Is it time to abandon the ASML stock?

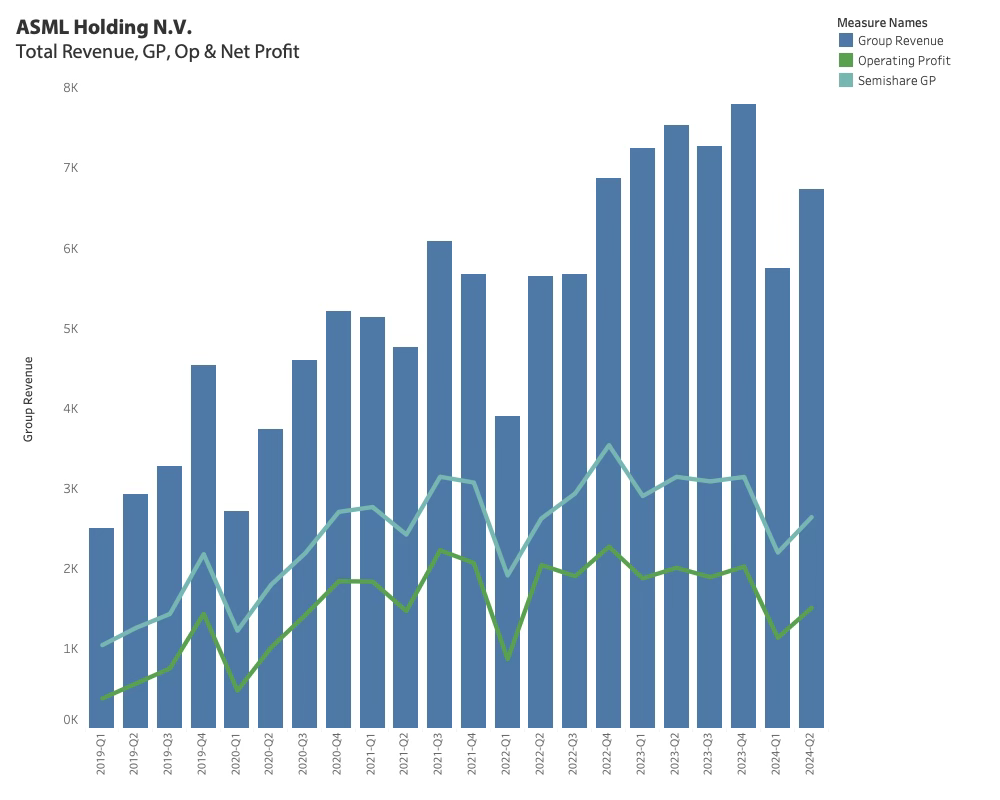

The first tool company to report Q2-24 results is ASML, and the lithography leader delivered a result above the guidance of EUR5.95B. Revenue of EUR6.242B is 4.9% above guidance and 18% above last quarter’s result of EUR5.29B.

Both operating profit and gross profit grew but not to the level of the end of last year. ASML management calls 2024 a transition year in investor communications, indicating a stronger 2025.

