Array

(

[content] =>

[params] => Array

(

[0] => /forum/threads/tsmc-considers-running-intel%E2%80%99s-us-factories-after-trump-team-request.22101/page-2

)

[addOns] => Array

(

[DL6/MLTP] => 13

[Hampel/TimeZoneDebug] => 1000070

[SV/ChangePostDate] => 2010200

[SemiWiki/Newsletter] => 1000010

[SemiWiki/WPMenu] => 1000010

[SemiWiki/XPressExtend] => 1000010

[ThemeHouse/XLink] => 1000970

[ThemeHouse/XPress] => 1010570

[XF] => 2030970

[XFI] => 1060170

)

[wordpress] => /var/www/html

)

Guests have limited access.

Join our community today!

Join our community today!

You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please, join our community today!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TSMC Considers Running Intel’s US Factories After Trump Team Request

- Thread starter XYang2023

- Start date

Intel board should not have fired Gelsinger

Intel's board should really have fired itself, and did it 10 years ago. It was board's decision to commence on endless *-lake cash cow milking without future commitment. No amount of CEO changes will fix a decision on the side of directors.

And yet people often do.Hard to be fired for something you inherited. No I think one of several

That doesn't sound right to me. Let's go hog wild with it and say AMD was going to sign an 18A contract to have client IO dies made in the 2028/2029 timeframe. If 18A made sense for AMD and they wanted to buy it, I have a hard time imagining Lisa Su saying, "I will only buy it if you get rid of him! (Pat)". She seems pragmatic and professional. I also would assume there isn't some personal vendetta between the two either. Even if they did, they wouldn't ever really be interacting. It would probably be Ann/Naga/Kevin plus staff interfacing with people 2–3 levels below Lisa. I mean, maybe I'm wrong and being too rational. But with companies this big you wouldn't expect something as petty or personal as not liking the CEO to make you chose a different supplier than your preferred choice.1). A whale client said to do a deal he had to go

I think that is more plausible sounding. But it doesn't sound like they want a strategy change. Maybe the new CEO they end up hiring has a strong vision and there is a change then. But if the board is demanding a change or die shake up, you would think they would have Dave and Michele start executing whatever pivot they wanted rather than telling them to stay the same exact course Pat was plotting. While the GPU thing sounds stupid to me it seems like it is the least contradictory with the facts as we know them. Either way, it seems likely the reason might become more clear with time.2). Board wanted to push on a strategy change and it was either get on board or leave.

Not really. Ohio should have had very little money put into it (based on construction photos), and Germany hasn't really done anything but earth moving. The only shells that were completed or are very close to completion would be D1X_mod 3 (needed to support high-NA and continued process development), Fab 34/44 (needed for Intel 3/4 HVM), Fab52/62 (needed for 18A HVM), NM Fab 9/11X retooling (needed for advanced packaging), Malaysia advanced packaging fab started under Bob Swan (thought to be needed for given intel product demand but start up is no delayed for like a year or two if memory serves), and Israel Fab38/48 (with rumors pointing to 48 being left empty until needed and both shells being nearly done). Even if you assume that internal demand will not exceed the capability OR/IR/NM/AZ and every dime spent on Ohio, Germany, Maylasisa, and Israel was wasted, I wouldn't think we are talking tens of billions. Intel said the D1X_mod 3 shell was $3B, and NM retool and construction was $3.5B (so I will call a Malaysia advanced packaging shell maybe $1.5B). We are talking around $8-9B max of "wasted" capex over 4 years. I say "wasted" because even if the original start-up timings are now incorrect due to Intel products once again overestimating how many wafers they would need, these other expansions do need to happen over the next 4 years to support 14A and 10A ramps and an increasing percent of Intel's products using advanced packaging even if you assume relatively meager external foundry demand until 2031.I am thinking the second as things are pretty dire and require a pivot. They wasted tens of billions on shells that they didn’t need. Foundry should build to real demand not hope and prayer.

