SEMICON China 2026by Admin on 01-06-2026 at 7:44 pm

SEMICON China attracts the world’s leading technology companies who design, develop, manufacture, and supply the technologies to manufacture the microelectronics that drive today’s most sophisticated consumer and commercial electronic products.

REGISTER HERE… Read More

DVCon China 2026by Admin on 12-11-2025 at 1:09 pm

Hello everyone! Welcome to the 2026 DvCon China Conference! As the chair of this conference, l am truly honored to be here with all of you. lt’s exciting to gather together and discuss the latest trends and cutting-edge technologies in the field of design verification.

In recent years, we’ve seen tremendous growth… Read More

Join us for the 2025 TSMC OIP ECOSYSTEM FORUM

Get ready for an electrifying dive into the future of semiconductor design at the 2025 TSMC Global Open Innovation Platform® (OIP) Ecosystem Forum! This isn’t just an event; it’s a dynamic hub where the brightest minds converge to ignite the next wave of innovation.

As the AI revolution… Read More

– AMAT has OK Q but horrible guide as China & Leading edge drop

– China finally chokes on indigestion & export issues -$500M hit

– TSMC trims on fab timing causing leading edge to slow -$500M hit

– Cycle which had slowed to single digits has rolled over to negative

AMAT guides down for big miss on Q4

…

Read More

Semiconductor Intelligence (SC-IQ) estimates semiconductor capital expenditures (CapEx) in 2024 were $155 billion, down 5% from $164 billion in 2023. Our forecast for 2025 is $160 billion, up 3%. The increase in 2025 is primarily driven by two companies. TSMC, the largest foundry company, plans between $38 billion and $42 billion… Read More

– AMAT has OK QTR but outlook below expectations as 2025 weakens

– Strength in AI cannot offset weakness in the rest of the market

– Increasing headwinds going into 2025 dampen overall outlook

– Weakness combined with regulatory uncertainty reduce valuations

Quarter and year are just OK but outlook is

…

Read More

- Lam put in good quarter with flattish guide- still a slow recovery

- This is better than worst case fears of order drop like ASML

- China spend is slowing but tech spending increase offsets

- Relief rally as the market was braced for bad news and got OK news

Lam has OK, slightly better than in line quarter with OK guide….

It coulda been… Read More

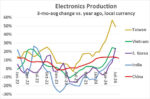

Electronics production in the major developed countries has been showing slow growth or declines in 2024. United States electronics production three-month-average change versus a year ago (3/12 change) was 0.4% in July 2024, the slowest since the pandemic year of 2020. Growth has been slowing since averaging 6.5% in 2022 and… Read More

Embargoes and other fun stuff in the Semiconductor Tools Market

While this post dives into the semiconductor tool market’s Q2 data, it is also about the senseless embargo game currently in place. The post illustration shows what my notebooks look like as embargoes enforce what they are supposed to suppress and are replaced… Read More