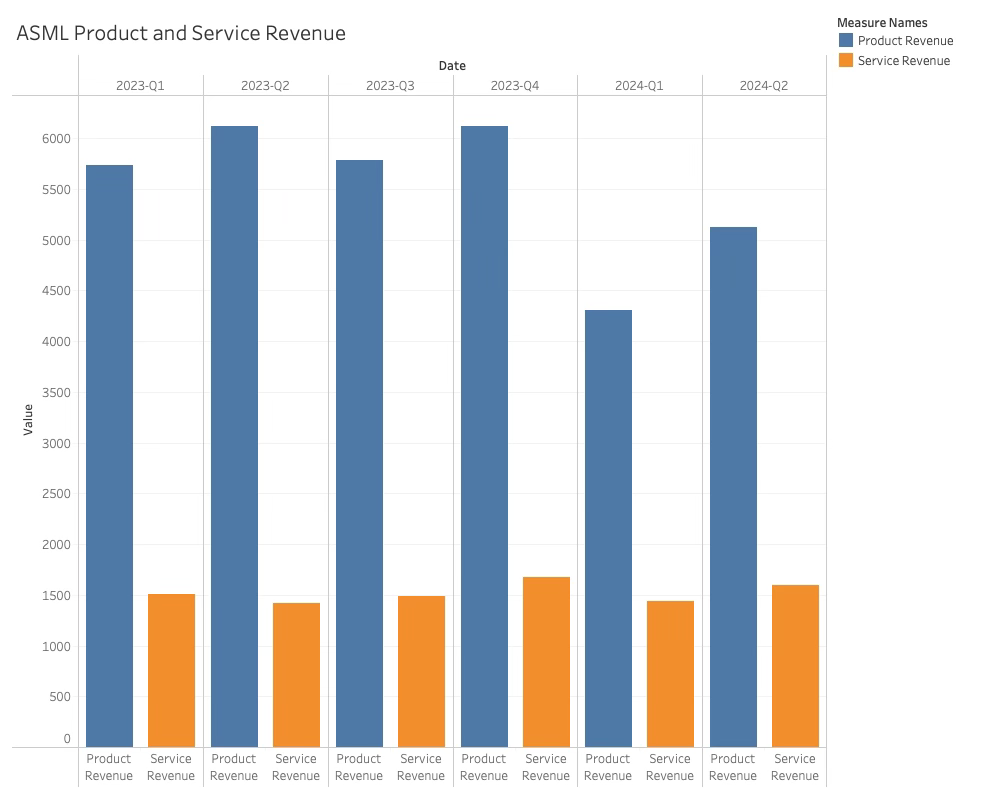

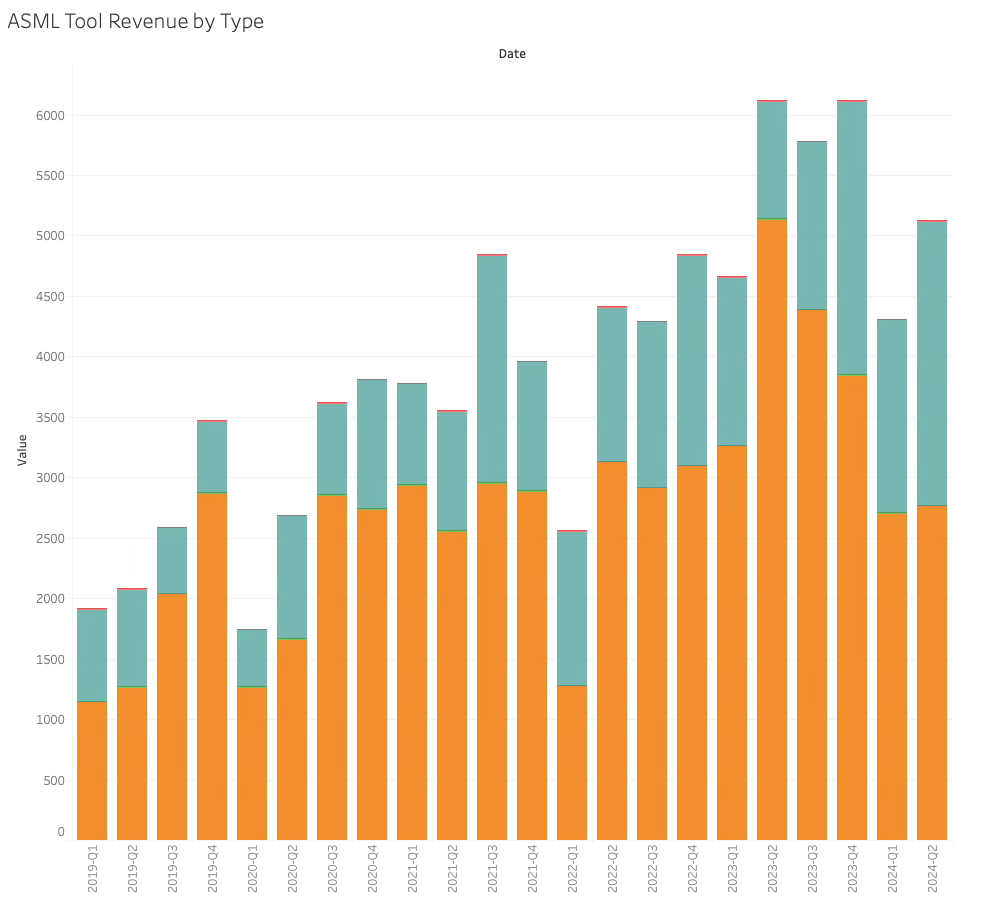

Tool revenue increased after a significant dip. Service Revenue is much more resilient than tool revenue, as it is dependent on the installed base of tools.