Yeah, I have no clue how and why Intel is so bad at projecting their own CPU demand. Anyone could have told you that there would be a 14nm capacity crunch, made even worse with the increasing product die sizes due to 10nm lateness. You can't just get away with not building any new fabs for nearly a decade. That isn't how this works. Then the same thing happened at 10nm made even worse due to the pandemic highs. Intel foolishly projected that growth would continue and told the whole world about it and got caught up with everyone else when demand crashed. Then in 2024 they overforcast CPU demand AGAIN just after clearing the channel of their prior oversupply. How can a factory network be optimized if your colleges can shift their demand profile by 40% swings at the drop of a hat? Letting this happen twice under his watch is by far the worst mistakes he had IMO. Maybe secondary was spending too much time fixing the fab side and not working sooner on fixing the rot on the design side. At the end of the day the fab side IMO just needs time for the investments to start paying off. But that strategy doesn't work if DCAI and NEX have imploded and CCG is reeling. Even during the pivot away from memory to CPUs intel had the benefit of their EPROM business to pay the bills while manufacturing was rebuilt and the CPU market grew large enough to sustain the rest of the firm.That is a spectacular failure of Pat’s part also somewhat the board and CFO

As an engineer that would be the thing that would sadden me the most. I always love seeing the difference in process technologies and seeing how different priorities and compromises are made. Would we have A16 and SF2-Z products in 2027 if Intel wasn't pushing so hard on BSPDNs, I suspect that would be waiting for 2028 or 2029 as a preamble before CFET in the 2030s.18A is on the cusp of delivering and possibly with some foundry after. 14A soon after and likely more competitive. The talent at Intel is still the best out there as well has all the support of the vendors. Let’s be honest as big a business TSMC to suppliers and customers everyone wants an alternative. To allow TSMC to managed Intel and transfer technology or manage their fabs will dilute innovation as well as stifle competition.

Even on EUV they were technically a fast follower. Intel did more early research and work with the early development tools, and Samsung had a more aggressive EUV adoption strategy. Areas where TSMC innovated... A few come to mind where TSMC is the first to HVM. SiGe PMOS (N5) something neither Samsung nor Intel has implemented in HVM, Cu metal with Co cladding (16FF), immersion lithography (limited trial production at 90nm and dedicated HVM at 40nm), Cu with Co and Ru cladding (N3), mixed row (N3), I think they also adopted linerless W contacts first (N4) but that might have been Samsung who was first and TSMC following.When you look back beyond EUV TSMC is a follower. Actually from a process architecture not clear where TSMC has innovated.

Last edited:

Not true...Hard to be fired for something you inherited.

Not true...

A high ranking manager may well be hired just to take the blame in a big company.

Everyone sees bad times coming, current management leaves on the high note, and somebody relatively naive, and low profile is needed to takes the post, and attend meetings with angry creditors. Once the market turns, the guy is ousted, put the blame on, and insiders take over again.

More news from the Republic of Korea.

From Taiwan.More news from the Republic of Korea.

From Taiwan.

Hopefully this is a bad translation because the title does not match the content:

Intel's wafer foundry TSMC acquires 20% of its shares and will also introduce Qualcomm, Broadcom and other big players

Trump administration proposes factory acquisition, AI chip competition is pushed back, performance worsens, management difficulties expected to be resolved through spin-off sale, TSMC's 72% foreign shareholders are a 'variable'.

The rumors of Taiwan's TSMC acquiring Intel's foundry division are being interpreted as a result of Intel's recent worst management crisis. Intel, which once dominated the global semiconductor market, is struggling to respond to the mobile-centric changes such as smartphones and is struggling to compete with artificial intelligence (AI) chip manufacturers, resulting in worsening performance.

According to foreign media on the 16th, Intel's re-entry into the foundry business, which it has been pursuing since 2021, is largely considered to be a failure. This is because it has failed to overcome the wall of TSMC and Samsung Electronics, which dominate the memory semiconductor market. There have been constant rumors of a sale of the foundry division, which is in deficit. Last year, Intel announced a large-scale restructuring plan and laid off 15% of its total employees. Last year, it sold Altera, a programmable semiconductor (FPGA) company.

There is analysis that the Donald Trump administration in the United States expects that selling the foundry division will resolve Intel’s management difficulties and bring TSMC’s cutting-edge technology to the United States. The underlying intention is to revive struggling Intel by utilizing TSMC and secure cutting-edge process technology of 3 nanometers (㎚·1㎚=1 billionth of a meter) or less.

