You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

– First SEMICON in Arizona was great- should make it permanent

– Congress finally wakes up to China issues long after cows are gone

– Memory cycle in support of AI could be huge but scary at same time

– AI demand seems bottomless- but may distort chip industry dynamics

Phoenix SEMICON was wonderful!

The crowds… Read More

– AMAT has OK Q but horrible guide as China & Leading edge drop

– China finally chokes on indigestion & export issues -$500M hit

– TSMC trims on fab timing causing leading edge to slow -$500M hit

– Cycle which had slowed to single digits has rolled over to negative

AMAT guides down for big miss on Q4

…

Read More

– Lam put up good numbers but H2 outlook was flat with unknown 2026

– China remains high & exposed at 35% of biz while US is a measly 6%

– Unclear if this is peak, pause, digestion, technology or normal cycle

– Coupled with ASML soft outlook & stock run ups means profit taking

Nice quarter but expected

…

Read More

- QTR was just “in-line” but guide was below expectations

- We think its not just China export rules but share loss as well

- Leading edge is strong but obviously not enough to offset China

- Memory remains weak-Foundry (TSMC) is the primary driver

Headwinds slow growth to flat

Applied reported $7.166B in revenues and Non … Read More

– KLA put up a good qtr & year with consistent growth

– AI & HBM are the main drivers of leading edge which helps KLA

– China slowing but not too fast, Outlook OK but not super

– Wafer inspection is huge but reticle inspection continues to slip

KLA reports good quarter and OK outlook

KLA reported revenues… Read More

– AMAT has OK QTR but outlook below expectations as 2025 weakens

– Strength in AI cannot offset weakness in the rest of the market

– Increasing headwinds going into 2025 dampen overall outlook

– Weakness combined with regulatory uncertainty reduce valuations

Quarter and year are just OK but outlook is

…

Read More

– CHIPS Act more likely to be maimed & cut than outright killed

– Will Legislators reverse flow of equipment to Reshore from Offshore?

– Recent order cuts, Fab Delay & SMIC comments are all negative

– News flow for semi equipment all bad in front of AMAT

CHIPS Act Chops likely to occur under new administration

…

Read More

- Investors finally realize the upcycle isn’t as strong as stocks indicated

- Industry Bifurcation between AI & rest of industry continues

- China spending risk/overhang finally kicks in

- AI is super strong, majority of chips remain weak- Invest accordingly

ASML simply states chip industry reality that investors have

…

Read More

- AMAT reports good but underwhelming quarter

- China slowing creates revenue & GM headwinds- ICAPs weak

- AI remains the one and only bright spot in both foundry & memory

- Cyclical recovery remains slow – Single digit Y/Y growth

OK quarter – still slow growing, revs up only 5% Y/Y

AMAT came in at revenues of $6.78B… Read More

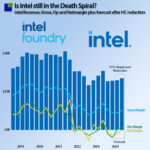

Does this justify the widespread Intel bashing?

The latest Intel earnings release was another sharp and deeper turn into the company’s death spiral. On the surface, it is just a whole load of bad news, and the web has been vibrating with Intel bashing since the release.

So what are the facts?

From a revenue perspective, Intel was inside… Read More