STRENGTHENING THE U.S. SEMICONDUCTOR SUPPLY CHAIN

NEW REPORT PROJECTS POSITIVE IMPACT OF CHIPS ACT, BUT CHALLENGES REMAIN

A new report by the Semiconductor Industry Association (SIA) and the Boston Consulting Group on the semiconductor supply chain forecasts significant improvements in the resilience of the supply chain in both the U.S. and globally in coming years. The study shows that investments from the industry, facilitated by incentives under the CHIPS Act, are making progress in growing domestic semiconductor manufacturing and strengthening the U.S. economy. Among other things, the report finds:

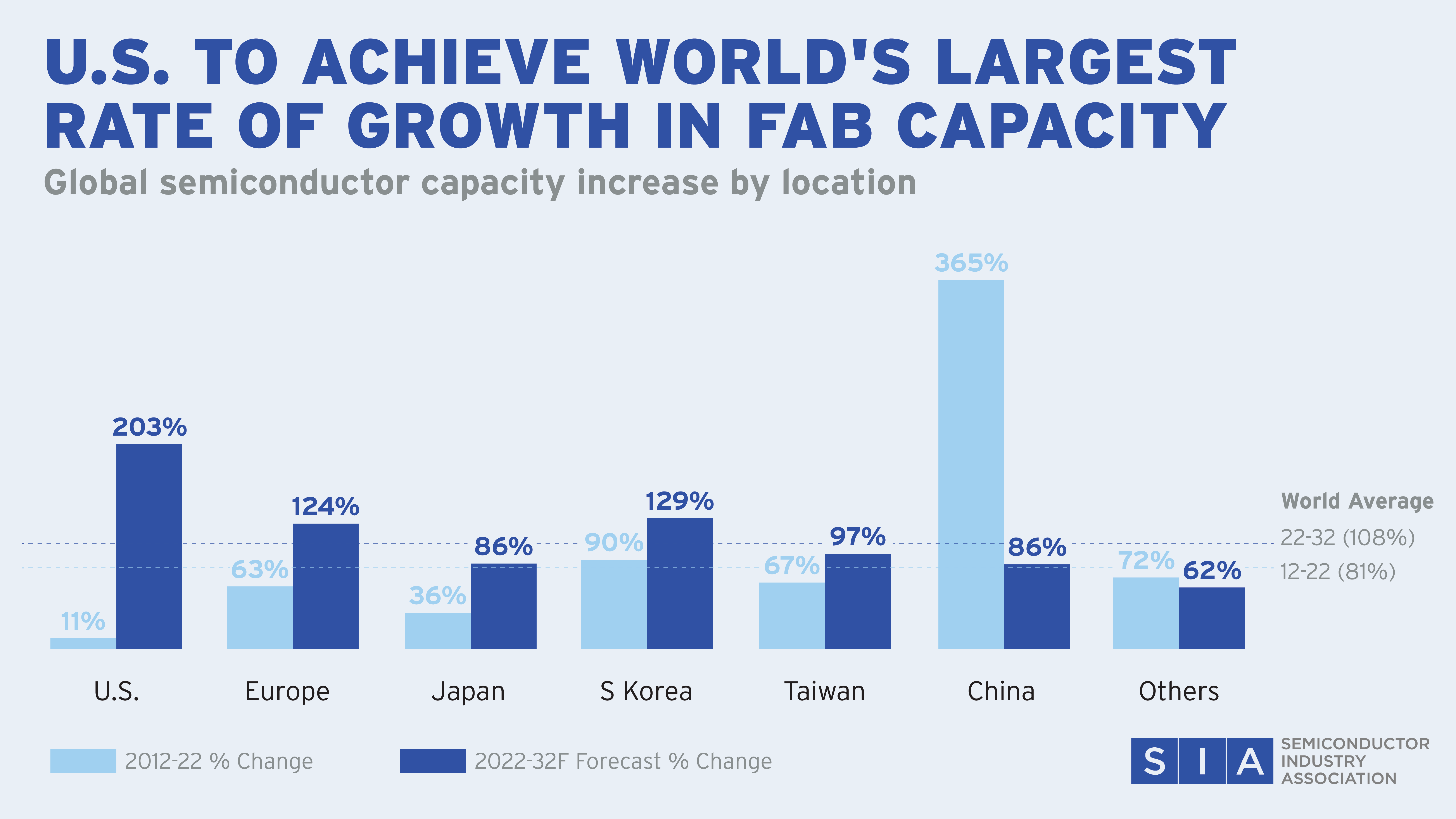

• U.S. fab capacity is projected to increase by 203% by 2032, a tripling of U.S. capacity.

