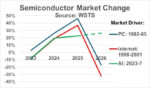

The currently strong semiconductor market is being driven by AI applications. A McKinsey survey showed 88% of businesses used AI in 2025 compared to just 55% in 2023. According to Inc.com, 306 of the S&P 500 companies mentioned AI in their third quarter 2025 earnings conference calls, up from only 53 citations three years earlier… Read More

Tag: wsts

Semiconductors Still Strong in 2025

The global semiconductor market in 2Q 2025 was $180 billion, up 7.8% from 1Q 2025 and up 19.6% from 2Q 2024, according to WSTS. 2Q 2025 marked the sixth consecutive quarter with year-to-year growth of over 18%.

The table below shows the top twenty semiconductor companies by revenue. The list includes companies which sell devices… Read More

Semiconductor Market Uncertainty

WSTS reported 1st quarter 2025 semiconductor market revenues of $167.7 billion, up 18.8% from a year earlier and down 2.8% from the prior quarter. The first quarter of 2025 was weak for most major semiconductor companies. Ten of the sixteen companies in the table below had declines in revenue versus 4Q 2024, ranging from -0.1% from… Read More

Weak Semiconductor Start to 2025

WSTS reported the global semiconductor market in 4th quarter 2024 was $170.9 billion, up 17% from a year earlier and up 3% from 3rd quarter 2024. The full year 2024 market was $628 billion, up 19.1% from 2023.

We at Semiconductor Intelligence give a virtual award for the most accurate semiconductor market forecast for the year. The… Read More

Semiconductors Slowing in 2025

WSTS reported third-quarter 2024 semiconductor market growth of $166 billion, up 10.7 percent from second-quarter 2024. 3Q 2024 growth was the highest quarter-to-quarter growth since 11.6% in 3Q 2016, eight years ago. 3Q 2024 growth versus a year ago was 23.2%, the highest year-to-year growth since 28.3% in 4Q 2021.

Nvidia remained… Read More

Robust Semiconductor Market in 2024

The global semiconductor market reached $149.9 billion in the second quarter of 2024, according to WSTS. 2Q 2024 was up 6.5% from 1Q 2024 and up 18.3% from a year ago. WSTS revised 1Q 2024 up by $3 billion, making 1Q 2024 up 17.8% from a year ago instead of the previous 15.3%.

The major semiconductor companies posted generally strong… Read More

Will Semiconductor earnings live up to the Investor hype?

The state of the Semiconductor Industry before the earnings season. This post will give the industry’s status before the results are revealed. We are sharing the information available.

The first Q2 swallows

A few companies with quarters not aligned to calendar quarters have reported. Nvidia was slightly ahead of expectations,… Read More

Strong End to 2023 Drives Healthy 2024

The global semiconductor market grew 8.4% in 4Q 2023 from 3Q 2023, according to WSTS. The 8.4% gain was the highest quarter-to-quarter growth since 9.1% in 2Q 2021. This was also the highest 3Q to 4Q increase in 20 years, since an 11% rise in 4Q 2003. 4Q 2023 was up 11.6% from a year ago, following five quarters of negative year-to-year… Read More

The Recovery has Started and it’s off to a Great Start!

August’s WSTS Blue Book showed Q2-2023 sales rebounding strongly, up 4.2 percent vs. Q1, heralding the end of the downturn and welcome news for the beleaguered chip industry.

The really good news, however, was that the downturn bottomed one quarter earlier than previously anticipated. This pull-forward only added a modest US$11… Read More

Semiconductor Decline in 2023

The semiconductor market dropped 0.8 percent in 2Q 2022 versus 1Q 2022, according to WSTS. The 2Q 2022 decline followed a 0.5% quarter-to-quarter decline in 1Q 2022. The 2Q 2022 revenues of the top 15 semiconductor suppliers match the overall market results, with a 1% decline from 1Q 2022. The results by company were mixed. Memory… Read More