On the 13th, President Trump announced the imposition of reciprocal tariffs on each country and said, “Most semiconductors (used in the United States) are produced in Taiwan, and some are made in Korea. We want those companies to come to the United States.” Brian Jacobson, chief economist at Annex Wealth Management, analyzed that “Combining TSMC’s expertise and engineers with Intel’s infrastructure will help launch President Trump’s dream of making the United States the center of the semiconductor industry.” Some believe that

if TSMC pursues an acquisition of Intel under pressure from the Trump administration, it is more likely to take the form of technological cooperation rather than investment or factory acquisition. The cost of replacing equipment to manufacture TSMC's advanced semiconductors at Intel's factories and the difficulty in securing workers for the U.S. factory are also cited as obstacles to the acquisition.

Collaboration between the two companies was also discussed during the time of former President Joe Biden, Bloomberg reported. According to a source familiar with the discussions at the time, Biden administration officials proposed licensing manufacturing technology for TSMC to use in Intel factories, but TSMC was not interested, saying it could ultimately benefit competitors.

It was also pointed out that TSMC would have to overcome shareholder opposition to make this deal happen. Taiwan's United Daily reported that more than 72% of TSMC's shareholders, who are foreigners, could oppose the Intel Foundry acquisition on the grounds that it would infringe on shareholder interests. Citing a semiconductor expert, the United Daily pointed out that "foreigners are very aware of Intel's situation, which is struggling due to poor performance, and will oppose cooperation out of concern for shareholder losses."

In Taiwan, there have been voices indirectly opposing TSMC's acquisition of Intel. On the 15th, Wu Cheng-wen, a member of Taiwan's National Science and Technology Council (NSTC), said on social media, "Since each country has unique industrial strengths, there is no need for one country to completely dominate or monopolize all technologies."

재기 실패한 인텔 파운드리…트럼프 압박에 TSMC가 사나

재기 실패한 인텔 파운드리…트럼프 압박에 TSMC가 사나, 트럼프 행정부, 공장 인수 제안 AI칩 경쟁 밀려 실적 악화 분리 매각으로 경영난 해소 기대 TSMC 72% 외국인 주주가 '변수'

Last edited:

Machine translation (GPT4o):

Intel Foundry: TSMC Reportedly Acquiring a 20% Stake, Also Attracting Qualcomm and Broadcom Investments

Economic Daily News Reporters: Yin Huizhong, Zhong Huiling; Translated by Lu Silun / Comprehensive Report

Recent reports from foreign media and supply chain sources indicate that Taiwan Semiconductor Manufacturing Company (TSMC, 2330) may acquire a 20% stake in Intel's spun-off foundry services division (Intel Foundry Services, IFS) through either technology valuation or direct investment. Additionally, IFS is expected to attract investments from major U.S. IC design companies such as Qualcomm and Broadcom. This initiative aims to foster an innovative collaboration model, help Intel recover from its downturn, and counterbalance the growing dominance of Taiwan's IC design sector—led by MediaTek (2454)—in the U.S. market.

No Comments from Key Players

When approached for comments, both Qualcomm and Intel declined to respond to market speculation. TSMC also refrained from commenting, and as of the deadline, Broadcom had not provided a response. Meanwhile, The Wall Street Journal reported that the Trump administration had previously asked TSMC to evaluate the feasibility of controlling parts or all of Intel’s wafer fabrication business, potentially through an investor consortium or other structural arrangements.

Boosting U.S. Manufacturing Capacity

Sources suggest that strengthening Intel’s wafer manufacturing capabilities through TSMC aligns with the Trump administration’s goal of enhancing "Made in America" production. The latest reports indicate that U.S. officials hope TSMC will acquire a 20% stake in IFS, either through technology valuation or direct capital investment. However, the specifics—such as the investment structure and financial details—have yet to be finalized.

