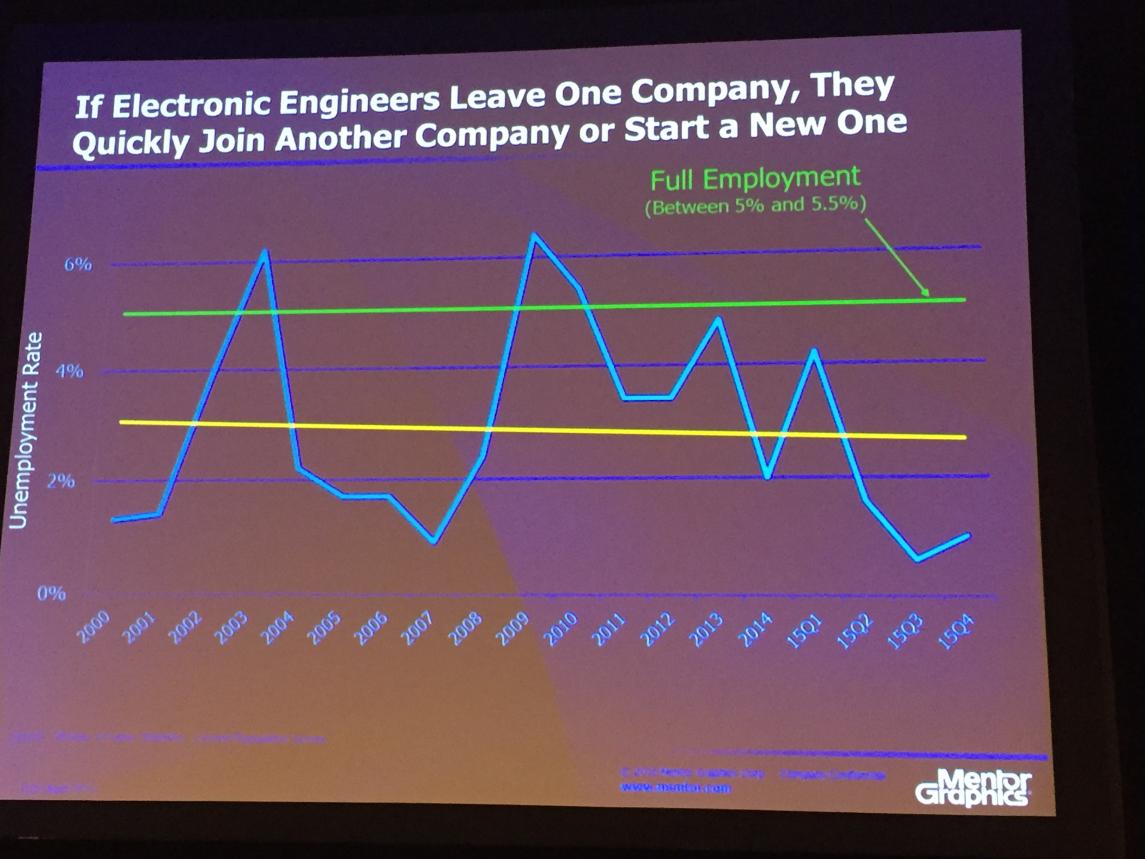

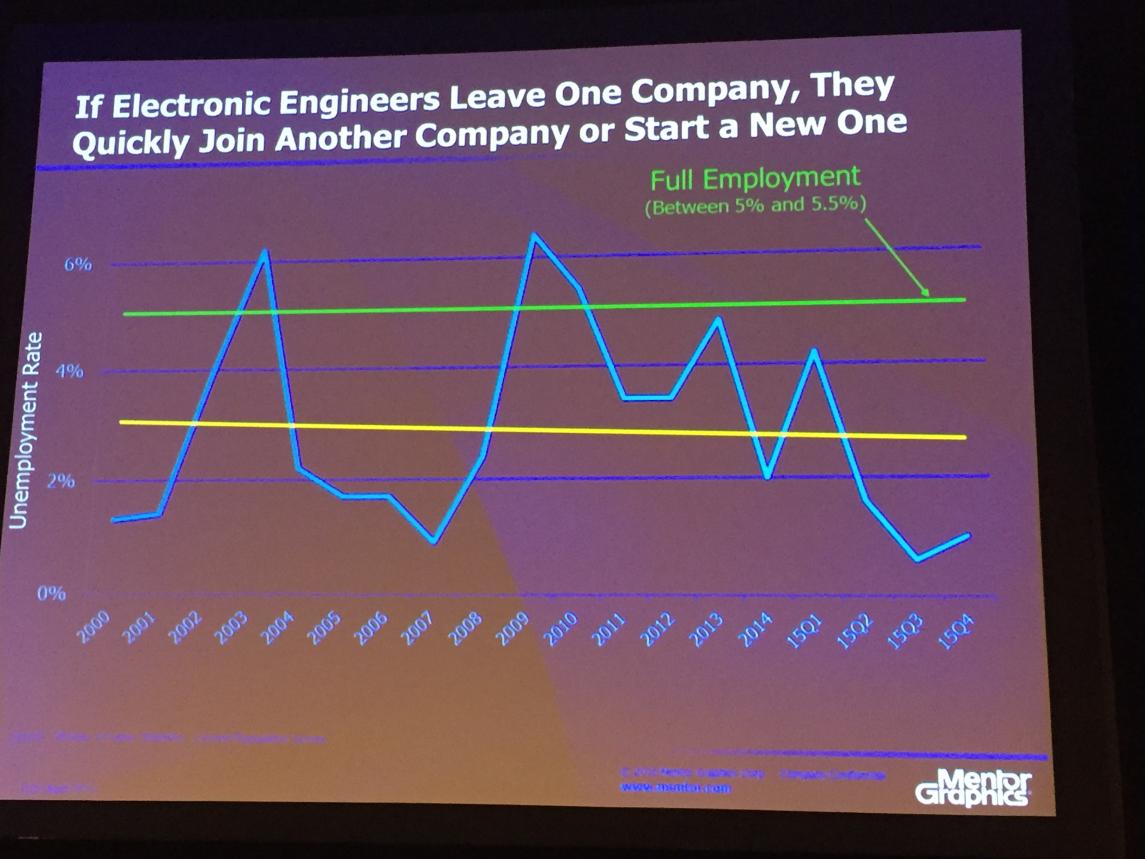

As I have mentioned before, semiconductor professionals are very smart people, pound for pound the smartest in the workforce in my opinion. So what happens when thousands of engineers from Qualcomm, Broadcom, Altera, and Intel get shown the door? They don’t go to work for Starbucks, they don’t go to the unemployment line, they continue to innovate, absolutely.

It is not just the semiconductor industry that is shedding, in Q1 2016 technology companies cut more than 17,000 jobs. According to media reports that’s an increase of 148% compared to Q1 2015. According to a Wall Street source that number could hit 260,000 jobs in 2016.

The slide above is from the Wally Rhines keynote “Merger Mania” at this week’s U2U Conference. It was a real nice walk down semiconductor history lane. Unfortunately the slides are not available for public consumption so I will do a quick rundown with the help of my trusty iPhone:

Is the merger and acquisition activity in the semiconductor industry accelerating?

- 23 Transactions in 2010

- 34 Transactions in 2011

- 12 Transactions in 2012

- 16 Transactions in 2013

- 32 Transactions in 2014

- 30 Transactions in 2015

Not really, but the value of the transactions are certainly higher. The average value of the yearly transactions between 2010 and 2014 is about $15B. The total transaction value in 2015 is more than $100B.