Almost all of the tool revenue growth came from memory tool sales, indicating that the memory companies are finally ready to make substantial investments in new capacity, which is much needed after the shift to HBM production.

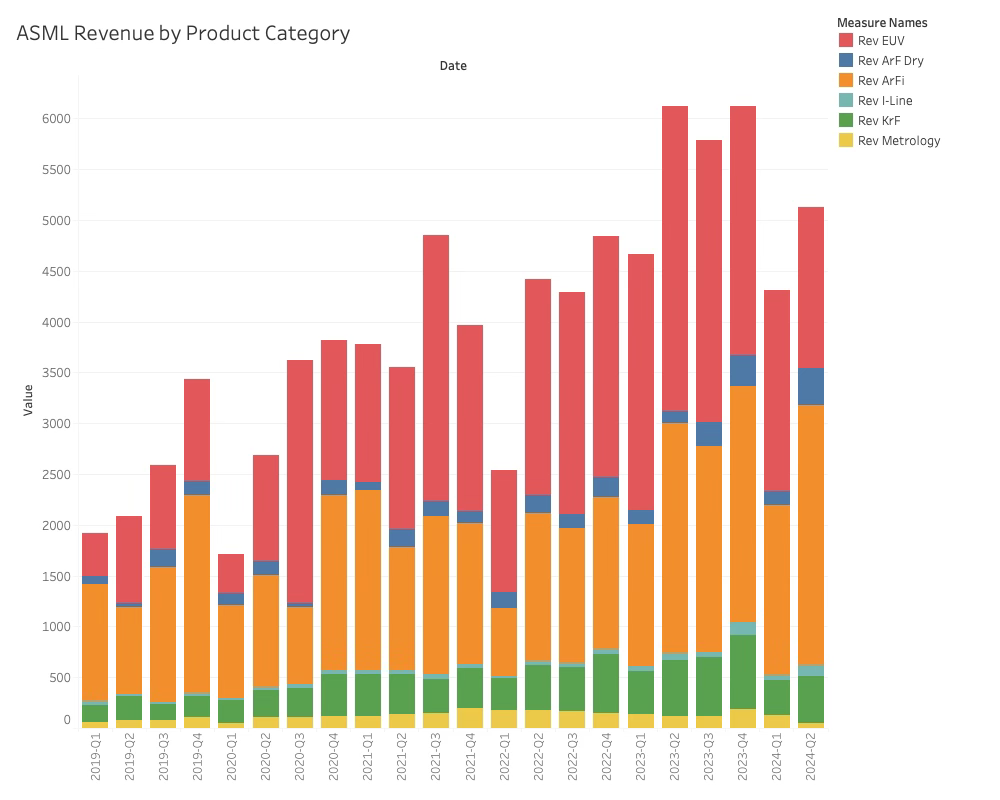

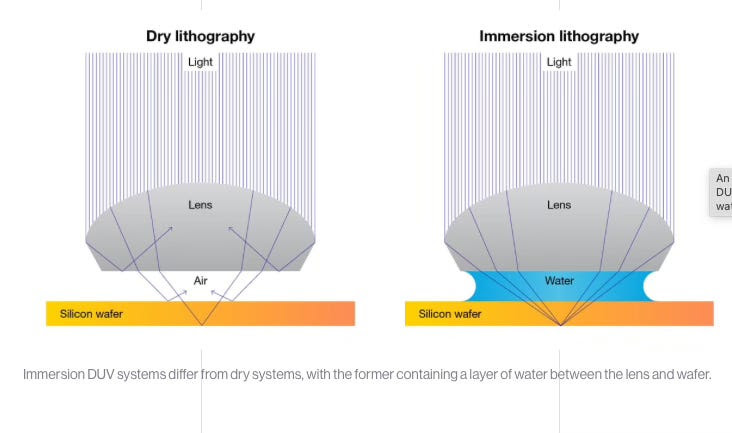

From a product perspective, the short-term trend of EUV revenue decline continued while the immersion product sales were solid.

