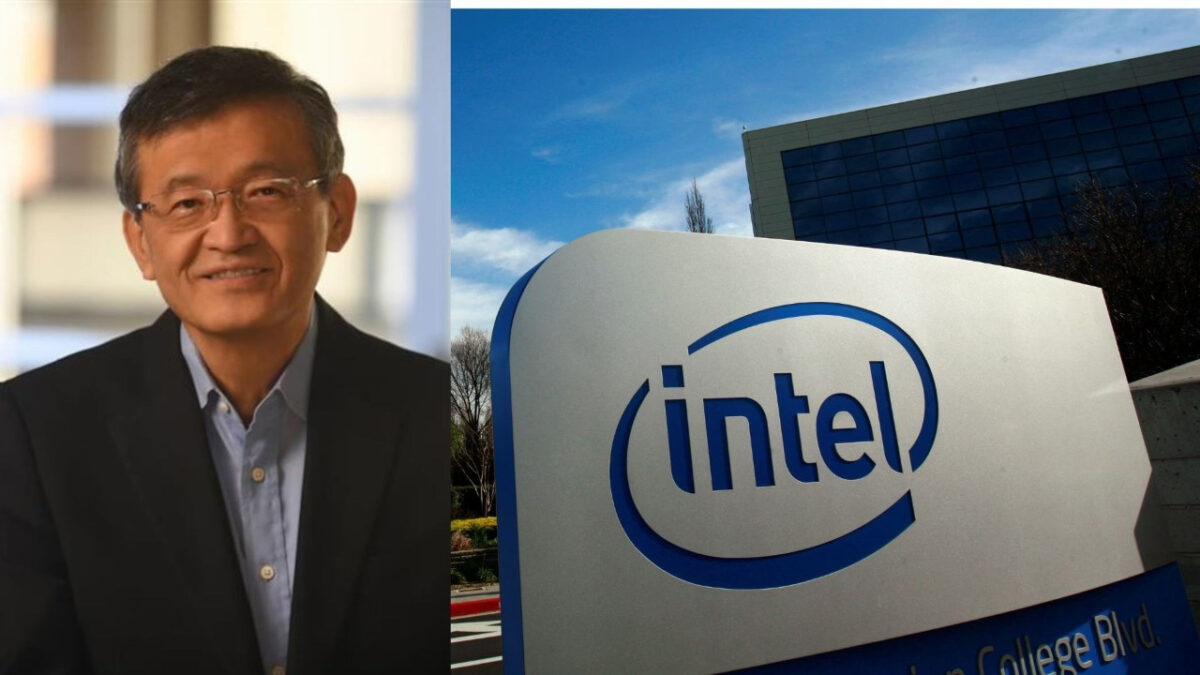

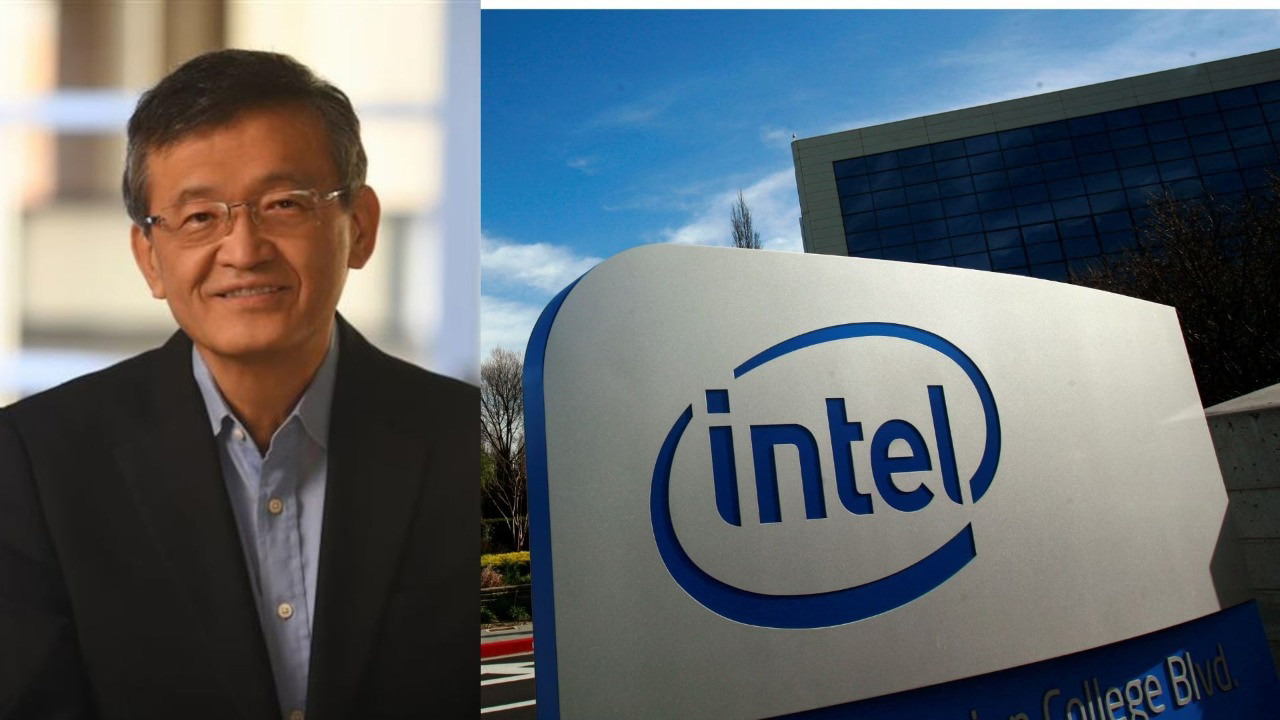

Lip-Bu Tan started as Intel CEO on March 18th of this year and some very impressive changes have already taken place. Intel started the year with more than 100,000 employees and will finish the year with around 75,000. Reporting structures have been flattened and the Intel culture is being transformed back into an innovation driven semiconductor manufacturing company.

The most impressive transformation however has been on the financial side. Both Softbank and Nvidia have invested $7B and the US Government made a 10% $8.9B equity investment. The biggest value here, in my opinion, is the trust placed in Lip-Bu Tan, absolutely.

What will Lip-Bu Tan do next?

Will there be more billion dollar investments? Yes, I think there could be. Will big customers do business with Intel Foundry. Yes, I think they will. In fact, I know they will but I totally respect Lip-Bu’s promise to keep wafer agreement negotiations private until the ink is dry so that is all I will say about that. And for those analysts who keep asking that question I would suggest they do the same, respect Lip-Bu Tan.

The latest Intel question that is running through the media: Should Intel go fully private via a government-led buyout of public shares, potentially with private equity or consortium partners? This would remove Intel from public markets freeing it from quarterly reporting pressures and allowing bold, long-term moves. Based on Intel’s history, current challenges, and ecosystem chatter, yes, I think Intel should go private. Below, I’ll try to break down the pros, cons, and a possible path forward. Help me out in the comments.

Pros and Cons of Privatization for Intel

Privatization isn’t a silver bullet, but it aligns with Intel’s need for more changes in order to stay on the leading edge of semiconductor manufacturing. Here’s a balanced comparison drawing from recent developments:

| Aspect | Pros of Going Private | Cons of Going Private |

| Strategic Flexibility | Frees management from short-term Wall Street demands, enabling focus on long-term R&D and a full breakup into specialized units (foundry, design, Mobileye, Altera, Intel Capital, etc…). Experts argue this could create more value than the “conglomerate” model. | Risk of bureaucratic inertia if government influence dominates; state-owned enterprises often prioritize politics over innovation, as seen in global examples like China’s SMIC. |

| Financial Stability | Access to patient capital (government / consortium) without dilution from public offerings, could fund $20B+ Ohio fabs without bankruptcy fears, privatization could unlock more value. | High buyout cost burdens taxpayers, past bailouts have had mixed returns (Solar/Auto). Recent stock surges suggest public markets still value upside. |