Qualcomm and Broadcom’s Strategic Investments

If Qualcomm and Broadcom invest in Intel's IFS, they will do so purely as financial backers, securing production capacity for their advanced process chips without getting involved in the foundry’s management. This approach aims to ensure a steady supply of high-end chips, strengthen U.S.-based semiconductor manufacturing, and boost IFS's capacity utilization. Furthermore, the move seeks to leverage the Trump administration's tariff strategies to counter MediaTek’s rapid expansion in the smartphone and networking chip markets, where it has been aggressively capturing U.S. market share.

Trump’s Strong Remarks on Taiwan’s Semiconductor Role

Last week, former U.S. President Donald Trump publicly stated, "Taiwan is taking away America’s semiconductor business. If we don’t bring it back, we won’t be happy." Analysts note that in the global semiconductor landscape, TSMC is the leading foundry, while MediaTek has overtaken Qualcomm in smartphone chip shipments, establishing itself as the market leader. MediaTek is also rapidly expanding in the WiFi chip sector, encroaching on Broadcom’s territory. This trend is seen as a significant challenge to U.S. semiconductor dominance.

Intel’s Efforts to Secure Qualcomm’s Advanced Process Orders

Intel had previously signaled its intention to secure Qualcomm as a customer for its advanced 20A process, but there have been no further updates. However, the U.S. government's ambition to strengthen Intel's foundry business, ensure sufficient advanced process capacity for American IC designers, and develop a more self-reliant semiconductor supply chain is evident. This strategy aims not only to challenge TSMC’s dominance in foundry services but also to solidify the U.S.'s existing IC design leadership.

Qualcomm and Broadcom's Move to Counter MediaTek’s Rise

By investing in IFS, Qualcomm and Broadcom intend to curb MediaTek’s growing influence and reclaim leadership in smartphone chip shipments. Additionally, they aim to prevent further market share losses in the networking chip segment.

Potential Intel Split: Foundry and Design Businesses

Sources reveal that both TSMC and Broadcom are separately evaluating potential deals involving Intel. There is speculation that Intel may be split into two businesses—chip manufacturing and chip design. TSMC is reportedly studying the feasibility of controlling parts or all of Intel’s wafer fabrication plants, while Broadcom is assessing the acquisition of Intel’s chip design and marketing divisions.

According to insiders, Broadcom has been closely evaluating Intel’s chip design and marketing operations and has had informal discussions with advisors regarding a potential bid. However, Broadcom is unlikely to make a formal offer unless it finds a partner willing to take over Intel’s manufacturing operations.

Intel’s Leadership and Strategic Realignment

Intel’s interim Executive Chairman, Frank Yeary, has been leading discussions with potential investors and U.S. government officials. The company has already begun separating its chip manufacturing division from other business units, a move that some analysts believe is laying the groundwork for a possible corporate split.

money.udn.com

money.udn.com

Intel Foundry: TSMC Reportedly Acquiring a 20% Stake, Also Attracting Qualcomm and Broadcom Investments

Economic Daily News Reporters: Yin Huizhong, Zhong Huiling; Translated by Lu Silun / Comprehensive Report

Recent reports from foreign media and supply chain sources indicate that Taiwan Semiconductor Manufacturing Company (TSMC, 2330) may acquire a 20% stake in Intel's spun-off foundry services division (Intel Foundry Services, IFS) through either technology valuation or direct investment. Additionally, IFS is expected to attract investments from major U.S. IC design companies such as Qualcomm and Broadcom. This initiative aims to foster an innovative collaboration model, help Intel recover from its downturn, and counterbalance the growing dominance of Taiwan's IC design sector—led by MediaTek (2454)—in the U.S. market.

No Comments from Key Players

When approached for comments, both Qualcomm and Intel declined to respond to market speculation. TSMC also refrained from commenting, and as of the deadline, Broadcom had not provided a response. Meanwhile, The Wall Street Journal reported that the Trump administration had previously asked TSMC to evaluate the feasibility of controlling parts or all of Intel’s wafer fabrication business, potentially through an investor consortium or other structural arrangements.

Boosting U.S. Manufacturing Capacity

Sources suggest that strengthening Intel’s wafer manufacturing capabilities through TSMC aligns with the Trump administration’s goal of enhancing "Made in America" production. The latest reports indicate that U.S. officials hope TSMC will acquire a 20% stake in IFS, either through technology valuation or direct capital investment. However, the specifics—such as the investment structure and financial details—have yet to be finalized.