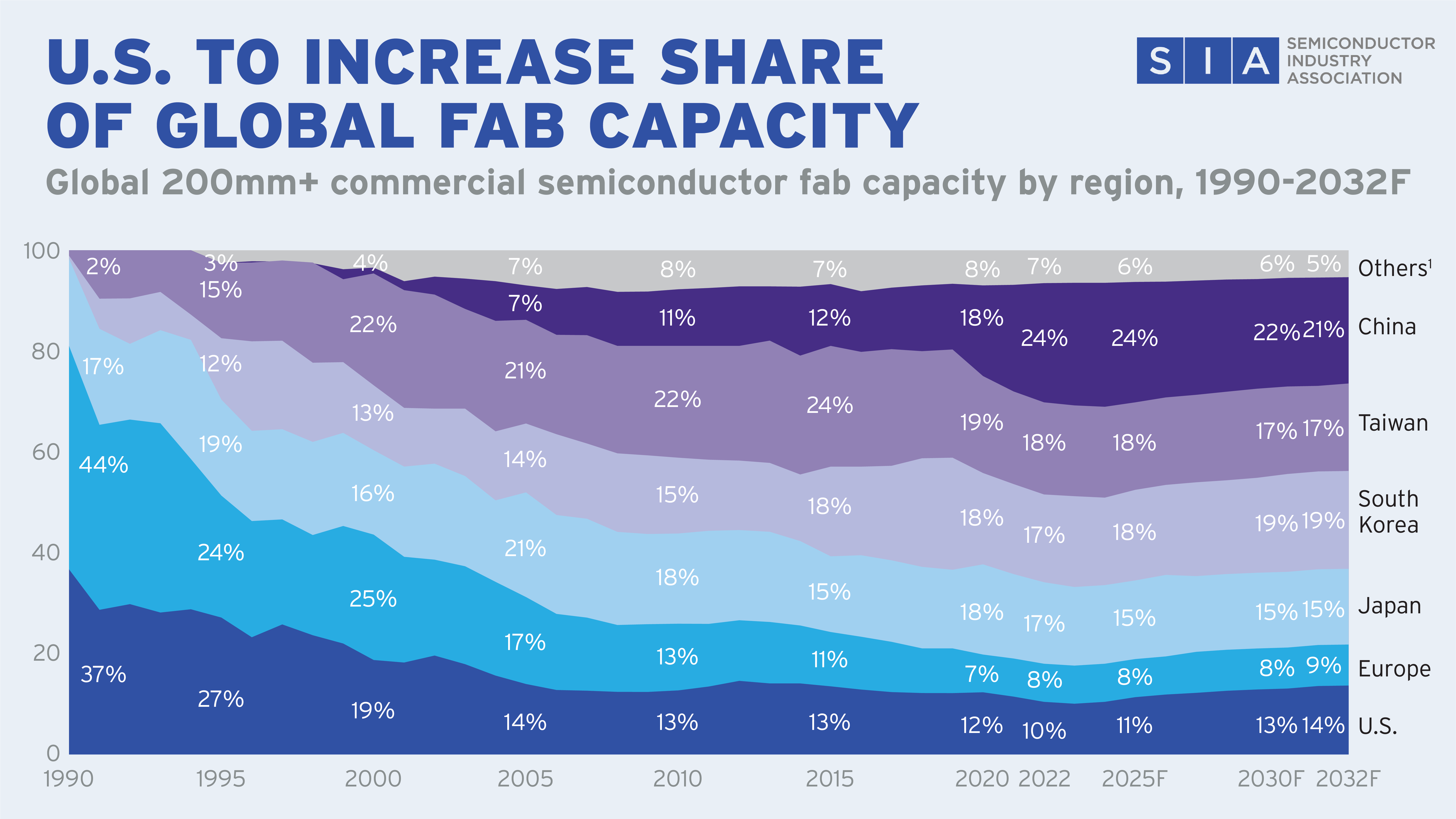

• The U.S. is expected to increase its share of global fab capacity for the first time in decades, growing from 10% today to 14% by 2032.