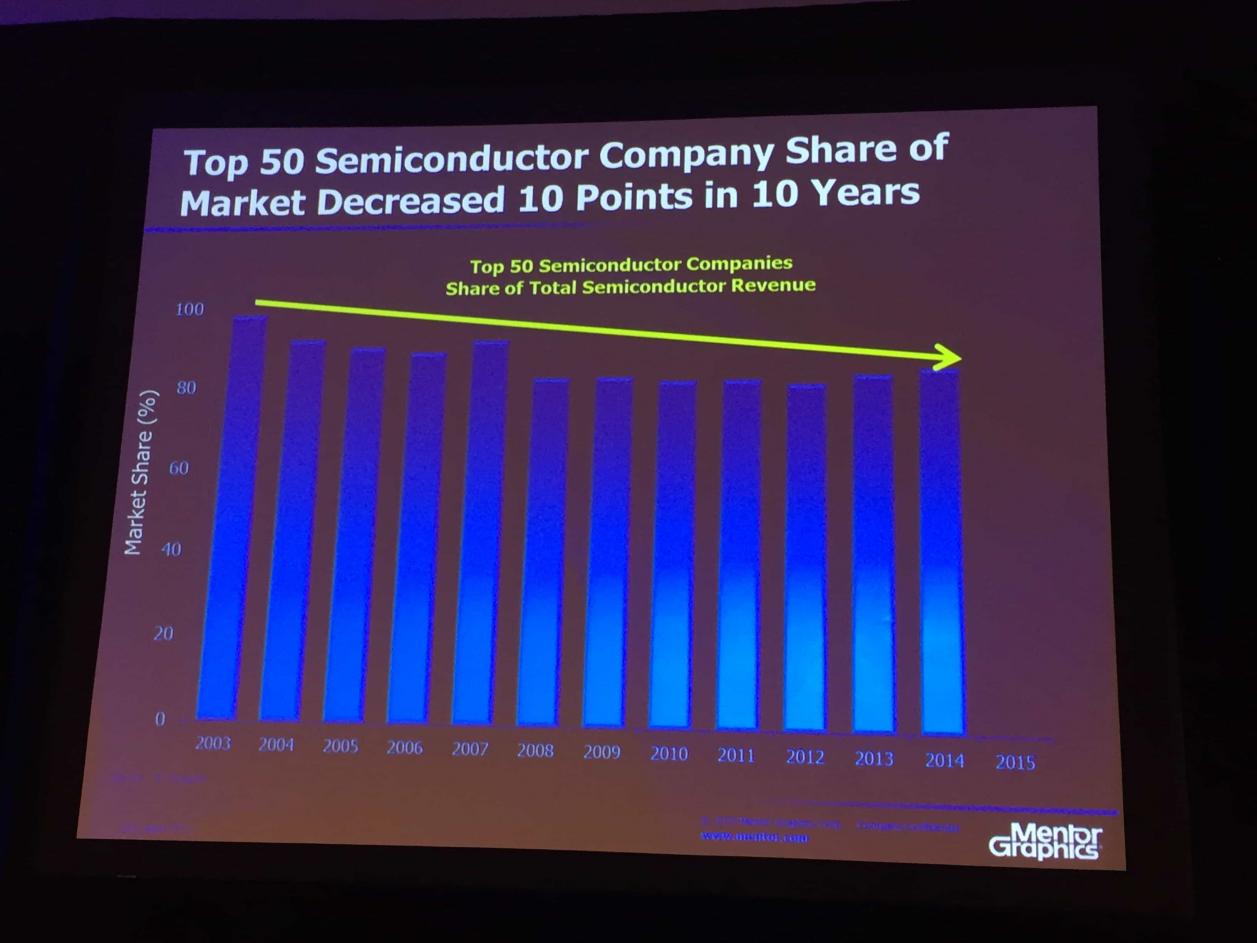

Is the semiconductor industry consolidating?

Not really, because, as I said, jettisoned semiconductor professionals do not go to work for Starbucks, they start new companies which is easy to do thanks to the mighty fabless semiconductor ecosystem.

In 2015 the combined market share of the top 10 semiconductor companies did increase as a result of the mega mergers but the decreasing trend will continue, especially if you include the new breed of fabless systems companies such as Apple, Google, and Amazon.

It really is interesting to see the semiconductor leadership changes over the last few decades. Please note that the fabless semiconductor ecosystem has tremendous influence now and remember that Samsung is a hybrid IDM, Systems Company, and Foundry. Putting TSMC in the top 10 is a little misleading since the other 9 companies are all TSMC customers, right?