Qualcomm and Broadcom’s Strategic Investments

If Qualcomm and Broadcom invest in Intel's IFS, they will do so purely as financial backers, securing production capacity for their advanced process chips without getting involved in the foundry’s management. This approach aims to ensure a steady supply of high-end chips, strengthen U.S.-based semiconductor manufacturing, and boost IFS's capacity utilization. Furthermore, the move seeks to leverage the Trump administration's tariff strategies to counter MediaTek’s rapid expansion in the smartphone and networking chip markets, where it has been aggressively capturing U.S. market share.

Trump’s Strong Remarks on Taiwan’s Semiconductor Role

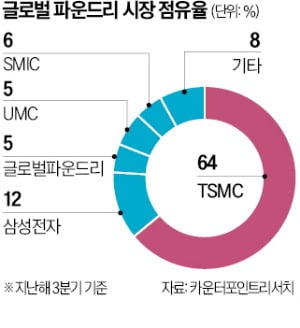

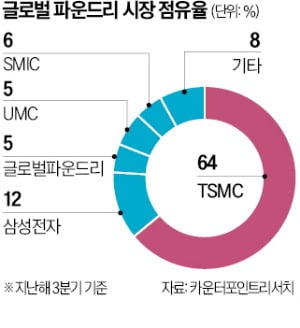

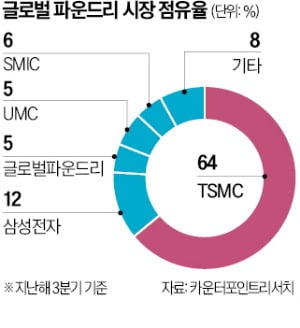

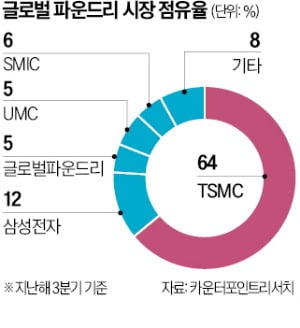

Last week, former U.S. President Donald Trump publicly stated, "Taiwan is taking away America’s semiconductor business. If we don’t bring it back, we won’t be happy." Analysts note that in the global semiconductor landscape, TSMC is the leading foundry, while MediaTek has overtaken Qualcomm in smartphone chip shipments, establishing itself as the market leader. MediaTek is also rapidly expanding in the WiFi chip sector, encroaching on Broadcom’s territory. This trend is seen as a significant challenge to U.S. semiconductor dominance.

Intel’s Efforts to Secure Qualcomm’s Advanced Process Orders

Intel had previously signaled its intention to secure Qualcomm as a customer for its advanced 20A process, but there have been no further updates. However, the U.S. government's ambition to strengthen Intel's foundry business, ensure sufficient advanced process capacity for American IC designers, and develop a more self-reliant semiconductor supply chain is evident. This strategy aims not only to challenge TSMC’s dominance in foundry services but also to solidify the U.S.'s existing IC design leadership.

Qualcomm and Broadcom's Move to Counter MediaTek’s Rise

By investing in IFS, Qualcomm and Broadcom intend to curb MediaTek’s growing influence and reclaim leadership in smartphone chip shipments. Additionally, they aim to prevent further market share losses in the networking chip segment.

Potential Intel Split: Foundry and Design Businesses

Sources reveal that both TSMC and Broadcom are separately evaluating potential deals involving Intel. There is speculation that Intel may be split into two businesses—chip manufacturing and chip design. TSMC is reportedly studying the feasibility of controlling parts or all of Intel’s wafer fabrication plants, while Broadcom is assessing the acquisition of Intel’s chip design and marketing divisions.

According to insiders, Broadcom has been closely evaluating Intel’s chip design and marketing operations and has had informal discussions with advisors regarding a potential bid. However, Broadcom is unlikely to make a formal offer unless it finds a partner willing to take over Intel’s manufacturing operations.

Intel’s Leadership and Strategic Realignment

Intel’s interim Executive Chairman, Frank Yeary, has been leading discussions with potential investors and U.S. government officials. The company has already begun separating its chip manufacturing division from other business units, a move that some analysts believe is laying the groundwork for a possible corporate split.

