Mark Milligan recently joined SpringSoft as VP Corporate Marketing. I sat down with him on Monday to get his perspective on things.

He started life, as so many of us, as an engineer. He was an ASIC designer working on low-level microcode for the Navy Standard Airborne Computer at Control Data. It was actually the first ASIC that they had done. It was the early days of RTL level languages and Mark worked on the simulation environment to verify the ASICs.

Teradyne had bought several companies and built the first simulation backplane so Mark switched to marketing and did the technical marketing for that product line.

Then he moved to the West Coast and joined Sunrise Test Systems which Viewlogic acquired (and eventuallly ended up in Synopsys). There he was an early advocate of DFT and scan. Funnily enough one pushback they used to get on running fault simulation is that designers didn’t want to know how bad it was, there wasn’t time or good tools to get coverage up and it was too late, typically, to bite the bullet and switch to a full scan methodology on the fly.

A spell in CoWare and then Virtualogix gave him a new perspective on embedded software (as did my tours of duty and VaST and Virtutech).

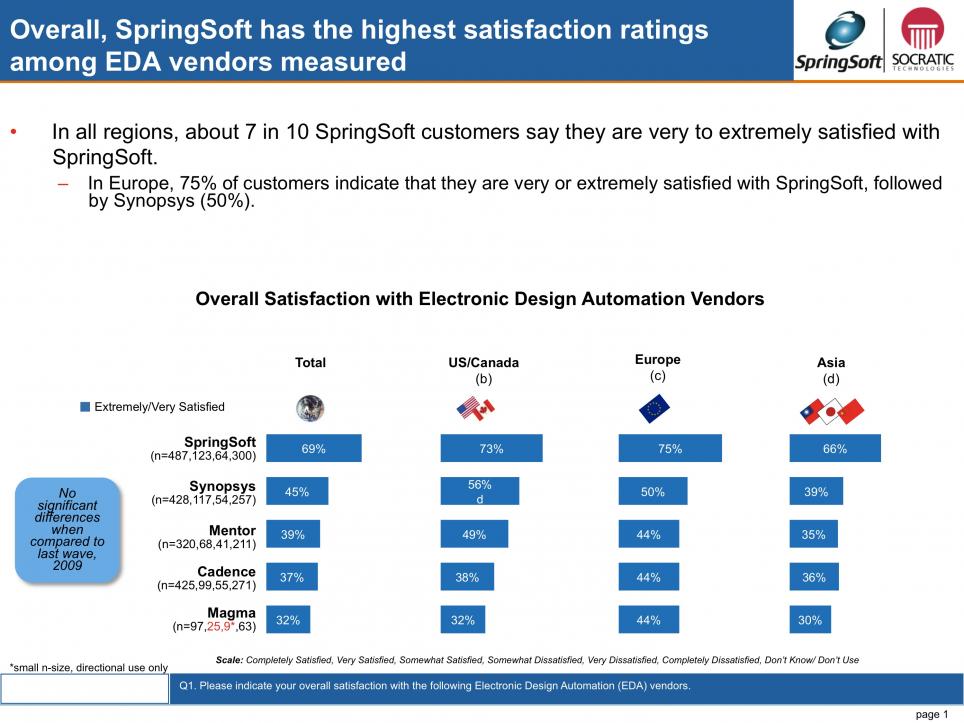

When Mark arrived at SpringSoft they had commissioned a customer satisfaction survey. He was pleased to discover that their customer satisfaction was 25% higher than any of Synopsys, Cadence, Mentor or Magma.

When Mark arrived at SpringSoft they had commissioned a customer satisfaction survey. He was pleased to discover that their customer satisfaction was 25% higher than any of Synopsys, Cadence, Mentor or Magma.

One challenge he feels SpringSoft faces is that products like Laker and Verdi have better name recognition than SpringSoft does itself.

Between 2008 to the present, SpringSoft has continued to grow and it has stayed profitable. In fact he believes they are the most profitable public EDA company (as a percentage of revenue, of course. For sure Synopsys makes more total profit). They are around 400 people, about 3/4 of them in Taiwan.

This profile, profitable and growing and medium sized, allows them to focus on specific pain areas to bring innovation to customers. They are big enough to be able to develop solutions and deliver them but small enough that they don’t have to try and do everything.

One similarity Mark noticed from a previous life was the way that, in the past, people wanted to know how good their test solution was (fault simulation) and now everyone wants to know how good their test benches are, which is a harder problem.

One similarity Mark noticed from a previous life was the way that, in the past, people wanted to know how good their test solution was (fault simulation) and now everyone wants to know how good their test benches are, which is a harder problem.

We talked a bit about innovation. Historically most innovation has come from small startup companies but these are no longer being funded in EDA. One the other hand, we have a few medium-sized EDA companies: SpringSoft, Atrenta, Apache (now part of Ansys but still being run as an EDA company). In the areas they cover, which for sure is not everything, there has been a lot of innovation there broadening out from single products to a portfolio that addresses a problem area.

Share this post via:

CEO Interview with Jerome Paye of TAU Systems