What are you on about!? There is nothing dishonest about using a different depreciation schedule it is in the law. As long as you stick to it the whole time all is legal. Intel used to use a 4yr depreciation model for most of it's existence. Were TI, GF, AMD, TSMC, Samsung, Micron, and SK cheating because they were making their numbers look better than using a 4yr. Of course not, it just changes how your cost changes overtime, you get to the same place eventually. Yeah you could do 5 or 8 years and your burden rate is lower in years 1 and 2 than the 4yr case. But you are still paying more in subsequent years. Given how expensive buildings are they (note the building not the land) are allowed to be 27.5 or 29.5 depending on what kind of building it is. Intel also did say that only some of the equipment would use the longer period. My guess without seeing the books is EUV tools given how expensive it is and the near time cash shortage at intel until these EUV nodes can get spooled up. It seems like a shrewd business decision to use a longer deprecation period to afford fab expansions in the short-term and accept slightly lower profits during the mid-term and same profitability during the long-term. In the world of intel nodes lasting 4-6 years a 5 or even 8 year depreciation schedule makes no sense. But if nodes will now run for decades like they do at TSMC, why not if it helps intel get past the hardest part of their foundry transformation.

View attachment 2094

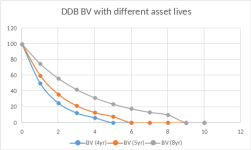

Note the integral of the left plots are the same ($100)

With all the possible good intention from Intel, as you mentioned on extending equipment depreciation from 5 to 8 years, we have to look into to the reality and what kinds of problems can be imposed on Intel.

Under the rapid change of manufacturing technology and market demand, TSMC's strategy is to depreciate the equipment as quick as the tax laws and accounting rules allowed while Intel is doing the opposite way. Do we really believe Intel's assertion that the equipment is still be competitive during the 6th, 7th, and 8the year?

If the answer is "yes", then Intel will be facing TSMC's near zero depreciation cost competition because TSMC completes its equipment depreciation in 5 years.

If the answer is "no", Intel will be holding a lot of non-competitive or non-productive equipment for three additional years than TSMC. TSMC is going to recover all its equipment investment, buy newer and more powerful machines, and move on.

Extending equipment depreciation from 5 years to 8 years has several effects on Intel:

1. Reduce the the expense and possibly boost Intel's EPS or keep Intel's EPS not to fall too quick. It will be good for Intel CEO and CFO to reach their performance requirements at the expense of Intel's future. Intel spent $133.9 billion since 2000 or $83.6 billion since 2010 in stock buyback program in order to boost Intel's EPS. Extending years of depreciation and buy back shares bear the same Intel attitude: keep EPS afloat while avoid addressing Intel's fundamental problems.

2. Reduce the annual depreciation expense can cosmetically boost Intel's "book value". Better book value and EPS can help Intel's stock price and consequently help Intel CEO's and CFO's performance review.

3. Reduce the annual depreciation expense can make people believe certain Intel capital investments are finically viable while the actual situation might be going the other way.

4. According Intel's estimate, extending the equipment depreciation from 5 years to 8 years resulted $2.5 billion increase to the gross margin for 2023. But wait a moment, Intel 2023 GAAP net profit was only $1.7 billion! That means without this depreciation manipulation, Intel 2023 will be in a net loss.

Semiconductor business is a very challenging and difficult business. But one thing for sure, financial engineering will masquerade the true problems and pass the hot potatoes to the future CEO and CFO.