It is rumored that it will join hands with Broadcom, Huida, etc. to jointly develop and welcome large orders next year.

feed

Aiming at the new AI science and technology, an advanced research and development team of more than 200 people was formed to join hands with Broadcom and Huida to seize the ultra-high-speed computing chip business opportunity.

TSMC Telex has joined hands with major customers such as Broadcom and Huida to jointly invest in the application of ultra-high-speed computing chips based on silicon photonics processes, and will begin to receive large orders as early as the second half of next year. (Associated Press)

TSMC Telex has joined hands with major customers such as Broadcom and Huida to jointly invest in the application of ultra-high-speed computing chips based on silicon photonics processes, and will begin to receive large orders as early as the second half of next year. (Associated Press)

AI has created a huge demand for data transmission. Silicon photonics and co-packaged optical components (CPO) have become new technologies in the industry. TSMC (2330) is actively rushing into it. It is reported that it will join hands with major customers such as Broadcom and Huida to jointly develop it, starting as early as the second half of next year . In anticipation of the big order, TSMC has invested more than 200 people to form an advance research and development team, targeting the business opportunities of ultra-high-speed computing chips based on silicon photonics processes that will come next year.

Regarding related rumors, TSMC stated that it does not respond to customer and product status. However, TSMC is highly optimistic about silicon photonics technology. TSMC Vice President Yu Zhenhua recently publicly stated, "If we can provide a good silicon photonics integrated system, we can solve the two key issues of energy efficiency and AI computing power. This will be a new one." Paradigm shift. We may be at the beginning of a new era."

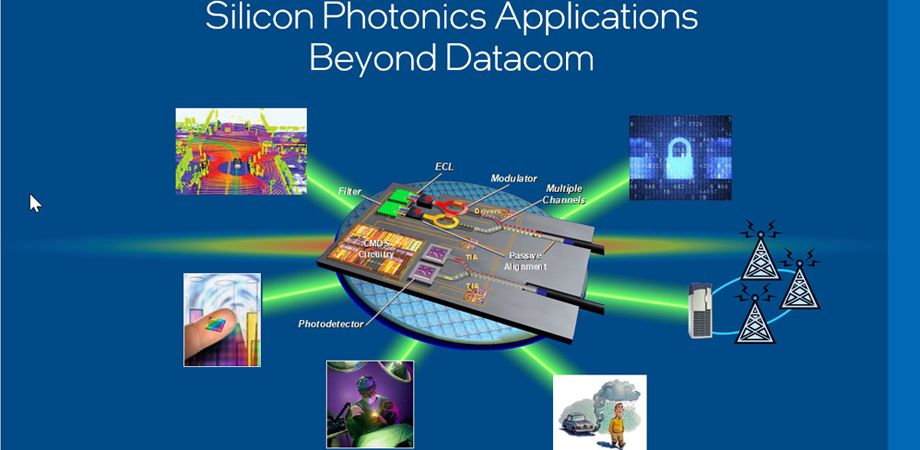

Silicon photonics is a hot topic in the industry at the recently concluded "SEMICON Taiwan 2023 International Semiconductor Equipment Exhibition". Semiconductor giants such as TSMC and ASE have delivered special lectures on related topics. The main reason is that AI applications are blooming everywhere, and how to make huge data transmission speeds faster Problems such as high speed and no delay in reaching signals have come to the fore. The traditional method of using electricity as a signal transmission method is no longer sufficient. Silicon photons convert electricity into light with faster transmission speeds, and have become highly anticipated by the industry to improve the transmission of huge amounts of data. New generation technology for speed.

International semiconductor industry players such as TSMC, Intel, Huida, and Broadcom have successively launched their silicon photonics and co-packaged optical component technology layouts. Explosive growth in the overall market can be seen as soon as 2024.

It is reported in the industry that TSMC is working with major customers such as Broadcom and Huida to develop new products such as silicon photonics and co-packaged optical components. The process technology is extending from 45 nanometers to 7 nanometers. There will be good news as soon as 2024. Entering the stage of mass production in 2025, it is expected to bring new business opportunities to TSMC.

According to industry insiders, TSMC has organized about 200 advanced research and development teams, and is expected to introduce silicon photonics into computing processes such as CPUs and GPUs in the future. Since the original internal electronic transmission lines have been changed to faster optical transmission speeds, the computing power It will be dozens of times that of existing computing processors. It is still in the research and development and academic stages. The industry is highly optimistic that related technologies will become a new driving force for the explosive growth of TSMC's operations in the next few years.

