This post is the second in a series that uses the history and economics of the American semiconductor industry to ask big picture questions about the future of fiscal policy and industrial policy. As the pandemic ends, the US will have a historic opportunity to revamp its public and economic infrastructure. However, to ensure that industrial policy is effective, many older strategies need to be updated to ensure that they are consistent with the suite of macroeconomic policy settings that support tight labor markets. Today’s post argues that the history of semiconductor manufacturing offers clear lessons for using industrial policy not just in resolving the present shortage, but in building a robust innovative ecosystem to secure the technological frontier for the long term.

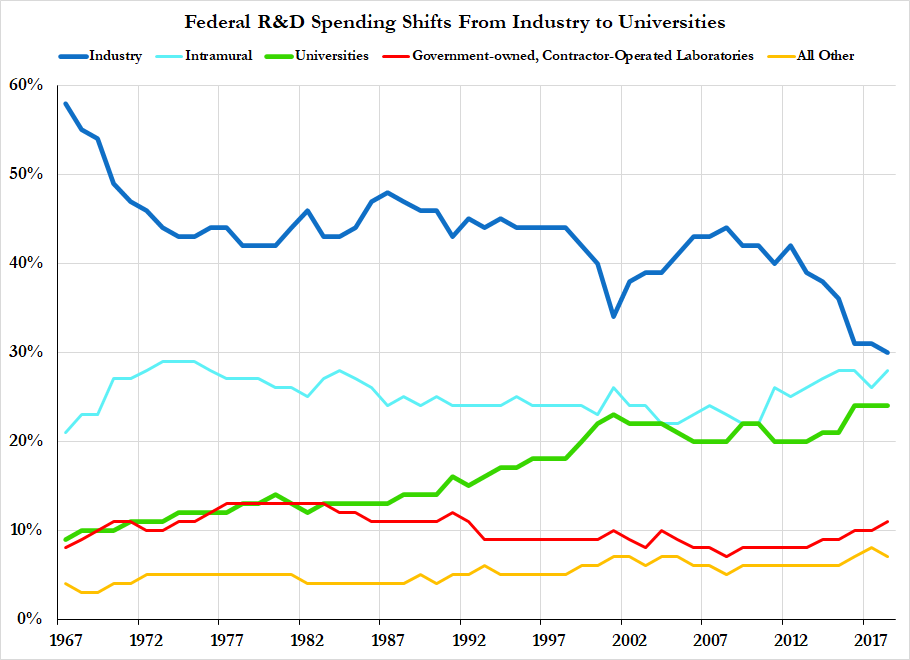

While this is a history of the semiconductor industry, the policy takeaways it highlights hold for a wide range of industries. First, fiscal mechanisms play a crucial role in providing liquidity and mitigating financial uncertainty for highly uncertain sectors operating at the economy’s technological frontier. At the same time, industrial policy which inculcates robust supply chains through the reduplication of investment and employment plays a central role in gaining and holding the technological frontier. Science policy — the coordination of R&D undertaken by universities, private companies and public-private partnerships — is not enough. Finally, policy ambition is critical. Though bipartisanship is important, the scale of industrial policy must be such that it is able to achieve its goals.

employamerica.medium.com

employamerica.medium.com

While this is a history of the semiconductor industry, the policy takeaways it highlights hold for a wide range of industries. First, fiscal mechanisms play a crucial role in providing liquidity and mitigating financial uncertainty for highly uncertain sectors operating at the economy’s technological frontier. At the same time, industrial policy which inculcates robust supply chains through the reduplication of investment and employment plays a central role in gaining and holding the technological frontier. Science policy — the coordination of R&D undertaken by universities, private companies and public-private partnerships — is not enough. Finally, policy ambition is critical. Though bipartisanship is important, the scale of industrial policy must be such that it is able to achieve its goals.

A Brief History of Semiconductors: How The US Cut Costs and Lost the Leading Edge

By Alex Williams and Hassan Khan