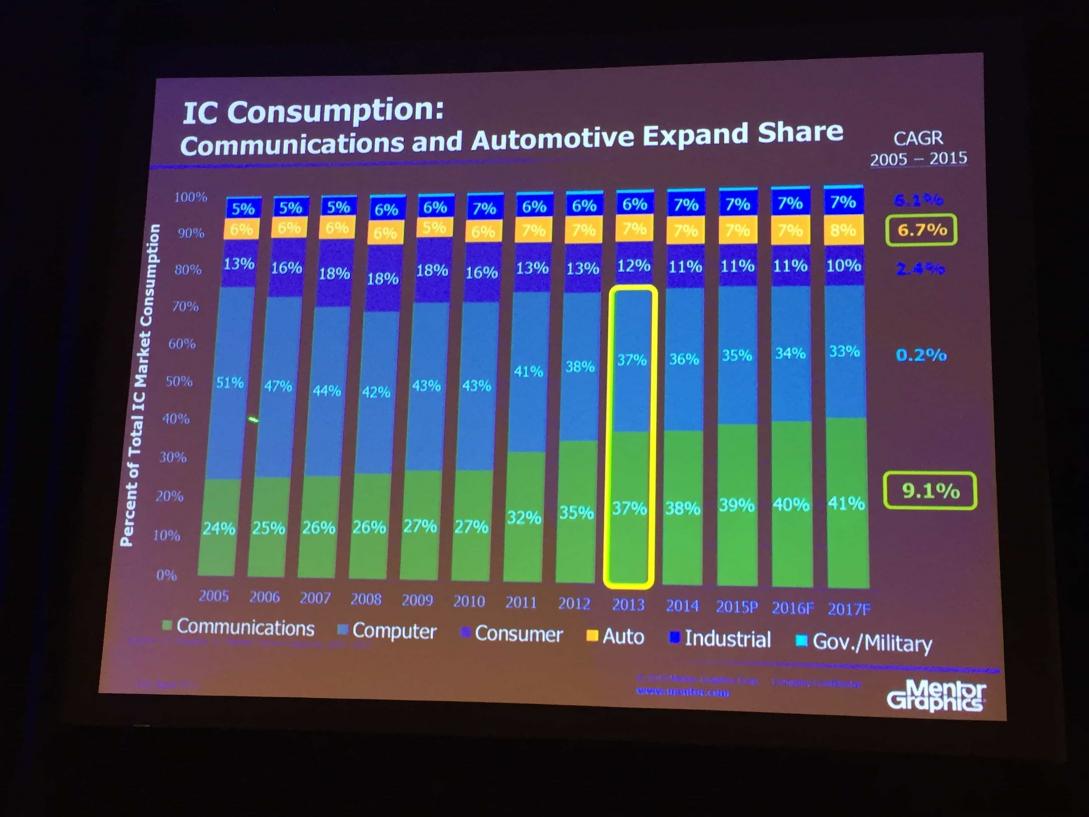

Where is IC Consumption Going?

Clearly computers no longer rule the chip industry and that trend will continue (unfortunately for Intel). Automotive is one of the new trending categories on SemiWiki and it is interesting to see where the traffic is coming from. The majority of the automotive traffic is from North America (Cupertino ls a hotspot) and some from Europe but many are now coming from China.

The Fabless Semiconductor Business Model is Getting Stronger!

Another interesting slide on the fabless semiconductor revolution. All is well but we still have a lot of work to do to continue this growth trajectory. Based on the traffic flow of SemiWiki, IoT (specifically ARM traffic) is growing exponentially so that is where my bet would be as to the future of the fabless semiconductor industry growth.