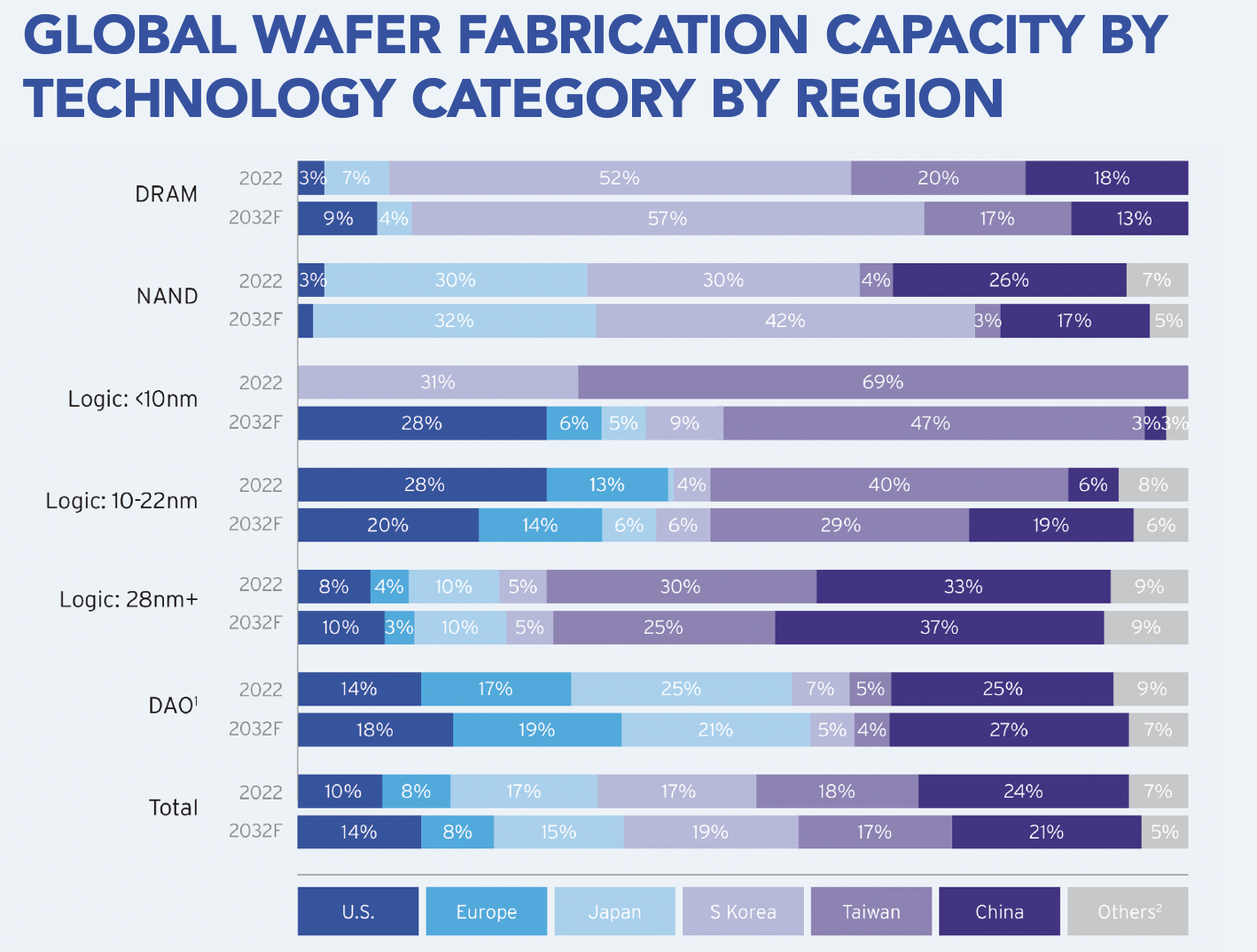

• The U.S. is forecast to grow its capabilities in critical technology segments, such as leading edge fabrication, DRAM memory, analog, and advanced packaging. For example, U.S. capacity for advanced logic will grow from 0% in 2022 to 28% by 2032, including new capabilities at the leading edge.