Immersion is a technique that utilises that light through water, resulting in amplification, allowing better resolution at the same light wavelength.

Given the Chips Act and other subsidies, the ASML result is somewhat counter-intuitive as EUV is used for 3-7nm leading-edge manufacturing nodes, and immersion is used for 7-14nm. Given the US attempt to become a leading-edge manufacturing location, it could be expected that leading-edge tools would dominate revenue. This indicates that the new factories are not yet in the tooling phase.

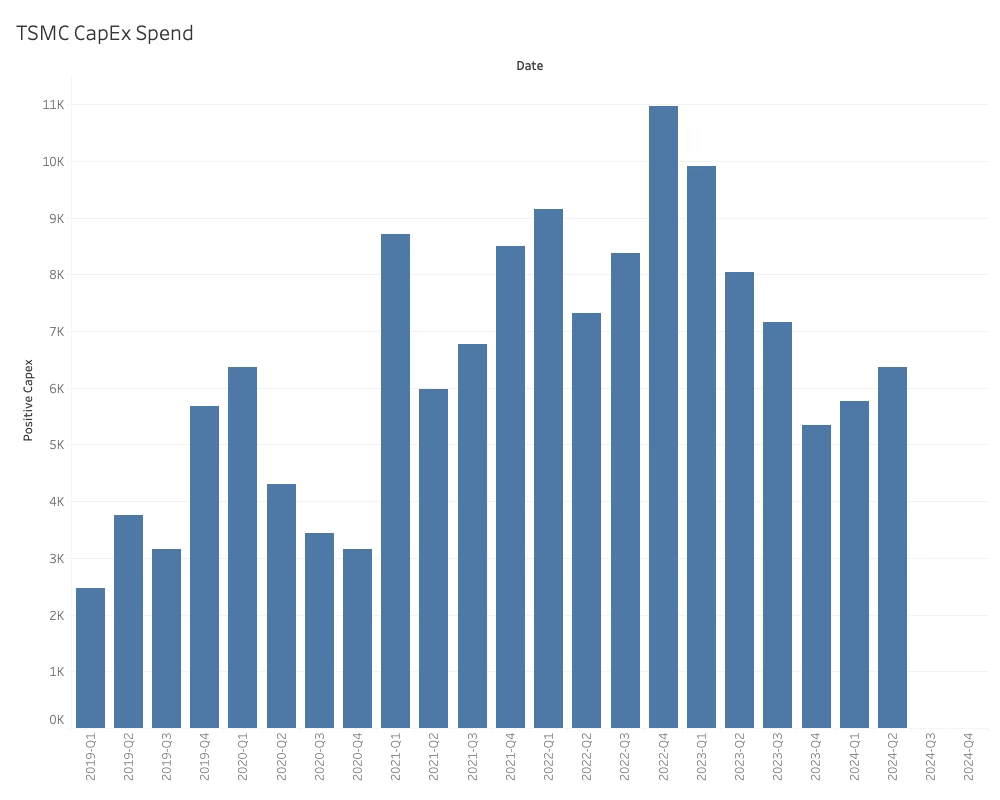

The other significant consumer of leading-edge tools is TSMC, which reported Q2-24 result right after ASML.