英特爾晶圓廠 台積傳入股二成 也將引進高通、博通等大咖 | 產業熱點 | 產業 | 經濟日報

外媒與供應鏈最新消息傳出,台積電可能透過技術作價或實際出資持有英特爾分拆出來的晶圓代工服務部門(IFS)二成股權,IFS...

Hopefully this is a bad translation because the title does not match the content:

Intel's wafer foundry TSMC acquires 20% of its shares and will also introduce Qualcomm, Broadcom and other big players

Trump administration proposes factory acquisition, AI chip competition is pushed back, performance worsens, management difficulties expected to be resolved through spin-off sale, TSMC's 72% foreign shareholders are a 'variable'.

The rumors of Taiwan's TSMC acquiring Intel's foundry division are being interpreted as a result of Intel's recent worst management crisis. Intel, which once dominated the global semiconductor market, is struggling to respond to the mobile-centric changes such as smartphones and is struggling to compete with artificial intelligence (AI) chip manufacturers, resulting in worsening performance.

According to foreign media on the 16th, Intel's re-entry into the foundry business, which it has been pursuing since 2021, is largely considered to be a failure. This is because it has failed to overcome the wall of TSMC and Samsung Electronics, which dominate the memory semiconductor market. There have been constant rumors of a sale of the foundry division, which is in deficit. Last year, Intel announced a large-scale restructuring plan and laid off 15% of its total employees. Last year, it sold Altera, a programmable semiconductor (FPGA) company.

There is analysis that the Donald Trump administration in the United States expects that selling the foundry division will resolve Intel’s management difficulties and bring TSMC’s cutting-edge technology to the United States. The underlying intention is to revive struggling Intel by utilizing TSMC and secure cutting-edge process technology of 3 nanometers (㎚·1㎚=1 billionth of a meter) or less.

On the 13th, President Trump announced the imposition of reciprocal tariffs on each country and said, “Most semiconductors (used in the United States) are produced in Taiwan, and some are made in Korea. We want those companies to come to the United States.” Brian Jacobson, chief economist at Annex Wealth Management, analyzed that “Combining TSMC’s expertise and engineers with Intel’s infrastructure will help launch President Trump’s dream of making the United States the center of the semiconductor industry.” Some believe that

if TSMC pursues an acquisition of Intel under pressure from the Trump administration, it is more likely to take the form of technological cooperation rather than investment or factory acquisition. The cost of replacing equipment to manufacture TSMC's advanced semiconductors at Intel's factories and the difficulty in securing workers for the U.S. factory are also cited as obstacles to the acquisition.

Collaboration between the two companies was also discussed during the time of former President Joe Biden, Bloomberg reported. According to a source familiar with the discussions at the time, Biden administration officials proposed licensing manufacturing technology for TSMC to use in Intel factories, but TSMC was not interested, saying it could ultimately benefit competitors.

It was also pointed out that TSMC would have to overcome shareholder opposition to make this deal happen. Taiwan's United Daily reported that more than 72% of TSMC's shareholders, who are foreigners, could oppose the Intel Foundry acquisition on the grounds that it would infringe on shareholder interests. Citing a semiconductor expert, the United Daily pointed out that "foreigners are very aware of Intel's situation, which is struggling due to poor performance, and will oppose cooperation out of concern for shareholder losses."

In Taiwan, there have been voices indirectly opposing TSMC's acquisition of Intel. On the 15th, Wu Cheng-wen, a member of Taiwan's National Science and Technology Council (NSTC), said on social media, "Since each country has unique industrial strengths, there is no need for one country to completely dominate or monopolize all technologies."

재기 실패한 인텔 파운드리…트럼프 압박에 TSMC가 사나

재기 실패한 인텔 파운드리…트럼프 압박에 TSMC가 사나, 트럼프 행정부, 공장 인수 제안 AI칩 경쟁 밀려 실적 악화 분리 매각으로 경영난 해소 기대 TSMC 72% 외국인 주주가 '변수'www.hankyung.com

Trump can invoke DPA, and expropriate Intel's ownership from shareholders no questions asked

Taiwanese media also reported that the US could ask TSMC's suppliers in Europe and Japan to stop supplying Taiwan as a form of pressure.Trump can invoke DPA, and expropriate Intel's ownership from shareholders no questions asked

Those arguments are going nowhere.

