New model represents fundamental change to operations aimed at unlocking significant value.

Intel leaders told analysts and investors during a webinar Wednesday that its transition to a new internal foundry model will be a key enabler to achieving its stated cost savings goal of more than $8-10 billion exiting 2025. In this new operating model, Intel’s internal product groups move to a foundry-style relationship with the company’s manufacturing group. As a result, company execs say they are projecting a broad class of increased efficiencies that will be reflected in greater profitability as Intel pursues its long-term ambition to achieve non-GAAP gross margins of 60%.

The Background:

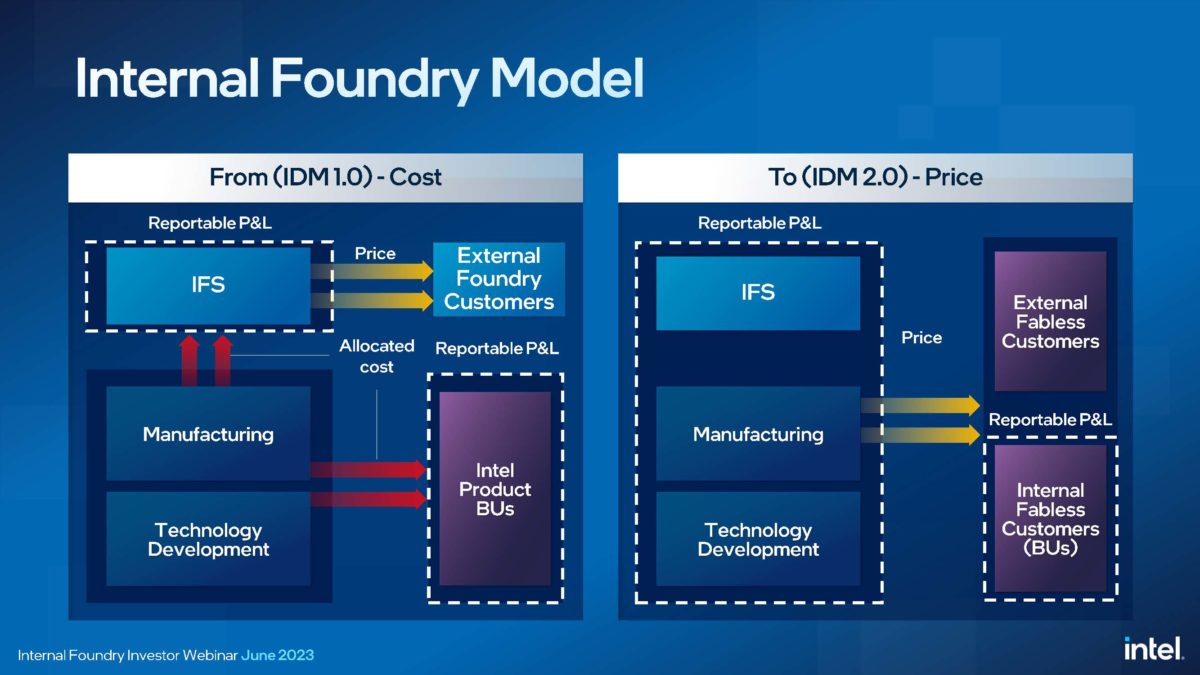

Intel is embarking on the most significant business transformation in its 55-year history. With IDM 2.0, Intel set out to regain process technology leadership, expand the use of third-party foundry capacity and build a world-class foundry business with a significant expansion of Intel’s manufacturing capacity. With these efforts well on track, Intel now is making a fundamental shift in how its product business units work with technology development and manufacturing to ensure long-term growth while achieving efficiencies and cost savings.

In this new “internal foundry” model, Intel’s product business units will engage with the company’s manufacturing group in a similar arm’s-length fashion that fabless semiconductor companies engage with external foundries.

Intel’s internal foundry model is key to the company’s overarching IDM 2.0 strategy — with the aim to return margins to their historic range and ambitions to serve a far wider variety of chip customers worldwide. The internal foundry model is also integral to Intel’s multiyear cost efficiency effort, which includes reducing costs by $3 billion in 2023, and $8 to $10 billion in cost savings exiting 2025 – which is where the new model plays a significant role.

David Zinsner, Intel Executive Vice President and Chief Financial Officer, and Jason Grebe, Corporate Vice President and General Manager of Intel’s Corporate Planning Group, hosted a webinar on Wednesday for investors and analysts. The event’s purpose was to explain the internal foundry model and its many benefits, and share its implications for Intel’s culture, competitiveness, financials – and, ultimately, its transformation.

Here are the key takeaways from the webinar. The event replay is available here, along with the accompanying slides.