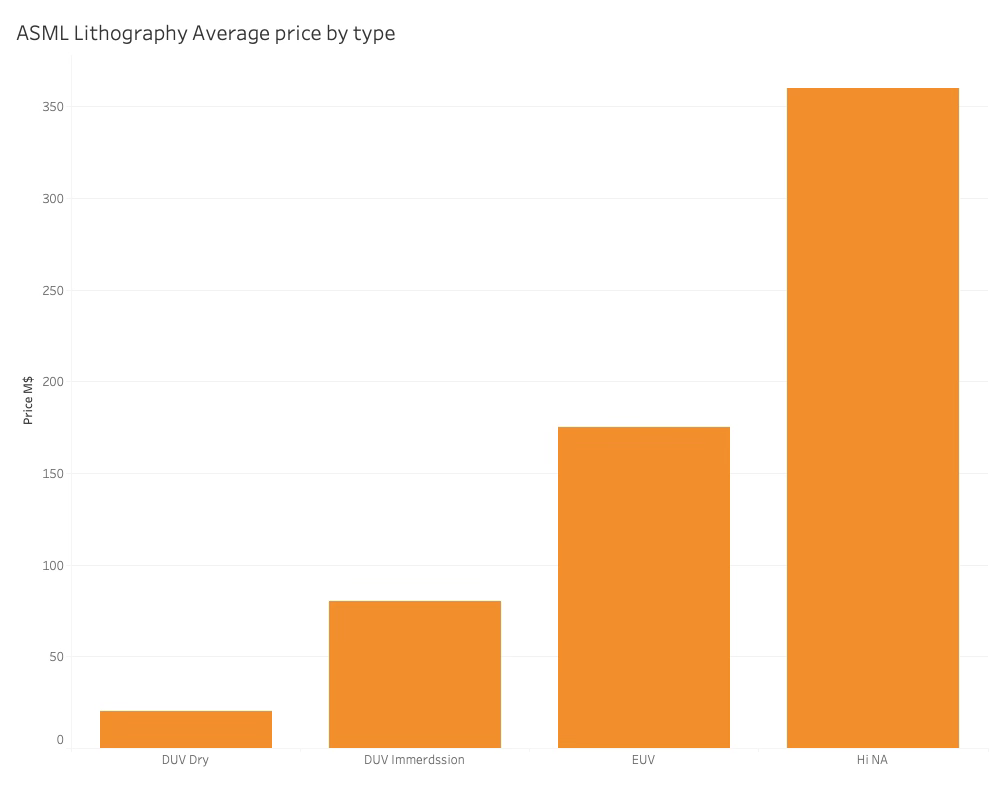

Although Capex spending was up, it was still just slightly above the maintenance investment level—the investment needed to maintain the deterioration of the existing manufacturing assets. TSMC is likely waiting for ASML’s High-NA tool to be available. ASML has confirmed they shipped one of these babies last quarter and installed another in Veldhoven on the joint IMEC/ASML manufacturing line. The tool is priced North of $350M, and ASML is trying to reach a production capacity of 20 systems annually during the 24/25 timeline.

