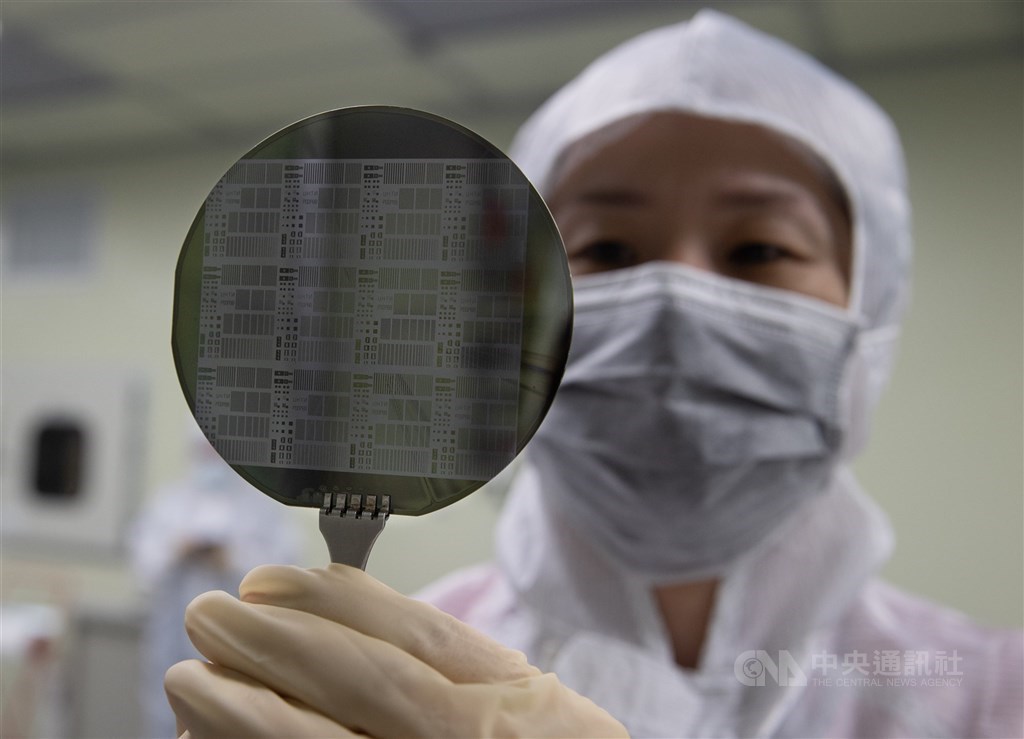

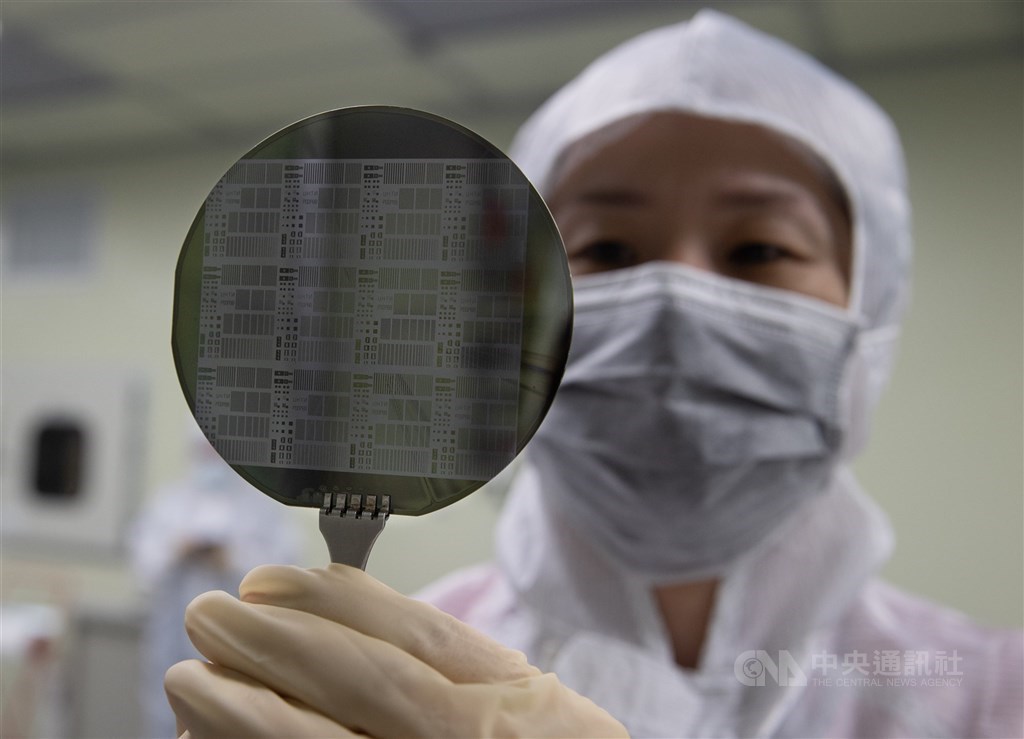

An engineer display a wafer. CNA file photo

Taipei, June 10 (CNA) Taiwan has taken the title of semiconductor equipment top spender in the first quarter of this year, with purchases soaring more than 40 percent, compared to a year earlier, according to global semiconductor trade association SEMI.

Data compiled by SEMI, which represents companies in the electronic manufacturing and design supply chain, showed Taiwan spent US$6.93 billion on semiconductor equipment in the first quarter, a surge of 42 percent from a year earlier, but a fall of 13 percent from the previous quarter.

Market analysts said Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, likely played a significant role with the company's capital expenditure recently forecast to hit almost US$32 billion in 2023.

As well as its 3 nanometer process starting mass production in Taiwan at the end of 2022, TSMC is also developing the 2nm process, which is scheduled to start commercial production in 2025. The chipmaker has also begun researching the more sophisticated 1.4nm process.

Following Taiwan, China ranked the second largest semiconductor equipment buyer, spending US$5.86 billion, down 23 percent from a year earlier and down 8 percent from last quarter, SEMI's data showed.

South Korea came in third in the first quarter, after buying US$5.62 billion worth of semiconductor equipment, up 9 percent from last year, but down 3 percent from a quarter earlier.

North America became the fourth largest market following its spending of US$3.93 billion on semiconductor equipment, which is a rise of 50 percent from a year earlier, and 51 percent from a quarter earlier, making it the fastest growing market in the world, SEMI said.

Analysts said the significant growth in spending in North America was largely sparked by U.S. President Joe Biden signing the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, which provides subsidies to semiconductor investments in the United States, into law in August 2022.

