One of the fun things when a company gets big but is still private, like Atrenta, is that you start to get invited to events like the Needham Growth Conference that took place earlier this week in New York. When I ran Compass Design Automation, which at the time was about $55M in revenue, I remember going to a couple of these events. At one level this seems like a pointless exercise since nobody can buy the stock. But there are actually two reasons that analysts should be interested. Firstly, when a company gets big enough, it can have an effect on the results of the other companies in the industry that are public. And secondly, when the company is big enough it starts to be plausible that it might have an IPO in the future, and an analyst who has a good understanding of the industry should not be hearing about it for the first time on the roadshow.

One of the fun things when a company gets big but is still private, like Atrenta, is that you start to get invited to events like the Needham Growth Conference that took place earlier this week in New York. When I ran Compass Design Automation, which at the time was about $55M in revenue, I remember going to a couple of these events. At one level this seems like a pointless exercise since nobody can buy the stock. But there are actually two reasons that analysts should be interested. Firstly, when a company gets big enough, it can have an effect on the results of the other companies in the industry that are public. And secondly, when the company is big enough it starts to be plausible that it might have an IPO in the future, and an analyst who has a good understanding of the industry should not be hearing about it for the first time on the roadshow.

So this week, Bert Clement, the CFO of Atrenta was at the Needham conference for his 15 minutes of fame (plus 5 more for questions). Of course the audience is primarily financial types so the focus is not so much on Atrenta’s technology. Just getting the audience to understand that you are in EDA and which part you serve is enough of a challenge.

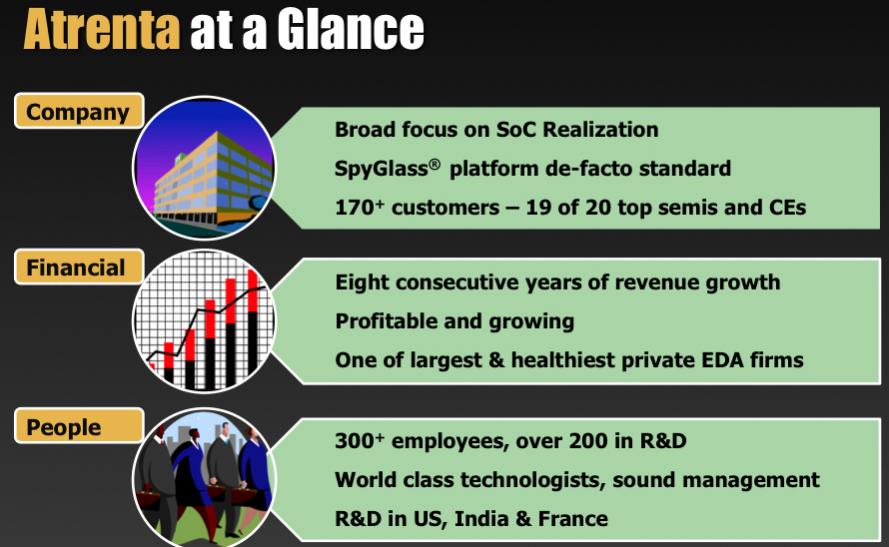

So what did Bert say. Firstly, that Atrenta is focused on SoC realization where it is really the only company today, and SpyGlass is pretty much the standard. They have 170 customers including 19 of the top 20 semiconductor companies. They have had eight consecutive years of revenue growth, are profitable and growing. They should do about $45M this year and margins are growing over time. So they are one of the largest and healthiest private EDA companies. They have over 300 employees with over 200 in R&D.

So what did Bert say. Firstly, that Atrenta is focused on SoC realization where it is really the only company today, and SpyGlass is pretty much the standard. They have 170 customers including 19 of the top 20 semiconductor companies. They have had eight consecutive years of revenue growth, are profitable and growing. They should do about $45M this year and margins are growing over time. So they are one of the largest and healthiest private EDA companies. They have over 300 employees with over 200 in R&D.

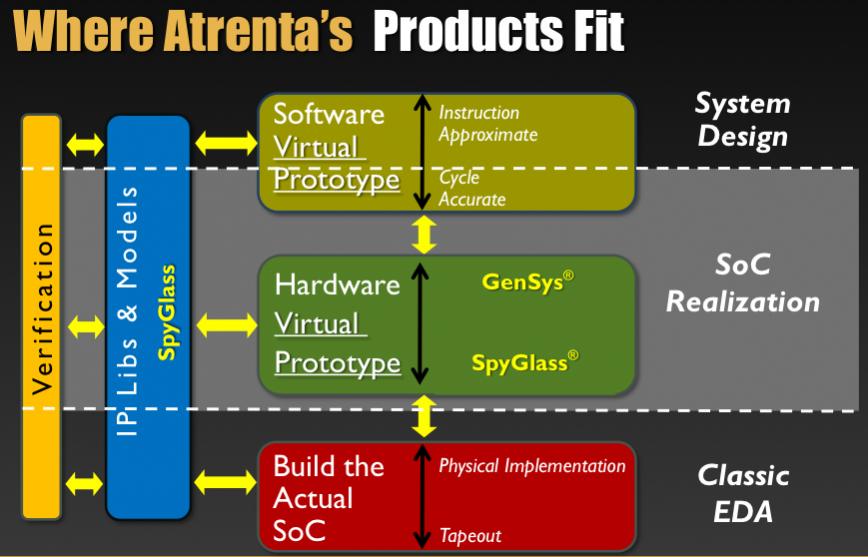

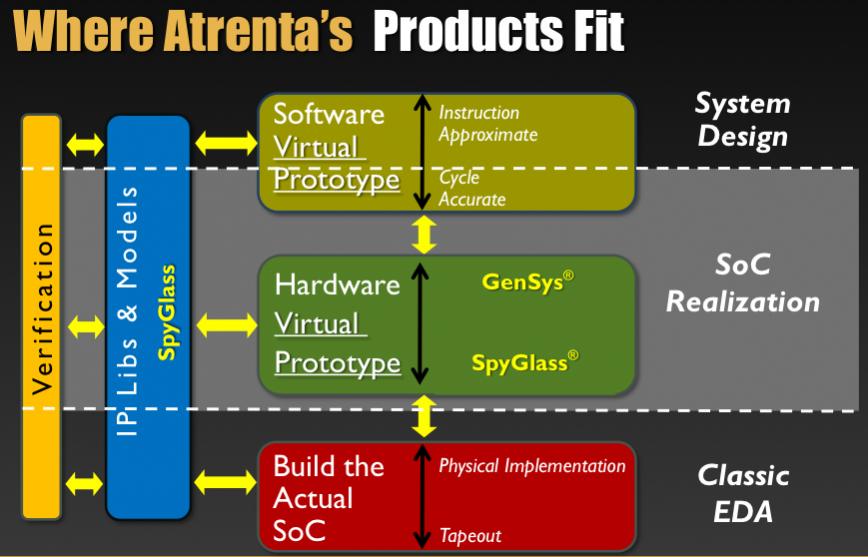

SoC Realization actually occupies an interesting niche in the spectrum of EDA areas. Below SoC realization is classic EDA, tools to build the actual SoC. This has single digit growth and is experiencing consolidation of suppliers (Synopsys/Magma being the most significant). Above SoC Realization is system design. It has double digit growth but the market is very fragmented and has a low TAM as a result. In the middle, SoC Reallization has double digit growth, an expanding supplier base of IP and IP companies, and is fuelled by the need for consumer products that incorporate a lot of IP to build very complex SoCs (think smartphones and tablets).

SoC Realization actually occupies an interesting niche in the spectrum of EDA areas. Below SoC realization is classic EDA, tools to build the actual SoC. This has single digit growth and is experiencing consolidation of suppliers (Synopsys/Magma being the most significant). Above SoC Realization is system design. It has double digit growth but the market is very fragmented and has a low TAM as a result. In the middle, SoC Reallization has double digit growth, an expanding supplier base of IP and IP companies, and is fuelled by the need for consumer products that incorporate a lot of IP to build very complex SoCs (think smartphones and tablets).

TSMC Process Simplification for Advanced Nodes