| National Security & Competition | Bolsters U.S. chip independence amid China tensions; a private Intel foundry could serve the top fabless companies without conflicts, reducing reliance on Taiwan. | Distorts markets by favoring Intel politically, harming competitors like AMD, possible foreign retaliation. |

| Talent & Operations | Long-term focus could stem talent drain, private status might attract top engineers with equity incentives tied to recovery. | Government oversight risk, eroding private-sector confidence. |

| Shareholder Value | Breakup could unlock billions in value, Softbank and Nvidia’s stake signals private interest in AI collaboration. | Public investors lose liquidity if breakup fails, possible value destruction. |

Overall, my pros outweigh cons if privatization is temporary and mission-driven. Intel’s vertical integration, once a strength, now drags it down as design and manufacturing compete for resources. Public status amplifies scrutiny on past failures but privatization could mimic Dell’s 2013 turnaround, where Michael Dell and Silver Lake took it private to refocus and list again at a much higher value.

Why Now? The Tipping Point in 2025

- Government’s Foot in the Door: The 10% stake (no board seats, but voting alignment) blurs public-private lines. Given the hostile political environment, Intel is at risk of becoming a political football when there is an administration change.

- Market Signals: Softbank and Nvidia’s investment isn’t charity, it’s a strategic bet on AI collaboration and as I said, there could be more $5B investments.

- Global Context: With TSMC’s limited US manufacturing and Samsung failing on the leading edge, the U.S. can’t afford Intel’s collapse. Privatization could create a “pure-play” U.S. foundry, echoing GE’s 2021-2024 breakup success with parts of GE now trading at premiums (GE Aerospace, GE HealthCare, and GE Vernova).

Bottom line: Intel’s survival demands escaping public-market and political quicksand. Privatization isn’t “handing over to China” (as some fear) but a U.S.-centric reset to reclaim leadership. Without it, Intel fades into the background, with it, Intel could power the next AI or quantum computing boom, absolutely.

Also Read:

AI Revives Chipmaking as Tech’s Core Engine

Advancing Semiconductor Design: Intel’s Foveros 2.5D Packaging Technology

Revolutionizing Processor Design: Intel’s Software Defined Super Cores

Share this post via:

Comments

2 Replies to “Yes Intel Should Go Private”

You must register or log in to view/post comments.