Shanghai Wusheng Semiconductor, which invested tens of billions of yuan, went bankrupt; so far last year, 23 related companies have withdrawn their IPO applications

The wave of unfinished semiconductor factories that started in mainland China in 2020 has recently shown signs of a comeback. Schematic diagram. Photo/Associated Press

The wave of unfinished semiconductor factories that started in mainland China in 2020 has recently shown signs of a comeback. Schematic diagram. Photo/Associated PressThe URL of the current page has been copied to your clipboard!

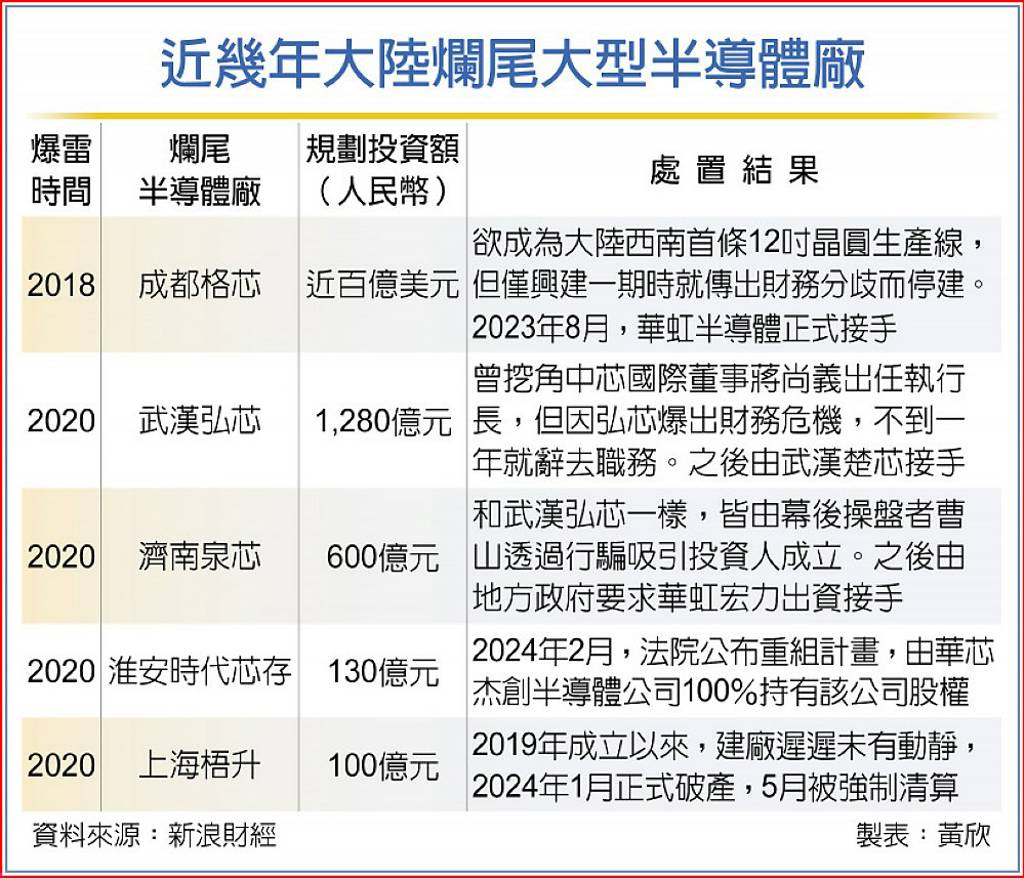

In recent years, large-scale semiconductor factories in mainland China have been unfinished.

In recent years, large-scale semiconductor factories in mainland China have been unfinished.The wave of unfinished semiconductor factories that started in mainland China in 2020 has recently shown signs of a comeback. Shanghai Wusheng Semiconductor Company, which plans to invest tens of billions of yuan (the same below), has recently entered bankruptcy liquidation procedures, and the market is worried that the wave of bankruptcies may spread. In addition, the capital market has become more cautious about the prospects of semiconductor companies. Since last year alone, 23 companies in related fields have announced the withdrawal of IPO applications.

According to reports from the financial industry, according to the National Corporate Bankruptcy and Reorganization Case Information Network, the Shanghai Pudong New Area People’s Court recently officially accepted the compulsory liquidation case of Shanghai Wusheng Semiconductor Group. It is reported that Wusheng Semiconductor was established in 2021 with a registered capital of 10 billion yuan. It was originally expected to complete construction within five years and increase the total investment to 18 billion yuan.

However, less than two years after its establishment, the group and two related companies have experienced financial crises and been subject to bankruptcy liquidation. Among them, Wusheng Electronics entered bankruptcy liquidation in early 2023 and declared official bankruptcy in January 2024. Another company, Nanjing Wusheng, will complete bankruptcy liquidation in October 2023. This also makes the market worried that the wave of semiconductor bankruptcies set off in 2020 will return with a vengeance.

Since 2014, as the mainland has officially promoted the development of the semiconductor industry and the United States has continued to impose sanctions on Huawei, the mainland has been eager to break through. Industrial subsidies of hundreds of billions of yuan and semiconductor parks have blossomed everywhere. Countless companies have rushed in, setting off a wave of Wave "core-making movement".

In 2020 alone, as many as 50,000 semiconductor-related companies were registered in mainland China. And in the first half of 2020 alone, the fully traceable investment amount in semiconductor projects in the top five provinces and cities including Jiangsu, Anhui, Zhejiang, Shandong, and Shanghai alone reached 160 billion yuan.

The result of the government, project parties, and investors' eagerness for success is that a large number of semiconductor projects have collectively fallen into unfinished trouble. In just over a year, a total of six tens of billions of star semiconductor projects in Jiangsu, Sichuan, Hubei, Guizhou and Shaanxi have been suspended.

Including the world's third largest wafer foundry GlobalFoundries, Chengdu's cooperation with Chengdu announced that it has broken down. The unfinished project with an investment of tens of billions of dollars can only be taken over by Hua Hong Semiconductor. There was also the Wuhan Hongchip project, which had vigorously poached former TSMC co-chief operating officer Chiang Shangyi, but it was eventually revealed to be a scam. Various bizarre and unfinished incidents emerged one after another.

As the semiconductor unfinished business crisis spreads, it also severely damages the investment confidence of the capital market. According to statistics from Chinese media, since 2023, there have been frequent cases of semiconductor companies announcing the withdrawal of IPO applications. Since the beginning of 2023, 23 companies in the semiconductor field have announced the termination of IPO applications. Entering 2024, IPO policies continue to tighten. Experts believe that the threshold for listing in mainland China will continue to increase in the future, and it will be more difficult for the semiconductor industry with insufficient qualifications to raise funds from the capital market, fearing another wave of exits.