The global semiconductor market is headed for a double-digit decline for the year 2019 after a decline of 15.6% in first quarter 2019 from fourth quarter 2018. According to WSTS (World Semiconductor Trade Statistics) data, this was the largest quarter-to-quarter decline since a 16.3% decline in first quarter 2009, ten years … Read More

Tag: mike cowan

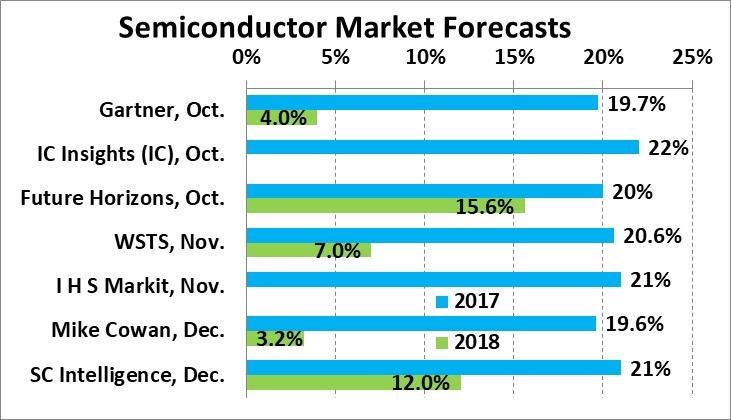

2017 Semiconductors +20%, 2018 slower

The global semiconductor market in 2017 will finish with annual growth of about 20%. Recent forecasts range from 19.6% to 22%. World Semiconductor Trades Statistics (WSTS) data is finalized through October, thus the final year results will almost certainly be within this range. We at Semiconductor Intelligence have raised … Read More

Semiconductors negative in 2016, positive in 2017

Note: the table and text below have been revised from an earlier post to correct the numbers for STMicroelectronics.

Semiconductor companies posted a wide range of results in 2nd quarter 2016. Intel, Micron Technology and Renesas Electronics all had declines in revenue in 2Q 2016 versus 1Q 2016. Samsung Semiconductor, Qualcomm… Read More

Semiconductor market going negative?

Several recent forecasts for the 2016 semiconductor market point to a decline. The title of this post is the same as we used for in October 2015. In October, Semiconductor Intelligence projected the market would grow 1.0% in 2015 despite several predictions of the market going negative. 2015 finished with a slight 0.2% decline.… Read More

Semiconductor equipment returns to growth

Semiconductor manufacturing equipment has returned to growth after a falloff in the second half of 2011. Combined data from SEMI (U.S. andEuropean companies) and SEAJ (Japanese companies) show billings peaked at a three-month-average of $3.2 billion in May 2011. Bookings and billings began todrop in June 2011, with billings… Read More