- Exynos 2600 confirmed for mass production in November of this year

- Will the foundry that has been in deficit revive 2nm?

- Will the Galaxy S26 be equipped as a springboard for attracting major customers?

- TSMC's excessive price hikes... Opportunity for Samsung

The mass production schedule for Samsung Electronics' Exynos 2600, the first to use the 2nm (1㎚=1 billionth of a meter) process, has been confirmed for November. This is only four months after Han Jin-man, head of the Foundry Business Division (President), took office. Immediately after taking office, President Han ordered yield improvement through an internal message, and it is evaluated that the results are being achieved.

According to the semiconductor industry on the 10th, after taking over the foundry division, President Han reviewed the operational status of the existing 2nm process dedicated organization and the production line operation method. In particular, he revised the sales strategy to improve technological competitiveness. While he had previously focused on North American big tech, President Han actively expanded design house partners in various markets such as China, India, and Europe. The strategy is to increase orders for mature processes, lower the fixed costs required to operate the foundry plant, and secure price competitiveness in advanced processes.

Samsung Electronics also applies the 'Gate All Around (GAA)' technology in the 2nm process. It is a technology that is more advanced than the existing FinFET, with a structure that surrounds the transistor through which current flows on all four sides. It has the advantage of increasing chip performance and reducing power consumption, making it advantageous for high-performance semiconductors. Previously, it succeeded in mass producing 3nm using GAA technology for the first time in the world, but the low yield led to poor performance.

As Samsung Electronics has set the mass production date for the Exynos 2600 for November, attention is focused on whether it will create a rebound momentum in its foundry business. If the Exynos 2600 is installed in the Galaxy S26, which is scheduled to be released in the first quarter of next year, without a hitch, it is expected to serve as an example of demonstrating 2nm technology and supply capabilities. The industry believes that proving the stabilization of the 2nm process will help Samsung Electronics attract external customers.

![[Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share [Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share](https://cphoto.asiae.co.kr/listimglink/1/2025040916224813283_1744183367.png)

An industry insider said, "The 2nm yield currently under development at Samsung Foundry is much better than previously known," and "more positive than the 3nm process." The 2nm yield was only 20-30% at the beginning of this year, but it was recently reported to have exceeded 40% in the wafer testing stage at a post-processing company.

Samsung Electronics is rapidly increasing its 2nm yield, but it still lags behind industry leader TSMC. TSMC has secured an initial 2nm yield of up to 60%. Considering that mass production usually starts at a yield of 70-80%, stabilizing the yield by the second half of the year is expected to be an important task.

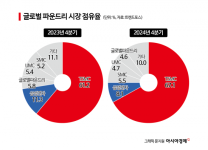

Samsung Foundry failed to overcome yield issues, handing over the leading edge process to TSMC, which became the starting point of the market share gap. According to TrendForce, the market share in the fourth quarter of 2023 widened from TSMC 61.2% and Samsung Electronics 11.3% to TSMC 67.1% and Samsung Electronics 8.1% in the fourth quarter of last year. Samsung's market share fell to single digits for the first time, and the gap with TSMC is 60 percentage points.

![[Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share [Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share](https://cphoto.asiae.co.kr/listimglink/1/2025040916302313301_1744183823.png)

Since President Han Jin-man took office in November of last year, the foundry division has been focusing on improving its structure with two tasks: “enhancing technology” and “securing customers.” Some are suggesting that the foundry division should be withdrawn or spun off, but Samsung Electronics is determined to continue investing. This is because if it regains its technological competitiveness, it will be able to establish itself as the only company that can provide “integrated solutions” for design, development, and production.

It is true that Samsung Electronics is lagging behind in terms of securing major customers. However, TSMC's repeated price increases could act as a new opportunity factor. Taiwan's Industry and Technology Times reported early last month that "TSMC is considering raising the price of its advanced processes by more than 15% this year." This is an upward adjustment from the previously known 5-10%, and it is known that this policy has already been conveyed to some customers.

cm.asiae.co.kr

cm.asiae.co.kr

- Will the foundry that has been in deficit revive 2nm?

- Will the Galaxy S26 be equipped as a springboard for attracting major customers?

