<header class="td-post-title" style="box-sizing: border-box; text-align: center;">The Secondhand Equipment Market and the Semiconductor Industry

</header>

The Rise of the Secondhand Equipment Market

While a market for used semiconductor equipment has existed for years, that market has heated up since December 2015. In part, these robust sales are being driven by the internet of things market, where previous-generation technology is often adequate to produce the increased numbers of semiconductors needed.

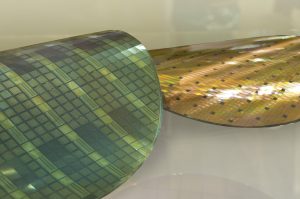

Equipment needed to produce 200mm wafers, in particular, is in high demand. While chip capacity demand for 300mm wafers is increasing, many objects in the internet of things use 200mm wafers, and used equipment can be an inexpensive starting point to fulfill the demand.

Some types of used equipment is even in short supply, and those familiar with the marketplace anticipate that the demand for 200mm wafers will continue into the foreseeable future for the fabrication of image sensors, analog products, microcontrollers, display drivers, and other legacy items associated with the internet of things.

The used equipment that’s in such demand often comes becomes available when leases on expensive chipmaking gear expire. The manufacturer then puts the equipment on the used market, where manufacturers involved with the internet of things tech snap it up. Many specific tools, including ion implanters and some metrology tools, are in extremely short supply. Another glitch in the secondhand market can occur when the supply of skilled technicians and engineers needed to work with these legacy tools doesn’t keep pace with the demand, even when the second equipment is available.

Buying on the Secondhand Market

The first-run life of a cutting-edge tool is about two years, at the maximum. However, the tool itself might have a life cycle of up to 15 usable years. Given this, it’s no wonder that customers are interested in the secondhand market, since many companies end up discarding equipment with a lot of life left in it.

That used equipment needs support to keep going, however. The need for spare parts is inevitable, as is the need for updated software. As a result, some customers look to the original equipment manufacturers to manage the risk of buying older equipment, especially when a software license is still available for the use of the tool.

As OEM companies stop providing support, however, the benefits of buying used equipment from them start to fade. In their place, used equipment companies and brokers have arisen, with those that provide responsive service surviving in the crowded marketplace. Many of the top companies now refurbish specific gear, especially equipment in high demand, or they’re able to direct buyers to refurbishment centers.

Customers who transact with used equipment vendors of all sorts, including brokers and auction houses, realize that they’re not getting cutting-edge tools. However, the price differential can be so substantial that it makes all kinds of sense to go the used route for certain applications. If a company working in internet-of-things technology needs to reconfigure a 200mm tool for a specific application, why pay a premium when a legacy tool can do the job at a fraction of the price?

The Bottom Line

The bottom line, of course, is one of the key reasons that the secondhand equipment market shows no signs of slowing. This explosive growth parallels that anticipated for the semiconductor industry overall in the next few years. As the internet-of-things market continues to expand, with increased demand for connected tech, it’s very likely that these two markets will continue to expand side by side into the foreseeable future.

Need semiconductor equipment?

EquipNet carries a range of equipment for all of your semiconductor needs, including front-end equipment, back-end equipment, electronic test and measurement, metrology, spare parts and much more.

For more information, visit our Semiconductor Industry page here, or contact us:

Greg Feinberg |Director, Global Sales|

Gregf@equipnet.com

</header>

The Rise of the Secondhand Equipment Market

While a market for used semiconductor equipment has existed for years, that market has heated up since December 2015. In part, these robust sales are being driven by the internet of things market, where previous-generation technology is often adequate to produce the increased numbers of semiconductors needed.

Equipment needed to produce 200mm wafers, in particular, is in high demand. While chip capacity demand for 300mm wafers is increasing, many objects in the internet of things use 200mm wafers, and used equipment can be an inexpensive starting point to fulfill the demand.

Some types of used equipment is even in short supply, and those familiar with the marketplace anticipate that the demand for 200mm wafers will continue into the foreseeable future for the fabrication of image sensors, analog products, microcontrollers, display drivers, and other legacy items associated with the internet of things.

The used equipment that’s in such demand often comes becomes available when leases on expensive chipmaking gear expire. The manufacturer then puts the equipment on the used market, where manufacturers involved with the internet of things tech snap it up. Many specific tools, including ion implanters and some metrology tools, are in extremely short supply. Another glitch in the secondhand market can occur when the supply of skilled technicians and engineers needed to work with these legacy tools doesn’t keep pace with the demand, even when the second equipment is available.

Buying on the Secondhand Market

The first-run life of a cutting-edge tool is about two years, at the maximum. However, the tool itself might have a life cycle of up to 15 usable years. Given this, it’s no wonder that customers are interested in the secondhand market, since many companies end up discarding equipment with a lot of life left in it.

That used equipment needs support to keep going, however. The need for spare parts is inevitable, as is the need for updated software. As a result, some customers look to the original equipment manufacturers to manage the risk of buying older equipment, especially when a software license is still available for the use of the tool.

As OEM companies stop providing support, however, the benefits of buying used equipment from them start to fade. In their place, used equipment companies and brokers have arisen, with those that provide responsive service surviving in the crowded marketplace. Many of the top companies now refurbish specific gear, especially equipment in high demand, or they’re able to direct buyers to refurbishment centers.

Customers who transact with used equipment vendors of all sorts, including brokers and auction houses, realize that they’re not getting cutting-edge tools. However, the price differential can be so substantial that it makes all kinds of sense to go the used route for certain applications. If a company working in internet-of-things technology needs to reconfigure a 200mm tool for a specific application, why pay a premium when a legacy tool can do the job at a fraction of the price?

The Bottom Line

The bottom line, of course, is one of the key reasons that the secondhand equipment market shows no signs of slowing. This explosive growth parallels that anticipated for the semiconductor industry overall in the next few years. As the internet-of-things market continues to expand, with increased demand for connected tech, it’s very likely that these two markets will continue to expand side by side into the foreseeable future.

Need semiconductor equipment?

EquipNet carries a range of equipment for all of your semiconductor needs, including front-end equipment, back-end equipment, electronic test and measurement, metrology, spare parts and much more.

For more information, visit our Semiconductor Industry page here, or contact us:

Greg Feinberg |Director, Global Sales|

Gregf@equipnet.com

Last edited by a moderator: