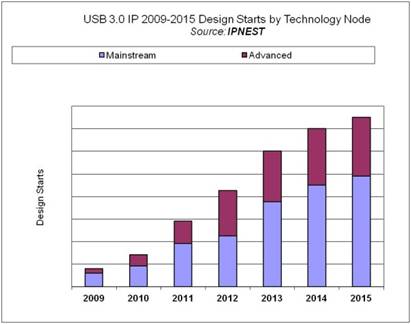

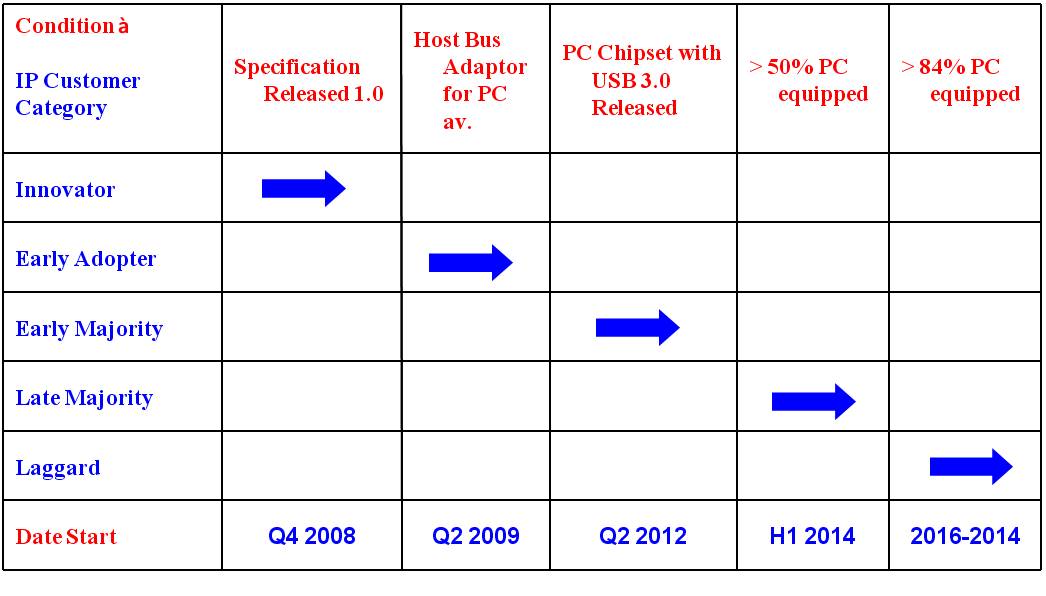

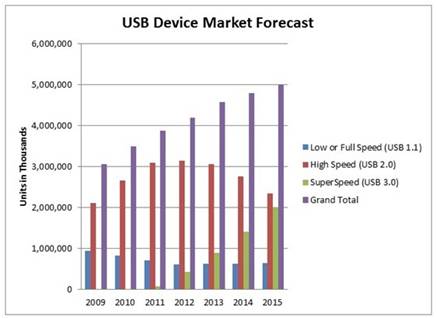

Using the “Diffusion of Innovation” theory, we have built a forecast for the market of USB 3.0 IP in 2011-2015. In this new version of the report, we have inserted the actual revenues generated by USB 3.0 IP from different vendors, for 2009 and 2010, and reworked the 2011-2015 forecast. Initially, we had expected this IP market to ramp up very fast, because the USB technology is already familiar to the end user, so the market adoption should be easier than for other emerging technology. In fact, the ramp-up is not as fast as expected, and the reason is crystal clear: even if the technology is already available and demonstrated in applications like external storage, the most important enabler was missing: the availability of PC or Notebook with native SuperSpeed USB support, or USB 3.0 included in the PC chipset. Because the electronic industry is expecting such an introduction to come in Q2 2012, and PC shipments to follow quickly and reach a rate greater than 80% during 2013, the sales for USB 3.0 IP are breaking a barrier: after “Innovators” and “Early Adopter”, USB 3.0 is expecting to reach “Early Majority” starting in 2012. Because of the SoC design cycle, IP sales are happening now, at OEM designing for Consumer Electronic and other mass market applications.

In order to build an accurate forecast for IP sales, we have used a bottom-up methodology. Usually, the top down approach is followed: based on an expected count of design start by market segment, you try to determine (using a secret sauce?) the proportion of designs where a certain technology will be used. For an emerging technology like USB 3.0, we have preferred an approach which is to review all the Applications (in all the market segments: PC, PC Peripherals, Consumer Electronics and Wireless handset), evaluating the list of actors (OEM, IDM, Fabless) for each Application, and determine if they will adopt USB 3.0 and, even more important, when they will do it. We have clearly identified a first wave of applications, where the adoption of SuperSpeed USB was fast: External Storage (HHD before SSD) and a very few PC Peripherals (Bridge, Hub, Web Camera…). The end user should be highly motivated, as he had to use a PCIe to USB 3.0 bridge (HBA or ExpressCard), to move to USB 3.0.

The second wave of Applications is starting to generate IP sales now, for products to be launched in 2012 and later and to be connected to PC integrating PC Chipset with native USB 3.0 support. These are, in CE segment: Set Top Boxes, DVD and Blue-Ray, HDTV, then Digital Video Camera before Digital Still Camera, in PC Peripherals segment: LCD PC Monitors, HDD Enclosures, External SSD and me-too ASSP for bridges and hubs and in Wireless handset segment the Application processors for smartphone. This second wave should represent a jump in USB 3.0 IP sales, breaking the 100 barrier during 2012 or 2013.

The third wave of Application could be linked to the “Late Majority” from the Innovation theory, and should start to hit the market in 2014, when more than 90% of the PC will be shipped with USB 3.0. We have listed all these applications and evaluated the number of additional USB 3.0 IP sales associated to be lower than for the second wave, but significant, so the USB 3.0 IP market in 2015 should weigh as much as the overall USB IP market in 2010.

If we consolidate the USB 3.0 IP with the existing USB IP market, the total USB IP market should be in the range of $55-60M in 2010. In other words, USB is still the largest of all the Interface IP markets (HDMI, PCI Express, SATA and DDRn) at that date, as we have shown in (4). But probably not for so long, as DDRn and HDMI (thanks to the royalties) IP markets are growing faster than USB. SuperSpeed USB has been introduced late in the market, compared with HDMI, PCIe gen-2 or SATA 3G. During this delay the end users have learned to use other protocols to interface a device to a host, this versatility has probably impacted the potential for USB 3.0 pervasion, and the related USB 3.0 IP sales.

This is the conclusion from the “USB 3.0 IP Forecast 2011-2015”. But as you now, “devil is in the details”, and you will find many details in this 48 pages survey –unique on the market- exclusively dealing with IP. Take a look at the Table of contents here.

Eric Esteve – CEO IPNEST

The Name Changes but the Vision Remains the Same – ESD Alliance Through the Years