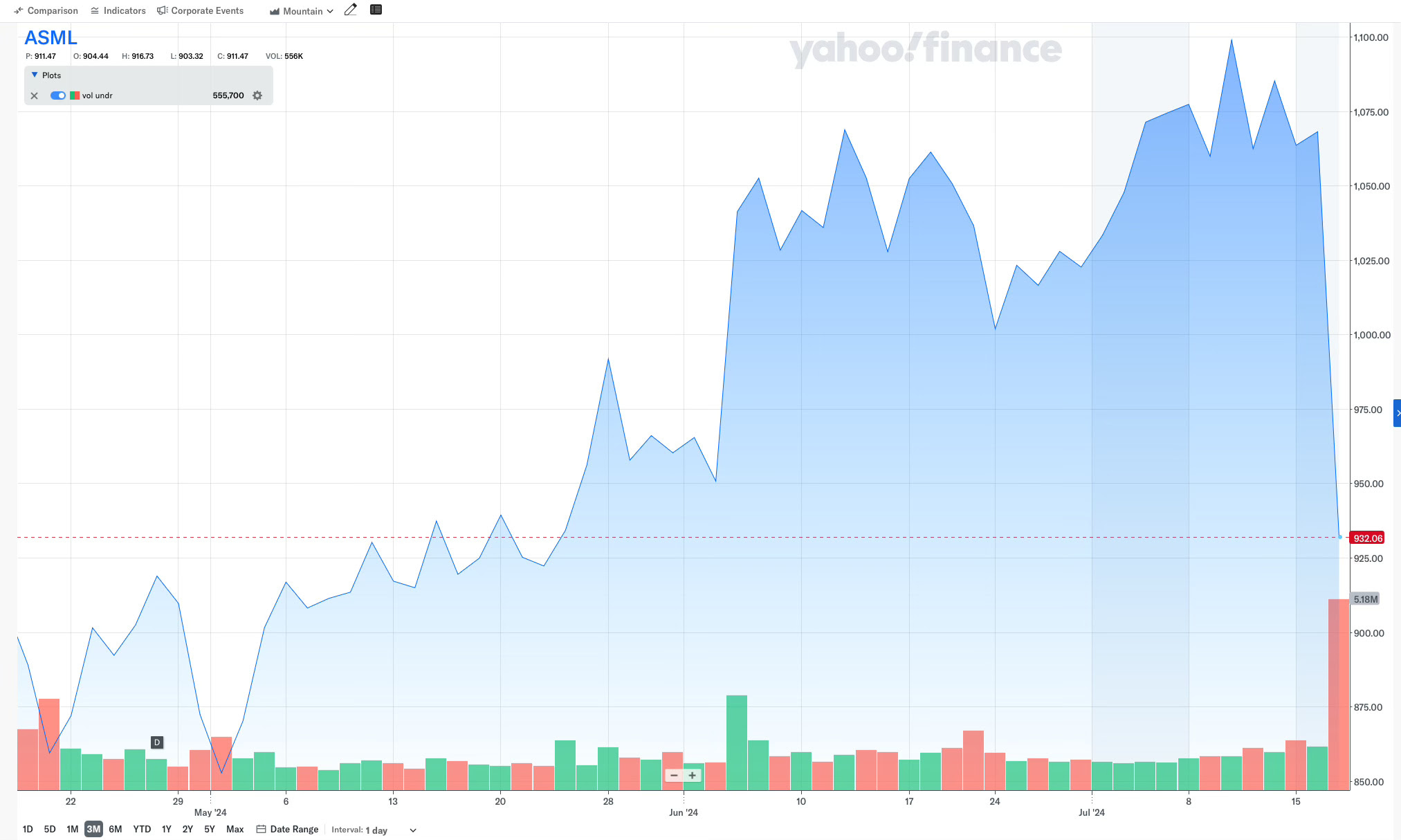

Despite beating the guidance and reasonable growth, the ASML share price plunged in the stock market. Are the markets losing confidence in the Lithography leader?

