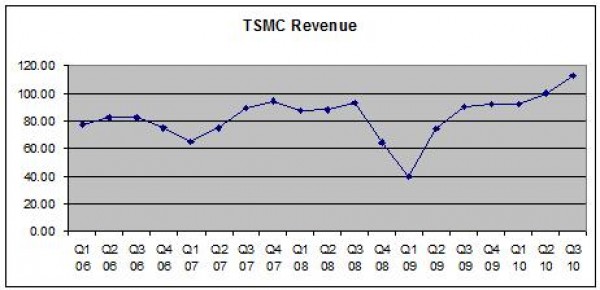

My visit to Taiwan last week was very encouraging. No earthquake, no typhoon, and both TSMC and UMC again posted record financial results, giving a peek into what 2011 has in store for us semiconductor professionals around the world.

A transcript from the TSMC earnings call can be foundhere, the UMC transcript is here. The TSMC transcript is 19 pages long so let me save you some time with the key financial points:

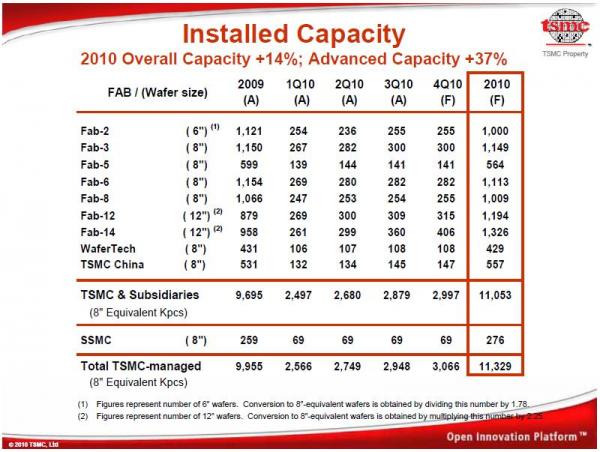

- TSMC’s net sales reached NT $412.3 billion ($13.4730 billion USD), up 6.9% from Q2 and up 24.8% from the same period a year ago.

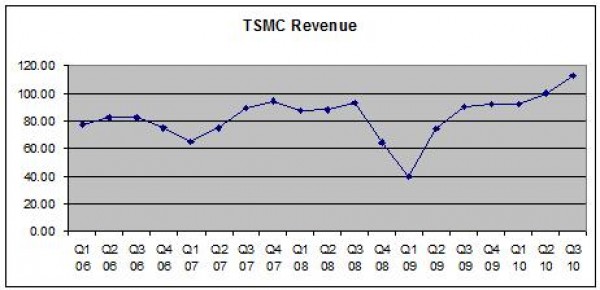

- Wafer shipments were 3.19 million 8 inch equivalent wafers, up 9% from the prior quarter and up 30.5% from the year ago quarter.

- Operating margin was 38.4%, down 2% points sequentially, but up 2.8% points compared with year ago quarter.

- EPS for Q3 reached NT$1.81, ROE was 36.5%.

- Q3 gross margin was 50%, up by 0.5% points from 49.5 in Q2, mainly due to continued cost improvements.

- Operating expense increased NT$1.6 billion from Q2, primarily due to a higher level of development activities for our 28 nanometer and 20 nanometer technologies, and also a higher opening expense for our Fab 12.

- Ended Q3 with $5B+ USD in cash and short term investments

“Our mission is simply to be the technology and capacity provider of the global logic IP industry for years to come. We want to be the technology and capacity provider of the largest IP industry for years to come.”

Morris Chang was again on the conference call. Morris resumed as TSMC CEO June 2009 after passing the CEO baton to Rick Tsai in July 2005. I really am glad Morris is back at TSMC! According to Morris:

- Q3 was a historical record in revenue dollars, in gross margin and in net income dollars.

- If Q4 were at the same exchange rate at Q3, then Q4 guidance would be revenue NT$111.6 billion to NT$113.7. billion which is higher than Q3 actual.

- Gross margin percentage would be 49.5% to 51.5%, which is also higher than the Q3 actual.

- CAPEX will be $5.5 billion this year, CAPEX will be greater in 2011.

- 71 customer 28 nm tape outs already scheduled.

- We are forecasting total foundry revenue growth will be 14% in 2011.

One thing that Morris said that needs clarification is on 28nm portability:

I also wanted to point out that as the 28 nanometer generation, customer designs are very difficult to port between foundries. They’re very difficult to move from one foundry to another. This is a new phenomena that did not exist even in the 45-40 generation.

It is true that TSMC 28nm designs cannot be manufactured at other foundries with little or no modifications like 40nm. TSMC 28nm designs can however be migrated to other foundries using process migration tools from Sagantec. Magma and Cadence also have migration tools (Titan ALX and Virtuoso Layout Migrate) but they both have complexity and capacity issues. Process migration is only a $10M market so I doubt Magma or Cadence will put much more effort into it. I’m currently working on 28nm migration projects with Sagantec so I know this by experience.

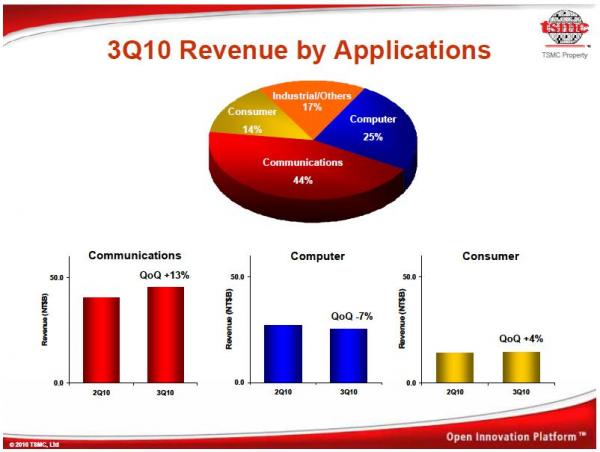

Communications (mobile internet) will continue to drive semiconductors in 2011 and the rest of this decade. Smartphones give people access to information and information is power. In India and China even the poorest of poor people have mobile phones. No indoor plumbing, but everyone has a mobile phone. Access to information raises the aspirations of the poor which will in turn force governments to acknowledge poverty and do something about it. The semiconductor industry is changing the world, believe it.