tim Breen, Marc Antaki, Glenda Dorchak, Martin L. Edelman, Camilla Languille, Jack Lazar, Elissa Murphy, Carlos Obeid, Dr. Bobby Yerramilli-Rao

Challenges

| Challenge | Details |

|---|---|

| Advanced Node Gap | No 7nm, 5nm, or 3nm offerings—less competitive in mobile & HPC |

| Customer Dependency | Relies heavily on automotive and RF verticals |

| Geopolitical Complexity | Navigates U.S., EU, and UAE interests in parallel |

| Talent Competition | Struggles to recruit leading-edge engineers from TSMC/Intel/Samsung |

Summary

GlobalFoundries plays a unique and essential role in the semiconductor ecosystem by focusing on feature-rich, mature, and reliable process technologies. As governments diversify supply chains and prioritize semiconductor security, GF has become a strategic pillar in U.S. and European industrial policy—even without cutting-edge nodes.

Also Read:

Share this post via:

Advancing Automotive Memory: Development of an 8nm 128Mb Embedded STT-MRAM with Sub-ppm Reliability