News Summary

“The fourth quarter was a positive step forward as we delivered revenue, gross margin and EPS above our guidance,” said Michelle Johnston Holthaus, interim co-CEO of Intel and CEO of Intel Products. “Our renewed focus on strengthening and simplifying our product portfolio, combined with continued progress on our process roadmap, is positioning us to better serve the needs of our customers. Dave and I are taking actions to enhance our competitive position and create shareholder value.”

“The cost reduction plan we announced last year to improve the trajectory of the company is having an impact,” said David Zinsner, interim co-CEO and chief financial officer of Intel. “We are fostering a culture of efficiency across the business while driving toward greater returns on our invested capital and improved profitability. Our Q1 outlook reflects seasonal weakness magnified by macro uncertainties, further inventory digestion and competitive dynamics. We will remain highly focused on execution to build on our progress and unlock value.”

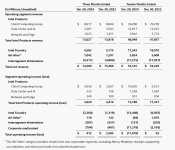

- Fourth-quarter revenue was $14.3 billion, down 7% year-over-year (YoY). Full-year revenue was $53.1 billion, down 2% YoY.

- Fourth-quarter earnings per share (EPS) attributable to Intel was $(0.03); non-GAAP EPS attributable to Intel was $0.13. Full-year EPS attributable to Intel was $(4.38); non-GAAP EPS attributable to Intel was $(0.13).

- Forecasting first-quarter 2025 revenue of $11.7 billion to $12.7 billion; expecting first-quarter EPS attributable to Intel of $(0.27) and non-GAAP EPS attributable to Intel of $0.00.

“The fourth quarter was a positive step forward as we delivered revenue, gross margin and EPS above our guidance,” said Michelle Johnston Holthaus, interim co-CEO of Intel and CEO of Intel Products. “Our renewed focus on strengthening and simplifying our product portfolio, combined with continued progress on our process roadmap, is positioning us to better serve the needs of our customers. Dave and I are taking actions to enhance our competitive position and create shareholder value.”

“The cost reduction plan we announced last year to improve the trajectory of the company is having an impact,” said David Zinsner, interim co-CEO and chief financial officer of Intel. “We are fostering a culture of efficiency across the business while driving toward greater returns on our invested capital and improved profitability. Our Q1 outlook reflects seasonal weakness magnified by macro uncertainties, further inventory digestion and competitive dynamics. We will remain highly focused on execution to build on our progress and unlock value.”