Along with other prominent integrated circuit (IC) makers, TSMC is building two wafer fabs in the U.S. state of Arizona, which will focus on advanced processes.

One will start mass production in 2024, using its advanced 4nm process, and the other will begin commercial production in 2026, using the 3nm process.

Japan took fifth place after spending US$1.9 billion on semiconductor equipment in the first quarter, little changed from a year earlier but a fall of 16 percent from the previous quarter, ahead of Europe, where spending hit US$1.52 billion, up 19 percent from a year earlier, and up 4 percent from a quarter earlier.

In the first quarter, total semiconductor equipment spending worldwide totaled about US$26.8 billion, up 9 percent from a year earlier but down 3 percent from a quarter earlier, SEMI's data showed.

SEMI said although the global economy was facing significant challenges, semiconductor spending remained solid, adding that emerging applications, like artificial intelligence, continued to grow, paving the way for the long-term growth of the IC industry.

In 2022, global semiconductor equipment spending hit US$107.6 billion, up 5 percent from a year earlier. China was the largest purchaser, with US$28.27 billion of spending, down 5 percent from a year earlier.

Taiwan came in next, with US$26.82 billion of spending, up 8 percent from a year earlier and ahead of South Korea, which bought US$21.51 billion worth of equipment, down 14 percent from a year earlier.

Taiwan top semiconductor equipment buyer in Q1 - Focus Taiwan

Taipei, June 10 (CNA) Taiwan has taken the title of semiconductor equipment top spender in the first quarter of this year, with purchases soaring more than 40 percent, compared to a year earlier, according to global semiconductor trade association SEMI.