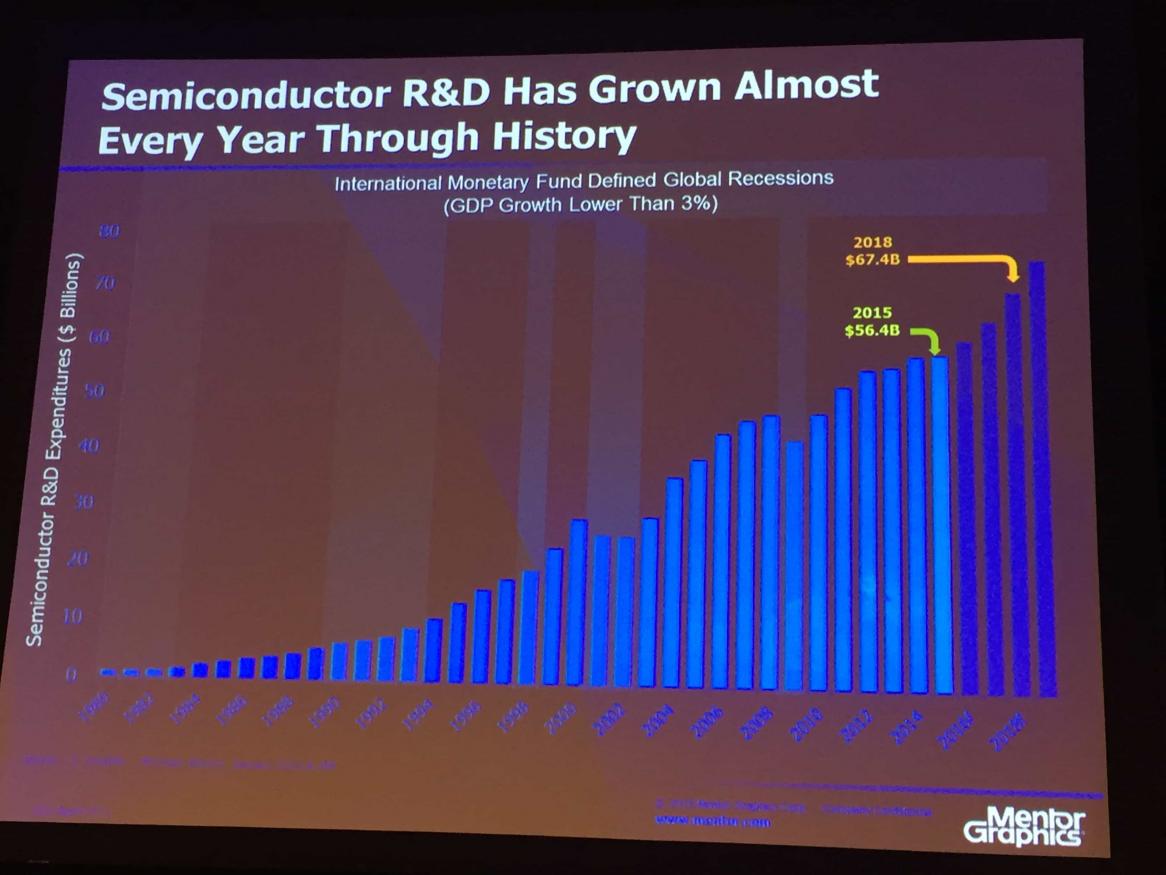

Semiconductor R&D Continues to Grow

And this is why semiconductor professionals don’t stay unemployed for long and I see no reason why this trend will not continue. Semiconductors are now an integral part of our basic human needs. If you look at Maslow’s Hierarchy of needs you will now see semiconductors inside everyone of them:

[LIST=1]

What about China?

The Chinese National Government is putting $20B into the semiconductor industry. Chinese local and regional governments and Chinese private equity investors are putting in another $100B. Given that China consumes more than half of the chips we make that seems to be a very wise investment.