Timecode: 00:04:17

Last edited:

Machine translation (GPT4o):

Intel Foundry: TSMC Reportedly Acquiring a 20% Stake, Also Attracting Qualcomm and Broadcom Investments

Economic Daily News Reporters: Yin Huizhong, Zhong Huiling; Translated by Lu Silun / Comprehensive Report

Recent reports from foreign media and supply chain sources indicate that Taiwan Semiconductor Manufacturing Company (TSMC, 2330) may acquire a 20% stake in Intel's spun-off foundry services division (Intel Foundry Services, IFS) through either technology valuation or direct investment. Additionally, IFS is expected to attract investments from major U.S. IC design companies such as Qualcomm and Broadcom. This initiative aims to foster an innovative collaboration model, help Intel recover from its downturn, and counterbalance the growing dominance of Taiwan's IC design sector—led by MediaTek (2454)—in the U.S. market.

No Comments from Key Players

When approached for comments, both Qualcomm and Intel declined to respond to market speculation. TSMC also refrained from commenting, and as of the deadline, Broadcom had not provided a response. Meanwhile, The Wall Street Journal reported that the Trump administration had previously asked TSMC to evaluate the feasibility of controlling parts or all of Intel’s wafer fabrication business, potentially through an investor consortium or other structural arrangements.

Boosting U.S. Manufacturing Capacity

Sources suggest that strengthening Intel’s wafer manufacturing capabilities through TSMC aligns with the Trump administration’s goal of enhancing "Made in America" production. The latest reports indicate that U.S. officials hope TSMC will acquire a 20% stake in IFS, either through technology valuation or direct capital investment. However, the specifics—such as the investment structure and financial details—have yet to be finalized.

Qualcomm and Broadcom’s Strategic Investments

If Qualcomm and Broadcom invest in Intel's IFS, they will do so purely as financial backers, securing production capacity for their advanced process chips without getting involved in the foundry’s management. This approach aims to ensure a steady supply of high-end chips, strengthen U.S.-based semiconductor manufacturing, and boost IFS's capacity utilization. Furthermore, the move seeks to leverage the Trump administration's tariff strategies to counter MediaTek’s rapid expansion in the smartphone and networking chip markets, where it has been aggressively capturing U.S. market share.

Trump’s Strong Remarks on Taiwan’s Semiconductor Role

Last week, former U.S. President Donald Trump publicly stated, "Taiwan is taking away America’s semiconductor business. If we don’t bring it back, we won’t be happy." Analysts note that in the global semiconductor landscape, TSMC is the leading foundry, while MediaTek has overtaken Qualcomm in smartphone chip shipments, establishing itself as the market leader. MediaTek is also rapidly expanding in the WiFi chip sector, encroaching on Broadcom’s territory. This trend is seen as a significant challenge to U.S. semiconductor dominance.

Intel’s Efforts to Secure Qualcomm’s Advanced Process Orders

Intel had previously signaled its intention to secure Qualcomm as a customer for its advanced 20A process, but there have been no further updates. However, the U.S. government's ambition to strengthen Intel's foundry business, ensure sufficient advanced process capacity for American IC designers, and develop a more self-reliant semiconductor supply chain is evident. This strategy aims not only to challenge TSMC’s dominance in foundry services but also to solidify the U.S.'s existing IC design leadership.

Qualcomm and Broadcom's Move to Counter MediaTek’s Rise

By investing in IFS, Qualcomm and Broadcom intend to curb MediaTek’s growing influence and reclaim leadership in smartphone chip shipments. Additionally, they aim to prevent further market share losses in the networking chip segment.

Potential Intel Split: Foundry and Design Businesses

Sources reveal that both TSMC and Broadcom are separately evaluating potential deals involving Intel. There is speculation that Intel may be split into two businesses—chip manufacturing and chip design. TSMC is reportedly studying the feasibility of controlling parts or all of Intel’s wafer fabrication plants, while Broadcom is assessing the acquisition of Intel’s chip design and marketing divisions.