Driving Value with Intel’s Internal Foundry Model

In its new operating model, Intel’s manufacturing groups will be accountable to a standalone profit and loss (P&L) for the first time. Beginning in Q1 2024, the reportable P&Ls will include a new manufacturing group segment – inclusive of manufacturing, technology development and Intel Foundry Services (IFS) – along with the company’s product groups – Client Computing, Data Center and AI, Network and Edge, and All Other.

The internal foundry model offers significant inherent business value beyond billions of dollars in cost savings. Intel will extend the use of market-based pricing to its internal business units, offering them the same certainty and stability as the company’s external customers. Intel will maintain the intimacy and deep connection between its product groups and technology development teams, preserving the competitive advantages it has had as an IDM. The new model also provides a tailwind to IFS by effectively creating the industry’s second-largest foundry (by volume from internal customers), allowing external customers to build off Intel’s internal scale and de-risking the process.

Intel’s manufacturing groups will face the same market dynamics as their external foundry counterparts and need to compete for volume through performance and price. This includes Intel’s internal customers, who will have the flexibility over time to engage with third-party foundries. It’s not an entirely new notion for Intel, however; today, roughly 20% of Intel’s silicon is manufactured externally.

“The semiconductor industry and computing in general have evolved rapidly, and we need to adjust our business operations in response. With the advent of smartphones, the digital network, the intelligent edge, cloud computing and AI, compute demands have diversified,” said Zinsner.

Supporting Long-Term Margin Ambitions

Intel’s long-term ambitions are to achieve non-GAAP gross margins of 60% and operating margins of 40%. The internal foundry model will highlight new opportunities and lead to an optimized cost structure in furtherance of these goals.

Intel has highlighted before its ambitions to be the second largest external foundry by 2030, which continues to be its goal. In its new model, based off internal volume, the company expects to be the second largest foundry next year – with manufacturing revenue greater than $20 billion.

“We’ve already done a lot of internal analysis and benchmarking to identify areas of opportunity,” said Grebe.

The internal foundry model will offer strong incentives for Intel business groups to work even more efficiently. For example, “expedited” wafers that business units decide to move through Intel’s manufacturing process are costly and reduce factory efficiency. Going forward, this service charge will be borne by the business units, and it’s expected that it will reduce the number of expedites to be on par with the competition.

Already Uncovered: Specific Examples of Internal Foundry Model Benefits

“We have identified many opportunities for optimization across both our manufacturing organizations and our business units that will lead to significant saving,” Grebe continued.

For example, cost and efficiency savings from fewer expedited wafers moving through the factories are expected to deliver annual savings over time in the range of $500 million to $1 billion.

Also, Intel’s test times currently run double or triple those of competitors. As business units are charged market prices based on test time, Intel expects pre-silicon design choices to reduce these test times, eventually producing savings of approximately $500 million annually.

And by reducing the number of wafer steppings, the number of physical iterations of a product’s design, the company estimates it will realize cost savings in the $500 million to $1 billion range.

Creating a ‘Tailwind’ for IFS

By creating, with internal customer volume, what will effectively be the world’s second-largest foundry, Intel will provide a scale and manufacturing tailwind for its IFS business.

First, by establishing the manufacturing organization as its own business and ensuring it has the decision rights to manage its P&L, Intel will be able to allocate clear corridors of capacity and supply commitments to external customers.

Also, because the internal foundry model is an arm’s-length approach that increases the independence of the manufacturing organizations, Intel will deliver complete segregation for foundry customers’ data and IP.

“As we begin retooling the company for this transformation, we are architecting with a security-first mindset, taking data separation as a key tenet into our system design,” Grebe noted.

Importantly, customers also expect world-class foundry service levels. As part of its shift to the internal foundry model, Intel is building the service-oriented mindset that is required to be a key player in the foundry business. Both Intel’s manufacturing group and IFS are benchmarking themselves against industry peers to ensure Intel is on track to provide best-in-class service levels expected from a foundry.

Lastly, more than five internal products are presently being developed on Intel’s latest 18A process technology, which is expected to come to market in 2025. This process node will initially ramp on internal volume, allowing any process issues to be addressed, and as a result will largely de-risk the new process for external IFS customers.

Establishing an internal foundry model is one of the most significant steps Intel is taking to deliver IDM 2.0 as it fundamentally changes the way the company operates and establishes the structure and incentives needed to drive a change in culture and new behaviors. As it leverages industry standard planning processes, data management strategies, systems and tools, Intel is building the foundation to be both a world-class IDM and foundry provider. Additionally, giving the manufacturing group its own P&L, along with the associated transparency and accountability, will be a key driver in achieving Intel’s target of reducing $8 to $10 billion in costs and achieve its long-term profit goals. Finally, the internal foundry model will be a strong tailwind to the company’s IFS strategy.

Intel Provides Update on Internal Foundry Model

Last edited: