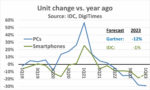

Shipments of PCs and smartphones were weak in 2022 and continue to decline in 2023. For the first quarter of 2023, IDC estimated PC shipments dropped 29% from a year earlier. This follows a 28% year-to-year decline in 4Q 2022. For the year 2022, PC shipments declined 16% from 2021, the largest year-to-year decline in the history of… Read More

Tag: semiconductor intelligence

Automotive Lone Bright Spot

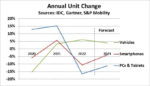

Automotive appears to be about the only bright spot in the semiconductor market for 2023. Forecasts for the overall semiconductor market range from a decline of 4% to a decline of 20%. Semiconductor companies generally have bleak outlooks for the start of 2023, citing excess inventories ad weak end market demand. The chart below… Read More

Semiconductors Down in 2nd Half 2022

The semiconductor market declined 6.3% in 3Q 2022 from 2Q 2022, according to WSTS. Based on the outlook for 4Q 2022, the second half of 2022 will be down over 10% from the first half of 2022. The 2H 2022 decline will be the largest half-year decline since a 21% drop in the first half of 2009 versus the second half of 2008 during the great … Read More

Continued Electronics Decline

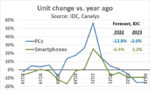

Third quarter 2022 data on PC and smartphone shipments shows a continuing year-to-year decline. IDC estimates PC units in 3Q 2022 were down 15% from a year earlier, matching the 2Q 2022 decline. IDC’s September forecast for PC units was a 12.8% decline for the year 2022, which is in line with the latest quarterly data. Canalys estimates… Read More

Semiconductors Weakening in 2022

The semiconductor market in 2022 is weakening. Driving factors include rising inflation, the Russian war on Ukraine, COVID-19 related shutdowns in China, and lingering supply chain issues. Four of the top 14 semiconductor companies (Intel, Qualcomm, Nvidia and Texas Instruments) are expecting lower revenues in 2Q 2022 versus… Read More

Semiconductor Growth Moderating

The global semiconductor market in 2021 was $555.9 billion, according to WSTS data released by the Semiconductor Industry Association (SIA). 2021 increased 26.2% from 2020, the largest annual increase since 31.8% in 2010, eleven years ago. We at Semiconductor Intelligence track publicly available semiconductor market forecasts… Read More

Semiconductor CapEx too strong?

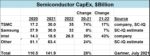

Semiconductor capital expenditures (CapEx) are on track for strong growth in 2021. For many companies the increase should continue into 2022. TSMC, the dominant foundry company, expects to spend $30 billion in CapEx in 2021, a 74% increase from 2020. TSMC announced in March it plans to invest $100 billion over the next three years,… Read More

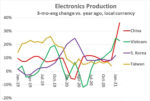

Electronics Recovery Mixed

Electronics production continues to recover from the COVID-19 pandemic. However, the recovery is mixed by country. The chart below shows three-month-average (3/12) change versus a year ago in electronics production by local currency for key Asian countries. China was averaging about 10% growth prior to the pandemic. After… Read More

Semiconductor CapEx strong in 2021

Semiconductor manufacturers are expanding capital spending in 2021 and beyond to help alleviate shortages. In addition, many governments around the world are proposing funding to support semiconductor manufacturing in their countries.

The United States Senate this month approved a bill which includes $52 billion to fund… Read More

Electronics Back Strongly in 2021

Electronics production has recovered strongly from slowdowns due to the COVID-19 pandemic. Most major Asian electronic producers reported double-digit increases in early 2021. The chart below shows three-month-average change versus a year ago for electronics production. The data is from each country’s official statistics… Read More