fansink

Well-known member

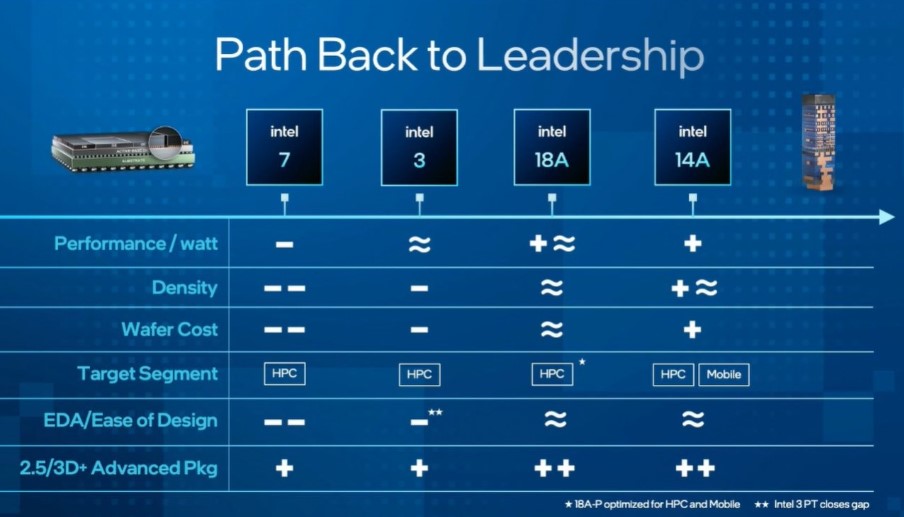

Intel is seemingly shifting its strategy of no longer outsourcing wafers to third parties to instead embracing a longer partnership with TSMC. This could be due to the unfavourable yields from Intel’s own 18A process.

It was recently reported that Intel may be pushing back its production of the next gen Panther Lake mobile processors due to unsatisfactory yields from the in-house 18A semiconductor manufacturing process. Now, according to the latest Intel earnings call, the company has announced a long-term partnership with TSMC for outsourcing wafers used for manufacturing its processors. The call, transcribed by Seeking Alpha, was between Intel’s John Pitzer and Morgan Stanley’s Joe Moore.

Intel has been struggling with bringing semiconductor manufacturing in-house as 18A, the process developed by Intel Foundry, has not presented favourable yields. TSMC, on the other hand, has a much more experienced and efficient 3nm and 2nm manufacturing process. According to the earnings call between Intel’s Corporate Vice President of Investor Relations and the MD, Semiconductor Industry Analyst at Morgan Stanley, Intel has been outsourcing about 30% of its wafers, most of it to TSMC, for a while now. However, till about a year ago, Intel wanted to reduce that number down to zero.

Now, it looks like Intel has a new strategy in place which brings about a longer partnership with TSMC. “We think it's always good to have at least some of our wafers with TSMC. They're a great supplier. It creates a good competition between them and Intel Foundry,” Pitzer reportedly added.

The earnings call and new strategy comes shortly after a known industry analyst, Ming Chi Kuo, shared that Intel’s Panther Lake mobile processors production has been pushed back due to the underwhelming performance of 18A process. This meant that the company would not be able to ship Panther Lake notebooks till 2026, missing out on 2025 Q4 sales, negatively impacting 2H25 revenue, profits, and supply chain trust.

The strategy shift may suggest that Intel has realized it is better to stick with TSMC for longer, but it is unclear how this will affect the Panther Lake processors that were supposed to be the first mobile SoCs developed on 18A.

It was recently reported that Intel may be pushing back its production of the next gen Panther Lake mobile processors due to unsatisfactory yields from the in-house 18A semiconductor manufacturing process. Now, according to the latest Intel earnings call, the company has announced a long-term partnership with TSMC for outsourcing wafers used for manufacturing its processors. The call, transcribed by Seeking Alpha, was between Intel’s John Pitzer and Morgan Stanley’s Joe Moore.

Intel has been struggling with bringing semiconductor manufacturing in-house as 18A, the process developed by Intel Foundry, has not presented favourable yields. TSMC, on the other hand, has a much more experienced and efficient 3nm and 2nm manufacturing process. According to the earnings call between Intel’s Corporate Vice President of Investor Relations and the MD, Semiconductor Industry Analyst at Morgan Stanley, Intel has been outsourcing about 30% of its wafers, most of it to TSMC, for a while now. However, till about a year ago, Intel wanted to reduce that number down to zero.

Now, it looks like Intel has a new strategy in place which brings about a longer partnership with TSMC. “We think it's always good to have at least some of our wafers with TSMC. They're a great supplier. It creates a good competition between them and Intel Foundry,” Pitzer reportedly added.

The earnings call and new strategy comes shortly after a known industry analyst, Ming Chi Kuo, shared that Intel’s Panther Lake mobile processors production has been pushed back due to the underwhelming performance of 18A process. This meant that the company would not be able to ship Panther Lake notebooks till 2026, missing out on 2025 Q4 sales, negatively impacting 2H25 revenue, profits, and supply chain trust.

The strategy shift may suggest that Intel has realized it is better to stick with TSMC for longer, but it is unclear how this will affect the Panther Lake processors that were supposed to be the first mobile SoCs developed on 18A.