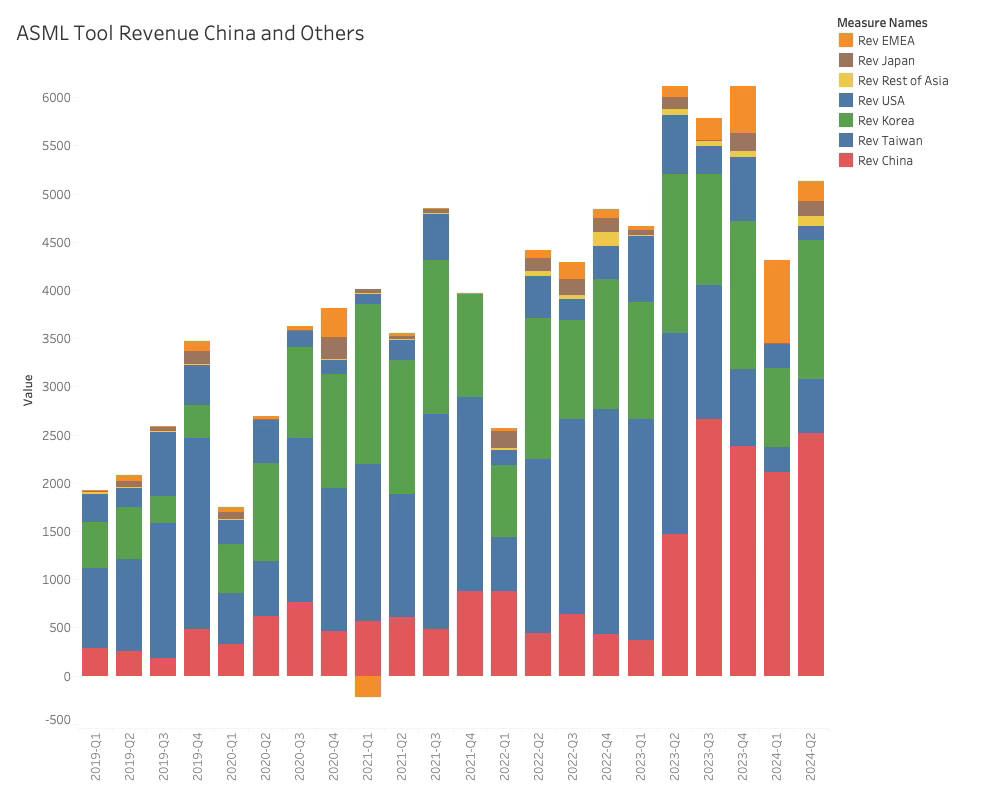

What about China?

The key reason for the decline is the ASML result coincided with news that further export limitations are in the works.

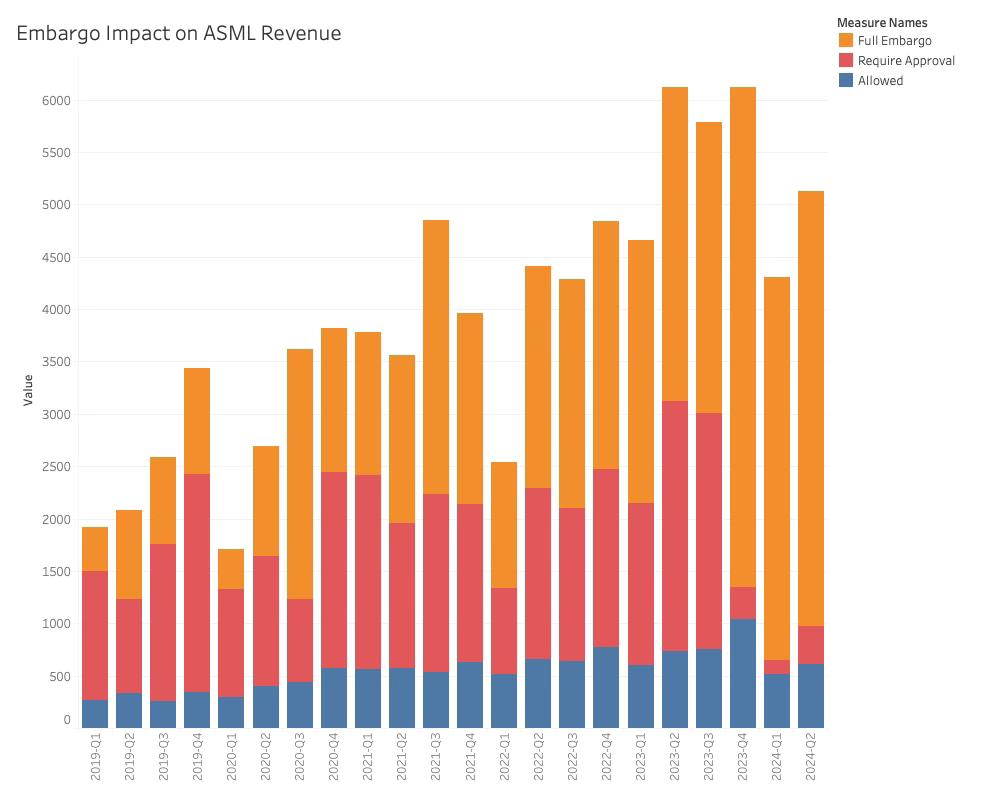

Since the signing of the Chips Act, tool sales to China have exploded. While this could be expected, it seems like the US administration’s patience has run out.