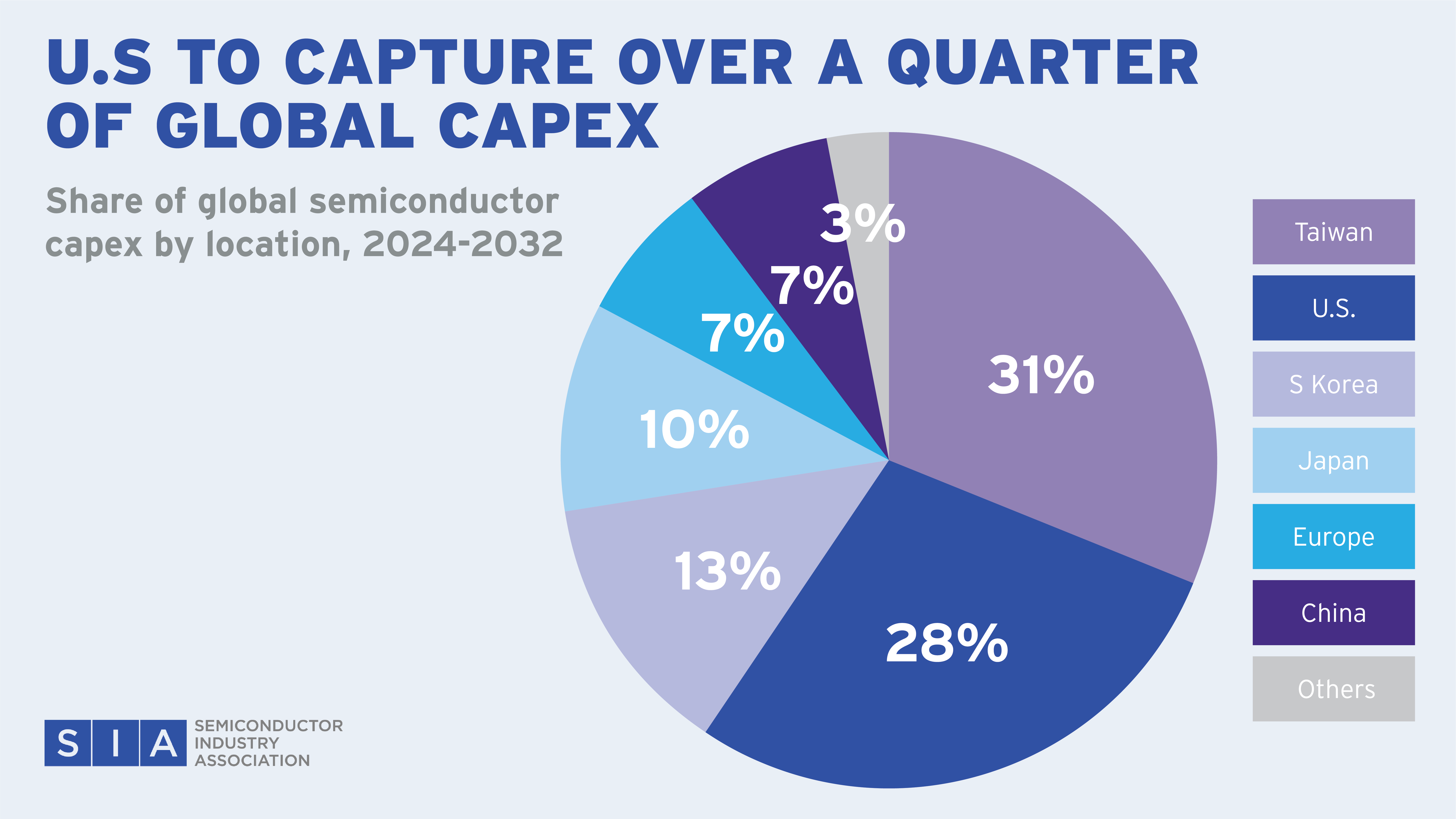

• The U.S. will secure more than one-quarter (28%) of global capital expenditures between 2024-2032 – an estimated $646 billion – an amount second only to Taiwan.

Despite this substantial progress, areas of vulnerability in the ecosystem remain, and additional work is needed to maintain this momentum and secure key areas of the chip supply chain.

DOWNLOAD THE SIA SUMMARY

VIEW THE SIA PRESS RELEASE

KEY FINDING: THE U.S. SEMICONDUCTOR SUPPLY CHAIN IS MAKING PROGRESS TO BECOMING MORE RESILIENT.

America is making progress toward its goal of securing the semiconductor supply chain. The report shows that semiconductor industry investments in the U.S., incentivized by the CHIPS Act, have amounted to nearly $450 billion across 25 states. These investments are working to advance American leadership and increase domestic semiconductor manufacturing capacity.

U.S. TO ACHIEVE WORLD’S LARGEST RATE OF GROWTH IN FAB CAPACITY

U.S. fab capacity as measured by wafer starts per month (wspm) is projected to triple over the next decade, increasing by 203%, the largest projected percent increase in the world. In contrast, U.S. fab capacity grew only 11% in the prior decade (2012-22).