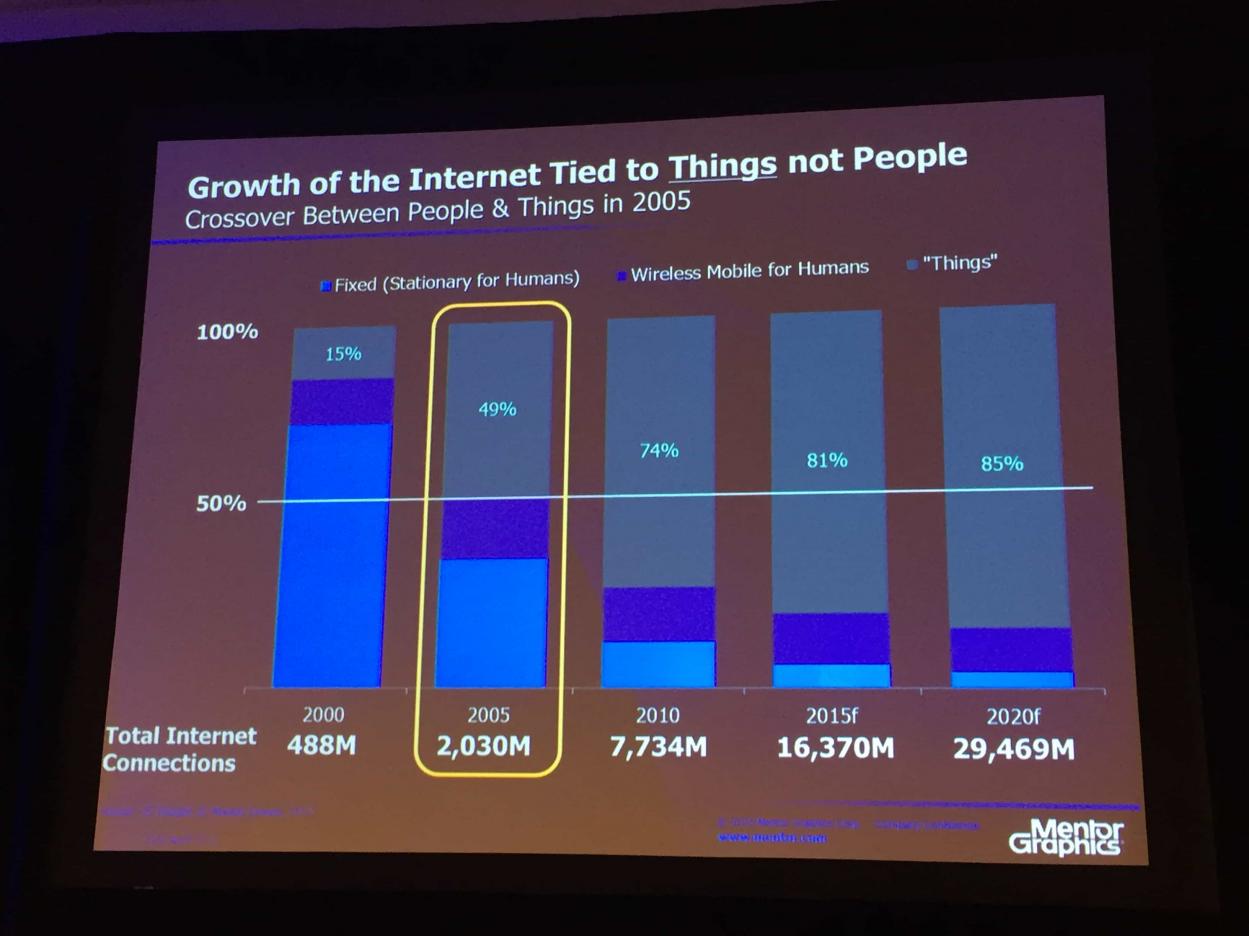

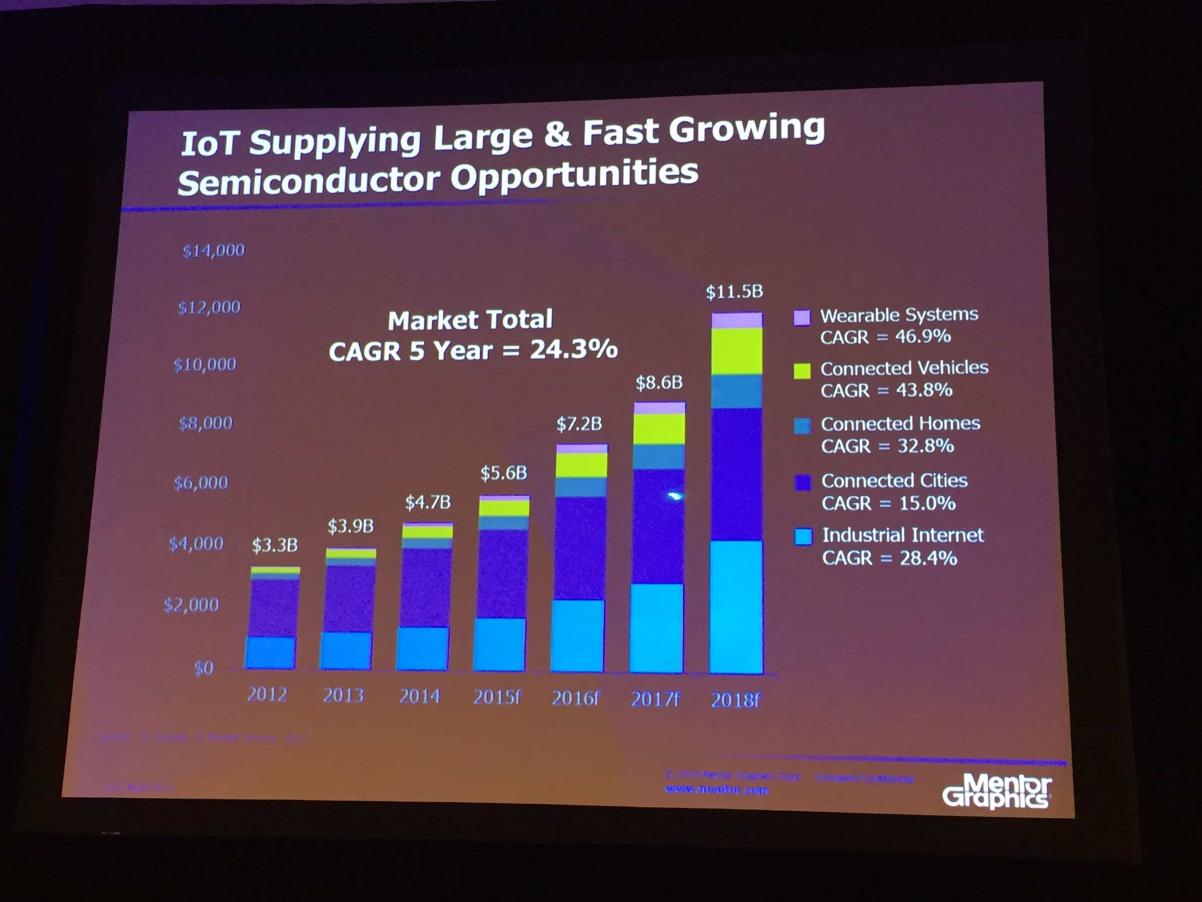

Is the Semiconductor Internet of Things Real?

This is the first part of the IoT growth argument.

And this is the second one, so yes semiconductor IoT is real.

In conclusion:

Consolidation May Continue But…

- There are risks of future profitability of the acquired company

- Historic success/failures of large acquisitions

- Government veto, i.e. CFIUS, MOFCOM, FTC, EC, etc…

- Too many acquisitions drives up the prices of acquirees

- R&D “synergy” reductions ultimately reduce revenue growth

- Long term interest rates (cheap money) will eventually increase

Current Merger Mania Sustained by…

- Continued low cost of borrowing

- Plentiful Chinese funding of acquisitions (that passes CFIUS and anti trust hurdles)

- Delayed emergence of new semiconductor applications that will grow new markets and new competitors

Questions? Comments? Observations? Opinions? Sarcasm?

Share this post via:

Comments

0 Replies to “Are Layoffs Good for the Semiconductor Industry?”

You must register or log in to view/post comments.