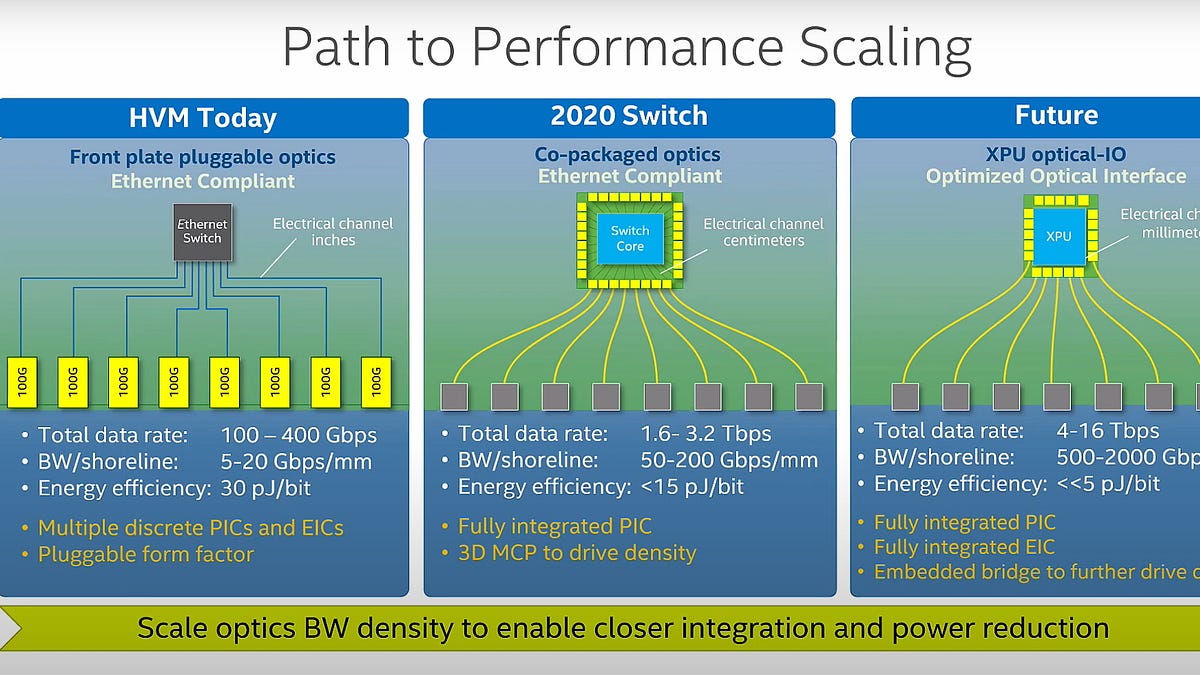

Industry analysis shows that high-speed data transmission still uses pluggable optical components. As transmission speeds rapidly advance and enter the 800G generation, and enter higher transmission rates such as 1.6T to 3.2T in the future, power loss and heat dissipation management problems will be the biggest. The solution introduced by the semiconductor industry is to integrate silicon photonic optical components and switch application-specific chips (ASICs) into a single module through CPO packaging technology. This solution has begun to be certified and adopted by major manufacturers such as Microsoft and Meta. In the new generation network architecture.

Even though CPO technology has just entered the market, the production cost is still high. As the advanced process advances to 3 nanometers, AI computing will drive the demand for high-speed transmission and further drive the restructuring of high-speed network architecture. It is expected that CPO technology will not be ignored and The necessary technologies will enter the market in large quantities after 2025.

What are silicon photons?

Silicon Photonics technology was launched by Intel in 2010. It combines silicon and laser technology, and converts electricity into light technology to convert data originally transmitted from copper wires into optical fibers with faster and more stable transmission distances. The difficulty lies in how to convert electronic data into light. Due to the relatively high cost and the large size of optical communication transceiver modules, they are mostly used in markets such as data centers and servers.

Currently, in addition to developing silicon photonics technology, TSMC is also developing co-packaged optical modules (CPO), which integrate photonic integrated circuits (PICs) in a packaging mode through silicon process wafers, which can convert electricity into optical signals more quickly. This makes the transfer speed faster. (Reporter Su Jiawei)

台積攻矽光子!傳攜手博通、輝達等共同開發 明年迎大單 | 產業熱點 | 產業 | 經濟日報

AI掀起巨量資料傳輸需求,矽光子及共同封裝光學元件(CPO)成為業界新顯學,台積電積極搶進,傳出攜手博通、輝達等大客戶共...