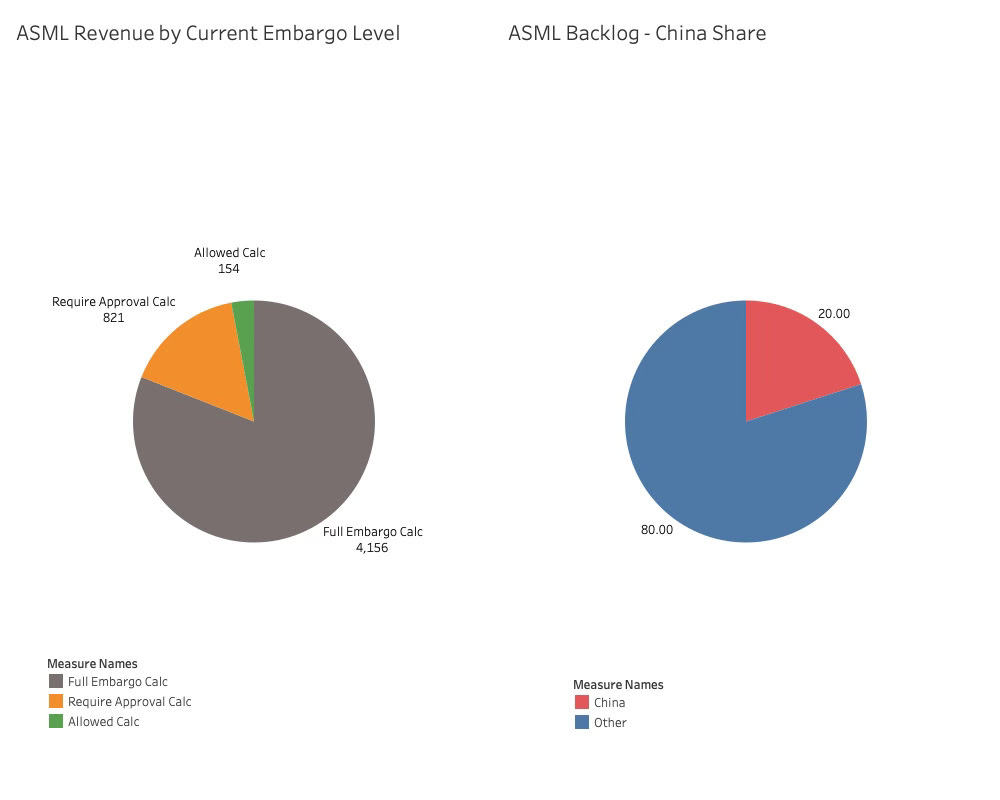

The Chinese companies have not had access to the EUV systems since 2019, and the latest embargo, which began on September 23, banned sales of the immersion systems. This makes 80% of ASML’s products (from a revenue perspective) unavailable for Chinese customers.

As ASML has been allowed to ship the backlog, the effect has been delayed, and China still accounted for 49% of all tool sales in Q2-24.

This, however, is about to end abruptly as the Chinese backlog has been depleted.

The ASML backlog now reflects the embargo revenue view, and from now on, the Chinese revenue will fall to 20% of the total from the current level of 49%.

The potential new embargo will impact ASML’s service revenue, which is currently 24% of total revenue. Under a potential new embargo, ASML can lose the ability to service its Chinese customers, which is incredibly important for keeping the tools alive and productive. As the Chinese manufacturing base could deteriorate fast, this could create new opportunities for ASML as mature node capacity would grow outside China.

The longer-term view

With the likely dip in China business and a potential embargo impacting service revenue, investors are starting to panic and run away from ASML. It is worth noting that this is an amazing company founded on a philosophy of long-term cooperation with its suppliers and other stakeholders. Constant innovation drives higher productivity and tool pricing a reaching an alarming (for customers) increasing in price.

While each tool increases productivity, it is still a hefty price if you want to be at the bleeding edge of Semiconductor manufacturing.

The current ASML manufacturing plan will enable the company to deliver a 20B$+ quarter (at current pricing) at the end of 2026. This is not a given or a forecast and can be changed according to industry development. However, it is a very strong indication that the company has faith in the long-term future of the current strategy.

Our research is focused on the business results and not on investment advice. However, if you have faith in the long-term plan of ASML, it might be too early to dump ASML shares.

Also Read:

Will Semiconductor earnings live up to the Investor hype?

What if China doesn’t want TSMC’s factories but wants to take them out?

Blank Wafer Suppliers are not Totally Blank

Share this post via:

TSMC vs Intel Foundry vs Samsung Foundry 2026