It's a one of the most clueless articles I've ever seen. And I'm a mechanical engineer, so well.... I can only imagine how much problems a legal person would find....

First, the article fails to take cultural linguistic differences in account; "monopolies" are _only_ forbidden in US English language; but not in English language. Where I live, a monopoly doesn't imply "a felony", while in US English, it does. Stricter speaking, it should be called "coercive monopoly" which is forbidden, but that nuance usually gets lost...

Second of all; if you actually read the Sherman Act, which takes you exactly 2 minutes, you see that's what's a felony, is a contract which in some way hampers those in the US; so it's besides the point whether TSMC has factories in the US or not.

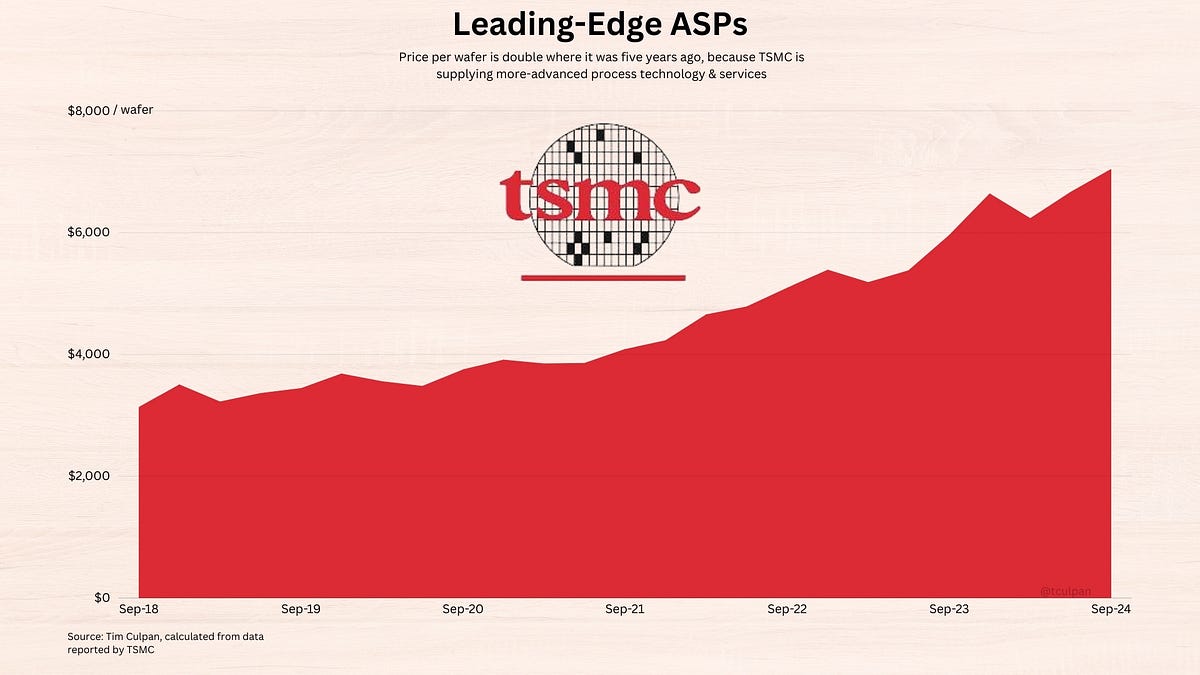

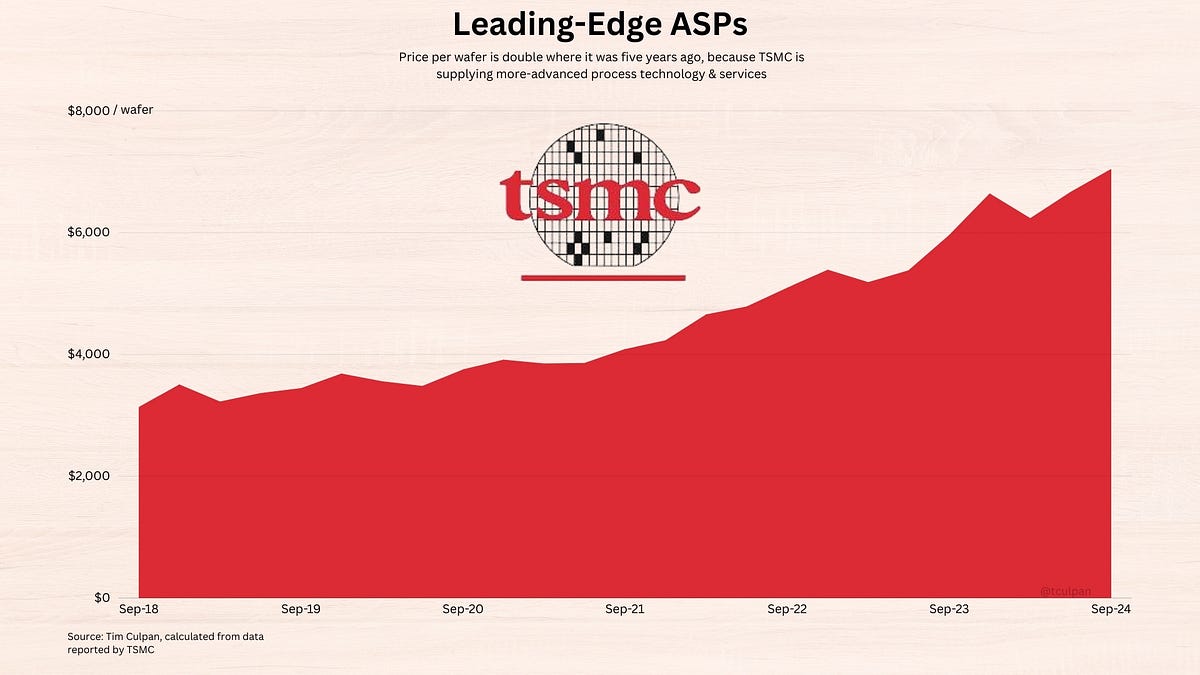

Third, it doesn;t look to context; ASML has the same profit margin as TSMC (and so did ARM in the past), and no US company ever complained much. And the profits or losses of course have _no relation_ with any violiatons as mentioned within the Sherman act article 1 and 2.

Fourth, the article assumes if Intel fab is succesfull, TSMC cannot be accused of monopoly abuse. That's wrong, because every company who has pricing power (in my jurisdiction this could already if you have more than 30% market share), you can still be accused of anti-competitive behavior.

Fifth, what TSCM does or does not address as TAM is not related to being anti-competetive in any way.

Sixth, it seems to assume in the end that things are related to politics, but that's not the way it works; or at least not the way it should work.

A US company which feels it's victim of anti-competitive behavoir files a complaint with the FTC or DJI, usually the government is no party in this conflict.

Seventh, it seems to assume that there's actually a result if a company is found guilty of anti competitive behavoir. Examining the matter however, one sees that even after being found guilty, Intel, for example, after more than 10 years of legal battles, didn't have to pay a single Euro fine after their anti-competitive breaking of the law. So _if_ a TSMC client or competitor ever raises a complaint, nothing will happen within the next 10 years; except for some lawyers buying the quickest Lucid's and some castles here and there.

Eight, the article seems to imply that US regulators should abuse monopoly law for political gain. Of course, that's not unthinkable giving the incoming US administration, however, it doesn't take into account any retaliatory measures which could be taken by TSMC or Taiwan. It's the US (nVidia, Qualcomm) which needs Taiwan and the Netherlands, and (apart of some EUV source which could be swapped for Gigaphoton) not the other way around. Because the Taiwanese and Dutch (and German and Japanese) could easily sell to the Chinese instead of the US; the Chinese will be happy to fill the demand gap.

timculpan.substack.com

timculpan.substack.com