Samsung Can Overtake TSMC In 5 Years Says Executive

Samsung believes that catching up to TSMC is possible in five years, and memory will overcome NVIDIA's AI GPUs. Take a look.

They better not forget Intel ...

Array

(

[content] =>

[params] => Array

(

[0] => /forum/threads/samsung-talking-smack-about-passing-tsmc.17923/

)

[addOns] => Array

(

[DL6/MLTP] => 13

[Hampel/TimeZoneDebug] => 1000070

[SV/ChangePostDate] => 2010200

[SemiWiki/Newsletter] => 1000010

[SemiWiki/WPMenu] => 1000010

[SemiWiki/XPressExtend] => 1000010

[ThemeHouse/XLink] => 1000970

[ThemeHouse/XPress] => 1010570

[XF] => 2030970

[XFI] => 1060170

)

[wordpress] => /var/www/html

)

I think talking smack has become a thing in the chip industry. TSMC talks smack about how expensive it is to build & manufacture in the US. Intel talks smack about how it's going to achieve process superiority. IBM is claiming to have developed the world's first 2nm process. So Samsung is just following the crowd.

Yeah, like Israel.

Don't forget about Gelsinger talking smack about the geopolitical situation, and how it favored fabs in places other than threatened areas.

Samsung Can Overtake TSMC In 5 Years Says Executive

Samsung believes that catching up to TSMC is possible in five years, and memory will overcome NVIDIA's AI GPUs. Take a look.wccftech.com

They better not forget Intel ...

Any ideas what kinds of fabs or process nodes Rocket Man has?The world champion of smack talking does not live in Seoul. He lives 200km up north, in a place called Pyongyang

Any ideas what kinds of fabs or process nodes Rocket Man has?

Any ideas what kinds of fabs or process nodes Rocket Man has?

Samsung at 2019 Apr: We will be No.1 in logic chips by 2030.

Samsung Electronics to Invest KRW 133 Trillion in Logic Chip Businesses by 2030

Samsung Electronics, a world leader in advanced semiconductor technology, today announced that it will invest KRW 133 trillion by 2030 to strengthen itsnews.samsung.com

----

Reality:

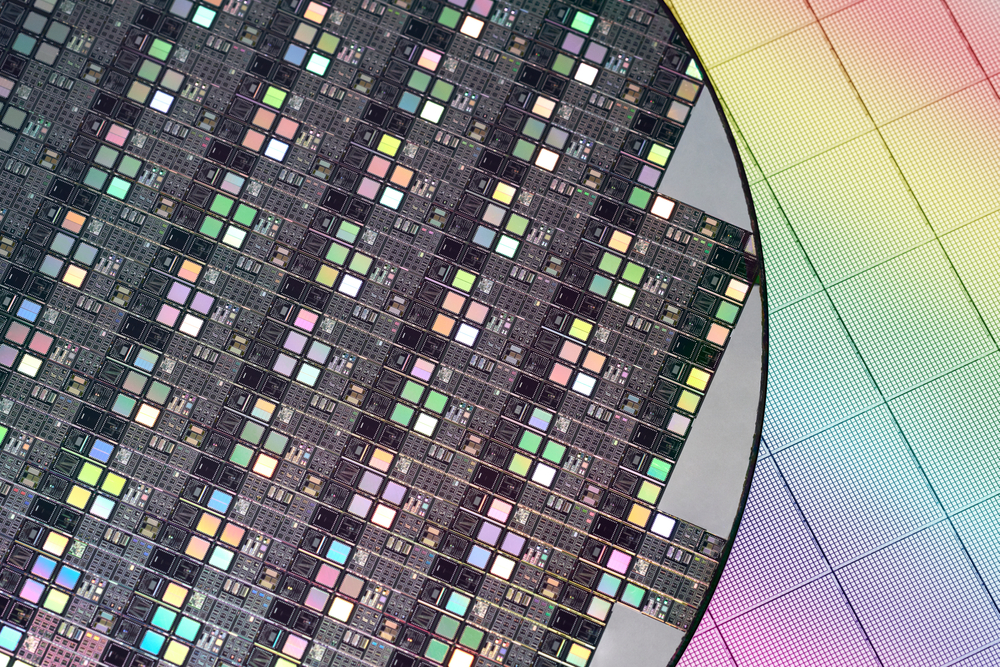

2019 Q1 foundry market share: TSMC 48.1%; Samsung 19.1%

2022 Q4 foundry market share: TSMC 58.5%; Samsung 15.8%

I can't think of another industry where so many people positioning themselves as experts talk about so much they really don't know much about.Another ridiculous article from a finance reporter.

"However, Samsung aims to close the technological gap between it and the Taiwanese firm by employing Gate All Around (GAA) transistors for the 3-nanometer process, the leading edge semiconductor node, in 2023."

I have not heard of one Samsung 3nm tape-out or even a design start. The EDA and IP companies seem a bit quiet as well. Samsung started 3nm production a year ago, right?

Samsung Begins Chip Production Using 3nm Process Technology With GAA Architecture | Samsung Semiconductor Global

Samsung is the first and only production of 3-nanometer process node, applying GAA transistor architecture in the world.semiconductor.samsung.com

Samsung has yet to learn that trust is key in the foundry business.

So IFS is a non threat to TSMC but a huge threat to Samsung logic? Am I understanding correctly?TSMC will be 60%+ market share in 2025 thanks to N3. If Intel Foundry get's their ecosystem and PDKs ship shape Samsung will fall even more.

He's certainly in the top two - and arguably met with the other one - visiting from the US - a few years back.The world champion of smack talking does not live in Seoul. He lives 200km up north, in a place called Pyongyang

That's kind of a long distance view of things, based on the fact Samsung sucks and is more vulnerable. I get it.I agree with the idea that IFS will take share from Samsung first, rather than from TSMC. Samsung's foundary customers are already more comfortable (though still probably queasy) with a potential competitor making their chips for them. That trust thing is a strong disincentive with most of TSMC's customers.

After awhile, if things go well at IFS, some of the holdouts will place a few orders. If for no other reason than gaining pricing leverage with TSMC. Then some more orders. The process will be gradual. Will IFS be able to keep itself supported long enough to become profitable given their current build plans? I surely do not know.

TSMC will be 60%+ market share in 2025 thanks to N3. If Intel Foundry get's their ecosystem and PDKs ship shape Samsung will fall even more.

That's kind of a long distance view of things, based on the fact Samsung sucks and is more vulnerable. I get it.

But, looking closer, NVIDIA has a somewhat rocky relationship with TSMC, and has used Samsung not too long ago, despite being a deficient process node. And have complained pretty publicly about the cost of wafers from TSMC very recently. And announced they are very interested in working with Intel foundries. If NVIDIA moves things to Intel, where are they moving them from? Not Samsung.

I would also not be surprised if Apple did some parts at Intel as well. At least in an exploratory way, to ensure supply and possibly make some less strategic parts there. Qualcomm is already involved with Intel. AMD is safe, but do they actually sell anything anymore.

So, I think both are going to get hit a bit, if Intel is successful. Intel already doesn't suck like Samsung, their I7 parts are the fastest clocked products in that segment, and have no problems competing with AMD parts on N5. Samsung isn't really competitive at anything, except smack talking.

But, Intel has to be successful with their nodes, and while they have been on high performance nodes, their experience with making a node suitable for lower power/higher density is limited. No doubt they can do it, but can they do it competitively against TSMC? Not an easy bar to reach.

A lot of things can happen, I think it's premature to think TSMC will be largely unaffected. They may be, and Intel may be largely unsuccessful, but there are other scenarios that could play out too.