According to insiders, Broadcom has been closely evaluating Intel’s chip design and marketing operations and has had informal discussions with advisors regarding a potential bid. However, Broadcom is unlikely to make a formal offer unless it finds a partner willing to take over Intel’s manufacturing operations.

Intel’s Leadership and Strategic Realignment

Intel’s interim Executive Chairman, Frank Yeary, has been leading discussions with potential investors and U.S. government officials. The company has already begun separating its chip manufacturing division from other business units, a move that some analysts believe is laying the groundwork for a possible corporate split.

英特爾晶圓廠 台積傳入股二成 也將引進高通、博通等大咖 | 產業熱點 | 產業 | 經濟日報

外媒與供應鏈最新消息傳出,台積電可能透過技術作價或實際出資持有英特爾分拆出來的晶圓代工服務部門(IFS)二成股權,IFS...money.udn.com

If this it not completely written by AI it is definitely AI “influenced”.

GPT4o's behaviour is changing. It is not following instructions as it is. It seems OpenAI's tries infusing reasoning in its behaviour. But it gets the main points across.If this it not completely written by AI it is definitely AI “influenced”.

Joseph Bonetti • 2nd Principal Engineering Program Manager at Intel Corporation

Recent articles about a possible Intel Foundry / TSMC joint entity or outright sell-off to TSMC have many incorrect statements about Intel's technological status. For instance, many articles say TSMC engineers will come over and share their know-how and help Intel to get their "3nm" & "2nm" nodes working. Huh? Intel's "3nm" node, Intel 3, has been in production for many months & is used in Intel's latest Xeon 6 chips. Intel 18A, Intel's "2nm" node is nearing completion, showing healthy progress, sampling chips to laptop makers, & is on track to be in Panther Lake chips late this year. Does TSMC have their "2nm" node, N2, up and running? No. Neither company has a "2nm" node at this point. However, Intel is on track to have theirs in production sooner.

Recent reports suggest Intel 18A will outperform TSMC's N2. Both of these upcoming "2nm" nodes feature a new type of transistor called gate all around (GAA). However, InteI's 18A node has backside power delivery, an amazing engineering feat in and of itself. 18A is the more advanced node. What about future nodes beyond N2 and 18A? These will likely need ASML's latest EUV tools called high numerical aperture (high NA) EUV. Intel is the only foundry that has one of these tools up and running and performing high NA R&D. Intel has two of these $350M machines up and running. It appears Intel will have at least a one-year headstart with high NA. It was reported many months ago that Intel bought up ASML's full capacity of high NA tools for 2024.

So who would be helping who exactly if there is a joint venture?

Yes, Intel Foundry is hurting financially because they're spending tens of billions building new foundries and on EUV tools. In addition, Intel Foundry has not yet attracted any large external customers. But this is natural. No large potential customer (Nvidia, Qualcomm, etc...) is going to risk their partnership with TSMC to try out something unproven. Intel Foundry is on the cusp of proving themselves with their own products, and soon after with MSFT and Amazon who are both early 18A customers. Once the world sees this success, big names will bring some production over to Intel Foundry. Technical competition from Intel plus the threat of tariffs are jointly a huge problem for TSMC. Handing over control of Intel's foundries solves this problem for TSMC, but hurts Intel, hurts US leadership, and gives credibility to the false idea that Intel Foundry is not as advanced as TSMC.

Intel Leaders, Intel Board, Trump Administration, please don't sell out and/or give control of Intel Foundry to TSMC, just as Intel is taking a technical lead and getting out of first gear. This would be a horrible, demoralizing mistake.

Last edited:

If this decision is made, who will be the winner? neither TSMC nor Intel, will it be Trump?Intel Leaders, Intel Board, Trump Administration, please don't sell out and/or give control of Intel Foundry to TSMC, just as Intel is taking a technical lead and getting out of first gear. This would be a horrible, demoralizing mistake.

If this decision is made, who will be the winner? neither TSMC nor Intel, will it be Trump?

There no winners. There will be plenty of scapegoats but no winners.