Intro

My Wednesday breakfast at DAC last week was at the Interoperability event sponsored by Synopsys. The Synopsys moderator was so jovial that he reminded me of Jerry Lewis, I was relieved when the guests gave us an update.

Notes

Interconnect Modeling- Open Source Interconnect Technology Format (ITF)o Used by Star RC

– Modeling parasitic of interconnect

– Interconnect Modeling Technical Advisory Board founded, meet twice per year

o Program of IEEE-ISTO

o Andy Brotman, VP Design Infrastructure at GF

IMTAB – foundry perspective

Design starts are slowing in number for each new node (although each new node has more devices)

Need to avoid risks, ensure 1st silicon success

Mistakes are more costly (NRE)

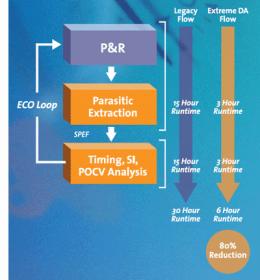

Parasitic variation increases at 20nm, more analysis required

Layout effects need to be simulated earlier

Best in class extraction tools are a must

Standard interconnect tech file used (Star RC, F3D, …)

New layout effects: Orientation dependent width bias

o Rich Laubhan, Engineer and Manager of Signal Integrity at LSI Corporation

User perspective (Used Star RC for 13 years now)

LSI products: HDD controllers, SSD controllers, RAID adapters, networking

Producing 65nm, 40nm, 28nm chips

Many signoff PVT/RC corners

• No real single corner to simulate

Many modes to simulate: functional, scan, BIST, TDF

High speed designs: 500MHz to 2GHz clocks

Can have 200 clock domains

Hierarchical designs with 20M instances

Plot of transistor feature size and number of metal layers (12 layers now)

ITRS plot: total metal interconnect on a chip over time, more resistive effects

No standard test structures to measure R L C values

We use Charge based capacitance measurement (CBCM)

More wires, higher resistance, metal fill effects: designer challenges

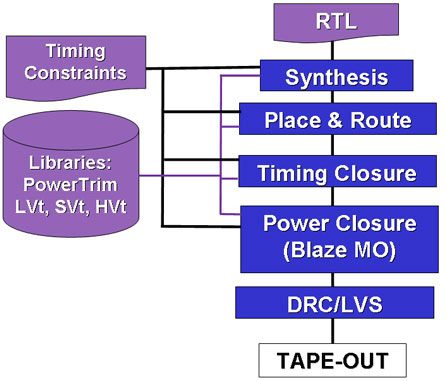

LSI Design Flow: Tech File and Design input to Parasitic Extraction, output a SPICE Or SPEF file

• Tech file: cross section, dielectrics, vias, R L C values

Tech File Complexity: IC Cross section with 12 metal layers, dielectrics

• Longer qualification time to meet accuracy goals

• Variation in process causes variation in R L C values

ITF Open source – provides a proven format with support from 130nm to 20nm

ITF Extensions proposed

• Quick process to get ratified

• Layout dependent effects

• TSV

• 28nm and 20nm effects

Desire to use fewer EDA tool formats to keep costs lower

• Changed extraction tools three times for last three technology nodes

Challenges

• Agreement on test structures

• Accurate results

Tenzing Norgay Award

– Surpass common levels of interoperability

– Contribute to overall industry advancement

– Provide a new view of the future

– 2011 Winner: Shreink Mehta

o Work on UPF, SystemVerilog

o Sun SPARC

o OVI and VHDL

o SPIRIT

IPL & Custom Design

– IPL Constraint 1.0, first standard for interoperable analog design constraints

– OPDK and iPDK are cooperating

– Vincent Varo, Process Design Kit Manager, STMicroelectronicso Desire to reduce effort in PDK development, create one PDK not many, use across all EDA tools

o Device Library, DRC, LVS, PEX, SPICE

o Standardized input to PDK development process from all foundries desired

Standard DRM, Device Specification format

o Challenge: How to validate an automatically created PDK?

o Mulitple methods to create a single iPDK

o Parasitic Extraction technolog file

IMTAB, or Si2 OPEX WG

o Desire to be EDA Tool independent

o Next steps

Automate the PDK validation process

Design re-use and portability

AMS design portability

Designs that are DRC and LVS clean by construction

– Ori Galzur, VP VLSI Design Center, TowerJazzo Largest foundry for speciality technologies

o Total of 4 foundries: Newport Beach, Japan, Israel, China

o Approaching $1B in revenues

o Power, BiCMOS, SiGe, RF CMOS, Image Sensor, Mixed-Signal CMOS, eNVM

1um to .13um

o Specialty PDK for high voltage process

Automatic device scaling based upon the voltage levels that you need

ESD rules added to PCELL

From schematics a designer gets to choose from a GUI all of the device parameters

o Average PDK has over 120 devices

o Each device can be used in: Standard, Shallow NBL, Deep epi

o All devices are voltage scalable, optimized

o Supporting multiple tool sets takes too much engineering effort

o Want one PDK to focus engineering on other value add efforts

o Choose the best foundry, best EDA tools, not locked into a vendor-specific PDK

Summary

– Demand that your Foundry and EDA vendors support iPDK