- TSMC's excessive price hikes... Opportunity for Samsung

The mass production schedule for Samsung Electronics' Exynos 2600, the first to use the 2nm (1㎚=1 billionth of a meter) process, has been confirmed for November. This is only four months after Han Jin-man, head of the Foundry Business Division (President), took office. Immediately after taking office, President Han ordered yield improvement through an internal message, and it is evaluated that the results are being achieved.

According to the semiconductor industry on the 10th, after taking over the foundry division, President Han reviewed the operational status of the existing 2nm process dedicated organization and the production line operation method. In particular, he revised the sales strategy to improve technological competitiveness. While he had previously focused on North American big tech, President Han actively expanded design house partners in various markets such as China, India, and Europe. The strategy is to increase orders for mature processes, lower the fixed costs required to operate the foundry plant, and secure price competitiveness in advanced processes.

Samsung Electronics also applies the 'Gate All Around (GAA)' technology in the 2nm process. It is a technology that is more advanced than the existing FinFET, with a structure that surrounds the transistor through which current flows on all four sides. It has the advantage of increasing chip performance and reducing power consumption, making it advantageous for high-performance semiconductors. Previously, it succeeded in mass producing 3nm using GAA technology for the first time in the world, but the low yield led to poor performance.

As Samsung Electronics has set the mass production date for the Exynos 2600 for November, attention is focused on whether it will create a rebound momentum in its foundry business. If the Exynos 2600 is installed in the Galaxy S26, which is scheduled to be released in the first quarter of next year, without a hitch, it is expected to serve as an example of demonstrating 2nm technology and supply capabilities. The industry believes that proving the stabilization of the 2nm process will help Samsung Electronics attract external customers.

![[Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share [Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share](https://cphoto.asiae.co.kr/listimglink/1/2025040916224813283_1744183367.png)

An industry insider said, "The 2nm yield currently under development at Samsung Foundry is much better than previously known," and "more positive than the 3nm process." The 2nm yield was only 20-30% at the beginning of this year, but it was recently reported to have exceeded 40% in the wafer testing stage at a post-processing company.

Samsung Electronics is rapidly increasing its 2nm yield, but it still lags behind industry leader TSMC. TSMC has secured an initial 2nm yield of up to 60%. Considering that mass production usually starts at a yield of 70-80%, stabilizing the yield by the second half of the year is expected to be an important task.

Samsung Foundry failed to overcome yield issues, handing over the leading edge process to TSMC, which became the starting point of the market share gap. According to TrendForce, the market share in the fourth quarter of 2023 widened from TSMC 61.2% and Samsung Electronics 11.3% to TSMC 67.1% and Samsung Electronics 8.1% in the fourth quarter of last year. Samsung's market share fell to single digits for the first time, and the gap with TSMC is 60 percentage points.

![[Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share [Exclusive] Samsung Electronics' Gamble: 'Yield Improvement'... Seeking to Recover Market Share](https://cphoto.asiae.co.kr/listimglink/1/2025040916302313301_1744183823.png)

Since President Han Jin-man took office in November of last year, the foundry division has been focusing on improving its structure with two tasks: “enhancing technology” and “securing customers.” Some are suggesting that the foundry division should be withdrawn or spun off, but Samsung Electronics is determined to continue investing. This is because if it regains its technological competitiveness, it will be able to establish itself as the only company that can provide “integrated solutions” for design, development, and production.

It is true that Samsung Electronics is lagging behind in terms of securing major customers. However, TSMC's repeated price increases could act as a new opportunity factor. Taiwan's Industry and Technology Times reported early last month that "TSMC is considering raising the price of its advanced processes by more than 15% this year." This is an upward adjustment from the previously known 5-10%, and it is known that this policy has already been conveyed to some customers.

See more related articles

Global fabless companies such as Nvidia, Apple, Qualcomm, and AMD are requesting production from TSMC, but there are constant foreign media reports that Apple and AMD are reviewing Samsung Electronics' 2nm process due to excessive price increases every year. An industry insider said, "Foundries are conducted under long-term contracts that look at the volume for three years in the long term," and "If they prove their 2nm technology, their market share will recover to double digits."

[단독]삼성전자 승부수 '수율 개선'…점유율 회복 모색

삼성전자의 2나노(1㎚=10억분의 1m) 공정이 처음 적용되는 '엑시노스 2600'의 양산 일정이 오는 11월로 확정됐다. 한진만 파운드리사업부장(사장)이 부임한 지 4...