(Reuters) -Chipmaker Intel has approached Taiwan Semiconductor Manufacturing Company about investments in manufacturing or partnerships, the Wall Street Journal reported on Thursday, citing people familiar with the matter.

The development follows a Bloomberg report on Wednesday that said Intel was in talks with Apple about securing an investment in the struggling chipmaker.

Intel's efforts to get outside investment began before U.S. President Donald Trump showed an interest in the company last month, WSJ said, but have gone into overdrive since the U.S. took a 10% stake in it.

Both Intel and TSMC declined to comment on the report.

Last week, Nvidia announced it would invest $5 billion in Intel for a roughly 4% stake in the company.

The chipmaker also got a $2 billion capital injection from SoftBank Group in August.

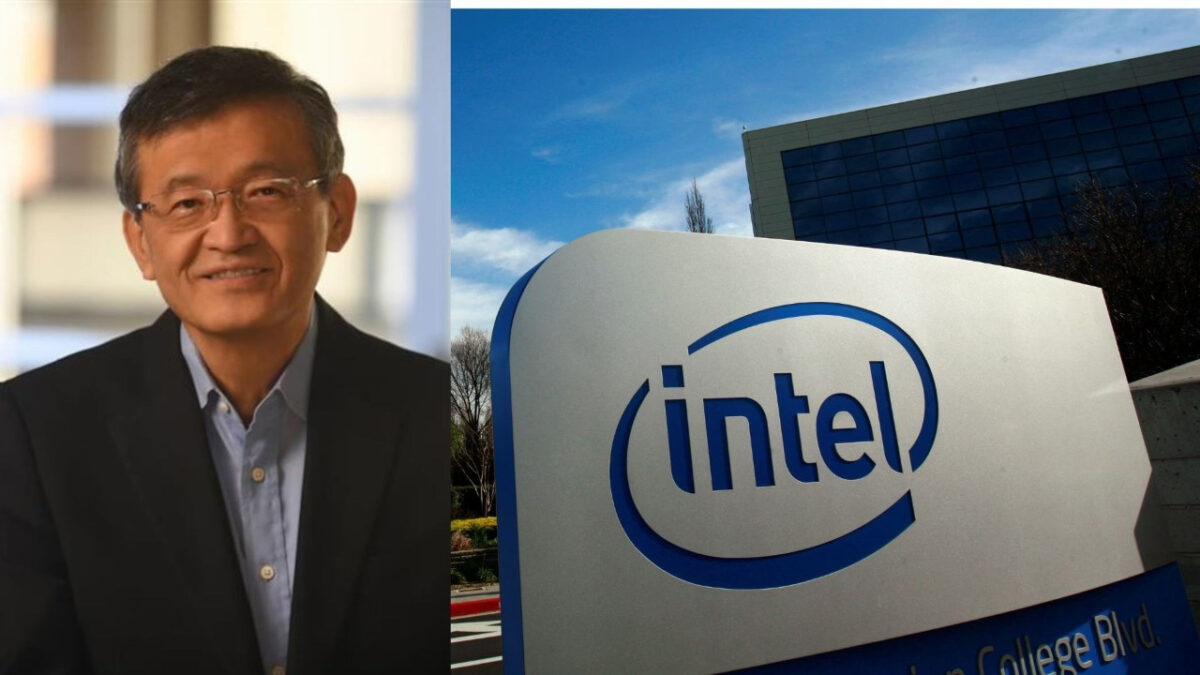

Intel CEO Lip-Bu Tan has been trying to bring in partners as part of a turnaround at the ailing chipmaker.

Once the chip industry's flag bearer that claimed to put the "silicon" in Silicon Valley, Intel has struggled to compete in the booming AI race, falling behind peers such as Nvidia and Advanced Micro Devices.

Intel has invested billions of dollars in setting up a contract manufacturing business that has struggled to compete with TSMC and barely attracted external customers.

The two companies had discussed a preliminary agreement to form a joint venture, with TSMC taking a 20% stake in the new company, the Information had reported in April.