U.S. TO INCREASE SHARE OF GLOBAL FAB CAPACITY

The U.S. share of global fab capacity has experienced a multi-decade decline, decreasing from 37% in 1990 to 12% in 2020, and further declining to 10% as of 2022. The report projects U.S. fab capacity would have declined further to 8% by 2032 without ambitious action to promote new investment. Based on announced projects to date, new investments in the U.S. are forecast to increase America’s share of global

fab capacity to 14% by 2032, marking the country’s first increase in decades.

U.S. GROWING IN KEY TECHNOLOGY SEGMENTS, INCLUDING ADVANCED LOGIC, AND CONTINUES LEADERSHIP IN KEY AREAS

The U.S. will gain share of fab capacity in key technology segments, including leading edge logic, DRAM memory, and analog. For example, while the U.S. previously relied exclusively on sources overseas for the most advanced chips, the U.S. will gain new capabilities in advanced logic, growing its share from 0% in 2022 to 28% by 2032. At the same time, the U.S. continues to lead the world in its overall contribution to the global value chain, with strong leadership positions in high value-added areas of semiconductor technology, including chip design, EDA, and fab equipment. In addition, the U.S. will see substantial growth in new capabilities in advanced packaging, which will further strengthen the U.S. semiconductor supply chain.

U.S. TO CAPTURE MORE THAN ONE-QUARTER OF GLOBAL CAPEX

Global capital expenditures in the semiconductor industry in the coming decade are estimated at $2.3 trillion, and the U.S. is expected to attract $646 billion in capital investments, more than one-quarter (28%) of total global semiconductor investment. By comparison, on the pre-CHIPS pace of investment, the U.S. would have captured only 9% of global capital expenditures.

The global semiconductor ecosystem will be further strengthened by private investments in facilities located in both developed and emerging markets, including increased capabilities in fabrication, back-end assembly, test, and packaging (ATP), and materials. These investments will result in overall improvements in supply chain resilience.

ADDITIONAL ACTION IS NEEDED TO ADDRESS REMAINING VULNERABILITIES.

Despite this substantial progress, the U.S. continues to face vulnerabilities in certain segments of the supply chain, including advanced logic capabilities, “legacy” chips (node size 28 nm and above), memory, advanced packaging, and key materials. With the continuation of smart policies, the U.S. has an opportunity to address these vulnerabilities in the face of growing global competition and grow its share of fabrication capacity, while also strengthening its leadership in areas such as advanced logic, design, EDA, and equipment.

America’s future is being built on semiconductors. Historic investments are underway in America’s semiconductor ecosystem, spurred in part by the CHIPS and Science Act, that will revitalize the semiconductor industry’s manufacturing capabilities and position the U.S. as a leader in innovation for decades.

DOWNLOAD THE REPORT

www.semiconductors.org

www.semiconductors.org

NEW REPORT PROJECTS POSITIVE IMPACT OF CHIPS ACT, BUT CHALLENGES REMAIN

A new report by the Semiconductor Industry Association (SIA) and the Boston Consulting Group on the semiconductor supply chain forecasts significant improvements in the resilience of the supply chain in both the U.S. and globally in coming years. The study shows that investments from the industry, facilitated by incentives under the CHIPS Act, are making progress in growing domestic semiconductor manufacturing and strengthening the U.S. economy. Among other things, the report finds:

• U.S. fab capacity is projected to increase by 203% by 2032, a tripling of U.S. capacity.

• The U.S. is expected to increase its share of global fab capacity for the first time in decades, growing from 10% today to 14% by 2032.

• The U.S. is forecast to grow its capabilities in critical technology segments, such as leading edge fabrication, DRAM memory, analog, and advanced packaging. For example, U.S. capacity for advanced logic will grow from 0% in 2022 to 28% by 2032, including new capabilities at the leading edge.

• The U.S. will secure more than one-quarter (28%) of global capital expenditures between 2024-2032 – an estimated $646 billion – an amount second only to Taiwan.

Despite this substantial progress, areas of vulnerability in the ecosystem remain, and additional work is needed to maintain this momentum and secure key areas of the chip supply chain.

DOWNLOAD THE SIA SUMMARY

VIEW THE SIA PRESS RELEASE

KEY FINDING: THE U.S. SEMICONDUCTOR SUPPLY CHAIN IS MAKING PROGRESS TO BECOMING MORE RESILIENT.

America is making progress toward its goal of securing the semiconductor supply chain. The report shows that semiconductor industry investments in the U.S., incentivized by the CHIPS Act, have amounted to nearly $450 billion across 25 states. These investments are working to advance American leadership and increase domestic semiconductor manufacturing capacity.

U.S. TO ACHIEVE WORLD’S LARGEST RATE OF GROWTH IN FAB CAPACITY

U.S. fab capacity as measured by wafer starts per month (wspm) is projected to triple over the next decade, increasing by 203%, the largest projected percent increase in the world. In contrast, U.S. fab capacity grew only 11% in the prior decade (2012-22).

U.S. TO INCREASE SHARE OF GLOBAL FAB CAPACITY

The U.S. share of global fab capacity has experienced a multi-decade decline, decreasing from 37% in 1990 to 12% in 2020, and further declining to 10% as of 2022. The report projects U.S. fab capacity would have declined further to 8% by 2032 without ambitious action to promote new investment. Based on announced projects to date, new investments in the U.S. are forecast to increase America’s share of global

fab capacity to 14% by 2032, marking the country’s first increase in decades.

U.S. GROWING IN KEY TECHNOLOGY SEGMENTS, INCLUDING ADVANCED LOGIC, AND CONTINUES LEADERSHIP IN KEY AREAS

The U.S. will gain share of fab capacity in key technology segments, including leading edge logic, DRAM memory, and analog. For example, while the U.S. previously relied exclusively on sources overseas for the most advanced chips, the U.S. will gain new capabilities in advanced logic, growing its share from 0% in 2022 to 28% by 2032. At the same time, the U.S. continues to lead the world in its overall contribution to the global value chain, with strong leadership positions in high value-added areas of semiconductor technology, including chip design, EDA, and fab equipment. In addition, the U.S. will see substantial growth in new capabilities in advanced packaging, which will further strengthen the U.S. semiconductor supply chain.

U.S. TO CAPTURE MORE THAN ONE-QUARTER OF GLOBAL CAPEX

Global capital expenditures in the semiconductor industry in the coming decade are estimated at $2.3 trillion, and the U.S. is expected to attract $646 billion in capital investments, more than one-quarter (28%) of total global semiconductor investment. By comparison, on the pre-CHIPS pace of investment, the U.S. would have captured only 9% of global capital expenditures.

The global semiconductor ecosystem will be further strengthened by private investments in facilities located in both developed and emerging markets, including increased capabilities in fabrication, back-end assembly, test, and packaging (ATP), and materials. These investments will result in overall improvements in supply chain resilience.

ADDITIONAL ACTION IS NEEDED TO ADDRESS REMAINING VULNERABILITIES.

Despite this substantial progress, the U.S. continues to face vulnerabilities in certain segments of the supply chain, including advanced logic capabilities, “legacy” chips (node size 28 nm and above), memory, advanced packaging, and key materials. With the continuation of smart policies, the U.S. has an opportunity to address these vulnerabilities in the face of growing global competition and grow its share of fabrication capacity, while also strengthening its leadership in areas such as advanced logic, design, EDA, and equipment.

- Extend current incentives – The U.S. should adopt measures to further strengthen the semiconductor supply chain by extending the duration of the incentives under the CHIPS Act, including an extension of the advanced manufacturing investment credit.

- Expand incentives to cover key areas – The existing CHIPS tax credit should be expanded to cover chip design so more of this critical stage of production occurs in the U.S.

- Grow the STEM talent pipeline – America needs to develop the skilled workforce – including engineers, computer scientists, and technicians – in the growing semiconductor industry and the broader economy. The U.S. must adopt policies to build on the industry’s longstanding workforce development efforts, expand the pipeline of STEM graduates in America, and retain and attract more of the top engineers and scientists from around the world.

- Invest in research to maintain U.S. technology lead –The U.S. should continue to fund the research programs authorized in the CHIPS and Science Act to maintain and grow U.S. technology leadership.

- Maintain access to global markets – To ensure the competitiveness of the U.S. semiconductor industry and enable the industry to continue robust investment in research and innovation, maintaining access to markets around the world remains vital.

America’s future is being built on semiconductors. Historic investments are underway in America’s semiconductor ecosystem, spurred in part by the CHIPS and Science Act, that will revitalize the semiconductor industry’s manufacturing capabilities and position the U.S. as a leader in innovation for decades.

DOWNLOAD THE REPORT